Japan Superfood Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2026-2034

Japan Superfood Market Summary:

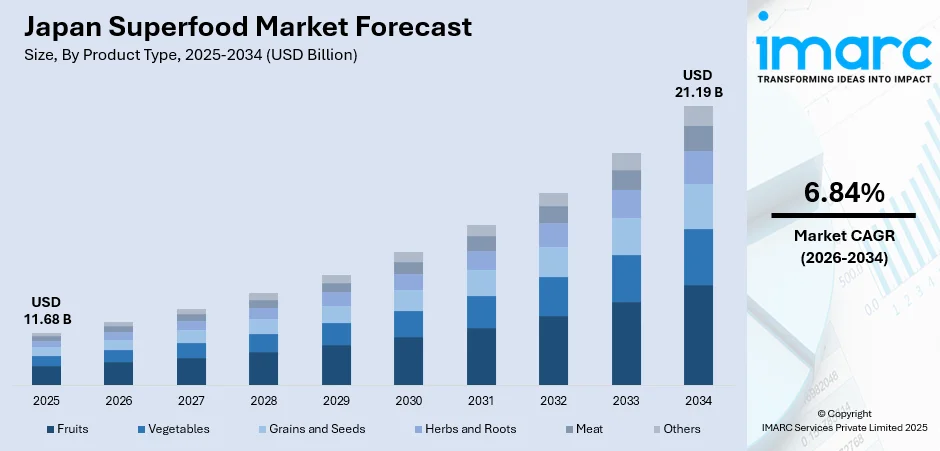

The Japan superfood market size was valued at USD 11.68 Billion in 2025 and is projected to reach USD 21.19 Billion by 2034, growing at a compound annual growth rate of 6.84% from 2026-2034.

The Japan superfood market is witnessing robust expansion driven by heightened consumer awareness regarding preventive healthcare and nutritional wellness. The growing preference for natural, plant-based ingredients among health-conscious Japanese consumers, coupled with the cultural appreciation for functional foods and traditional dietary practices, continues to accelerate market development across diverse product categories and application segments.

Key Takeaways and Insights:

-

By Product Type: Fruits dominated the market with approximately 29.64% revenue share in 2025, driven by the widespread popularity of antioxidant-rich berries including acai, goji, and blueberries among Japanese consumers seeking natural immunity-boosting solutions and anti-aging benefits.

-

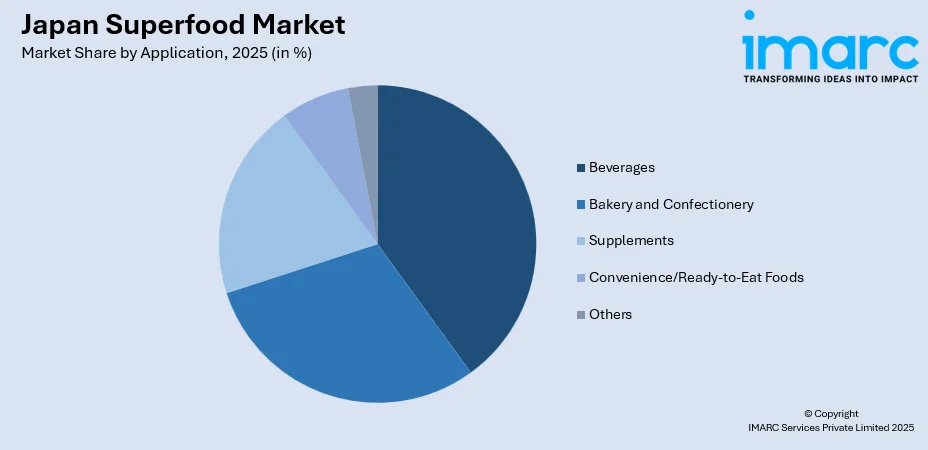

By Application: Beverages led the market with a share of approximately 38.76% in 2025, owing to the strong Japanese preference for functional drinks, ready-to-consume smoothies, and fortified tea products that seamlessly integrate superfood ingredients into daily dietary routines.

-

By Distribution Channel: Supermarkets and hypermarkets represented the largest segment with a market share of 49.73% in 2025, attributed to their extensive product assortments, competitive pricing strategies, and convenient one-stop shopping experiences that appeal to mainstream consumers.

-

By Region: Kanto Region dominated the market with approximately 36% revenue share in 2025, driven by the concentration of health-conscious urban populations in Tokyo and surrounding prefectures, higher disposable incomes enabling premium superfood purchases, and sophisticated retail infrastructure.

