Japan Sports Medicine Market Size, Share, Trends and Forecast by Product, Application, End User, and Region, 2026-2034

Japan Sports Medicine Market Summary:

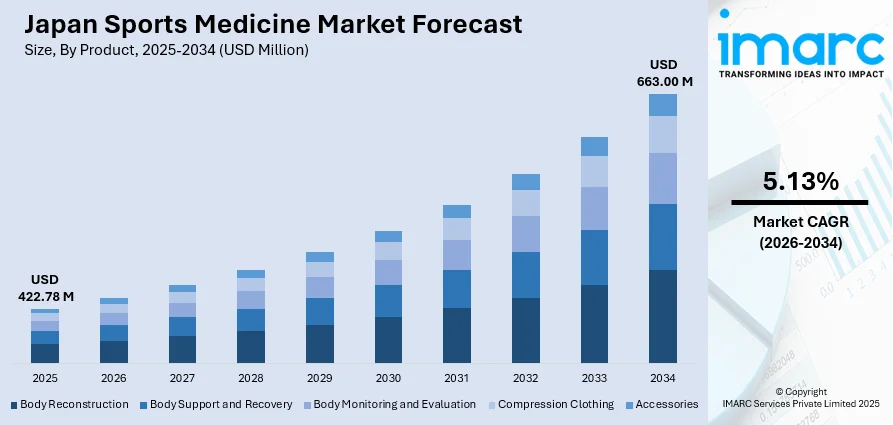

The Japan sports medicine market size was valued at USD 422.78 Million in 2025 and is projected to reach USD 663.00 Million by 2034, growing at a compound annual growth rate of 5.13% from 2026-2034.

The Japan sports medicine market is experiencing robust expansion driven by the convergence of an aging yet increasingly active population and rising participation in recreational and competitive sports activities. Advanced healthcare infrastructure, technological innovations in minimally invasive surgical techniques, and growing adoption of regenerative medicine therapies are strengthening treatment outcomes. Government initiatives through the Japan Sports Agency promoting physical fitness, combined with preparations for major international sporting events, are enhancing the Japan sports medicine market share.

Key Takeaways and Insights:

-

By Product: Body reconstruction dominates the market with a share of 40.23% in 2025, driven by rising demand for arthroscopic devices, fracture repair products, orthobiologics, and advanced implant technologies that enable effective surgical reconstruction of sports-related musculoskeletal injuries.

-

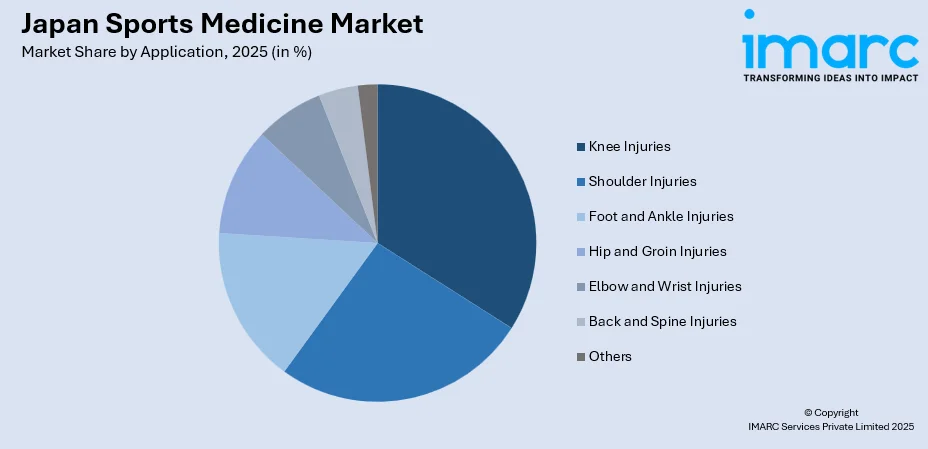

By Application: Knee injuries lead the market with a share of 18.74% in 2025, reflecting the high prevalence of anterior cruciate ligament tears, meniscal damage, and degenerative joint conditions requiring specialized orthopedic interventions among athletes and active individuals.

-

By End User: Hospitals hold the largest share at 52.35% in 2025, owing to comprehensive diagnostic capabilities, advanced surgical facilities, multidisciplinary sports medicine teams, and integrated rehabilitation services offered by major medical institutions.

-

By Region: Kanto Region represents the largest segment with 34% share in 2025, supported by the concentration of specialized sports medicine facilities, university hospitals, professional sports teams, and advanced healthcare infrastructure in the Greater Tokyo metropolitan area.

