Japan Real Estate Market Report by Property (Residential, Commercial, Industrial, Land), Business (Sales, Rental), Mode (Online, Offline), and Region 2026-2034

Japan Real Estate Market:

The Japan real estate market size reached USD 448.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 576.2 Billion by 2034, exhibiting a growth rate (CAGR) of 2.74% during 2026-2034. The growing number of residential and commercial properties, along with the rising international investment trends, are propelling the market across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 448.3 Billion |

| Market Forecast in 2034 | USD 576.2 Billion |

| Market Growth Rate 2026-2034 | 2.74% |

Access the full market insights report Request Sample

Japan Real Estate Market Analysis:

- Major Market Drivers: The increasing urban development initiatives by government bodies are bolstering the market across the country. Additionally, they are offering favorable tax incentives and revitalization programs, which are strengthening the market.

- Key Market Trends: The rising affordable and smaller housing options are among the emerging trends propelling the market. Besides this, foreign exchange rates, as well as cultural preferences and lifestyle choices, are also acting as significant growth-inducing factors.

- Challenges and Opportunities: One of the primary challenges hindering the market is the elevating number of vacant homes. However, key players across the country are focusing on promoting urban redevelopment and implementing policies to encourage immigration and support younger families, which will continue to fuel the market in the coming years.

Japan Real Estate Market Trends:

Demand for Senior Housing

The increasing geriatric population across the country is stimulating the market. According to the National Institute of Population and Social Security Research, in Japan, those aged over 65 are anticipated to account for 34.8% of the population by 2040. Moreover, the declining birth rate is resulting in changes in housing demand. The Prime Minister of Japan, Fumio Kishida, said in January 2023 that his country is on the brink of not being able to function as a society because of its declining birth rate. As a result, there is an escalating requirement for adapting communities and properties to cater to the needs of an aging population, including the launch of senior housing and healthcare facilities. This is one of the real estate market trends in Japan. The Ministry of Land in Japan provides subsidies for the private sector and local governments to build daycare centers or housing for elderly people. Additionally, the growing popularity of assisted living complexes is also propelling the market. For example, in November 2023, AXA IM Alts purchased two senior housing properties in Hokkaido, Japan, from an affiliate of Goldman Sachs for approximately €34 Million. Apart from this, Gakken Cocofump is one of the companies in Japan that develops and operates elderly welfare as well as nursing care across the country. In an initiative to enrich and improve the quality of life of old-age residents, they entered into a collaborative agreement with Nintendo in November 2023 to launch Nintendo Switch software and consoles in assisted living facilities in Japan.

Smarty City Initiatives

The widespread adoption of smart building technologies is revolutionizing Japan's real estate growth, as they aid in improving safety, energy efficiency, and convenience in both residential and commercial properties. For example, in March 2024, Toyota invested £8 billion in its smart city project called Woven City. Set just miles away from Mount Fuji on Honshū Island, Japan, it is powered by hydrogen and specifically designed to minimize emissions levels. Furthermore, Toyota also partnered with Pattaya City to develop the city as an electric tourism hub, utilizing sustainable energy to reduce costs, enhance service efficiency, minimize the ecological impact of the city's operations, etc. Additionally, the escalating demand for sustainable practices, which involves the use of renewable energy resources, energy-efficient building materials, green roofs, etc., is also contributing to the overall market growth. For instance, in March 2024, Spatial Pleasure, one of the startups in Japan, built a software platform, Digital, Measurement, Reporting, and Verification (DMRV), which certifies and measures carbon credits for transportation operators contributing to the decarbonization of an area. Besides this, key companies across the country are leveraging sensor networks, AI, and other advanced technologies to alleviate traffic congestion, which is bolstering the market. For instance, in June 2023, SoftBank Corp. and TOKYU LAND CORPORATION announced their plan to expand their joint "Smart City Takeshiba" project in Tokyo's Takeshiba district. By adopting a data exchange platform that enables numerous businesses in Japan to access real-time data collected in the area, they aim to enhance disaster prevention measures and improve urban navigation. In addition, TOKYU LAND and SoftBank further collaborated with operators of alternative mobility services, including OpenStreet Co., Ltd., to display availability on digital signage.

