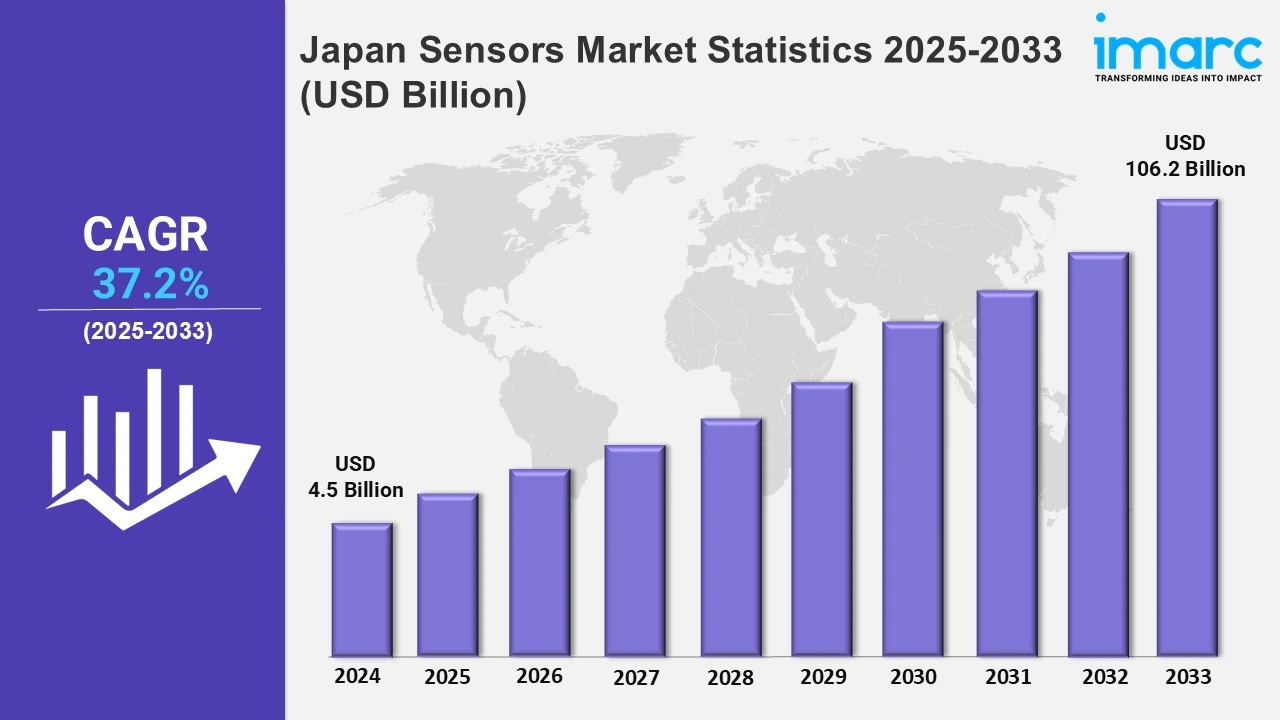

Japan Sensors Market Expected to Reach USD 106.2 Billion by 2033 - IMARC Group

Japan Sensors Market Statistics, Outlook and Regional Analysis 2025-2033

The Japan sensors market size was valued at USD 4.5 Billion in 2024, and it is expected to reach USD 106.2 Billion by 2033, exhibiting a growth rate (CAGR) of 37.2% from 2025 to 2033.

To get more information on this market, Request Sample

The Japanese sensor industry is observing significant innovations due to the increasing demand for high-precision imaging, security applications, and industrial automation. The rapid deployment of space-based infrared tracking systems, high-performance CMOS sensors, and 3D Time-of-Flight technology reflects the country’s focus on innovation and national security. In addition, the rising need for advanced semiconductor technology and miniaturized components is further strengthening the market. For example, in January 2025, Japan’s Ministry of Defense initiated testing of infrared sensors on the HTV-X cargo transporter to track hypersonic missiles. The space-based system enhances national security by countering threats from China and Russia. In the same way, the consumer electronics sector in Japan is witnessing a surge in demand for high-performance image sensors, particularly for smartphone cameras. The country’s leading semiconductor manufacturers are investing in sensor innovation to enhance imaging capabilities in low-light and high-contrast conditions. For instance, in September 2024, Sony Semiconductor Solutions launched the LYT-818, a 50-megapixel CMOS sensor featuring ultra-low noise and HDR technology in Atsugi. This development significantly improves smartphone camera performance, setting new industry benchmarks.

The increasing consumer preference for premium smartphones with advanced imaging capabilities is a major driver of the Japanese sensor industry. Furthermore, the rapid advancements in AI-powered image processing and computational photography are influencing sensor design and functionality. Concomitantly, the growing adoption of sensors in industrial automation and automotive safety is contributing to market expansion. The increasing focus on leading-edge driver-assistance systems and self-directed driving technologies is fueling the demand for high-precision distance measurement solutions. For example, in July 2024, Nuvoton Technology began mass production of a VGA-resolution 3D Time-of-Flight sensor in Kyoto. This sensor is designed for automotive safety, industrial automation, and smart door locks, providing accurate distance measurement even in bright ambient lighting. The integration of sensors in automotive applications enhances object detection, collision avoidance, and lane-keeping assistance, driving market growth. Overall, the rising demand for smart security systems and biometric authentication technologies is creating new opportunities for sensor manufacturers in Japan.

Japan Sensors Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. Growing adoption of IoT applications and ongoing technological advancements are fueling the expansion of Japan’s sensor industry.

