Japan Surgical Navigation Systems Market Size, Share, Trends and Forecast by Technology, Application, End User, and Region, 2026-2034

Japan Surgical Navigation Systems Market Overview:

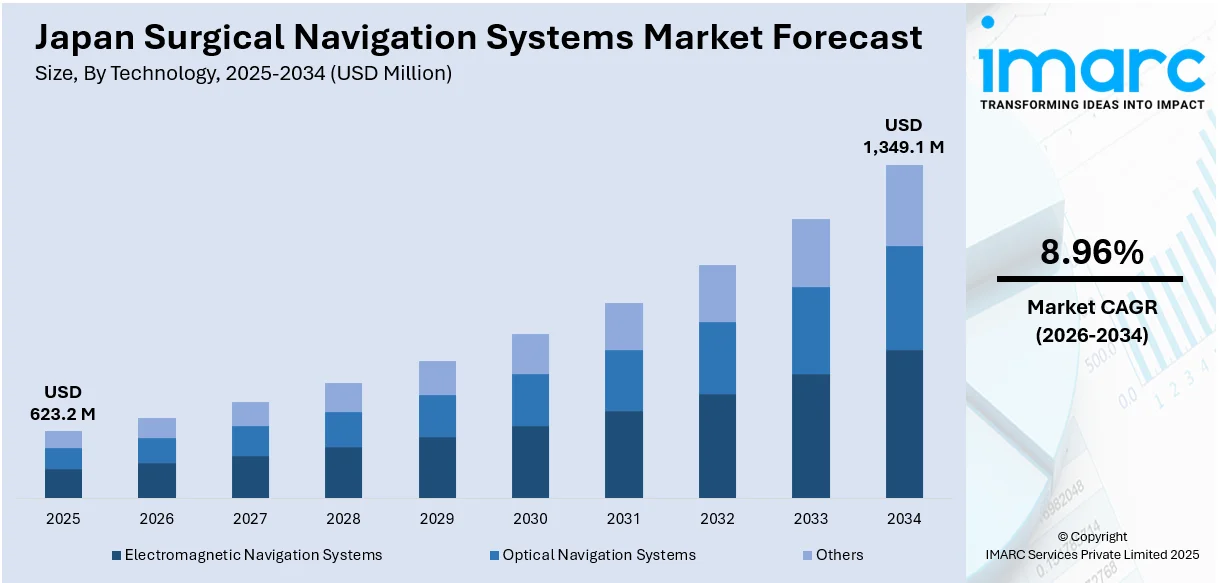

The Japan surgical navigation systems market size reached USD 623.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,349.1 Million by 2034, exhibiting a growth rate (CAGR) of 8.96% during 2026-2034. The market is driven by amplifying demand for minimally invasive (MI) procedures, the convergence of advanced imaging modalities like CT and MRI for improved intraoperative precision, and the increasing role of ambulatory surgical centers for providing cost-effective, efficient outpatient care. These converging trends, underpinned by the advanced medical infrastructure of Japan and changing healthcare policies, are expected to provide continued thrust to Japan surgical navigation systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 623.2 Million |

| Market Forecast in 2034 | USD 1,349.1 Million |

| Market Growth Rate 2026-2034 | 8.96% |

Japan Surgical Navigation Systems Market Trends:

Growing Use of Minimally Invasive Surgeries

Growth in Japan toward minimally invasive surgeries (MIS) is strongly driving the adoption of surgery navigation systems. Such procedures provide quicker recovery, shorter stays at the hospital, and lower risks of complications, and hence are extremely attractive to patients and healthcare professionals alike. Surgical navigation solutions improve the accuracy of these procedures through real-time imaging and detailed anatomical mapping. As Japan is plagued by geriatric population and mounted rates of degenerative and chronic diseases, demand for less traumatic and safer surgical procedures keeps amplifying. This is more in neurosurgery, orthopedic, and ENT applications where precision is intensely crucial. As per the reports, in September 2024, MicroPort® MedBot™'s SkyWalker™ Orthopedic Surgical Robot was approved for the Japanese market by Japan's Ministry of Health, Labour and Welfare, a major milestone in robotic-assisted knee arthroplasty innovation. Moreover, the outlook in Japan's surgical navigation systems market is sound, led by the necessity to enhance surgical outcomes without compromising patient safety. The general adoption of these systems into surgical workflows is anticipated to improve both the quality of care as well as the overall efficiency of operating rooms in Japan.

To get more information on this market Request Sample

Integration of Advanced Imaging Technologies

Advances in imaging modalities are driving the development of surgical navigation systems in Japan. According to the reports, in April 2024, Sendai Tokushukai Hospital in Japan launched the Senhance® Surgical System program, the second large private hospital to adopt this robotic technology for improving precision surgery. Furthermore, interfacing with high-resolution imaging technologies like CT, MRI, and 3D fluoroscopy allows surgeons to see internal structures with extraordinary precision and maneuver difficult procedures with greater confidence. This is especially valuable in disciplines like neurosurgery and spinal surgery, where accurate visualization of small anatomical areas is paramount. Japan's well-developed medical infrastructure allows for easy integration of these innovations, which results in more precise interventions and fewer complications following surgery. In addition, the capacity of newer navigation systems to connect with hospital networks and store data for post-surgical analysis improves clinical decision-making. Consequently, Japan surgical navigation systems share is expected to grow, reflecting the nation's dedication to harnessing technological innovation to improve healthcare provision and maximize surgical accuracy across an increasing variety of specialties.