-

Key Players: Leading manufacturers in the Japan sports medicine market are expanding product portfolios, advancing regenerative medicine technologies, and strengthening partnerships with healthcare institutions. Their investments in arthroscopic devices, bioinductive implants, and digital health solutions are accelerating innovation and improving treatment outcomes.

To get more information on this market Request Sample

The Japan sports medicine market is advancing as healthcare providers, sports organizations, and consumers embrace innovative treatment solutions for athletic injuries and musculoskeletal conditions. The country's well-established healthcare infrastructure and emphasis on technological innovation are enabling widespread adoption of minimally invasive procedures and regenerative therapies. Growing health consciousness across generations is driving participation in fitness activities, subsequently increasing demand for injury prevention and rehabilitation products. Sustained governmental commitment to sports promotion through the Japan Sports Agency demonstrates continued investment in athlete healthcare and physical fitness initiatives nationwide. This governmental support, combined with demographic trends favoring active lifestyles among aging populations and continuous technological advancements in surgical devices and rehabilitation equipment, positions the market for continued expansion as the nation prepares for upcoming international sporting events and addresses the evolving healthcare needs of its increasingly active population across all age groups.

Japan Sports Medicine Market Trends:

Regenerative Medicine Adoption Transforming Treatment Protocols

The integration of regenerative medicine therapies is reshaping sports injury treatment approaches across Japan. Platelet-rich plasma injections, stem cell-based treatments, and bioinductive implants are gaining acceptance for their ability to accelerate tissue healing and reduce recovery times. Healthcare providers increasingly recognize the potential of these biological solutions for addressing sports-related musculoskeletal injuries, from ligament tears to cartilage damage. This shift toward regenerative approaches reflects broader clinical emphasis on restoring natural tissue function rather than relying solely on traditional surgical interventions, supporting the Japan sports medicine market growth.

Digital Health Integration Enabling Remote Patient Monitoring

Wearable technology and digital health platforms are revolutionizing how sports medicine professionals monitor patient recovery and athletic performance. Advanced sensors enable continuous tracking of physiological parameters, movement patterns, and rehabilitation progress. The growing adoption of these technologies across healthcare and fitness applications reflects increasing demand for connected health solutions among Japanese consumers and providers. These innovations facilitate personalized treatment protocols, early detection of potential injuries, and seamless communication between athletes and healthcare providers through integrated telehealth platforms.

Minimally Invasive Surgical Techniques Improving Patient Outcomes

Advanced arthroscopic procedures and minimally invasive surgical techniques are becoming standard practice in Japanese sports medicine facilities. These approaches offer reduced tissue trauma, shorter hospital stays, and accelerated rehabilitation timelines compared to traditional open surgeries. Sophisticated visualization systems, navigation technologies, and specialized instrumentation enable surgeons to perform complex reconstructive procedures with enhanced precision. The growing preference for bioinductive implants and similar technologies demonstrates the expanding demand for solutions that support natural healing processes while minimizing surgical invasiveness.

Market Outlook 2026-2034:

The Japan sports medicine market is poised for sustained expansion throughout the forecast period, driven by demographic shifts, technological innovations, and evolving healthcare delivery models. Increasing sports participation rates across age groups, combined with growing awareness of injury prevention, will continue generating demand for specialized medical products and services. The market generated a revenue of USD 422.78 Million in 2025 and is projected to reach a revenue of USD 663.00 Million by 2034, growing at a compound annual growth rate of 5.13% from 2026-2034. Strategic investments in advanced surgical technologies, regenerative therapies, and digital health integration will strengthen market competitiveness and improve patient outcomes.

Japan Sports Medicine Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Body Reconstruction | 40.23% |

| Application | Knee Injuries | 18.74% |

| End User | Hospitals | 52.35% |

| Region | Kanto Region | 34% |

Product Insights:

- Body Reconstruction

- Fracture and Ligament Repair Products

- Arthroscopy Devices

- Implants

- Orthobiologics

- Prosthetics

- Body Support and Recovery

- Braces and Supports

- Physiotherapy

- Thermal Therapy

- Ultrasound Therapy

- Laser Therapy

- Electrostimulation Therapy

- Body Monitoring and Evaluation

- Cardiac Monitoring

- Respiratory Monitoring

- Hemodynamic Monitoring

- Musculoskeletal Monitoring

- Compression Clothing

- Accessories

- Bandages

- Disinfectants

- Tapes

- Others

Body reconstruction dominates with a market share of 40.23% of the total Japan sports medicine market in 2025.

The body reconstruction segment encompasses arthroscopy devices, fracture and ligament repair products, orthobiologics, implants, and prosthetics essential for surgical treatment of sports injuries. Rising demand for advanced reconstructive solutions reflects the growing complexity of athletic injuries and patient expectations for complete functional restoration. In October 2023, Smith+Nephew launched its REGENETEN Bioinductive Implant in Japan at the 50th Annual Meeting of the Japan Shoulder Society, providing healing options for patients with rotator cuff tears ranging from partial thickness to massive full-thickness tears exceeding 5 centimeters.