-

Key Players: The Japan superfood market exhibits moderate competitive intensity, characterized by established domestic food manufacturers competing alongside international health food enterprises and emerging specialty brands. Market participants differentiate through product innovation, quality certifications, sustainable sourcing practices, and strategic partnerships with retail channels.

To get more information on this market Request Sample

The Japan superfood market benefits from a sophisticated consumer base that demonstrates strong appreciation for nutritionally dense foods with proven health benefits. Japanese dietary culture, which traditionally emphasizes balance, seasonality, and functional ingredients, provides a receptive foundation for superfood adoption. In 2024, Japanese wellness brand SOGO SMILE launched a kale‑based “superfood candy” that leverages the nutrient‑dense properties of kale to make vegetable intake more accessible and enjoyable for health‑focused consumers, reflecting growing product innovation in the domestic market. The market landscape encompasses diverse product categories ranging from exotic imported superfoods to indigenous Japanese ingredients gaining recognition for their exceptional nutritional profiles. Consumer education initiatives by manufacturers and retailers have enhanced understanding of superfood benefits, while the integration of these ingredients into familiar food formats facilitates mainstream acceptance across demographic segments.

Japan Superfood Market Trends:

Rising Popularity of Indigenous Japanese Superfoods

The Japanese superfood market is experiencing growing interest in traditional domestic ingredients recognized for their exceptional nutritional properties. In 2025, Tokyo‑based agricultural firm Nihon Agri announced the first export of domestically grown Japanese matcha to cafés in the United States, illustrating international demand for traditional superfood ingredients beyond Japan’s borders. Items such as matcha, natto, miso, and various seaweeds are gaining renewed appreciation as consumers seek locally-sourced alternatives to imported superfoods. This trend reflects broader preferences for sustainable consumption, reduced food miles, and cultural heritage preservation while supporting domestic agricultural communities.

Integration of Superfoods in Convenience Formats

Manufacturers are increasingly developing superfood products in convenient, ready-to-consume formats aligned with busy Japanese lifestyles. In July 2024, Asahiko, the Japanese branch of South Korea’s Pulmuone, reported that its Tofu Bar, a high‑protein snack widely available in major convenience stores across Japan, sold over 70 million units since its launch, underscoring strong consumer appetite for functional, on‑the‑go nutritious foods. Single-serve smoothie packs, superfood-infused snack bars, and fortified instant beverages address time-constrained consumers seeking nutritional benefits without preparation requirements. This convenience-driven innovation expands superfood accessibility beyond health-focused specialty segments into mainstream daily consumption occasions.

Emphasis on Clean Label and Organic Certifications

Japanese consumers demonstrate increasing preference for superfood products featuring transparent ingredient lists, organic certifications, and minimal processing. According to reports, Japan’s authorities urged food manufacturers to adopt stricter raw-material origin labelling, clearly disclosing main ingredient origins on packaging to enhance transparency and help consumers make informed choices. The clean label movement drives manufacturers to reformulate products eliminating artificial additives while highlighting natural superfood content. Certifications from recognized Japanese and international organic bodies serve as trust signals influencing purchase decisions among discerning health-conscious consumers.

Market Outlook 2026-2034:

The Japan superfood market is positioned for sustained growth throughout the forecast period, underpinned by demographic trends favoring preventive healthcare approaches, expanding product innovation across application categories, and evolving consumer preferences toward natural nutrition solutions. The aging population's focus on healthy aging and longevity creates consistent demand for nutrient-dense superfood products. E-commerce channel expansion complements traditional retail distribution, enhancing product accessibility nationwide. The market generated a revenue of USD 11.68 Billion in 2025 and is projected to reach a revenue of USD 21.19 Billion by 2034, growing at a compound annual growth rate of 6.84% from 2026-2034.

Japan Superfood Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Fruits |

29.64% |

|

Application |

Beverages |

38.76% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

49.73% |

|

Region |

Kanto Region |

36% |

Product Type Insights:

- Fruits

- Vegetables

- Grains and Seeds

- Herbs and Roots

- Meat

- Others

The fruits dominate with a market share of 29.64% of the total Japan superfood market in 2025.

Fruits maintain market leadership driven by their versatile application potential and strong consumer recognition of associated health benefits. In 2025, Tokyo-based Fruta Fruta Co., Ltd., a pioneer in introducing acai to Japan and exclusive importer of Amazonian fruit ingredients, expanded acai availability across cafés, foodservice, and retail, boosting mainstream appeal. Berries including blueberries, acai, and goji berries enjoy widespread popularity for their antioxidant properties and perceived anti-aging benefits that resonate strongly with Japan's aging population.

