Japan Structured Cabling Market Size, Share, Trends and Forecast by Product Type, Wire Category, Application, Vertical, and Region, 2026-2034

Japan Structured Cabling Market Overview:

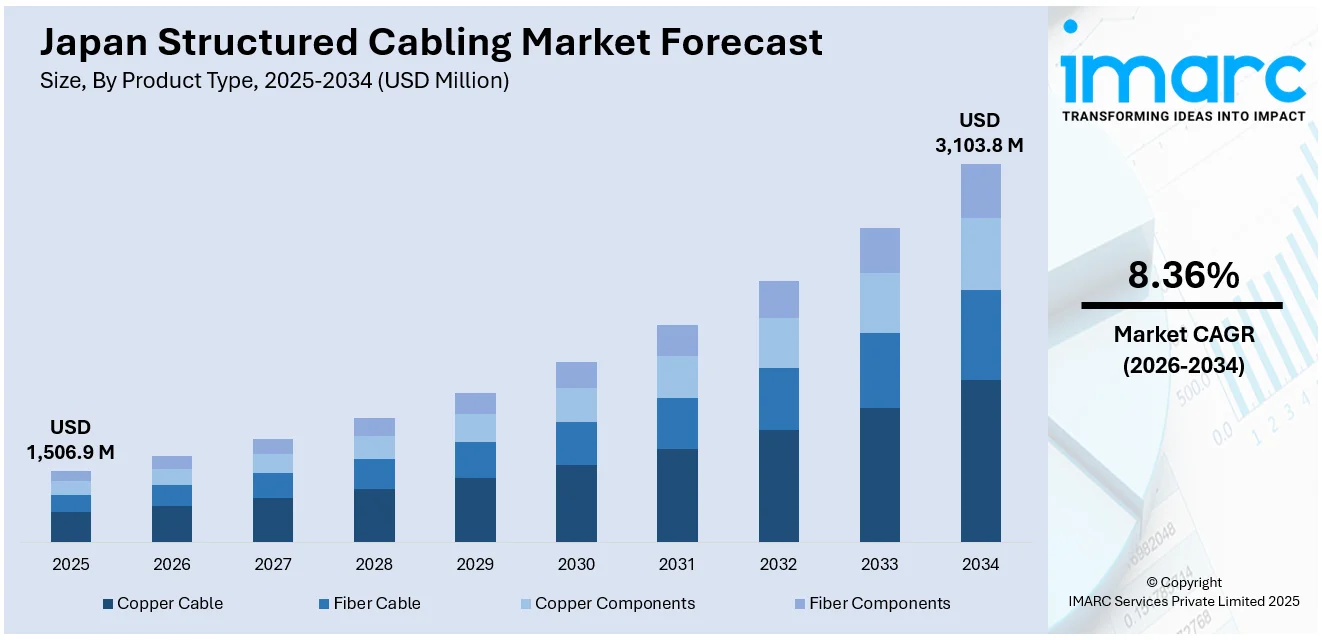

The Japan structured cabling market size reached USD 1,506.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3,103.8 Million by 2034, exhibiting a growth rate (CAGR) of 8.36% during 2026-2034. The market is driven by the growing investments into installing information technology (IT) infrastructure that will drive automation, cloud computing, and data analysis, innovations in data center and cloud services adoption, and increasing focus on building smart cities and intelligent infrastructure.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,506.9 Million |

| Market Forecast in 2034 | USD 3,103.8 Million |

| Market Growth Rate 2026-2034 | 8.36% |

Japan Structured Cabling Market Trends:

Digital Transformation Across Enterprises and Government Sectors

Japan's digital innovation is one of the major factors impelling the growth of the market. The country's business and government sectors are pouring resources into installing information technology (IT) infrastructure that will drive automation, cloud computing, and data analysis. Structured cabling is the cornerstone of this evolution, providing solid, high-speed data transmission critical to these technologies. The "Digital Garden City Nation" vision of the Japanese government encourages regional digitalization and seeks to link rural and urban areas with high-speed networks, increasing demand for structured cabling solutions. Moreover, greater deployment of Internet of Things (IoT) devices and edge computing in industries like manufacturing, logistics, and healthcare requires strong, scalable cabling infrastructures. This change is also driven by the implementation of smart buildings and networked workplaces, where cabled systems provide smooth device integration and centralized control of networked infrastructures, creating an infrastructure foundation for future-proof digital environments within Japan. The IMARC Group predicts that the Japan edge computing market size is expected to reach USD 5,918.17 Million by 2033.

To get more information on this market Request Sample

Expansion of Data Centers and Cloud Services

Innovations in data center and cloud services adoption in Japan is playing an important role in driving the market. Cloud computing is increasingly becoming a fundamental part of businesses, and hyperscale and colocation data centers are growing massively to accommodate ever-growing storage and processing needs. Structured cabling provides fast, low-latency connectivity among these data centers, supporting high numbers of servers and network appliances. Japan's geographical location and technological capabilities are also making it a destination for international cloud service providers to set up or expand their data center presence in the country. In addition to this, local companies are also setting up local data infrastructure to address data sovereignty requirements. In 2024, Oracle Alloy partnered with NTT Data Japan to assists Japanese companies in using cloud services while maintaining data sovereignty and compliance needs.