Technological innovations in bioinductive materials, bioabsorbable implants, and minimally invasive surgical instrumentation are enhancing treatment outcomes and reducing recovery periods. Surgeons increasingly prefer arthroscopic approaches that minimize tissue trauma while enabling precise reconstruction of damaged ligaments, tendons, and cartilage. The segment benefits from ongoing research collaborations between medical device manufacturers and academic institutions developing next-generation orthopedic solutions tailored to the anatomical and physiological characteristics of Japanese patients, ensuring optimal surgical outcomes across diverse injury presentations.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Knee Injuries

- Shoulder Injuries

- Foot and Ankle Injuries

- Hip and Groin Injuries

- Elbow and Wrist Injuries

- Back and Spine Injuries

- Others

Knee injuries lead with a share of 18.74% of the total Japan sports medicine market in 2025.

Knee injuries represent the most prevalent application category driven by high incidence of anterior cruciate ligament tears, meniscal damage, and patellofemoral disorders among athletes and active individuals. The anatomical complexity of the knee joint and biomechanical stresses during athletic activities necessitates specialized diagnostic and treatment approaches. Sports medicine professionals across Japan consistently observe knee-related conditions as among the most common presentations requiring intervention across all athletic populations.

Treatment modalities for knee injuries encompass arthroscopic reconstruction procedures, ligament repair techniques, cartilage restoration therapies, and comprehensive rehabilitation programs. The segment benefits from continuous advancements in surgical instrumentation, imaging technologies, and regenerative medicine applications that improve diagnostic accuracy and treatment efficacy. Growing participation in high-impact sports such as soccer, basketball, and skiing contributes to sustained demand for knee injury management solutions across professional, amateur, and recreational athletic populations throughout Japan.

End User Insights:

- Hospitals

- Orthopedic Specialty Clinics

- Fitness and Training Centers

- Ambulatory Surgical Centers (ASCs)

- Others

Hospitals exhibit a clear dominance with a 52.35% share of the total Japan sports medicine market in 2025.

Hospitals serve as primary treatment centers for sports injuries requiring comprehensive diagnostic evaluation, surgical intervention, and post-operative rehabilitation. Major university hospitals and medical centers operate dedicated sports medicine departments staffed by orthopedic surgeons, sports medicine physicians, physical therapists, and athletic trainers. These institutions offer integrated services spanning injury assessment, advanced imaging, surgical treatment, and structured rehabilitation programs designed to restore athletes to competitive activity levels safely and efficiently.

The hospital segment benefits from substantial capital investments in advanced surgical technologies, including arthroscopic equipment, robotic-assisted surgery systems, and sophisticated imaging modalities. Leading institutions maintain partnerships with professional sports teams and national athletic organizations, providing specialized care for elite competitors while conducting clinical research advancing treatment protocols. Hospital-based sports medicine programs increasingly emphasize multidisciplinary approaches integrating orthopedic expertise with nutritional counseling, psychological support, and performance optimization services.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto Region represents the leading segment with a 34% share of the total Japan sports medicine market in 2025.

The Kanto Region dominates the Japan sports medicine market owing to the concentration of advanced healthcare infrastructure, specialized orthopedic facilities, and professional sports organizations in the Greater Tokyo metropolitan area. The region hosts numerous university hospitals, research institutions, and private specialty clinics offering comprehensive sports medicine services. In January 2025, Tokyo Sports and Orthopaedic Clinic established its Kitasando branch in Shibuya, featuring a five-story facility with MRI imaging, and 19 inpatient beds.

The region benefits from substantial population density, higher disposable incomes enabling access to premium healthcare services, and proximity to major sporting venues and athletic training facilities. Professional baseball, soccer, and Olympic sport organizations headquartered in the Kanto Region generate consistent demand for specialized injury treatment and prevention programs. The concentration of elite athletes and recreational sports enthusiasts creates a robust patient base seeking quality care. Additionally, the presence of leading medical device distributors and pharmaceutical companies facilitates rapid adoption of innovative sports medicine technologies throughout the regional healthcare network.

Market Dynamics:

Growth Drivers:

Why is the Japan Sports Medicine Market Growing?

