Japan Roofing Market Size, Share, Trends and Forecast by Roofing Material, Roofing Type, Application, and Region, 2026-2034

Japan Roofing Market Overview:

The Japan roofing market size reached USD 8,629.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 11,928.2 Million by 2034, exhibiting a growth rate (CAGR) of 3.66% during 2026-2034. Frequent natural disasters, aging residential infrastructure, energy efficiency regulations, urban heat mitigation, solar roofing adoption, rising home renovations, surging demand for low-maintenance materials, growth in prefabricated housing, and green building certifications are factors stimulating the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 8,629.0 Million |

| Market Forecast in 2034 | USD 11,928.2 Million |

| Market Growth Rate 2026-2034 | 3.66% |

Japan Roofing Market Trends:

Demand for High-Durability and Impact-Resistant Materials Due to Natural Disasters

Japan is prone to natural disasters, particularly earthquakes and typhoons, which directly influence consumer and contractor preferences in the roofing segment. Japan experienced heightened seismic activity in 2024, with a total of 1,563 earthquakes of magnitude 4.0 or higher occurring within 300 kilometers of the country. This figure surpasses the annual average of approximately 1,012 such quakes over the past decade. Roofing materials must meet stringent structural performance standards to withstand high wind speeds, seismic shocks, and flying debris. This has accelerated the adoption of impact-resistant metal roofing, reinforced tiles, and composite materials engineered for structural integrity. Additionally, government-mandated building codes such as those enforced under the Building Standard Law require roofing systems to adhere to strict safety benchmarks, particularly in high-risk zones. The frequency and unpredictability of typhoons in southern Japan, combined with the seismic activity around the Pacific Ring of Fire, make these considerations central to both new construction and re-roofing projects, which is another factor boosting the Japan roofing materials market growth.

.webp)

To get more information on this market Request Sample

Rising Replacement Demand from Aging Infrastructure

Japan possesses one of the oldest housing stocks among developed nations, with a substantial portion of residential buildings exceeding 30 years in age. This has led to a corresponding increase in demand for roof replacements, particularly in detached houses and low-rise apartment complexes. The market has responded with durable and easy-to-install roofing options tailored to retrofit needs, such as lightweight metal panels and polymer-modified bitumen membranes. Replacement activity is further fueled by structural renovations aimed at earthquake retrofitting and improving insulation performance. Additionally, homeowners are increasingly choosing modern roofing solutions that offer superior weatherproofing, aesthetic appeal, and minimal upkeep, especially as aging property owners seek long-term value and reduced maintenance burdens, which is boosting the Japan roofing market share. Roofing companies are aligning their marketing and product strategies to capture this demand cycle, particularly in suburban and rural markets where older housing dominates. This trend is expected to intensify over the next decade.

Government Incentives for Energy-Efficient Housing

Energy efficiency remains a strategic priority for Japan’s housing policy, influencing material selection across the building envelope, including roofing systems. National programs under the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) and the Agency for Natural Resources and Energy incentivize energy-saving home improvements, such as the installation of solar-integrated roofing panels and high-reflectance (cool) roof coatings. Recently, under Japan's "Housing Energy Saving 2024 Campaign," the government is providing subsidies for energy-efficient home renovations. Eligible upgrades include installing insulation, replacing windows, and installing high-efficiency water heaters. These subsidies generally cover 30–50% of renovation costs, with maximum grants ranging from approximately USD 3,300 to USD 6,600. These initiatives are part of broader efforts to cut carbon emissions and reduce household energy consumption. As a result, roofing manufacturers are expanding product lines to include photovoltaic shingles, solar tiles, and advanced insulation-enhanced roofing underlays. Apart from this, government subsidies and low-interest loans for eco-friendly renovations also provide a positive Japan roofing market growth, particularly in urban residential zones where energy costs are a key concern for homeowners.

Japan Roofing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on roofing material, roofing type, and application.

Roofing Material Insights:

- Bituminous Roofing

- Metal Roofing

- Tile Roofing

- Others

The report has provided a detailed breakup and analysis of the market based on the roofing material. This includes bituminous roofing, metal roofing, tile roofing, and others.

