Japan Thermal Processing Equipment Market Size, Share, Trends and Forecast by Equipment Type, Process Type, Heating Source, Automation Level, End Use Industry, and Region, 2026-2034

Japan Thermal Processing Equipment Market Overview:

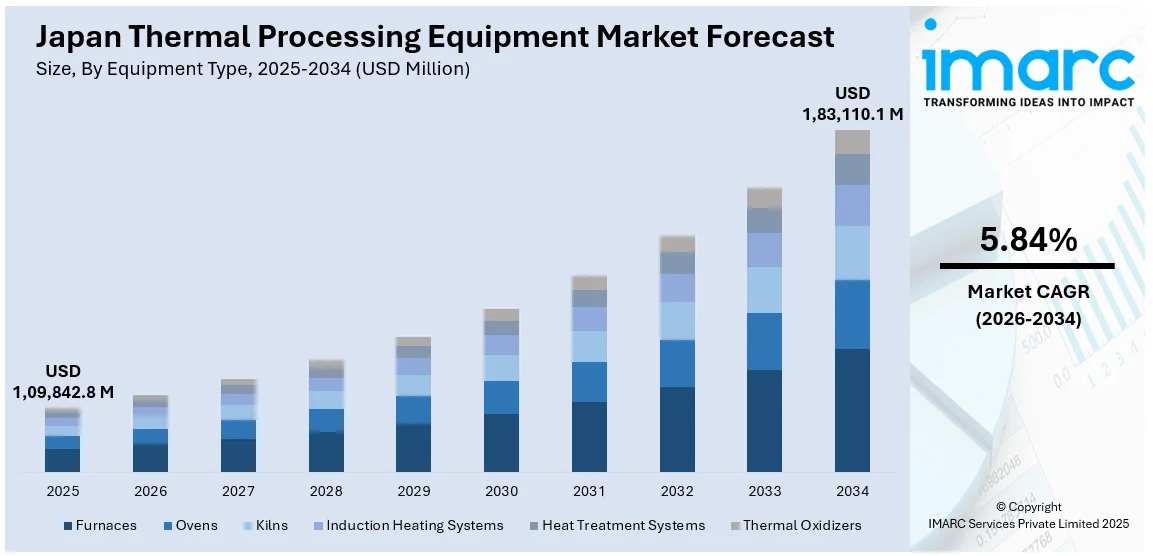

The Japan thermal processing equipment market size reached USD 1,09,842.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,83,110.1 Million by 2034, exhibiting a growth rate (CAGR) of 5.84% during 2026-2034. The market is driven by rising demand from the automotive, aerospace, and electronics industries, alongside stringent energy efficiency regulations. Technological advancements, including automation, IoT, and AI, enhance precision and productivity. Government initiatives promoting carbon neutrality further accelerate the adoption of eco-friendly solutions. Additionally, the shift toward smart manufacturing and predictive maintenance is further expanding the Japan thermal processing equipment market share, ensuring operational efficiency and cost savings.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,09,842.8 Million |

| Market Forecast in 2034 | USD 1,83,110.1 Million |

| Market Growth Rate 2026-2034 | 5.84% |

Japan Thermal Processing Equipment Market Trends:

Increasing Demand for Energy-Efficient Thermal Processing Equipment

The market is witnessing a growing demand for energy-efficient solutions due to rising energy costs and stringent environmental regulations. In 2023, 87.2% of the total energy supply in Japan came from imports, with 37.7% coming from oil, 26.1% from coal, and 21% from natural gas, causing higher energy prices for the different industries. Domestic production of energy is limited, consisting mainly of nuclear energy at 38.2% and renewable energy in the form of wind, solar, and biofuels. This high dependence on foreign energy emphasizes the urgent necessity for Japan's thermal processing equipment industry to adopt energy-saving technologies and diversify fuel sources in order to remain competitive. Additionally, manufacturers are adopting the benefits of the latest technologies through induction heating and vacuum heat treatment to maximize energy savings and reduce the emission of carbon emissions. The motivation toward embracing new technology is also driven by the innovative Japanese government goal towards becoming carbon-neutral by the year 2050, forcing several segments of Japanese industries like automotive, aeronautical, and electronics sectors to make important investments in clean heating and thermal treatment solutions. Besides, most of the above manufacturers are now building operational efficiencies and employing several IoT and AI-based monitoring technologies aimed at enhancing energy efficiency as well as the utilization of energy. As businesses shift towards cleaner manufacturing systems, suppliers are also creating their green manufacturing equipment with reduced energy usage and greater efficiency to operate within Japan's sustainability standards, as well as companies succeeding in cutting costs with energy-efficient thermal processing equipment, again pointing to a major trend in the market.

To get more information on this market Request Sample

Growth in Automation and Smart Manufacturing Integration

Automation and smart manufacturing are transforming Japan’s market. The growing need for precision, consistency, and reduced labor costs is propelling the Japan thermal processing equipment market growth. The adoption of Industry 4.0 technologies, such as robotics, AI, and real-time data analytics, is enhancing thermal treatment processes by improving temperature control, reducing defects, and increasing throughput. Japan is currently the world leader in robotics, with a historic total of 435,299 industrial robots, driven primarily by automotive (132,766 units), electronics (143,768 units), and metal companies (64,915 units) to help modernize their factories. Yet despite a 9% decrease in installations to 46,106 units in 2023, Japan remains the second-largest robotics market globally. This growth shows an increasing demand for precision systems, such as thermal processing equipment, to support the next generation of automation as the manufacturing industry throughout the country transitions towards both electric and hydrogen-based technologies. Japanese manufacturers, particularly in the automotive and semiconductor sectors, are increasingly investing in automated thermal processing systems to maintain high-quality standards and competitive advantage. Furthermore, predictive maintenance enabled by IoT sensors helps minimize downtime and extend equipment lifespan. As Japan continues to lead in advanced manufacturing, the integration of automation in thermal processing equipment is expected to grow, supporting higher productivity and operational efficiency in industrial applications. This trend underscores the market’s shift toward intelligent, connected, and automated thermal solutions.

