Japan Statin Market Size, Share, Trends and Forecast by Type, Therapeutic Area, Drug Class, Application, Distribution, and Region, 2026-2034

Japan Statin Market Overview:

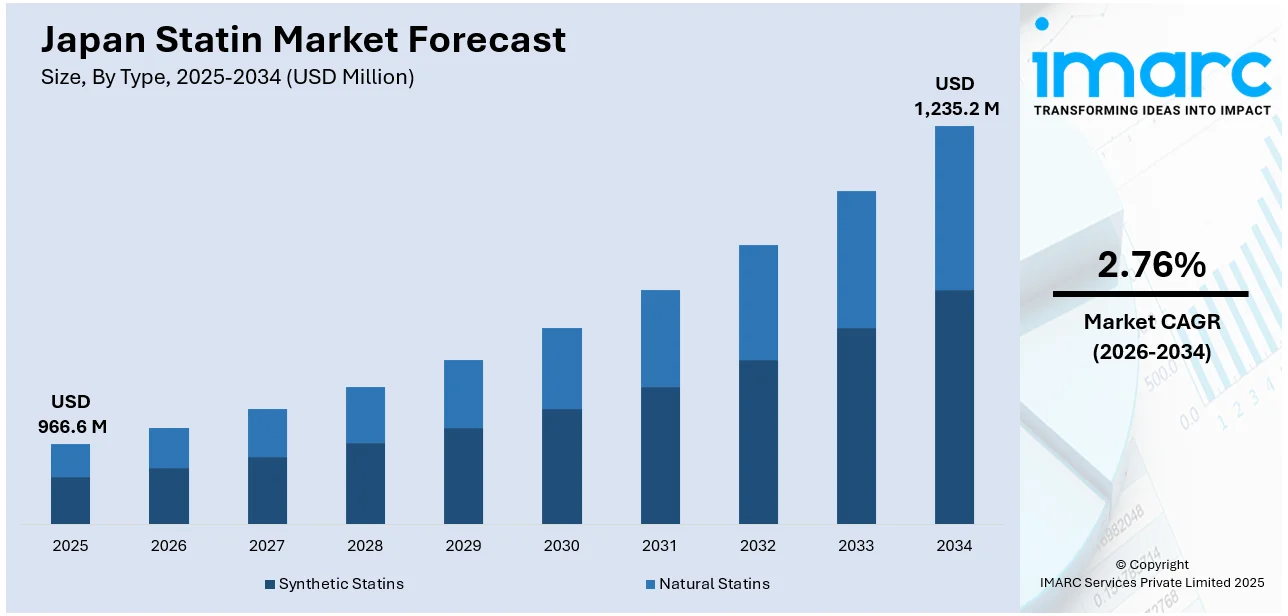

The Japan statin market size reached USD 966.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,235.2 Million by 2034, exhibiting a growth rate (CAGR) of 2.76% during 2026-2034. The market is primarily driven by Japan’s ageing population, widespread clinical adoption of statins for chronic disease management, mandatory health checkups under industrial health regulations, inclusion of statins in reimbursement schemes, and standardized prescription practices guided by national medical guidelines.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 966.6 Million |

| Market Forecast in 2034 | USD 1,235.2 Million |

| Market Growth Rate 2026-2034 | 2.76% |

Japan Statin Market Trends:

Government-Driven Healthcare Infrastructure and Prescription Practices

Japan’s statin market is shaped by the country's universal healthcare model, which guarantees access to affordable medications through co-payment systems and centralized drug pricing. The National Health Insurance (NHI) system plays a pivotal role in facilitating equitable access to essential drugs, including statins. All citizens are enrolled in either employee-based or community-based insurance schemes, under which statins are reimbursed for eligible conditions such as hyperlipidemia and ischemic heart disease. Japan’s universal health insurance system mandates enrollment in employer-based or community-based plans. Premiums are income- and age-based. All residents are covered, with individuals typically responsible for 30% of medical costs. With statins included in the NHI drug list, patients incur significantly reduced costs, which promotes adherence to long-term therapy and ensures stable consumption volumes. Regulatory mechanisms in Japan further reinforce standardized clinical practice. The Pharmaceuticals and Medical Devices Agency (PMDA) oversees the approval and post-marketing surveillance of drugs, ensuring that only clinically effective and safe statins remain on the market. Periodic updates to treatment protocols by professional medical societies reflect evidence from domestic and global clinical trials. Pharmaceutical companies operating in Japan also benefit from stable pricing policies and volume-based procurement systems that allow for predictable market planning. Both branded and generic statins are readily available through hospital and retail pharmacies. Prescription practices are driven by long-term patient engagement strategies, with routine monitoring and medication adjustments forming the basis of standard follow-up care. These operational consistencies contribute to the reliability and maturity of the Japan statin market outlook, supported by institutional trust in pharmacological treatment and robust public health financing.