Growing Tourism Impact

The increasing number of tourists across the country is elevating the requirement for vacation rentals, hotels, service apartments, etc., which is positively influencing the Japan real estate outlook. As per the Japan National Tourism Organization, arrivals of tourists across the country increased by around 6% in 2024 when compared to 2019. Additionally, Accor, one of the international hotel chains, believes that the country will continue to attract more inbound tourists, with the government setting a goal of attracting about 60 million foreign visitors annually by 2030. As a result, there is a rising popularity of retail spaces, entertainment venues, restaurants, etc., to serve tourists. For instance, in November 2023, Arcadia Resort Miyakojima opened on Irabu Island as part of the city of Miyakojima, Japan. The hotel consists of 14 luxury suites with ocean views. Besides this, one of the travel agencies in Japan, JTB, expanded its inbound travel route offerings to less-known destinations, including Kanazawa, since the country reopened its border in 2022. Furthermore, according to Asian Investor, Japan emerged as the top destination for cross-border investments within the country, attracting US$9.3 Billion. According to MSCI Real Assets, foreign investors, including KKR & Co., Goldman Sachs Group Inc., Blackstone Inc., etc., spent a combined US$2 Billion on hotel deals in Japan so far in 2023, the most compared with any other sector in Asian commercial property. These investments not only improve property values but also foster urban development, which is expected to fuel the market in the coming years.

Japan Real Estate Market Segmentation

IMARC Group provides an analysis of the key trends in each segment of the market, along with the Japan real estate market forecast at the country and regional levels for the period 2026-2034. Our report has categorized the market based on property, business, and mode.

Breakup by Property:

- Residential

- Commercial

- Industrial

- Land

The report has provided a detailed breakup and analysis of the market based on the property. This includes residential, commercial, industrial, and land.

The real estate market in Japan encompasses diverse segments, including residential, commercial, industrial, and land properties, each contributing uniquely to the nation's economy. Residential properties, particularly in major cities, remain in high demand due to urbanization and population density, driving the development of high-rise apartments and suburban housing projects. In November 2023, Invesco and Alyssa Partners collaborated to build around 15 multifamily properties located in Osaka, Tokyo, Nagoya, and Fukuoka. Commercial properties are equally significant. Based on the data from CBRE, the World Property Journal reported that investments in Japan's commercial real estate industry for the first quarter of 2024 surged by 7% year-over-year, which accounted for approximately JPY1.439 trillion. Additionally, land properties offer significant opportunities, particularly in rural and suburban areas, where land for agricultural use, new developments, or future urban expansion is highly sought after.

Breakup by Business:

- Sales

- Rental

The report has provided a detailed breakup and analysis of the market based on the business. This includes sales and rental.

The sales of residential properties in the country are rising, as local families and international investors are seeking stable and appreciating assets. The rental options are equally gaining traction, supported by a significant expatriate population, students, and domestic workers who prefer renting due to high property prices or the flexibility it offers. Residential rentals range from compact city apartments to larger suburban homes, while the commercial rental market includes office spaces, retail outlets, and co-working spaces, catering to diverse business needs. As per the Japan real estate analysis, the country's well-established legal framework, efficient public transportation, and high living standards further enhance the attractiveness of its real estate market for both sales and rentals, fostering continuous growth and investment opportunities. For example, in February 2024, the land ministry in Japan took various steps to make it easier for rental housing owners to lease their properties to elderly individuals by certifying rental housing equipped with services to watch over tenants.

Breakup by Mode:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the mode. This includes online and offline.