The fruit segment benefits from established supply chains enabling year-round availability of both fresh and processed superfood fruit products across retail channels. Consumer acceptance of superfood fruits extends across demographic segments, from younger consumers incorporating them into smoothies and breakfast bowls to older populations seeking natural approaches to maintaining vitality. Manufacturers leverage fruit-based superfoods in diverse product formats including juices, dried snacks, and supplement ingredients. The natural sweetness and familiar appeal of fruit-based superfoods facilitates mainstream adoption compared to less familiar superfood categories requiring consumer education.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Bakery and Confectionery

- Beverages

- Supplements

- Convenience/Ready-to-Eat Foods

- Others

The beverages lead with a share of 38.76% of the total Japan superfood market in 2025.

The beverages application segment demonstrates strong market performance reflecting Japanese consumer preferences for functional drinks that deliver health benefits in convenient liquid formats. In August 2025, Japanese beverage maker Melodian Co., Ltd. launched Acai CHARGE, a superfood‑infused drink featuring acai and a mix of berries with added iron to support daily nutritional needs, illustrating product innovation tailored to health‑conscious consumers seeking quick, functional hydration. Superfood-infused teas, smoothies, and fortified juices align with established Japanese beverage consumption habits while introducing enhanced nutritional profiles.

The segment benefits from innovation in ready-to-drink formats that eliminate preparation time while maintaining superfood efficacy and taste appeal. Market growth in superfood beverages reflects the successful integration of ingredients like matcha, acai, and spirulina into appealing drink formulations. Japanese consumers demonstrate sophisticated understanding of functional beverage benefits, creating receptive conditions for product launches combining traditional ingredients with modern nutritional science. Distribution through convenience stores and vending machines extends superfood beverage accessibility to busy urban consumers seeking on-the-go nutrition solutions.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Independent Small Grocery Stores

- Online Sales

- Others

The supermarkets and hypermarkets dominate with a market share of 49.73% of the total Japan superfood market in 2025.

Supermarkets and hypermarkets lead superfood distribution by offering extensive product ranges in a single location. These retailers allow consumers to compare options, review ingredient details, and explore new offerings through dedicated health sections. Their bulk purchasing power supports competitive pricing, appealing to price-sensitive shoppers. By combining convenience, variety, and affordability, supermarkets and hypermarkets remain the preferred choice for consumers seeking both familiar and emerging superfood products.

The channel capitalizes on established consumer shopping habits and consistently high foot traffic to boost visibility and awareness of superfood products. In-store promotions, tasting sessions, and strategic placement alongside complementary health items encourage product trial and adoption. Major supermarket chains are progressively allocating more shelf space to premium superfoods, reflecting recognition of rising consumer demand and the strong profit potential of this category compared with conventional foods. This strategy strengthens both product exposure and long-term purchasing behavior among shoppers.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region exhibits a clear dominance with a 36% share of the total Japan superfood market in 2025.

The Kanto Region leads the market due to its status as Japan’s most populous and economically advanced area, including the Greater Tokyo metropolitan region. A high concentration of health-conscious urban professionals and affluent consumers drives strong demand for premium superfoods. Advanced retail infrastructure, including flagship health stores, upscale supermarkets, and specialty shops, ensures wide product availability across diverse superfood categories, supporting both consumer access and category growth.

Consumer awareness of superfood benefits is particularly high in the Kanto region, driven by concentrated media exposure, influential health personalities, and trendsetting urban lifestyles. The region often acts as a key test market for new superfood product launches, with successful products later expanding to other parts of Japan. Elevated disposable incomes in the Tokyo metropolitan area support premium pricing, allowing manufacturers to invest in high-quality ingredient sourcing and develop innovative formulations that meet the demands of discerning, health-conscious consumers.

Market Dynamics:

Growth Drivers:

Why is the Japan Superfood Market Growing?

Aging Population Driving Preventive Healthcare Focus

Japan's demographic profile, characterized by one of the world's highest proportions of elderly citizens, fundamentally drives superfood market expansion. In August 2024, Morinaga Milk Industry introduced a fermented probiotic drink under its Puresu line specifically designed to support intestinal health, reduce fatigue, and promote metabolic well‑being, a product explicitly developed with the nutritional needs of Japan’s aging population in mind. The aging population demonstrates strong interest in dietary approaches supporting healthy aging, cognitive function maintenance, and chronic disease prevention. Superfoods offering documented benefits for cardiovascular health, bone strength, and immune function resonate particularly with older consumer segments seeking to maintain quality of life through nutrition. Cultural attitudes favoring natural health approaches over pharmaceutical interventions further support superfood adoption among elderly Japanese consumers.

