Japan Steel Tubes Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2026-2034

Japan Steel Tubes Market Overview:

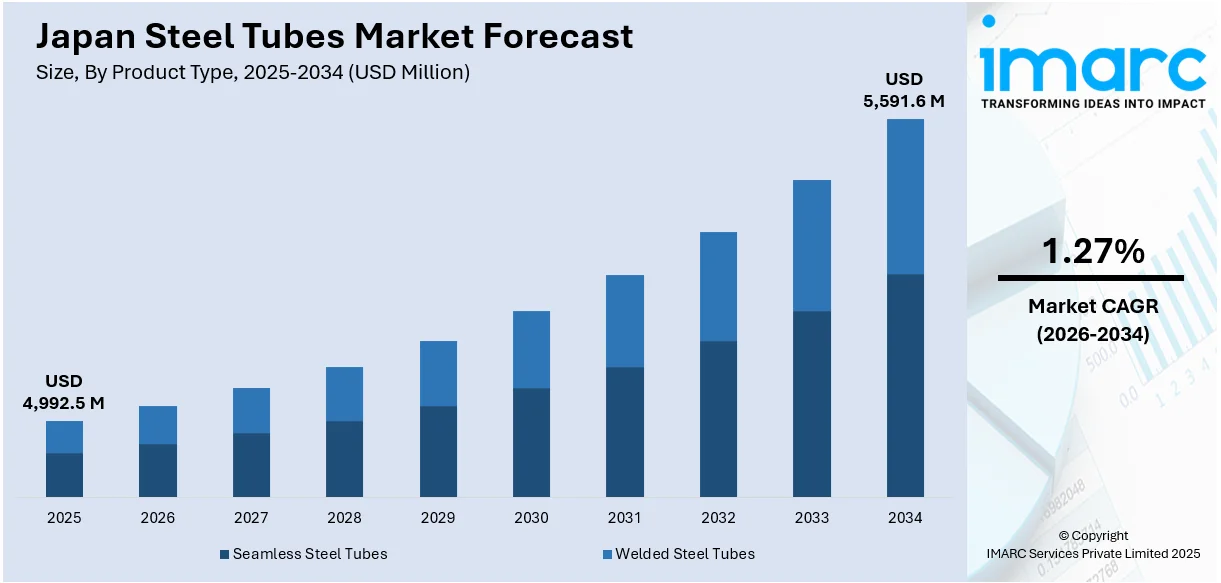

The Japan steel tubes market size reached USD 4,992.5 Million in 2025. The market is projected to reach USD 5,591.6 Million by 2034, exhibiting a growth rate (CAGR) of 1.27% during 2026-2034. The market is growing steadily with rising demand in major industries of construction, automotive, and energy. Technological innovation in manufacturing and emphasis on high-performance, durable materials is defining the industry trends. Industry players are improving product quality and increasing applications to address changing consumer and regulatory needs. Local manufacturers are also focusing on sustainability and innovation. With an evolving industrial scenario and growing infrastructure growth, opportunities continue to be strong in the Japan steel tubes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4,992.5 Million |

| Market Forecast in 2034 | USD 5,591.6 Million |

| Market Growth Rate 2026-2034 | 1.27% |

Japan Steel Tubes Market Trends:

Shifting Focus in Domestic Production

Japan’s steel tube sector is evolving beyond sheer scale. Despite long-standing infrastructure requirements, recent METI guidance highlights that in 2025 domestic crude steel output is forecasted to decline markedly. This suggests that producers are pivoting toward high-quality, precision-manufactured tubes, prioritizing tighter tolerances, specialized finishes, and engineered alloys, rather than bulk commodity products. Industry regulation updates from METI continue to support niche technical standards, encouraging local mills to invest in more specialized fabrication capabilities. That shift underlines a growing orientation toward value-added production addressing demand in sectors like medical equipment, aerospace, and precision automation over sheer volume. It reflects strategic recalibration favoring technical differentiation. With domestic demand likely to remain steady but not expansive, within manufacturing facilities dynamics emphasize engineering finesse over mass supply. All told, Japan’s internal steel tube landscape is increasingly geared toward specialized utility, supporting long‑term relevance via innovation within a mature production base. Japan steel tubes market growth is thus unfolding through quality transformation rather than volumetric expansion.

To get more information on this market Request Sample

Export Strategy Anchored in Value

Japan’s steel tube exports stabilized in 2024, maintaining steady volumes but without significant growth after the overseas slowdown caused by shifting global demand patterns. Official data from the Japan Iron & Steel Federation, based on customs records, confirms that export shipments remained flat from January to November 2024, reflecting a cautious approach by producers. Instead of competing on volume alone, Japanese manufacturers are focusing on premium quality and technical specialization offering tubes with tighter machining tolerances, corrosion resistance, and application specific properties that meet exacting client demands. This pivot toward value-driven exports allows Japanese suppliers to preserve strong pricing and sustain market relevance despite stagnating shipment levels. Buyers overseas continue to seek out Japanese tubes for their reliability and advanced material characteristics, underlining the importance of differentiation over scale. In this evolving landscape, Japan steel tubes market trends clearly show that export strategy prioritizes technical excellence and quality positioning above broad volume expansion, a shift that supports long-term competitiveness in key international markets.

