Japan Smart Conveyor Systems Market Size, Share, Trends and Forecast by Component, Product Type, Technology, Automation Level, Industry Vertical, and Region, 2026-2034

Japan Smart Conveyor Systems Market Overview:

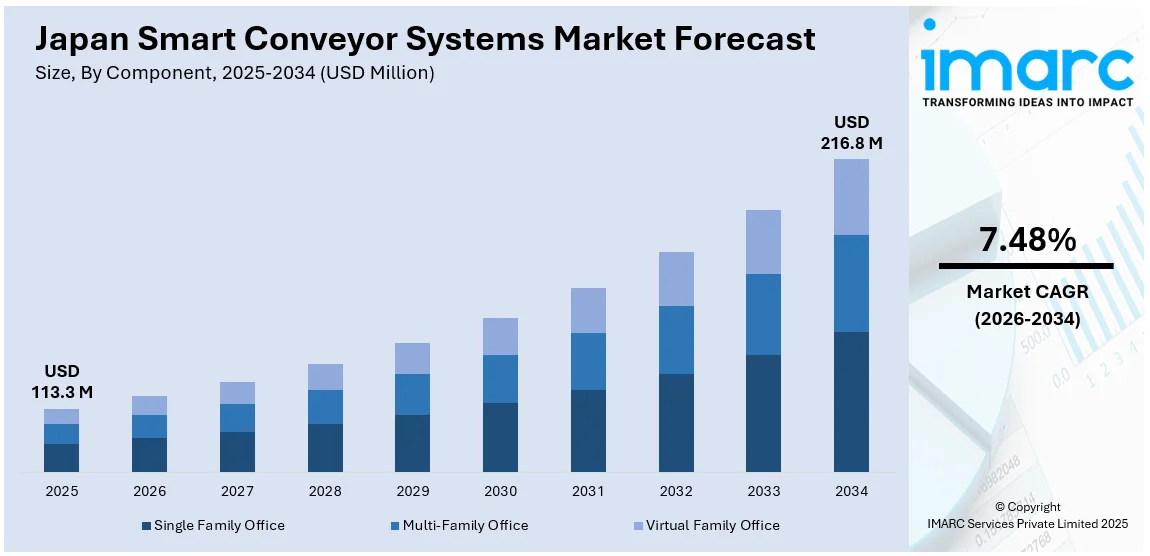

The Japan smart conveyor systems market size reached USD 113.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 216.8 Million by 2034, exhibiting a growth rate (CAGR) of 7.48% during 2026-2034. Rising labor costs, widespread adoption of industrial automation, and the rapid growth of electronic commerce and logistics are fueling the market growth. Other key drivers include the demand for space-saving solutions, increased use of the Industrial Internet of Things (IIoT), and implementation of Industry 4.0 technologies. Apart from this, advancements in sensor and motion control systems, government-led digital transformation programs, growing focus on predictive maintenance, and preference for modular, and scalable material handling systems across factories, warehouses, and distribution centers are stimulating the Japan smart conveyor systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 113.3 Million |

| Market Forecast in 2034 | USD 216.8 Million |

| Market Growth Rate 2026-2034 | 7.48% |

Japan Smart Conveyor Systems Market Trends:

Rising Labor Costs

Japan’s rising labor costs are a key factor pushing industries toward smart automation solutions like intelligent conveyor systems. This trend is largely tied to structural labor shortages, especially due to the country’s aging population. As of 2023, Japan’s elderly (65+) made up 29.1% of the population, the highest among major economies. With fewer young workers entering the job market, employers are increasing wages to attract and retain talent. In 2024, major Japanese firms agreed to an average wage increase of 5.28% during spring labor negotiations, the largest hike in over three decades. These developments are raising operational costs, especially in labor-intensive sectors like manufacturing, logistics, and retail. Companies are responding by accelerating investments in automation technologies, including smart conveyor systems, which reduce dependence on manual labor. These systems not only cut costs but also enhance efficiency, supporting 24/7 operations with minimal human oversight. Given Japan’s demographic trajectory and wage inflation, the adoption of automated material handling systems is expected to deepen further, which is driving the Japan smart conveyor systems market growth.

To get more information on this market Request Sample

Strong Industrial Automation Uptake

Japan’s long-standing commitment to automation makes it a natural market for smart conveyor systems. In 2023 alone, Japanese factories operated over 435,000 industrial robots, representing a steady 5% year-on-year increase. This widespread automation stems from the need to sustain productivity levels despite a declining labor pool. The government also supports advanced manufacturing through programs tied to Society 5.0, which promotes cyber-physical integration in factories. Smart conveyor systems fit seamlessly into this landscape by automating material flow, reducing downtime, and enabling real-time monitoring. These systems are especially useful in industries such as automotive, electronics, and semiconductors, where precision and consistency are critical. As factories grow more connected through IoT and edge computing, conveyors equipped with sensors, feedback loops, and machine learning capabilities are becoming essential.

Expansion in E-commerce and Logistics

Japan’s expanding e-commerce sector is transforming logistics operations and boosting demand for smart conveyor systems. This explosive growth has led to higher volumes of small, frequent orders, straining traditional logistics and warehouse operations. To meet the demand for faster and more accurate fulfillment, companies are upgrading their infrastructure with smart conveyor systems that can handle sorting, routing, and real-time tracking with minimal manual intervention. Leading logistics firms in Japan are also integrating these systems with automated storage, robotics, and AI-based analytics tools to optimize warehouse flow. The surge in mobile commerce, with majority of internet users accessing platforms via smartphones, further intensifies delivery expectations. Smart conveyors help meet these expectations by speeding up order processing and reducing errors. With consumer behavior shifting toward same-day and next-day deliveries, especially in dense urban areas, the importance of intelligent and responsive logistics systems is growing. Smart conveyors are thus becoming central to warehouse automation strategies across Japan’s fast-evolving retail and logistics sectors.

