Japan Security Robots Market Expected to Reach USD 2,794.6 Million by 2033 - IMARC Group

Japan Security Robots Market Statistics, Outlook and Regional Analysis 2025-2033

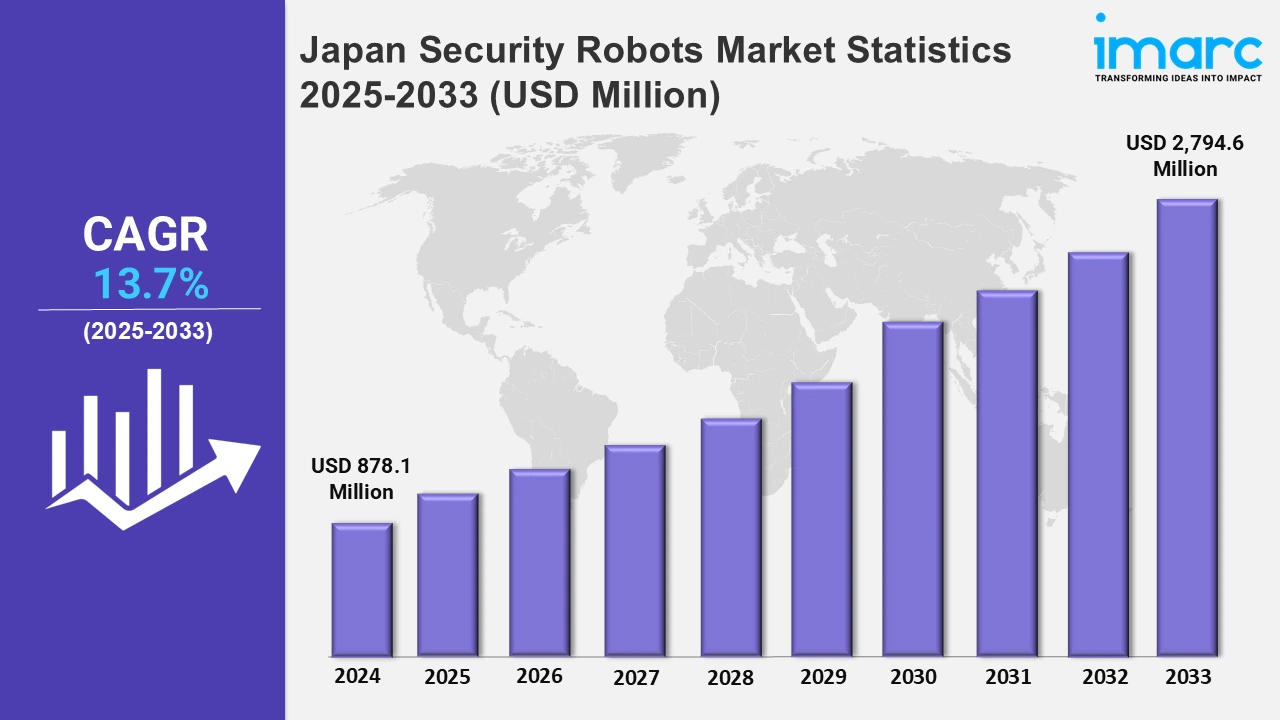

The Japan security robots market size was valued at USD 878.1 Million in 2024, and it is expected to reach USD 2,794.6 Million by 2033, exhibiting a growth rate (CAGR) of 13.7% from 2025 to 2033.

To get more information on this market, Request Sample

The rapid advancements in autonomous mobility and robotics are significantly shaping the security robots market in Japan, especially with the growing demand for automation in urban areas. The adoption of these technologies is being driven by the need for improved efficiency, safety, and scalability in environments such as warehouses, transportation, and public spaces. A key development in this space occurred in December 2024 when Avride’s delivery robots received certification to operate in Japan. This milestone signals the expansion of autonomous systems in urban settings, allowing for efficient, secure delivery services while reducing the reliance on human labor. The success of Avride’s robots reflects Japan’s ongoing shift towards integrating more intelligent, self-sustaining solutions into its daily operations. Further strengthening this trend, in September 2024, EXEDY introduced the smart robot Neibo, which can be customized via a no-code application, catering to specific operational needs within warehouses and factories. Neibo’s remarkable towing capacity of 600kg and its integration capabilities enhance its versatility, making it a valuable asset in labor-saving automation efforts. This innovation not only boosts operational efficiency but also plays a critical role in Japan’s security robot market, as companies seek solutions that can seamlessly enhance productivity and reduce human error.

