Japan Rechargeable Battery Market Size, Share, Trends and Forecast by Battery Type, Capacity, Application, and Region, 2026-2034

Japan Rechargeable Battery Market Overview:

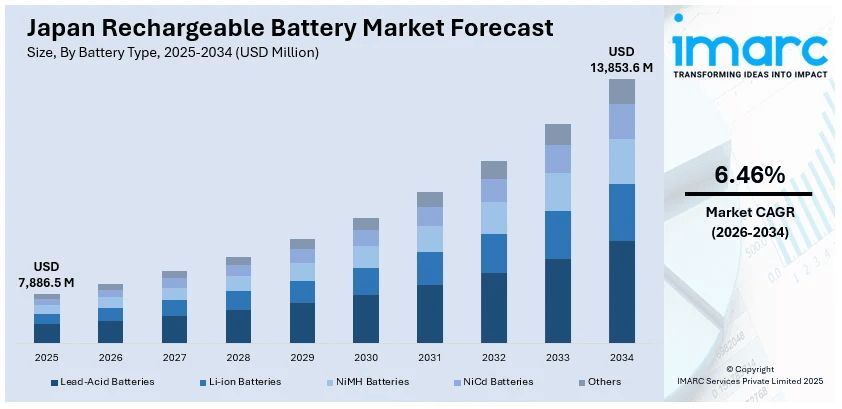

The Japan rechargeable battery market size reached USD 7,886.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 13,853.6 Million by 2034, exhibiting a growth rate (CAGR) of 6.46% during 2026-2034. Rising electric vehicle (EV) production, national carbon neutrality targets, sustained consumer electronics output, advancements in solid-state battery research, increasing reliance on backup power systems, expansion of battery recycling, smart city developments, growing use in medical devices, and efforts to localize critical battery material supply are some of the factors propelling the market Japan rechargeable battery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 7,886.5 Million |

| Market Forecast in 2034 | USD 13,853.6 Million |

| Market Growth Rate 2026-2034 | 6.46% |

Japan Rechargeable Battery Market Trends:

Push Towards Carbon Neutrality and Energy Transition

Japan’s target of reaching carbon neutrality by 2050 is driving demand for rechargeable batteries across various industries. The government’s Green Growth Strategy outlines ambitious targets to decarbonize key industries, including power generation, transportation, and manufacturing. In line with this, energy storage technologies are being prioritized to complement renewable sources like solar and wind, which are inherently intermittent. Rechargeable batteries are critical in stabilizing power supply and supporting grid resilience. Additionally, public-private partnerships have resulted in funding for pilot projects and infrastructure development, including the installation of residential and grid-scale battery systems, which is supporting the Japan rechargeable battery market growth. This macro-level policy direction is creating long-term demand visibility for battery manufacturers, stimulating research and development (R&D) investments and scaling production capacities, which is another growth-inducing factor. Besides this, local governments are also integrating battery storage into smart city frameworks, further embedding rechargeable battery use into the fabric of Japan’s energy ecosystem.

To get more information on this market Request Sample

Electric Vehicle Expansion by Domestic Automakers

The growing electrification of Japan’s automotive industry is playing a significant role in boosting demand for rechargeable batteries, particularly lithium-ion variants. Major Japanese automakers such as Toyota, Honda, and Nissan are rapidly scaling their electric vehicle offerings to meet both international emissions regulations and local policy goals. In 2024, Toyota outlined its intention to significantly boost EV production, targeting 600,000 units by 2025, a sharp rise from around 190,000 the previous year. To support this, the company committed nearly 730 billion yen (approximately USD 5.6 billion) toward expanding battery manufacturing infrastructure in Japan and the U.S., with the goal of raising total production capacity by 40 GWh. These developments directly translate to large-volume battery procurement contracts and joint ventures with battery suppliers, stimulating the market growth. Government support in the form of purchase subsidies and EV infrastructure investments, such as fast-charging networks, is also reinforcing consumer confidence and market uptake. Furthermore, fleet electrification among logistics and public transport operators is contributing to the market growth.

Robust Demand from Consumer Electronics Sector

Japan’s consumer electronics industry, renowned for its innovation and manufacturing precision, continues to be a major contributor to the rechargeable battery market. Leading brands such as Sony, Panasonic, and Sharp are consistently rolling out compact, high-performance devices that rely on advanced battery solutions for power efficiency and longevity. Moreover, the ongoing demand for smartphones, wireless audio devices, laptops, and wearables is fueling the need for energy-dense and fast-charging battery systems, which is favoring the market growth. Japanese manufacturers are particularly focused on improving battery safety and thermal management to support high-performance consumer devices, which is propelling the market growth.

