Japan Solar Panel Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2026-2034

Japan Solar Panel Market Overview:

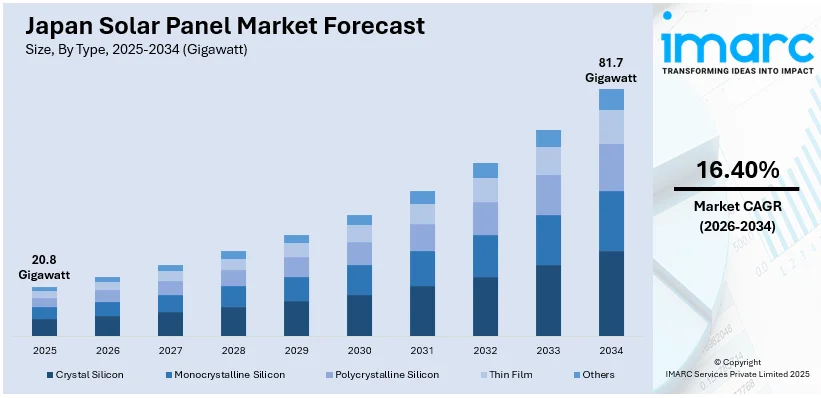

The Japan solar panel market size reached 20.8 Gigawatt in 2025. Looking forward, IMARC Group expects the market to reach 81.7 Gigawatt by 2034, exhibiting a growth rate (CAGR) of 16.40% during 2026-2034. The market is driven by government policies promoting renewable energy, rising electricity costs, and the push for carbon neutrality by 2050. Incentives such as subsidies and feed-in tariffs also accelerate adoption. Increased demand for residential solar, hybrid systems for disaster resilience, and advancements in energy storage technology are further expanding the Japan solar panel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 20.8 Gigawatt |

| Market Forecast in 2034 | 81.7 Gigawatt |

| Market Growth Rate 2026-2034 | 16.40% |

Japan Solar Panel Market Trends:

Rising Demand for Residential Solar Installations

The market is experiencing a rise in demand for residential solar installations, driven by government incentives and rising electricity costs. The country’s feed-in tariff (FIT) program, which previously supported large-scale solar projects, is now shifting focus to smaller residential systems. Households with solar panels have saved an average of JPY 143,422 (around USD 978.04) in the fiscal year 2020, 3.35 times greater than households without solar energy systems. By 2023, residential solar accounted for 9% of Japan's total electricity supply and could reach 14 GW in annual rooftop installations by 2030. Feed-in tariffs and solar mandates are thought to be pivotal in making savings broader and solar technology more ubiquitous. Homeowners are increasingly adopting solar panels to reduce energy bills and achieve energy independence. Additionally, Japan’s push for carbon neutrality by 2050 has encouraged households to invest in renewable energy solutions. Technological advancements, such as high-efficiency solar panels and battery storage systems, have made residential solar more accessible and cost-effective. Companies are offering customized solutions, including rooftop solar and community solar programs, to cater to diverse housing needs. With Japan’s limited land availability, rooftop solar installations are becoming a preferred choice, further enhancing the Japan solar panel market growth. As energy prices continue to rise, the residential solar segment is expected to expand steadily in the coming years.

To get more information on this market Request Sample

Growth of Hybrid and Off-Grid Solar Systems

Another key trend in Japan’s solar panel market is the growing adoption of hybrid and off-grid solar systems, particularly in remote and disaster-prone areas. Following frequent natural disasters including earthquakes and typhoons, there is a growing need for reliable and decentralized power solutions. Hybrid systems, which combine solar panels with battery storage and backup generators, provide energy security during grid outages. The Japanese government is promoting off-grid solar solutions through subsidies and disaster preparedness initiatives. On 10th October 2024, Amp Energy secured equity funding of up to USD 145 Million (JPY 20 Billion) for Amp Japan to accelerate its off-grid solar, onshore wind, and battery storage projects. Amp has 300 MW already built and another 800 MW under development, and plans to set up a 2 GW platform in Japan by 2030. This funding, underpinned by Aravest-SMBC’s SDIEF and Banpu NEXT, enhances Japan's mission to reform and implement decentralized and sustainable energy solutions. Businesses and households in rural regions are increasingly investing in these systems to ensure uninterrupted power supply. Additionally, advancements in energy storage technology, such as lithium-ion batteries, have improved the efficiency of hybrid systems. As Japan continues to prioritize energy resilience, the demand for hybrid and off-grid solar solutions is rising, creating a positive Japan solar panel market outlook.

Japan Solar Panel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and end use.

Type Insights:

- Crystal Silicon

- Monocrystalline Silicon

- Polycrystalline Silicon

- Thin Film

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes crystal silicon, monocrystalline silicon, polycrystalline silicon, thin film, and others.

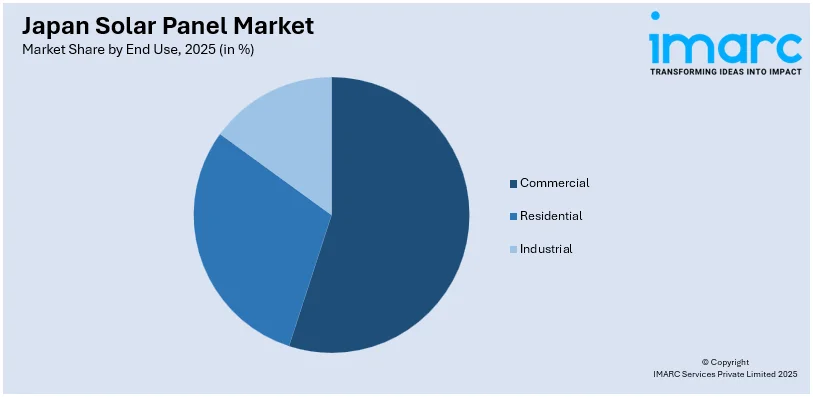

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Commercial

- Residential

- Industrial

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes commercial, residential, and industrial.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Solar Panel Market News:

- August 27, 2024: Trinasolar launched a 2,700 MWh agrivoltaics project in Kyoto, integrating solar energy production throughput with the cultivation of Japanese yam using its 3,392 ultra high-efficiency Vertex N 720W panels. With a significant expected reduction of approximately 1,760 tons of carbon dioxide per year, this system sets an example of a way land can be used for agriculture while producing renewable energy. Agrivoltaics are in line with Japan's goal of carbon neutrality, and this progress is significant for Japanese solar history.

- May 05, 2024: Mubadala and PAG launched PAG REN I to accelerate Japan's pathway to 108GW of solar capacity by 2030 and capitalize on corporate power purchase agreements (PPAs) and clean energy infrastructure. This initiative fits into Japan's RE100 targets and enhances energy security through domestic solar power generation. This is Mubadala's first investment into Japan's solar market and enhances Mubadala's world-wide renewable energy portfolio.

Japan Solar Panel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Gigawatt |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Crystal Silicon, Monocrystalline Silicon, Polycrystalline Silicon, Thin Film, Others |

| End Uses Covered | Commercial, Residential, Industrials |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan solar panel market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan solar panel market on the basis of type?

- What is the breakup of the Japan solar panel market on the basis of end use?

- What is the breakup of the Japan solar panel market on the basis of region?

- What are the various stages in the value chain of the Japan solar panel market?

- What are the key driving factors and challenges in the Japan solar panel market?

- What is the structure of the Japan solar panel market and who are the key players?

- What is the degree of competition in the Japan solar panel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan solar panel market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan solar panel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan solar panel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)