Moreover, in July 2024, West Japan Railways launched a humanoid robot capable of remotely performing tasks such as fixing overhead wires, a step forward in applying robotic systems to infrastructure maintenance. This development reduces workforce demands, enhances safety, and further expands the application of security robots in critical sectors like transportation and infrastructure. The increasing demand for autonomous security robots in Japan is also being fueled by factors such as labor shortages, aging populations, and the growing need for smart surveillance systems. Japan’s focus on advancing robotic technology, supported by initiatives from both private and public sectors, is creating new opportunities for innovation in the security robot market. With companies like Avride, EXEDY, and West Japan Railways driving these developments, the security robot market in Japan is poised for significant growth, as these robots provide solutions to operational challenges while contributing to enhanced safety and efficiency across multiple industries. The continued integration of robotic systems into various aspects of urban infrastructure and industry highlights Japan’s commitment to maintaining its position as an international leader in automation and robotics.

Japan Security Robots Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The growth of Japan's security robot market is driven by the adoption of advanced technologies like neural networks, enabling robots to learn and enhance their capabilities over time.

Kanto Region Security Robots Market Trends:

The Kanto region, led by Tokyo, is witnessing a surge in security robot adoption, driven by the demand for high-tech security solutions in urban areas. With a focus on reducing human labor and increasing surveillance efficiency, autonomous patrol robots like Cruzr are deployed in commercial buildings and transport hubs. For example, Chiba's Narita International Airport has begun using security robots to assist with monitoring and customer service, improving overall security and operational efficiency.

Kansai/Kinki Region Security Robots Market Trends:

In the Kansai region, particularly in Osaka, security robots are being integrated into smart city initiatives, optimizing surveillance in both private and public spaces. The presence of major tech companies, such as Panasonic, is contributing to the rise of robots for security patrols, enhancing the region’s safety infrastructure. For example, a trial deployment of autonomous security robots at Osaka's Universal Studios Japan has shown promising results in reducing the need for human security personnel while improving response times.

Central/Chubu Region Security Robots Market Trends:

The Chubu region is experiencing growth in security robots for industrial applications, particularly in Nagoya. Companies in the automotive sector are adopting robots for facility security and surveillance. PatrolBot, an autonomous security robot, is being used in factories to monitor for intrusions, ensuring safety in high-risk environments. A notable example is Toyota's use of security robots at its production plants, highlighting the importance of automation in ensuring safety and reducing costs in industrial settings.

Kyushu-Okinawa Region Security Robots Market Trends:

The Kyushu-Okinawa region is seeing increased adoption of security robots, driven by technological advancements and the need for enhanced safety. A notable example is in Oita Prefecture, where Nippon Otis Elevator integrated autonomous robots with Otis Gen2 Prestige elevators in April 2024. This innovation, utilizing cloud-based Otis Integrated Dispatch technology, not only improves delivery efficiency but also strengthens security at government facilities. The integration highlights the growing role of security robots in Japan's workforce, contributing to market expansion in the region.

Tohoku Region Security Robots Market Trends:

The Tohoku region is increasingly adopting security robots to enhance disaster response and recovery. Robots like Cobalt are deployed in high-risk areas to monitor infrastructure, detect hazards, and assist with evacuations. In cities like Sendai, robotic security systems are integrated into emergency response teams, ensuring safety in vulnerable zones. This growing use of security robots highlights the region’s innovation in leveraging technology to improve disaster resilience, streamline recovery efforts, and enhance safety protocols during emergencies.