Japan Smart Conveyor Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on component, product type, technology, automation level, and industry vertical.

Component Insights:

- Hardware

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services.

Product Type Insights:

- Belt Conveyors

- Roller Conveyors

- Overhead Conveyors

- Pallet Conveyors

- Sortation Systems

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes belt conveyors, roller conveyors, overhead conveyors, pallet conveyors, and sortation systems.

Technology Insights:

- IoT-Enabled Conveyors

- AI-Driven Systems

- Robotic Integration

- RFID and Barcode Scanning

The report has provided a detailed breakup and analysis of the market based on the technology. This includes IoT-enabled conveyors, AI-driven systems, robotic integration, and RFID and barcode scanning.

Automation Level Insights:

- Semi-Automated Conveyor Systems

- Fully Automated Conveyor Systems

A detailed breakup and analysis of the market based on the automation level have also been provided in the report. This includes semi-automated conveyor systems and fully automated conveyor systems.

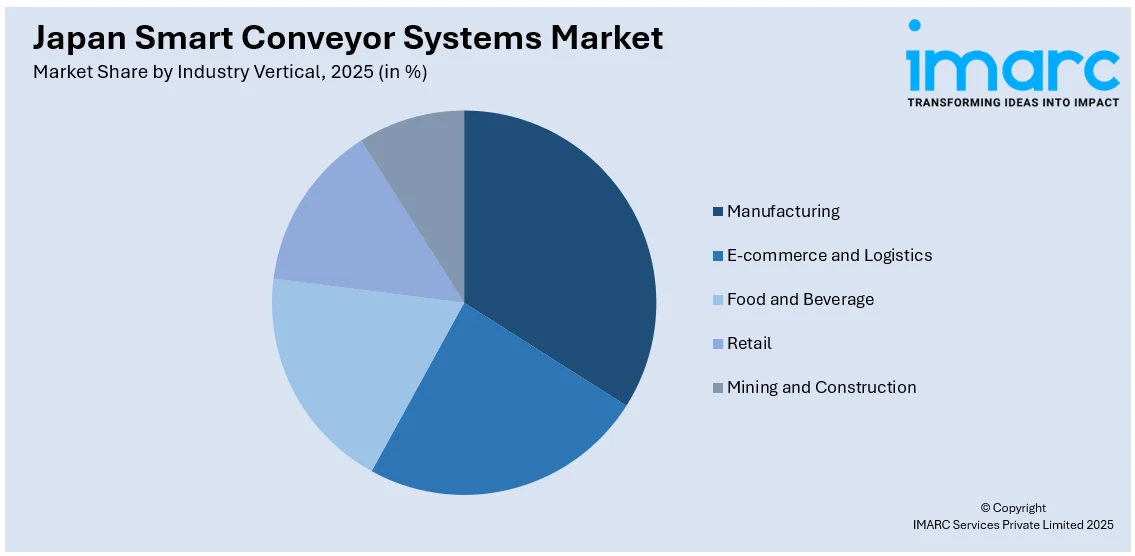

Industry Vertical Insights:

Access the comprehensive market breakdown Request Sample

- Manufacturing

- E-commerce and Logistics

- Food and Beverage

- Retail

- Mining and Construction

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes manufacturing, e-commerce and logistics, food and beverage, retail, and mining and construction.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Smart Conveyor Systems Market News:

- In 2024, Japan's Ministry of Land, Infrastructure, Transport and Tourism proposed the "Autoflow Road," a 310-mile automated freight delivery system between Tokyo and Osaka. This initiative aims to address labor shortages and reduce emissions by replacing up to 25,000 trucks daily. Test runs are scheduled for 2027 or early 2028, with full operations expected by the mid-2030s.

- In 2024, JFE Steel introduced an artificial intelligence (AI) driven monitoring system for belt conveyors. Utilizing image recognition and three dimensional (3D) sensors, the system detects belt damage and misalignment, enhancing safety and reducing downtime in steel plant operations.

- In 2024, Ocado Technology and Aeon announced plans to build a third robotic warehouse in Japan, featuring advanced conveyor systems integrated with AI and robotics. This expansion aims to improve online grocery fulfillment and address labor shortages.

Japan Smart Conveyor Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Product Types Covered | Belt Conveyors, Roller Conveyors, Overhead Conveyors, Pallet Conveyors, Sortation Systems |

| Technologies Covered | IoT-Enabled Conveyors, AI-Driven Systems, Robotic Integration, RFID and Barcode Scanning |

| Automation Levels Covered | Semi-Automated Conveyor Systems, Fully Automated Conveyor Systems |

| Industry Verticals Covered | Manufacturing, E-commerce and Logistics, Food and Beverage, Retail, Mining and Construction |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan smart conveyor systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan smart conveyor systems market on the basis of component?

- What is the breakup of the Japan smart conveyor systems market on the basis of product type?

- What is the breakup of the Japan smart conveyor systems market on the basis of technology?

- What is the breakup of the Japan smart conveyor systems market on the basis of automation level?

- What is the breakup of the Japan smart conveyor systems market on the basis of industry vertical?

- What is the breakup of the Japan smart conveyor systems market on the basis of region?

- What are the various stages in the value chain of the Japan smart conveyor systems market?

- What are the key driving factors and challenges in the Japan smart conveyor systems?

- What is the structure of the Japan smart conveyor systems market and who are the key players?

- What is the degree of competition in the Japan smart conveyor systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan smart conveyor systems market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan smart conveyor systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan smart conveyor systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)