Aging Yet Increasingly Active Population Driving Healthcare Demand

Japan's demographic profile significantly influences sports medicine demand as the nation maintains the world's highest proportion of elderly citizens while simultaneously experiencing rising fitness consciousness across age groups. In September 2024, people aged 65 and older comprised a record 29.3% of the country's population, while those 75 and above accounted for 16.8%. Despite advanced age, Japanese seniors demonstrate remarkable engagement in physical activities. A 2024 survey of 3,000 adults found that 54.8% played sports at least once a week, representing a substantial increase from 23.7% in 1992. This combination of longevity and active lifestyle generates sustained demand for sports medicine products addressing age-related musculoskeletal conditions alongside athletic injuries.

Government Investment Supporting Sports Infrastructure Development

Substantial governmental commitment to sports promotion and athlete healthcare strengthens the foundation for market expansion. The Ministry of Education, Culture, Sports, Science, and Technology and the Japan Sports Agency allocate significant budgetary resources toward national sports development initiatives, with dedicated funding streams designated for improving international competitiveness among Japanese athletes. National sports promotion plans outline comprehensive measures including healthcare provisions for athletes at all competitive levels. Ongoing preparations for major international sporting events hosted within Japan are driving infrastructure investments that benefit sports medicine service delivery nationwide. These governmental initiatives create favorable conditions for healthcare providers, equipment manufacturers, and rehabilitation specialists operating within the sports medicine sector.

Technological Advancements Enabling Superior Treatment Outcomes

Continuous innovations in medical devices, digital health platforms, and regenerative medicine therapies are transforming sports injury treatment capabilities. In April 2024, OMRON Healthcare acquired Luscii Healthtech, a digital health and remote consultation service platform provider, demonstrating the integration of advanced telehealth solutions into sports medicine practice. Wearable technology in Japan facilitates continuous patient monitoring and personalized rehabilitation protocols. Advances in arthroscopic instrumentation, bioinductive implants, and AI-powered diagnostic tools enable surgeons to achieve superior outcomes while minimizing recovery periods, driving adoption of premium sports medicine solutions across healthcare facilities.

Market Restraints:

What Challenges the Japan Sports Medicine Market is Facing?

High Treatment Costs Limiting Access

Premium pricing for advanced sports medicine technologies including imported orthopedic implants, robotic surgical systems, and regenerative therapies creates accessibility barriers for some patient populations. Insurance coverage limitations for innovative treatments such as stem cell therapies and platelet-rich plasma injections often require substantial out-of-pocket expenditures, potentially restricting market penetration.

Regulatory Complexity Affecting Product Introduction

Japan's stringent medical device regulatory framework, including requirements under the Act on Safety of Regenerative Medicine, necessitates comprehensive approval processes for innovative sports medicine products. Manufacturers must navigate extensive documentation, clinical validation, and certification requirements that extend timelines for introducing advanced treatment technologies to the market.

Geographic Disparities in Healthcare Access

Advanced sports medicine capabilities remain concentrated in major urban centers, creating access disparities for patients in rural and remote regions. Limited availability of specialized orthopedic facilities, certified sports medicine physicians, and comprehensive rehabilitation services outside metropolitan areas constrains market growth potential in underserved geographic segments.

Competitive Landscape:

The Japan sports medicine market exhibits a competitive landscape characterized by the presence of established multinational medical technology companies alongside domestic healthcare providers. Leading manufacturers focus on expanding product portfolios, advancing regenerative medicine technologies, and developing minimally invasive surgical solutions. Competition intensifies around arthroscopic devices, orthobiologic products, and digital health platforms. Strategic partnerships between medical device companies and academic institutions drive research innovation, while collaborations with professional sports organizations enhance market visibility and clinical validation of new technologies.

Japan Sports Medicine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Applications Covered | Knee Injuries, Shoulder Injuries, Foot and Ankle Injuries, Hip and Groin Injuries, Elbow and Wrist Injuries, Back and Spine Injuries, Others |

| End Users Covered | Hospitals, Orthopedic Specialty Clinics, Fitness and Training Centers, Ambulatory Surgical Centers (ASCs), Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan sports medicine market size was valued at USD 422.78 Million in 2025.

The Japan sports medicine market is expected to grow at a compound annual growth rate of 5.13% from 2026-2034 to reach USD 663.00 Million by 2034.

Body reconstruction dominated the market with a share of 40.23%, driven by rising demand for arthroscopic devices, orthobiologics, and advanced implant technologies enabling effective surgical reconstruction of sports-related injuries.

Key factors driving the Japan sports medicine market include an aging yet increasingly active population, substantial government investment in sports promotion, technological advancements in surgical devices and regenerative therapies, growing sports participation rates, and expanding digital health integration.

Major challenges include high treatment costs for advanced technologies, regulatory complexity affecting product approvals, geographic disparities in healthcare access, limited insurance coverage for innovative therapies, and supply chain constraints for specialized medical devices.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)