To get more information on this market Request Sample

Ageing Population and Increased Incidence of Lifestyle-Related Illnesses

Japan’s demographic profile is among the most aged globally, with the country facing a major demographic shift as the fastest-ageing country. The working-age to elderly ratio dropped from 5.1:1 in 1990 to an estimated 1.8:1 by 2025. This has significantly increased demand for advanced medical treatment and long-term care services. This segment of the population is particularly vulnerable to cardiovascular diseases, high cholesterol levels, and metabolic disorders. As individuals age, their physiological capacity to metabolize lipids declines, which often results in elevated LDL cholesterol and triglyceride levels. In Japan, this trend has translated into an increase in routine screenings and pharmacological interventions aimed at managing cholesterol levels. Statins remain the frontline treatment due to their long-standing track record in reducing cardiovascular risk and preventing myocardial infarctions, especially in the elderly. Medical institutions across Japan have integrated statin therapy into chronic disease management protocols, particularly for geriatric patients with co-morbidities such as hypertension and diabetes. These developments contribute directly to the consistent expansion of the Japan statin market share, particularly in hospital and outpatient settings. Urbanization and dietary shifts have also contributed to rising cholesterol levels among younger demographics, which further expands the treatment pool. An increase in processed food consumption, lower physical activity levels, and prolonged working hours have all contributed to dyslipidemia across various age groups. As a result, annual health checkups, mandated for working professionals under Japan’s Industrial Safety and Health Law, have emerged as critical touchpoints for early diagnosis. Once detected, dyslipidemia is typically managed through lifestyle counselling and pharmacotherapy. Physicians often begin with moderate statin doses and escalate based on patient response and adherence. These interventions, facilitated through corporate wellness programs and workplace clinics, continue to drive Japan statin market growth, especially among middle-aged individuals in urban regions.

Japan Statin Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, therapeutic area, drug class, application, and distribution.

Type Insights

- Synthetic Statins

- Natural Statins

The report has provided a detailed breakup and analysis of the market based on the type. This includes synthetic statins and natural statins.

Therapeutic Area Insights

- Cardiovascular Disorders

- Obesity

- Inflammatory Disorders

- Others

The report has provided a detailed breakup and analysis of the market based on the therapeutic area. This includes cardiovascular disorders, obesity, inflammatory disorders, and others.

Drug Class Insights

- Atorvastatin

- Fluvastatin

- Lovastatin

- Pravastatin

- Simvastatin

- Others

The report has provided a detailed breakup and analysis of the market based on the drug class. This includes atorvastatin, fluvastatin, lovastatin, pravastatin, simvastatin, and others.

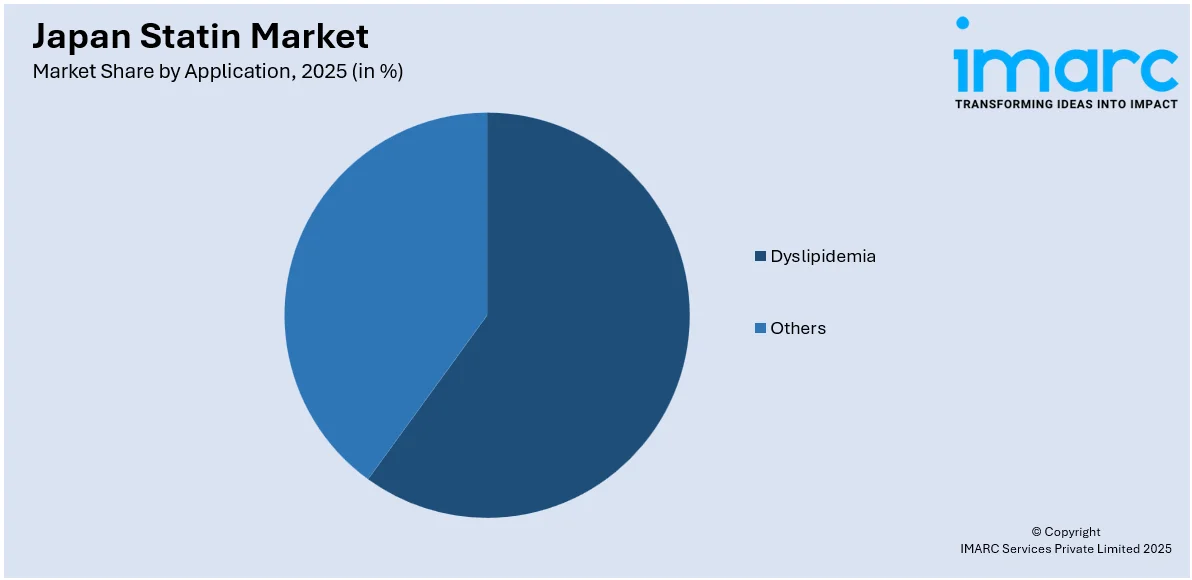

Application Insights

Access the comprehensive market breakdown Request Sample

- Dyslipidemia

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes dyslipidemia and others.

Distribution Insights

- Hospitals

- Clinics

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution. This includes hospitals, clinics, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has provided a detailed breakup and analysis of the market based on the region. This includes Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Statin Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Synthetic Statins, Natural Statins |

| Therapeutic Areas Covered | Cardiovascular Disorders, Obesity, Inflammatory Disorders, Others |

| Drug Classes Covered | Atorvastatin, Fluvastatin, Lovastatin, Pravastatin, Simvastatin, Others |

| Applications Covered | Dyslipidemia, Others |

| Distributions Covered | Hospitals, Clinics, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan statin market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan statin market on the basis of type?

- What is the breakup of the Japan statin market on the basis of therapeutic area?

- What is the breakup of the Japan statin market on the basis of drug class?

- What is the breakup of the Japan statin market on the basis of application?

- What is the breakup of the Japan statin market on the basis of distribution?

- What is the breakup of the Japan statin market on the basis of region?

- What are the various stages in the value chain of the Japan statin market?

- What are the key driving factors and challenges in the Japan statin market?

- What is the structure of the Japan statin market and who are the key players?

- What is the degree of competition in the Japan statin market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan statin market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan statin market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan statin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)