The offline real estate remains strong, with traditional real estate agencies providing personalized services, in-depth local knowledge, and face-to-face consultations. These agencies often host open houses, property tours, and in-person meetings to guide buyers and renters through the process. On the other hand, the online real estate market is rapidly expanding, driven by the country's high internet penetration and tech-savvy population. In January 2024, GA Technologies Co., Ltd., headquartered in Tokyo, Japan, announced the acquisition of the equity of RW OpCo, LLC to expand its online real estate business across the country. Numerous online platforms and apps offer comprehensive property listings, virtual tours, and digital transaction services, making it easier for users to search for and secure properties from anywhere. This, in turn, is escalating the Japan real estate demand.

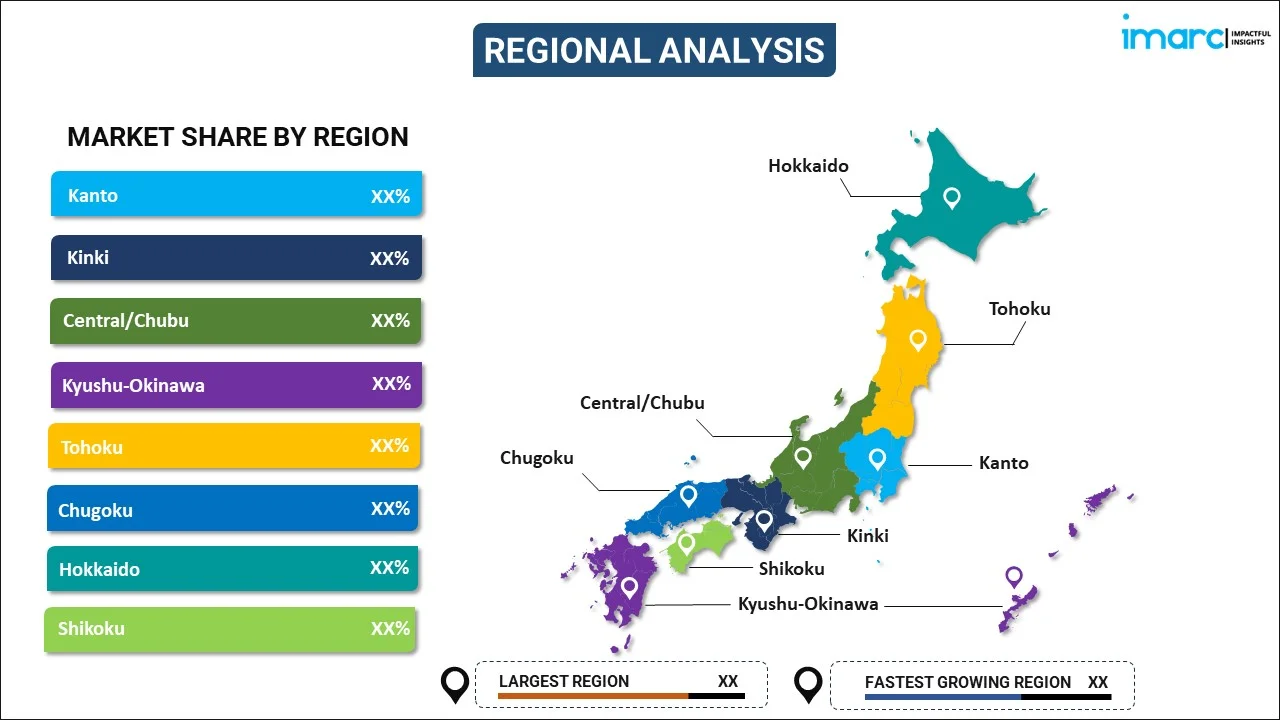

Breakup by Region:

To get detailed regional analysis of this market Request Sample

- Kanto

- Kinki

- Central/Chubu

- Kyushu-Okinawa

- Tohoku

- Chugoku

- Hokkaido

- Shikoku

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto, Kinki, Central/ Chubu, Kyushu-Okinawa, Tohoku, Chugoku, Hokkaido, and Shikoku.

