Japan Soup Market Expected to Reach USD 900 Million by 2033 - IMARC Group

Japan Soup Market Statistics, Outlook and Regional Analysis 2025-2033

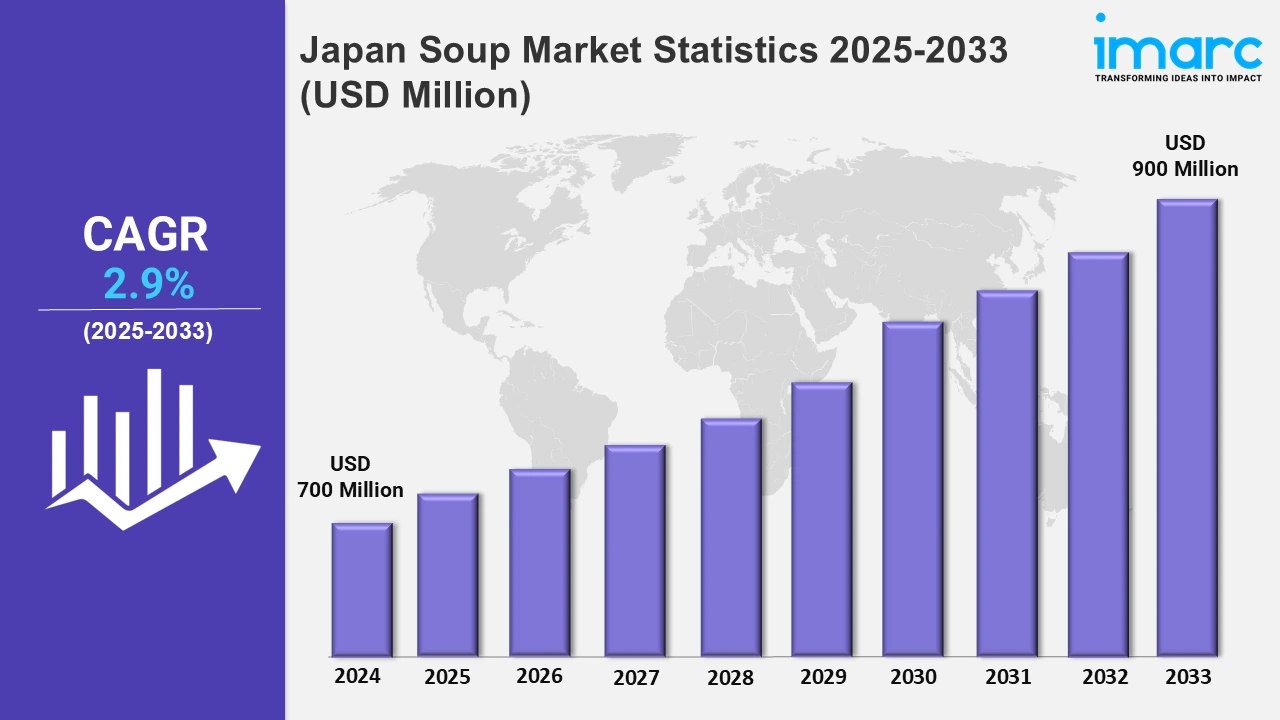

The Japan soup market size was valued at USD 700 Million in 2024, and it is expected to reach USD 900 Million by 2033, exhibiting a growth rate (CAGR) of 2.9% from 2025 to 2033.

To get more information on this market, Request Sample

The Japan soup market is largely propelled by the rising number of single-person households, the escalating need for healthy and natural food alternatives, and the increasing consumption of convenient meal derivatives. For example, in February 2024, Hikari Miso Co., Ltd. released the Mainichi instant miso soup across supermarkets and other food outlets throughout Japan.

Besides this, the elevating health consciousness among individuals is bolstering the requirement for wholesome, nutritious food choices like soup, which is positively influencing the market across the country. For instance, in July 2024, Japanese company Ajinomoto launched its instant soup derivative, Soup & Go, in the international market. Moreover, the emerging trend of veganism, vegetarianism, and gluten-free diets and the introduction of soup variants that cater to these preferences are further propelling the market forward. For example, in December 2024, Miso Tasty unveiled its innovative range of vegan Miso Soups made with real Japanese dashi.

Japan Soup Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Kanto region, Kinki region, Central/ Chubu region, Kyushu/Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The widespread popularity of ready-to-eat soup derivatives is fueling the market expansion in Japan.

Kanto Region Soup Market Trends:

The marketplace in the Kanto region is mostly boosted given the rising shift towards convenience and health-conscious eating. As of 2024, the overall Japanese soup market witnessed a ¥ 125 Billion expansion. Besides this, soups like miso are gaining immense popularity due to their probiotic and nutritional characteristics.

