Japan Rooftop Solar Market Size, Share, Trends and Forecast by Grid Type, End User, and Region, 2026-2034

Japan Rooftop Solar Market Overview:

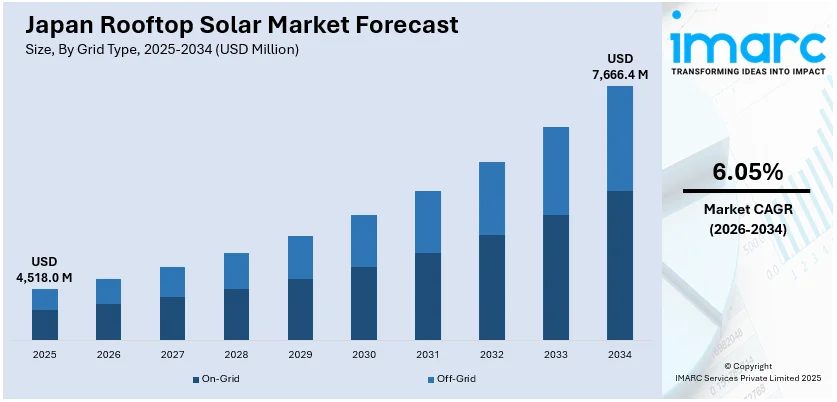

The Japan rooftop solar market size reached USD 4,518.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 7,666.4 Million by 2034, exhibiting a growth rate (CAGR) of 6.05% during 2026-2034. The Government is steadily strengthening its policies and incentives to support renewable energy. This, along with the inflating electricity prices in Japan, is impelling the growth of the market. Besides this, continuous innovations in photovoltaic (PV) technologies are expanding the Japan rooftop solar market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4,518.0 Million |

| Market Forecast in 2034 | USD 7,666.4 Million |

| Market Growth Rate 2026-2034 | 6.05% |

Japan Rooftop Solar Market Trends:

Government Incentives and Policy Support

The Japanese rooftop solar industry is experiencing steady growth as the Government is strengthening its policies and incentives to support renewable energy. The nation's determination to become carbon-neutral by 2050 is providing support for rooftop solar in the form of subsidies, tax incentives, and supportive net-metering policies. Homeowners and businesses alike are increasingly deriving advantage from such schemes as the feed-in tariff (FiT), leading to the utilization through the prospect of secure returns on excess power generation. In addition, energy standards in building regulations are also strengthened, driving new and old buildings in that direction for solar installations. Through coordination between national energy planning and global arrangements like the Paris Agreement, Japan is enhancing investors' confidence in solar technology. Public-private partnerships and city-level initiatives are further accelerating the rooftop solar deployment, making it a key pillar in Japan's overall energy transition strategy. The Tokyo metropolitan government, targeting its "carbon halving" goal of bringing the city's greenhouse gas output down by 50% by 2030, is also encouraging the promotion of renewable power. Beginning from April 2025, the new system imposing the installation of solar power is installed.

To get more information on this market Request Sample

Rising Electricity Prices

Electricity prices in Japan are increasing, driven by the country's dependence on costly fossil fuel imports and supply chain disruptions. According to energynews, in 2024, electricity prices in Japan skyrocketed 3% on July 30, following a 24% increment owing to high energy requirements. As utility costs skyrocket, residential and commercial customers are increasingly looking to rooftop solar systems as a way of achieving energy independence and saving on long-term energy costs. This economic imperative is turning rooftop solar into not only an environment friendly option but also a financially savvy one. People are calculating the payback periods and discovering that, with declining solar panel prices and government incentives, rooftop systems are yielding attractive returns. In addition, Japan's exposure to global energy market volatility is increasing the attractiveness of decentralized energy solutions such as rooftop solar. By producing their own electricity, home and business owners are shielding themselves from uncertain rate increases. This economic incentive is continuing to raise the adoption levels, particularly in urban and suburban areas where there is a high demand for energy and there is available rooftop space.

Technological Advancements

Continuous innovations in photovoltaic (PV) technologies are making rooftop solar systems more efficient, affordable, and easier to install across Japan. Advanced panel designs with higher energy conversion efficiencies are allowing homeowners and businesses to generate more power even in space-constrained urban environments. Simultaneously, the integration of smart energy management systems and battery storage solutions is enabling people to maximize self-consumption and reduce dependence on the grid. Japanese tech firms are actively developing next-generation solar materials, including bifacial panels and perovskite cells, which are promising superior performance in varying light conditions. Additionally, improvements in lightweight, flexible panels are broadening installation possibilities on older buildings and diverse roof types. By offering better durability and longer warranties, these technological upgrades are boosting end user confidence, impelling the Japan rooftop solar market growth. In 2025, Enphase Energy, Inc. announced the shipment of IQ8™ Microinverters to Japan. The milestone follows a distribution partnership with ITOCHU Corporation, one of the largest trading companies in Japan. As residential rooftops in Tokyo tend to be compact, it is often difficult to design effective solar systems. Enphase's IQ8 Microinverters counter this obstacle through flexible, scalable solutions that improve solar energy yield and reliability.

Japan Rooftop Solar Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on grid type and end user.

Grid Type Insights:

- On-Grid

- Off-Grid

The report has provided a detailed breakup and analysis of the market based on the grid type. This includes on-grid and off-grid.

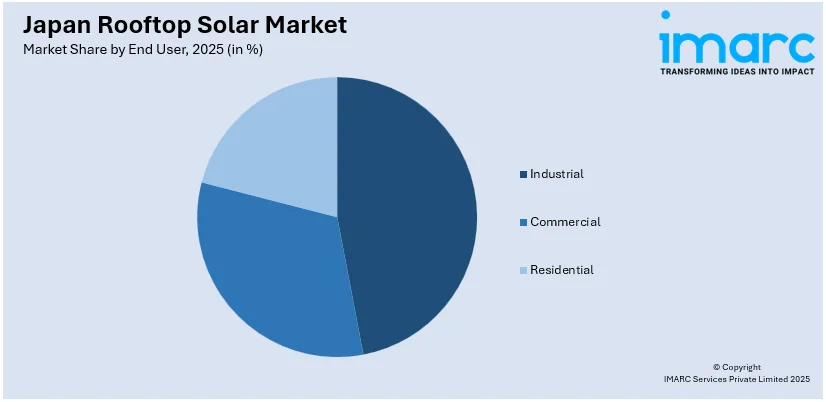

End User Insights:

Access the comprehensive market breakdown Request Sample

- Industrial

- Commercial

- Residential

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes industrial, commercial, and residential.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Rooftop Solar Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Grid Types Covered | On-Grid, Off-Grid |

| End Users Covered | Industrial, Commercial, Residential |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan rooftop solar market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan rooftop solar market on the basis of grid type?

- What is the breakup of the Japan rooftop solar market on the basis of end user?

- What is the breakup of the Japan rooftop solar market on the basis of region?

- What are the various stages in the value chain of the Japan rooftop solar market?

- What are the key driving factors and challenges in the Japan rooftop solar?

- What is the structure of the Japan rooftop solar market and who are the key players?

- What is the degree of competition in the Japan rooftop solar market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan rooftop solar market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan rooftop solar market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan rooftop solar industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)