Kanto Region Sensors Market Trends:

The Kanto region, home to Tokyo, is a key hub for sensor technology, driving advancements in industrial automation and smart infrastructure. In August 2024, Figaro Sensor Technology showcased gas and environmental sensors at SENSOR EXPO JAPAN, highlighting innovations in air quality monitoring and industrial safety. These sensors support smart city initiatives and workplace hazard detection, reinforcing Kanto’s role in environmental monitoring and automation.

Kansai/Kinki Region Sensors Market Trends:

Kansai, centered around Kyoto and Osaka, is a leader in sensor fusion technology, particularly for autonomous systems. In October 2024, Kyocera introduced the world’s first Camera-LIDAR Fusion Sensor in Kyoto, ensuring parallax-free object detection. This breakthrough improves self-driving vehicle navigation and maritime safety, strengthening Japan’s position in automotive and industrial automation. Kansai’s expertise in precision optics and sensor alignment continues to drive next-generation detection systems.

Central/Chubu Region Sensors Market Trends:

Chubu, which includes Ishikawa and Aichi, is a manufacturing powerhouse in high-resolution thermal imaging sensors. In December 2024, Japan Display Inc. JDI partnered with Obsidian Sensors, Inc. to produce SXGA (1280×1024) uncooled microbolometers on glass at its Ishikawa factory. These sensors serve the security, automotive, and defense markets, improving Japan’s technological leadership in thermal imaging for surveillance and vehicle night vision applications.

Kyushu-Okinawa Region Sensors Market Trends:

Kyushu, particularly Kumamoto, is a growing semiconductor and sensor production hub. In December 2024, Sony Semiconductor surpassed 20 billion image sensor shipments and started constructing a new facility in Kumamoto. This expansion boosts production for mobile, automotive, and industrial image sensors, strengthening Japan’s semiconductor supply chain. Furthermore, Kyushu’s investment in imaging technology enhances sensor capabilities for advanced driver-assistance systems and smart manufacturing applications.

Tohoku Region Sensors Market Trends:

The Tohoku region, including Sendai, specializes in agricultural sensor development for precision farming. Given its agricultural landscape, companies design soil moisture and nutrient measuring devices to optimize irrigation and crop yields. Wireless sensors help farmers track environmental conditions remotely, reducing water waste and improving productivity. For instance, automated irrigation systems use real-time data from these sensors to ensure crops receive precise hydration levels.

Chugoku Region Sensors Market Trends:

Healthcare sensors are in heightened demand in the Chugoku region for wearable technology and medical diagnostics. Moreover, local companies manufacture glucose-monitoring biosensors to help people with diabetes track their health in real time. Research facilities in Hiroshima also create non-invasive blood oxygen level sensors. Besides this, wearable fitness trackers with heart rate sensors, for instance, improve preventative healthcare and remote patient monitoring.

Hokkaido Region Sensors Market Trends:

Hokkaido’s extreme climate conditions drive demand for sensors monitoring cold-weather infrastructure. Ice-detecting devices help avert traffic accidents by warning authorities of dangerous circumstances. In this context, structural health monitoring sensors are integrated into bridges to track temperature variations and material stress to ensure long-term durability. For instance, in winter conditions, embedded fiber-optic sensors improve maintenance tactics by giving real-time input on cracks developing in frozen infrastructure.

Shikoku Region Sensors Market Trends:

Shikoku focuses on maritime sensor applications due to its strong dependence on fisheries and coastal industries. Companies develop pressure and sonar sensors for deep-sea exploration and fishing vessel navigation. These technologies improve resource management by tracking fish populations and underwater environmental changes. For example, real-time salinity sensors assist local fisheries in monitoring optimal breeding conditions, ensuring sustainable seafood production.

Top Companies Leading in the Japan Sensors Industry

Japan’s sensor industry is advancing, with Renesas leading innovation, as the company launched RRH62000 in August 2024, a compact module integrating PM, TVOC, and CO₂ detection with AI. Developed in Tokyo, it supports smart homes, HVAC systems, and public buildings, ensuring compliance with air quality standards. The market report provides a detailed competitive analysis, including industry structure, positioning of key players, winning strategies, and major company portfolios, reflecting Japan’s technological progress in environmental monitoring.

Japan Sensors Market Segmentation Coverage

- On the basis of the parameters measured, the market has been bifurcated into temperature, pressure, level, flow, proximity, environmental, chemical, inertial, magnetic, vibration, and others. Sensors measure these parameters to ensure accurate monitoring and control in different applications as they detect environmental changes and provide data for safety, automation, and process optimization.

- Based on the mode of operations, the market is categorized into optical, electrical resistance, biosensor, piezoresistive, image, capacitive, piezoelectric, LiDAR, radar, and others. These sensors convert physical changes into measurable signals and enable distance measurement, detect biological interactions, and enhance vision-based applications, thereby supporting medical imaging, security, and automation.

- On the basis of the end use industry, the market has been divided into automotive, consumer electronics (smartphones, tablets, laptops, and computers, wearable devices, smart appliances or devices, and others), energy, industrial and other, medical and wellness, construction, agriculture, and mining, aerospace, and defense. These industries rely on sensors for automation, safety, and efficiency, allowing real-time monitoring, analytical maintenance, resource optimization, and system integration, advancing connectivity, precision, and intelligent operations in various applications.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 106.2 Billion |

| Market Growth Rate 2025-2033 | 37.2% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Parameters Measures Covered | Temperature, Pressure, Level, Flow, Proximity, Environmental, Chemical, Inertial, Magnetic, Vibration, Others |

| Mode of Operations Covered | Optical, Electrical Resistance, Biosensor, Piezoresistive, Image, Capacitive, Piezoelectric, LiDAR, Radar, Others |

| End Use Industries Covered |

|

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)