Surge in Demand from Ambulatory Surgical Centers

Japan is witnessing a significant increase in the number of ambulatory surgical centers (ASCs) due to the demand for cost-effective and efficient surgical care outside the confines of traditional hospital environments. ASCs provide the benefit of having complex procedures done in outpatient settings, backed by sophisticated technologies like surgical navigation systems. Such systems are essential for guaranteeing precision and safety, especially in orthopedic and dental operations frequently done in ASCs. The small size and easy-to-use interfaces of current navigation units make them particularly appropriate for application in smaller, specialized clinical facilities. In addition, Japan's healthcare policies in favor of outpatient surgery help drive this increasing demand. Japan surgical navigation systems market growth is further backed by these trends, as boosting numbers of ASCs invest in navigation technology to ensure high-quality care while optimizing throughput and patient satisfaction. This shift mirrors the larger trend within Japan's healthcare system toward decentralization and technology integration in surgery.

Japan Surgical Navigation Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on technology, application, and end user.

Technology Insights:

- Electromagnetic Navigation Systems

- Optical Navigation Systems

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes electromagnetic navigation systems, optical navigation systems, and others.

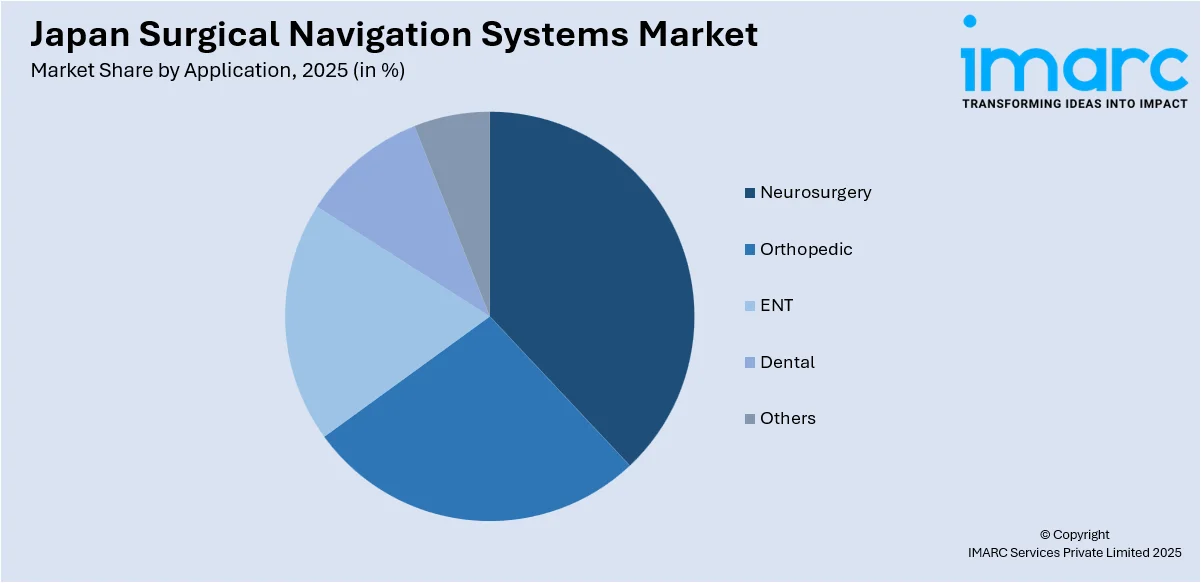

Application Insights:

Access the comprehensive market breakdown Request Sample

- Neurosurgery

- Orthopedic

- ENT

- Dental

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes neurosurgery, orthopedic, ENT, dental, and others.

End User Insights:

- Hospitals

- Ambulatory Surgical Centers

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals and ambulatory surgical centers.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Surgical Navigation Systems Market News:

- In June 2024, Tokyo's National Cancer Center Research Institute published a procurement notice for a surgical navigation system, due for delivery by March 31, 2026, as part of its 2025 medical equipment investment. The system, designed to improve surgical accuracy, calls for bids from suitable suppliers by August 20, 2024.

Japan Surgical Navigation Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Electromagnetic Navigation Systems, Optical Navigation Systems, Others |

| Applications Covered | Neurosurgery, Orthopedic, ENT, Dental, Others |

| End Users Covered | Hospitals, Ambulatory Surgical Centers |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan surgical navigation systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan surgical navigation systems market on the basis of technology?

- What is the breakup of the Japan surgical navigation systems market on the basis of application?

- What is the breakup of the Japan surgical navigation systems market on the basis of end user?

- What is the breakup of the Japan surgical navigation systems market on the basis of region?

- What are the various stages in the value chain of the Japan surgical navigation systems market?

- What are the key driving factors and challenges in the Japan surgical navigation systems?

- What is the structure of the Japan surgical navigation systems market and who are the key players?

- What is the degree of competition in the Japan surgical navigation systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan surgical navigation systems market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan surgical navigation systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan surgical navigation systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)