According to official government statistics, Hokkaido possesses Japan’s largest estimated population of 5.2 million, out of which 32.5 % are over the age of 65. Apart from this, the Kawasaki Eco-Town in Kawasaki City, located in the prefecture of Kanagawa, is one of the first and leading eco-towns in Japan, which is positively influencing the market. As per the Public Relations Office of the government in Japan, around 1,000 observers from Japan and abroad visit the Kawasaki Eco-Town each year. The city also holds the annual Kawasaki International Eco-Tech Fair to spread awareness about the eco-town’s achievements. Moreover, Central/Chubu, including Nagoya, is an industrial hub, owing to the elevating demand for residential, commercial, and industrial properties. Other than this, the growing popularity of vacation homes across the Kyushu-Okinawa region, known for its scenic beauty, will continue to fuel the market in the coming years.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive Japan real estate analysis, such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Real Estate Market News:

- July 2025: Japanese real estate investment company GATES declared its plan to tokenize more than USD 200 Billion in revenue-generating properties utilizing the Oasys blockchain. The project would commence with a tokenization of USD 75 Million in properties situated in central Tokyo, seeking to enhance accessibility of Japan’s real estate market for investors.

- July 2025: eXp Realty®, the prominent independent real estate brokerage firm and a key subsidiary of eXp World Holdings, Inc. (Nasdaq: EXPI), announced its expansion into Japan. To begin the launch, eXp was set to hold a live welcome event in Tokyo on October 2, 2025, during which company leaders would present the vision and model of their business. eXp offered the most scalable business model in real estate, empowering individual agents to manage efficient, high-performing businesses.

- June 2025: Daiwa Securities, the Japanese brokerage firm, was set to partner with the Osaka-based firm Samty and the investment manager Hillhouse to gather ¥100 Billion (USD 690 Million) real estate fund targeting both domestic and international institutions. Daiwa would focus on Japanese rental properties and hotels, which typically offered more protection against inflation than other sectors.

- April 2025: Morgan Stanley raised approximately 100 Billion Yen (S$ 910.8 Million) for a real estate fund concentrated in Japan. Investment would focus on office spaces and multi-family residential properties in key urban areas, along with logistics and hotel developments.

- February 2025: Brookfield Asset Management finalized two significant real estate investments in Japan, totaling USD 1.6 Billion. The acquisitions encompassed a share in Tokyo's renowned Gajoen complex, a multifaceted development that consisted of office areas, retail shops, and a high-end hotel, along with a 1 Million square foot location near Nagoya, which was to be converted into a logistics warehouse. The action indicated increasing foreign investment in Japan's real estate.

- December 2024: Blackstone, a major player in private equity, consented to acquire a mixed-use commercial property complex in Tokyo, Japan, for USD 2.6 Billion, which it described as the largest real estate investment by a foreign investor in Japan. The asset featured 135 upscale residences, a luxury hotel with 250 rooms, event spaces for conferences and weddings, more than 30 cafes and restaurants, along with retail and service shops.

Japan Real Estate Market Report:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Properties Covered | Residential, Commercial, Industrial, Land |

| Businesses Covered | Sales, Rental |

| Modes Covered | Online, Offline |

| Regions Covered | Kanto, Kinki, Central/ Chubu, Kyushu-Okinawa, Tohoku, Chugoku, Hokkaido, Shikoku |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan real estate market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Japan real estate market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan real estate industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The real estate market in Japan was valued at USD 448.3 Billion in 2025.

The Japan real estate market is projected to exhibit a CAGR of 2.74% during 2026-2034, reaching a value of USD 576.2 Billion by 2034.

Rising demand for residential properties in metropolitan areas like Tokyo and Osaka is fueled by urban migration and limited land availability. Government initiatives supporting infrastructure development, such as high-speed rail and smart city projects, are further boosting property values. Additionally, foreign investment is increasing, driven by Japan’s low-interest rates.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)