Kinki Region Soup Market Trends:

The soup market in the Kinki region, particularly in cities like Kyoto and Osaka, is experiencing a change in dietary habits. Consumers are increasingly choosing healthy and ready-to-eat food alternatives, thus bolstering the demand for soup. Moreover, in January 2025, Marukome, the leading company of Japanese miso, launched the English version of Hakkoubishoku, the web publication for a conversation on Japan’s unique food culture.

Central/Chubu Region Soup Market Trends:

The ongoing innovations in packaging and the widespread availability of different soup types, including UHT, chilled, dried, etc., are propelling the market outlook in the Central/Chubu region. In addition to this, major players, such as Pokka Corporation, Unilever, and Campbell's Soup Company, have a significant presence in this region, as they cater to consumer interest by offering convenient and health-driven soup variants.

Kyushu-Okinawa Region Soup Market Trends:

The soup market in the Kyushu-Okinawa region of Japan is bolstering due to the increasing trend of blending traditional Japanese with international flavors. Additionally, local dishes in the area reflect a mixture of native elements with Chinese and Southeast Asian influences, such as tonkotsu ramen from Kagoshima, known for its rich, pork-based broth.

Tohoku Region Soup Market Trends:

The Tohoku region of Japan features a distinctive soup market characterized by seasonal ingredients and local dietary habits. This area is recognized for its diverse range of hotpots and stews like Kiritanpo nabe, made with pounded rice and chicken. Moreover, in July 2024, the ramen noodle soup brand Nissin launched new cup noodle flavors in Japan, notably the Nissin Raoh Fugu Dashi Salt.

Chugoku Region Soup Market Trends:

The shifting preferences of consumers towards health-conscious, convenient meal alternatives are primarily driving the soup market in the Chugoku region of Japan. Besides this, the presence of numerous distribution channels in the area provides people with diverse choices of food, catering to busy individuals looking for quick and easy access to meals.

Hokkaido Region Soup Market Trends:

The Hokkaido region focuses mainly on traditional flavors and local ingredients, which are influenced by the rich marine sources and cold climate in the area. Additionally, miso-based soups and regional specialties like seafood broths are extensively popular, catering to health-conscious individuals. For example, in January 2025, JA ZEN-NOH started selling protein soup made with ingredients from Hokkaido, such as onions, sweet corn, skimmed milk powder, and red bean residue.

Shikoku Region Soup Market Trends:

The inflating demand for soups that incorporate traditional Japanese diets is propelling the market growth in the Shikoku region. Furthermore, the ongoing advances in packaging like utilizing retort pouches to extend the shelf-life of soups, along with preserving their taste, are augmenting the market expansion forward. For instance, in February 2024, Hikari Miso introduced its Makanai Miso Soup Awase, a combination of white and red miso devised to enhance flavor and nutrition.

Top Companies Leading in the Japan Soup Industry

There are several companies encompassing the soup market in Japan. For instance, in February 2024, Otsuka Foods Co., Ltd. introduced two Bon curry noodle toppings with diverse soup and sauce varieties. Besides this, in July 2024, Ajinomoto's Taste of the Soup label launched products for commercial and renewed purposes, which included Cook Do menu-specific seasonings and Knorr quick- serve soup.

Japan Soup Market Segmentation Coverage

- Based on type, the market has been segmented into canned/preserved soup, chilled soup, dehydrated soup, frozen soup, and UHT soup. Canned/preserved variants are commercially cooked and sealed in cans. Chilled soup is generally refrigerated and served cold. The dehydrated type comprises dried ingredients, while frozen soup is cooked and frozen for later use. Lastly, the UHT soup is processed at ultra-high temperatures.

- Based on the category, the market has been categorized into vegetarian soup and non-vegetarian soup. Vegetarian soup only contains plant-based broth, herbs, vegetables, and spices, while non-vegetarian soup comprises fish, meat, chicken, or other animal-based proteins.

- Based on the packaging, the market has been divided into canned, pouched, and others. Canned soup packs usually include metal containers, and the pouched derivatives comprise flexible bags or pouches.

- Based on the distribution channel, the market has been separated into supermarkets and hypermarkets, convenience stores, online stores, and others. Supermarkets and hypermarkets are large self-service stores, while convenience stores are small retail shops with a limited range of products. Online stores allow customers to purchase goods directly via the internet.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 700 Million |

| Market Forecast in 2033 | USD 900 Million |

| Market Growth Rate 2025-2033 | 2.9% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Canned/Preserved Soup, Chilled Soup, Dehydrated Soup, Frozen Soup, UHT Soup |

| Categories Covered | Vegetarian Soup, Non-Vegetarian Soup |

| Packagings Covered | Canned, Pouched, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/Chubu Region, Kyushu/Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Soup Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)