Japan Rechargeable Battery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on battery type, capacity, and application.

Battery Type Insights:

- Lead-Acid Batteries

- Li-ion Batteries

- NiMH Batteries

- NiCd Batteries

- Others

The report has provided a detailed breakup and analysis of the market based on the battery type. This includes lead-acid batteries, li-ion batteries, NiMH batteries, NiCd batteries, and others.

Capacity Insights:

- 150 - 1000 mAh

- 1300 - 2700 mAh

- 3000 - 4000 mAh

- 4000 - 6000 mAh

- 6000 - 10000 mAh

- More than 10000 mAh

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes 150 - 1000 mAh, 1300 - 2700 mAh, 3000 - 4000 mAh, 4000 - 6000 mAh, 6000 - 10000 mAh, and more than 10000 mAh.

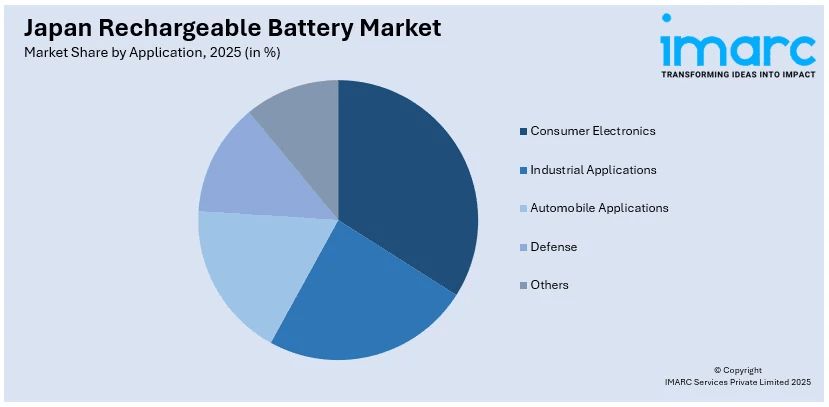

Application Insights:

Access the comprehensive market breakdown Request Sample

- Consumer Electronics

- Industrial Applications

- Automobile Applications

- Defense

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes consumer electronics, industrial applications, automobile applications, defense, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Rechargeable Battery Market News:

- In March 2025, the Japan Atomic Energy Agency unveiled the world's first rechargeable battery utilizing depleted uranium, a byproduct of nuclear fuel enrichment. The prototype achieved a voltage of 1.3 volts and demonstrated stable charge-discharge cycles.

- In January 2025, Mazda announced plans to build a new module pack plant for automotive cylindrical lithium-ion battery cells in Iwakuni City, Yamaguchi Prefecture. The plant will produce battery modules and packs using cells procured from Panasonic Energy, supporting Mazda's electrification strategy

- In 2024, Panasonic Energy finalized preparations for mass-producing its 4680 cylindrical lithium-ion batteries at the Wakayama plant. These batteries offer approximately five times the capacity of previous models, aiming to extend the driving range of electric vehicles and reduce the number of batteries required per vehicle.

Japan Rechargeable Battery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Battery Types Covered | Lead-Acid Batteries, Li-ion Batteries, NiMH Batteries, NiCd Batteries, Others |

| Capacities Covered | 150 - 1000 mAh, 1300 - 2700 mAh, 3000 - 4000 mAh, 4000 - 6000 mAh, 6000 - 10000 mAh, More than 10000 mAh |

| Applications Covered | Consumer Electronics, Industrial Applications, Automobile Applications, Defense, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan rechargeable battery market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan rechargeable battery market on the basis of battery type?

- What is the breakup of the Japan rechargeable battery market on the basis of capacity?

- What is the breakup of the Japan rechargeable battery market on the basis of application?

- What is the breakup of the Japan rechargeable battery market on the basis of region?

- What are the various stages in the value chain of the Japan rechargeable battery market?

- What are the key driving factors and challenges in the Japan rechargeable battery market?

- What is the structure of the Japan rechargeable battery market and who are the key players?

- What is the degree of competition in the Japan rechargeable battery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan rechargeable battery market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan rechargeable battery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan rechargeable battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)