Rising Health Consciousness Among Younger Demographics

Younger Japanese consumers demonstrate increasing health consciousness driving superfood adoption across diverse product categories. The Japanese government’s Strategic Initiative for a Healthy and Sustainable Food Environment, launched by the Ministry of Health, Labour and Welfare to improve the nation’s food environment and promote healthier eating habits in collaboration with industry and academia, supports broader nutrition awareness that resonates with younger wellness‑oriented consumers. Millennial and Generation Z populations prioritize wellness as a lifestyle value, incorporating superfoods into daily dietary routines through smoothies, health bowls, and functional snacks. Social media influence accelerates superfood trends as visually appealing products gain viral attention across platforms popular with younger demographics. Fitness and beauty motivations complement health drivers, with consumers recognizing connections between nutrition, physical performance, and skin health.

Product Innovation and Application Diversification

Continuous product innovation expands superfood market opportunities by introducing ingredients into new applications and consumption formats. Manufacturers develop convenient product formats including single-serve sachets, ready-to-drink beverages, and superfood-enhanced snacks addressing diverse usage occasions. Innovation in processing technologies preserves nutritional content while enabling longer shelf life and improved taste profiles. The integration of superfoods into familiar food categories including bakery products, confectionery, and dairy items facilitates mainstream consumer adoption beyond health food enthusiasts. Cross-category innovation combining multiple superfoods with complementary benefits creates differentiated products commanding premium positioning in the competitive marketplace.

Market Restraints:

What Challenges the Japan Superfood Market is Facing?

Premium Pricing Limiting Mass Market Penetration

Superfood products typically command premium price points that constrain adoption among price-sensitive consumer segments. Import costs for exotic superfood ingredients, organic certification requirements, and specialized processing contribute to higher retail prices. Economic uncertainty and inflation concerns amplify consumer price sensitivity, potentially limiting superfood purchases to occasional indulgences rather than daily dietary staples for some population segments.

Regulatory Complexity for Health Claims

Japanese regulatory frameworks governing health claims on food products create compliance challenges for superfood manufacturers. Restrictions on permitted health benefit communications limit marketing messaging effectiveness and may constrain consumer education efforts. Navigating approval processes for Foods for Specified Health Uses designations requires substantial documentation and clinical evidence, creating barriers for newer superfood ingredients seeking market entry.

Supply Chain Vulnerabilities for Imported Ingredients

Dependence on imported superfood ingredients exposes the market to supply chain disruptions, currency fluctuations, and sourcing challenges. Climate variability affecting agricultural production in origin countries can impact ingredient availability and pricing stability. Transportation logistics and import procedures add complexity to maintaining consistent product supply, particularly for perishable superfood ingredients requiring careful handling to preserve nutritional quality.

Competitive Landscape:

The Japan superfood market features a dynamic competitive environment encompassing established domestic food and beverage corporations, international health food enterprises, and emerging specialty brands focused on specific superfood categories. Market participants compete across dimensions including product innovation, ingredient quality and sourcing transparency, distribution network coverage, and brand positioning around health benefits. Domestic manufacturers leverage deep understanding of Japanese consumer preferences and established retail relationships, while international competitors bring global superfood expertise and diverse ingredient portfolios. Strategic differentiation increasingly emphasizes organic certifications, sustainable sourcing practices, and scientific validation of health benefits. The competitive landscape continues evolving as traditional food companies expand into superfood categories and startups introduce innovative products targeting emerging consumer segments. Partnership strategies connecting ingredient suppliers, manufacturers, and retailers facilitate market development and product accessibility expansion.

Recent Developments:

-

In May 2025, A Japanese company launched a superfood supplement capsule combining Uji matcha with 18 grains for convenient daily intake. The product was showcased at Beauty World Japan Tokyo, reflecting growing consumer demand for easy-to-consume functional foods.

Japan Superfood Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Fruits, Vegetables, Grains and Seeds, Herbs and Roots, Meat, Others |

| Applications Covered | Bakery and Confectionery, Beverages, Supplements, Convenience/Ready-to-Eat Foods, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Independent Small Grocery Stores, Online Sales, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan superfood market size was valued at USD 11.68 Billion in 2025.

The Japan superfood market is expected to grow at a compound annual growth rate of 6.84% from 2026-2034 to reach USD 21.19 Billion by 2034.

Fruits dominated the market with approximately 29.64% share, driven by strong consumer recognition of berry-based superfoods and their versatile application potential across diverse product formats.

Key factors driving the Japan superfood market include aging population focus on preventive healthcare, rising health consciousness among younger demographics, and continuous product innovation across application categories.

Major challenges include premium pricing limiting mass market penetration, regulatory complexity for health claims, and supply chain vulnerabilities for imported superfood ingredients affecting availability and cost stability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)