Japan Small Home Appliances Market Expected to Reach USD 3.7 Billion by 2033 - IMARC Group

Japan Small Home Appliances Market Statistics, Outlook and Regional Analysis 2025-2033

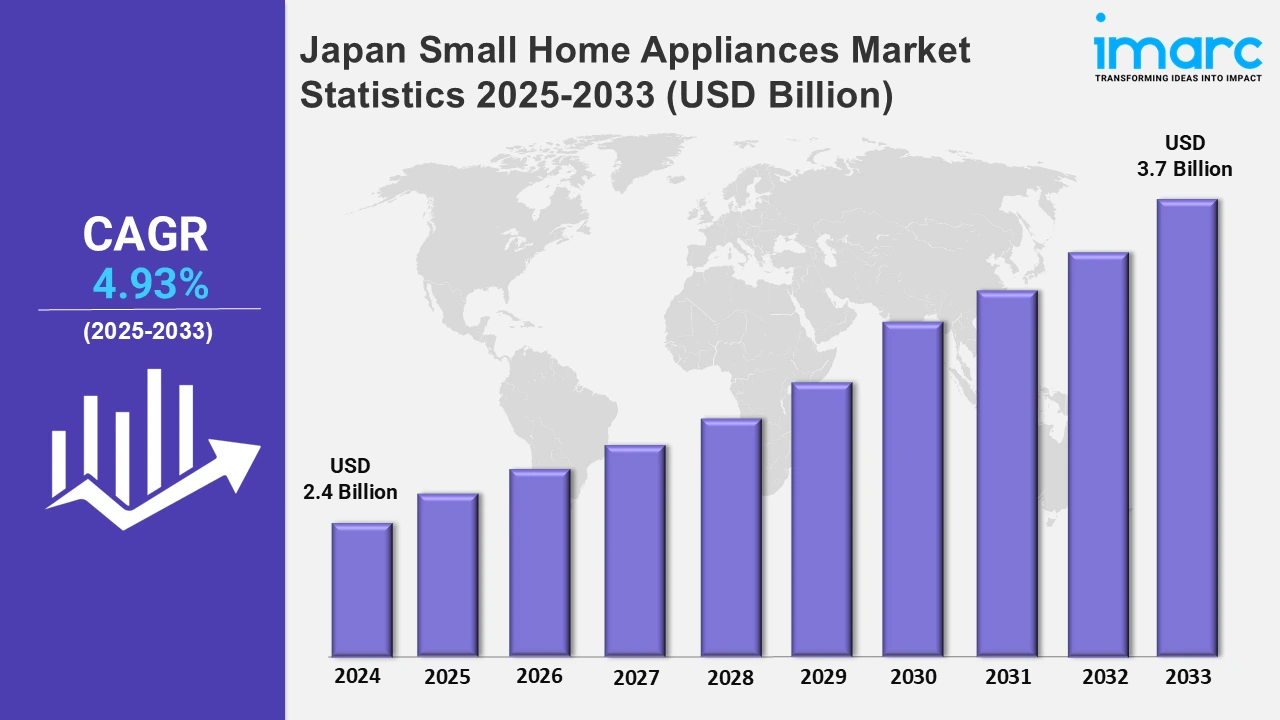

The Japan small home appliances market size was valued at USD 2.4 Billion in 2024, and it is expected to reach USD 3.7 Billion by 2033, exhibiting a growth rate (CAGR) of 4.93% from 2025 to 2033.

To get more information on this market, Request Sample

Japan’s small home appliances market is witnessing notable growth, fueled by continuous innovation, especially in urban centers like Tokyo. A key player in this trend is Dreame, with the March 2024 launch of the DreameBot X30 Ultra, a compact robot vacuum-packed with advanced features. The device boasts automatic mop cleaning, self-maintenance capabilities, and hair-cutting brushes, offering consumers more convenience in daily chores. The demand for time-saving and efficient devices has surged with Japan’s high population density and the fast-paced nature of urban living. The DreameBot X30 Ultra, along with similar smart appliances, fits seamlessly into the modern Japanese lifestyle, where time is precious. These smart home solutions offer a blend of automation and functionality, catering to consumers seeking both convenience and advanced technology. As a result, leading brands are intensifying efforts to launch products that provide seamless user experiences, further propelling the competition in Japan’s small appliance sector.

Parallel to this trend, Japan’s growing interest in ethnic foods, particularly Korean cuisine, is influencing the development of small kitchen appliances. According to the article published by NIKKEI ASIA in September 2024, Japan’s Korean food market has experienced a remarkable 50% growth over the past five years. This surge in popularity, driven by the rising demand for frozen foods and meal kits, has led to a demand for kitchen gadgets tailored to preparing these dishes. Mini rice cookers, air fryers, and other specialized appliances are now being introduced, enabling consumers to replicate authentic Korean meals in the comfort of their homes. These products offer quick and easy meal preparation, making them ideal for busy individuals and families. The increasing focus on health-conscious cooking and the shift toward home meal preparation further enhances the appeal of these gadgets. Manufacturers are, therefore, innovating and refining their product offerings to cater to these evolving consumer demands. In the personal care sector, Panasonic Beauty introduced its latest hair dryer in May 2024, designed to elevate everyday hair care routines. This launch is a clear reflection of the broader trend of small appliances becoming integral to both household chores and personal beauty regimens.

Japan Small Home Appliances Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. In Japan, small home appliance demand has risen due to energy efficiency, IoT tech, urbanization, smaller households, space-saving designs, multipurpose products, and sustainability focus.