Roofing Type Insights:

- Flat Roof

- Slope Roof

A detailed breakup and analysis of the market based on the roofing type have also been provided in the report. This includes flat roof and slope roof.

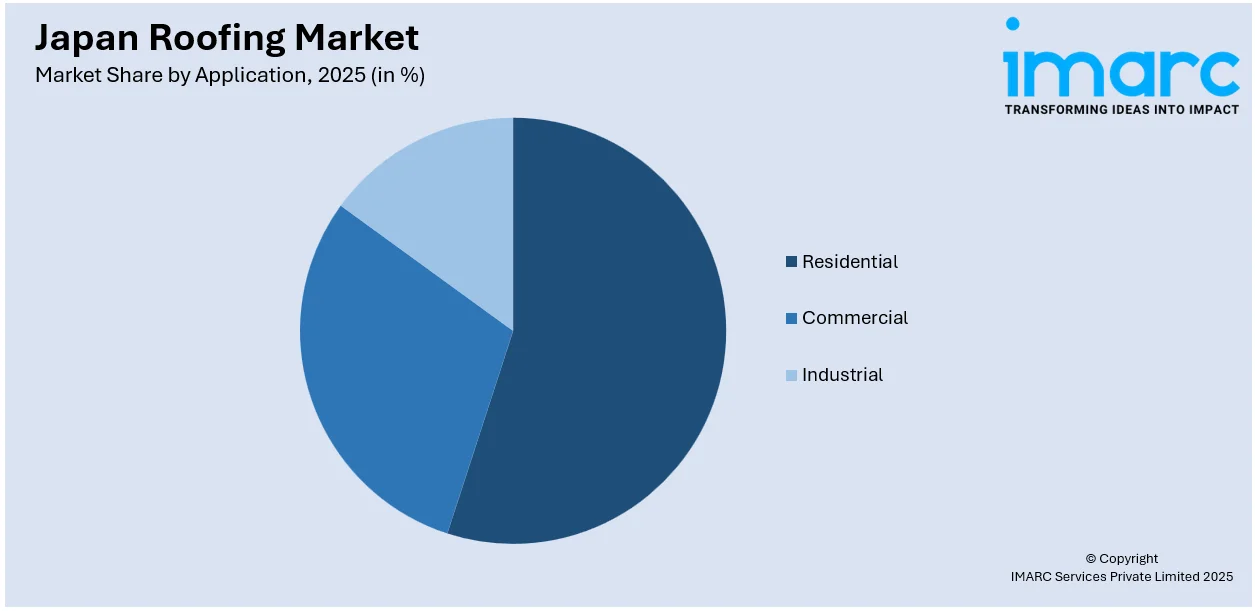

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Roofing Market News:

- In 2024, Sangobuild introduced its new generation of Titan Solar Roof Tiles, designed to integrate solar energy solutions seamlessly into roofing materials. These tiles aim to provide both aesthetic appeal and energy efficiency, catering to the growing demand for sustainable building materials in Japan.

- In 2024, At Japan Build Tokyo 2024, Sangobuild showcased its latest innovations, including BIPV Solar Roof Tiles, Stone-Coated Metal Roof Tiles, and Asphalt Shingles, emphasizing its commitment to green building and sustainable development.

Japan Roofing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Roofing Materials Covered | Bituminous Roofing, Metal Roofing, Tile Roofing, Others |

| Roofing Types Covered | Flat Roof, Slope Roof |

| Applications Covered | Residential, Commercial, Industrial |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan roofing market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan roofing market on the basis of roofing material?

- What is the breakup of the Japan roofing market on the basis of roofing type?

- What is the breakup of the Japan roofing market on the basis of application?

- What is the breakup of the Japan roofing market on the basis of region?

- What are the various stages in the value chain of the Japan roofing market?

- What are the key driving factors and challenges in the Japan roofing market?

- What is the structure of the Japan roofing market and who are the key players?

- What is the degree of competition in the Japan roofing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan roofing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan roofing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan roofing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)