Adoption of Smart Cities and Intelligent Infrastructure

Japan's dedication towards building smart cities and intelligent infrastructure is bolstering the market growth. Cities like Tokyo, Osaka, and Fukuoka are implementing smart city technologies using sensors, automation, and artificial intelligence (AI)-enabled data analysis devices for enhanced management of the cities. In 2024, the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) declared the lost of regions chosen for the 2024 Smart City Implementation Support Project. Smart cities rely on solid, high-speed communication networks, and structured cabling becomes critical in supporting efficient device, system, and data center interconnectivity. Smart transportation systems, energy infrastructure, and public surveillance solutions deployments also highlight the necessity of high-capacity cabling infrastructure. Further, efforts such as 5G deployments and next-gen mobility solutions need high-quality backhaul support enabled by structured cabling. By supplying a physical infrastructure for intelligent networks, structured cabling systems enable not just existing digital infrastructure but also scalable integration for future technologies, affirming their key role in Japan's future urban planning agendas.

Japan Structured Cabling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on product type, wire category, application, and vertical.

Product Type Insights:

- Copper Cable

- Fiber Cable

- Copper Components

- Fiber Components

The report has provided a detailed breakup and analysis of the market based on the product type. This includes copper cable, fiber cable, copper components, and fiber components.

Wire Category Insights:

- Category 5e

- Category 6

- Category 6A

- Category 7

A detailed breakup and analysis of the market based on the wire category have also been provided in the report. This includes category 5e, category 6, category 6a, and category 7.

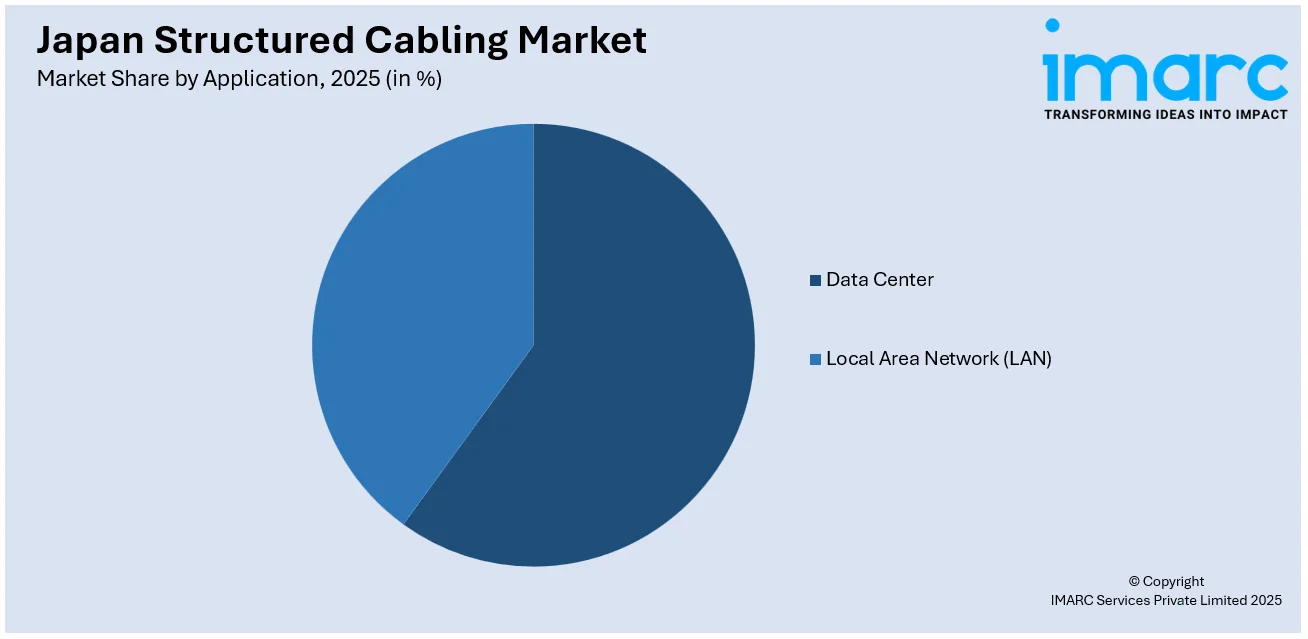

Application Insights:

Access the comprehensive market breakdown Request Sample

- Data Center

- Local Area Network (LAN)

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes data center and local area network (LAN).

Vertical Insights:

- Government

- Industrial

- IT and Telecommunications

- Residential and Commercial

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes government, industrial, IT and telecommunications, residential and commercial, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Structured Cabling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Copper Cable, Fiber Cable, Copper Components, Fiber Components |

| Wire Categories Covered | Category 5e, Category 6, Category 6A, Category 7 |

| Applications Covered | Data Center, Local Area Network (LAN) |

| Verticals Covered | Government, Industrial, IT and Telecommunications, Residential and Commercial, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan structured cabling market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan structured cabling market on the basis of product type?

- What is the breakup of the Japan structured cabling market on the basis of wire category?

- What is the breakup of the Japan structured cabling market on the basis of application?

- What is the breakup of the Japan structured cabling market on the basis of vertical?

- What is the breakup of the Japan structured cabling market on the basis of region?

- What are the various stages in the value chain of the Japan structured cabling market?

- What are the key driving factors and challenges in the Japan structured cabling market?

- What is the structure of the Japan structured cabling market and who are the key players?

- What is the degree of competition in the Japan structured cabling market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan structured cabling market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan structured cabling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan structured cabling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)