Kanto Region Small Home Appliances Market Trends:

In the Kanto region, which includes Tokyo, the demand for smart home appliances is rapidly growing. A notable example is Hitachi’s August 2024 launch of a vacuum cleaner incorporating augmented reality. This innovation makes cleaning a game, reducing stress, and enhancing the user experience. Besides this, the region’s tech-savvy consumers are increasingly drawn to appliances that integrate advanced technologies like IoT and augmented reality, aligning with the trend of transforming mundane household tasks into interactive, engaging experiences.

Kansai/Kinki Region Small Home Appliances Market Trends:

The Kansai/Kinki region, with Osaka as a key center, is seeing a rise in home appliances that emphasize convenience and innovation. A prime example is Panasonic’s May 2023 introduction of the “foodable” subscription service, which combines IoT-enabled kitchen appliances with curated food deliveries. This service taps into consumer trends favoring convenience and high-quality meals, reflecting Kansai’s focus on combining technology with everyday life. By offering both appliances and food in a seamless experience, Panasonic is enhancing user engagement and co-creating value with consumers.

Central/Chubu Region Small Home Appliances Market Trends:

In the Central/Chubu region, particularly Aichi and Nagoya, consumers are increasingly seeking compact kitchen gadgets like air fryers, mini-ovens, and multifunctional cookers. As Nagoya is a manufacturing hub, local innovation drives the trend of high-tech appliances that offer convenience in small urban apartments. The demand is also shaped by the region's growing interest in healthier cooking options and space-efficient appliances, catering to a mix of young professionals and families.

Kyushu-Okinawa Region Small Home Appliances Market Trends:

The hot, muggy weather in Kyushu-Okinawa is increasing demand for climate-sensitive small products like air conditioners and dehumidifiers. Moreover, in Fukuoka, air purifiers are becoming popular due to concerns about the quality of the air portable. Besides this, compact heating and cooling equipment is highly sought after in Okinawa, especially by senior citizens and those living in smaller dwellings. These regions focus on convenience and comfort, with energy-efficient products becoming increasingly sought after.

Tohoku Region Small Home Appliances Market Trends:

Tohoku, including Sendai, sees growing demand for winter-related small appliances, such as electric heaters and rice cookers, due to its cold winters. In line with this, consumers in Sendai prioritize energy-efficient solutions that offer warmth and comfort during harsh weather. There is also a steady demand for small kitchen gadgets like electric kettles and rice cookers with a robust culinary heritage. Besides this, there is a growing inquisitiveness in food preservation devices like vacuum sealers in the rural parts of the region.

Chugoku Region Small Home Appliances Market Trends:

Portable kitchen appliances that fit smaller homes are gaining traction in Chugoku, with Hiroshima serving as a major hub. In addition, products like coffee makers and portable blenders are becoming popular, particularly with students and young professionals. Further, this trend is influenced by Hiroshima's crowded cities and active university population, as people search for reasonably priced, effective, and compact appliances for their houses and small flats.

Hokkaido Region Small Home Appliances Market Trends:

In Hokkaido, where winters are harsh, demand spikes for small home appliances that provide warmth and comfort, such as electric heaters, humidifiers, heated blankets, etc. In Sapporo, residents seek energy-efficient alternatives to withstand the cold. Additionally, Hokkaido's agricultural background drives interest in appliances like vacuum sealers and food dehydrators, which are popular for preserving seasonal produce. The region's consumers focus on functionality, energy efficiency, and comfort.

Shikoku Region Small Home Appliances Market Trends:

Shikoku, particularly in Takamatsu, is seeing an increase in demand for compact and multifunctional kitchen appliances like rice cookers and blenders. The region’s rural areas have also shown a rise in eco-friendly appliances such as energy-efficient refrigerators and solar-powered devices. Shikoku's older population contributes to the demand for health-related appliances, including air purifiers and water filters. The trend is towards appliances that combine convenience, sustainability, and health benefits.

Top Companies Leading in the Japan Small Home Appliances Industry

The Japan small home appliances market remains highly competitive, with major players like Panasonic, Sharp, Hitachi, and global brands such as Philips and Dyson leading with energy-efficient, multifunctional, and IoT-enabled products. Smaller brands differentiate through unique designs and eco-friendly solutions. In August 2024, TOSHIBA launched the Dew Series rice cooker, featuring AI-controlled steam adjustments and 360-degree heating. This innovation enhances cooking efficiency and texture, meeting Japan's demand for smarter and more precise appliances, thereby reinforcing TOSHIBA’s leadership in the sector.

Japan Small Home Appliances Market Segmentation Coverage

- On the basis of the product, the market has been bifurcated into tea/coffee makers, vacuum cleaners, food processors, grills and toasters, and others. Tea/coffee makers dominate the market. These devices offer convenience, efficiency, and modern functionality, catering to daily household tasks with innovative designs and advanced technology.

- Based on the distribution channel, the market is categorized into multi-brand stores, exclusive stores, online, and others. Multi-brand stores represent the market. These sales channels provide a diverse range of products, which ensures accessibility, choice, and competitive pricing for customers in the market.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 2.4 Billion |

| Market Forecast in 2033 | USD 3.7 Billion |

| Market Growth Rate 2025-2033 | 4.93% |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Tea/Coffee Makers, Vacuum Cleaners, Food Processors, Grills and Toasters, Others |

| Distribution Channels Covered | Multi-brand Stores, Exclusive Stores, Online, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Small Home Appliances Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)