Chugoku Region Security Robots Market Trends:

The Chugoku region, particularly in Hiroshima, is embracing security robots for public safety in tourist areas and heritage sites. Robots such as Robocop are being deployed at historical landmarks to monitor crowds, ensuring both security and the preservation of cultural heritage. An example includes the deployment of security robots at Hiroshima Peace Memorial Park, which ensures the safety of visitors and acts as an informative guide, enhancing the overall visitor experience while maintaining safety standards.

Hokkaido Region Security Robots Market Trends:

In Hokkaido, the use of security robots is rising due to the region's large and sparsely populated areas, making human patrols difficult. Robots like Savioke are used to monitor remote facilities such as ski resorts and national parks. For example, Niseko's popular ski resorts have implemented security robots for surveillance during the busy winter season. These robots help ensure the safety of tourists by patrolling ski slopes and public areas, offering real-time data to security teams.

Shikoku Region Security Robots Market Trends:

Shikoku is seeing a growth in security robots for rural and agricultural applications, particularly in areas like Kagawa. Robots equipped with advanced sensors are being used to patrol agricultural fields and prevent theft, ensuring crops and machinery are secure. In smaller towns like Tokushima, SecuRob robots are being employed to safeguard agricultural produce in warehouses, reducing the need for human security while maintaining a constant monitoring presence, proving effective in enhancing the safety of rural areas.

Top Companies Leading in the Japan Security Robots Industry

Some of the leading tire market companies include Secom Co. Ltd., SMP Robotics Systems Corp., and Sohgo Security Services Co. Ltd. (ALSOK), among many others. Additionally, detailed profiles of key industry players are provided, highlighting their operations, strengths, and strategies in the Japanese security robots sector. For instance, in November 2024, Ubitus introduced its LLM-driven AI robot at the NVIDIA AI Summit Japan. Powered by NVIDIA Jetson and H100 GPU, the robot's natural language understanding and visual recognition enhance security operations, boosting market potential for intuitive, real-time robotic applications across industries.

Japan Security Robots Market Segmentation Coverage

- On the basis of the component, the market has been bifurcated into propulsion system, frames and sensors, camera systems, guidance and navigation control system, power systems, and others. These systems are critical components, ensuring efficient movement, precise monitoring, accurate decision-making, and reliable operation in complex environments, thereby enhancing performance and adaptability in various mission scenarios.

- Based on the type, the market is categorized into unmanned ground vehicle, unmanned aerial vehicle, and autonomous underwater vehicle. These vehicles provide versatile platforms, equipped with advanced sensors and communication systems, enabling seamless surveillance, navigation, and interaction in diverse terrains, vital for maintaining security and performing a variety of specialized tasks autonomously.

- On the basis of the application, the market has been divided into spying, patrolling, explosive detection, rescue operations, and others. These applications are executed with precision, utilizing advanced sensors and communication technologies, enhancing situational awareness, operational efficiency, and safety in hazardous environments while minimizing human risk in high-stakes security operations.

- Based on the end user, the market is categorized into defense and military, residential, and commercial. These sectors increasingly rely on advanced robotic systems, offering enhanced surveillance, threat detection, and intervention capabilities, addressing diverse needs for security, monitoring, and emergency response, with tailored solutions improving both protection and efficiency across various settings.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 878.1 Million |

| Market Forecast in 2033 | USD 2,794.6 Million |

| Market Growth Rate 2025-2033 | 13.7% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Propulsion System, Frames and Sensors, Camera Systems, Guidance and Navigation Control System, Power Systems, Others |

| Types Covered | Unmanned Ground Vehicle, Unmanned Aerial Vehicle, Autonomous Underwater Vehicle |

| Applications Covered | Spying, Patrolling, Explosive Detection, Rescue Operations, Others |

| End Users Covered | Defense and Military, Residential, Commercial |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Companies Covered | Secom Co. Ltd., SMP Robotics Systems Corp., Sohgo Security Services Co. Ltd. (ALSOK), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Security Robots Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)