Regional Plateau Spurs Precision Positioning

The Asia‑Pacific steel tube sector settled into a clear plateau in 2024, as production volumes remained essentially unchanged from the previous year. According to reports, Japan ranked third globally in crude steel production that year, behind China and India, maintaining its role in the regional balance of output. That broader flatness in raw steel output reinforces Japan’s tactical shift: emphasizing engineering-grade tubes, tight machining tolerances, and high-spec alloys over expanded volume. With domestic demand stable but not growing strongly, Japanese manufacturers are doubling down on niche segments catering to clients requiring bespoke tubing solutions, precision instrumentation, and critical infrastructure components. This emphasis on premium fabrication helps preserve export relevance even when overall shipment levels remain steady. Supported by continuity in quality control standards and certification regimes, Japan solidifies its reputation in advanced tube markets. Ultimately, growth in export value remains the goal, not scale volume. In this context, Japan steel tubes market is rooted in specialized quality positioning rather than headline production spikes.

Japan Steel Tubes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, material type, and end use industry.

Product Type Insights:

- Seamless Steel Tubes

- Welded Steel Tubes

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seamless steel tubes and welded steel tubes.

Material Type Insights:

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes carbon steel, stainless steel, alloy steel, and other.

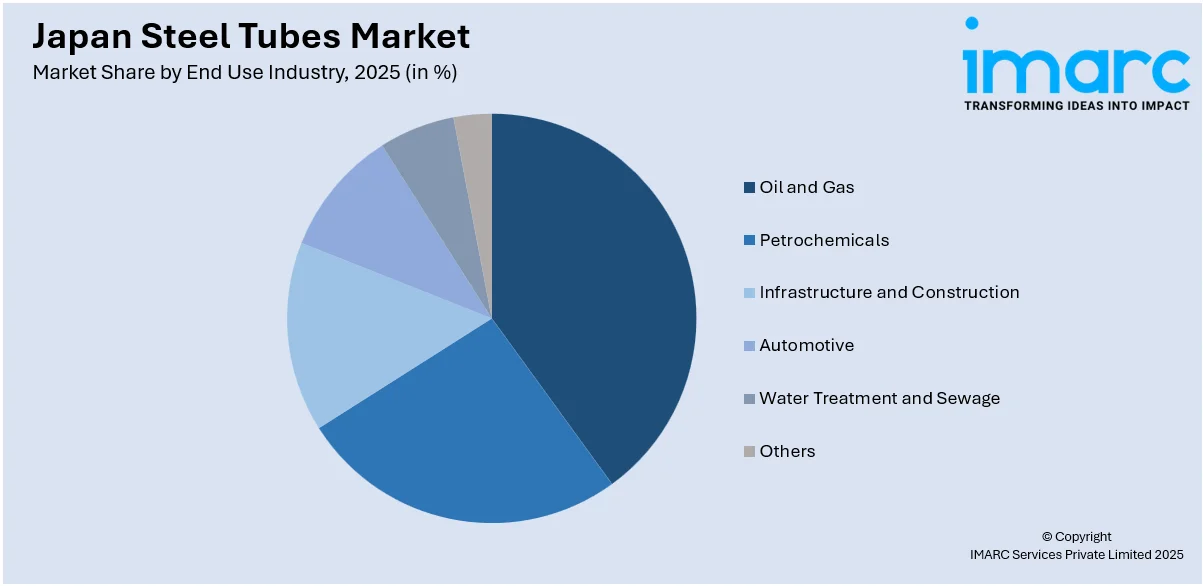

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Oil and Gas

- Petrochemicals

- Infrastructure and Construction

- Automotive

- Water Treatment and Sewage

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes oil and gas, petrochemicals, infrastructure and construction, automotive, water treatment and sewage, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include the Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Steel Tubes Market News:

- February 2025: Japan’s JFE Steel has announced the sale of its JGreeX™ green steel to JFE Shoji Pipe & Fitting (JKK), a trading company within the JFE Shoji group. This marks the first instance of JGreeX™ being distributed by a Japanese steel distributor in the pipe industry. The collaboration facilitates small-lot shipments, rapid deliveries, and an expanded market presence. Employing a mass-balance approach, JFE Steel assigns emission reductions to specific JGreeX™ products, aligning with its commitment to decarbonize supply chains and support greenhouse gas reduction in construction and infrastructure sectors.

Japan Steel Tubes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Type Covered | Seamless Steel Tubes, Welded Steel Tubes |

| Material Type Covered | Carbon Steel, Stainless Steel, Alloy Steel, Other |

| End Use Industries Covered | Oil and Gas, Petrochemicals, Infrastructure and Construction, Automotive, Water Treatment and Sewage, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan steel tubes market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan steel tubes market on the basis of product type?

- What is the breakup of the Japan steel tubes market on the basis of material type?

- What is the breakup of the Japan steel tubes market on the basis of end use industry?

- What is the breakup of the Japan steel tubes market on the basis of region?

- What are the various stages in the value chain of the Japan steel tubes market?

- What are the key driving factors and challenges in the Japan steel tubes market?

- What is the structure of the Japan steel tubes market and who are the key players?

- What is the degree of competition in the Japan steel tubes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan steel tubes market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan steel tubes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan steel tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)