Japan Thermal Processing Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on equipment type, process type, heating source, automation level, and end use industry.

Equipment Type Insights:

- Furnaces

- Ovens

- Kilns

- Induction Heating Systems

- Heat Treatment Systems

- Thermal Oxidizers

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes furnaces, ovens, kilns, induction heating systems, heat treatment systems, and thermal oxidizers.

Process Type Insights:

- Heat Treatment

- Annealing

- Hardening and Tempering

- Sintering

- Drying and Curing

- Calcination

A detailed breakup and analysis of the market based on the process type have also been provided in the report. This includes heat treatment, annealing, hardening and tempering, sintering, drying and curing, and calcination.

Heating Source Insights:

- Electric Thermal Processing

- Gas-Fired Systems

- Infrared and Microwave Heating

- Induction Heating

The report has provided a detailed breakup and analysis of the market based on the heating source. This includes electric thermal processing, gas-fired systems, infrared and microwave heating, and induction heating.

Automation Level Insights:

- Manual Thermal Processing Equipment

- Semi-Automated Systems

- Fully Automated Systems

A detailed breakup and analysis of the market based on the automation level have also been provided in the report. This includes manual thermal processing equipment, semi-automated systems, and fully automated systems.

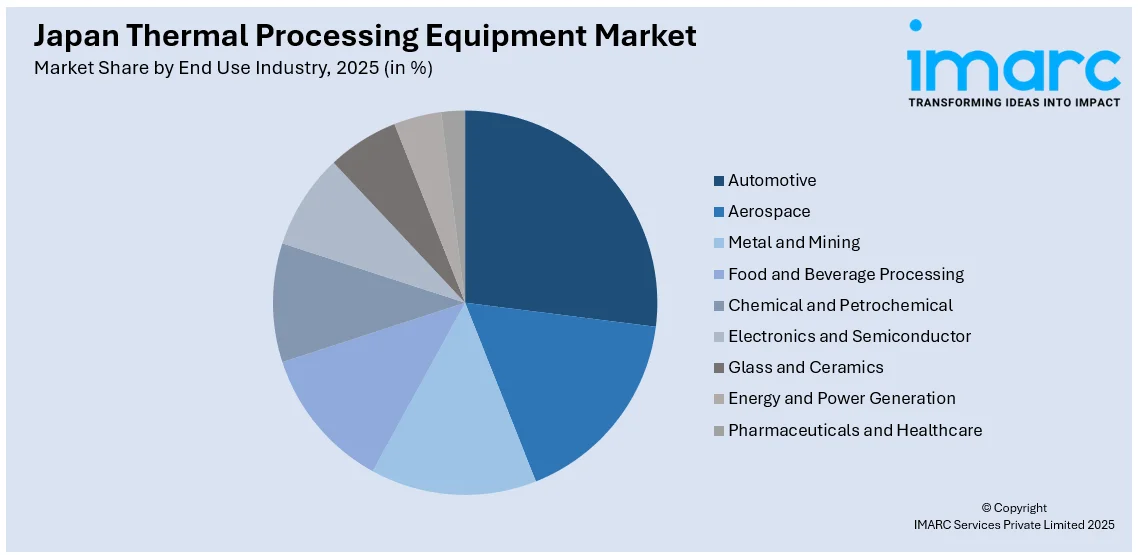

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Aerospace

- Metal and Mining

- Food and Beverage Processing

- Chemical and Petrochemical

- Electronics and Semiconductor

- Glass and Ceramics

- Energy and Power Generation

- Pharmaceuticals and Healthcare

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes automotive, aerospace, metal and mining, food and beverage processing, chemical and petrochemical, electronics and semiconductor, glass and ceramics, energy and power generation, and pharmaceuticals and healthcare.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Thermal Processing Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Furnaces, Ovens, Kilns, Induction Heating Systems, Heat Treatment Systems, Thermal Oxidizers |

| Process Types Covered | Heat Treatment, Annealing, Hardening and Tempering, Sintering, Drying and Curing, Calcination |

| Heating Sources Covered | Electric Thermal Processing, Gas-Fired Systems, Infrared and Microwave Heating, Induction Heating |

| Automation Levels Covered | Manual Thermal Processing Equipment, Semi-Automated Systems, Fully Automated Systems |

| End Use Industries Covered | Automotive, Aerospace, Metal and Mining, Food and Beverage Processing, Chemical and Petrochemical, Electronics and Semiconductor, Glass and Ceramics, Energy and Power Generation, Pharmaceuticals and Healthcare |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan thermal processing equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan thermal processing equipment market on the basis of equipment type?

- What is the breakup of the Japan thermal processing equipment market on the basis of process type?

- What is the breakup of the Japan thermal processing equipment market on the basis of heating source?

- What is the breakup of the Japan thermal processing equipment market on the basis of automation level?

- What is the breakup of the Japan thermal processing equipment market on the basis of end use industry?

- What is the breakup of the Japan thermal processing equipment market on the basis of region?

- What are the various stages in the value chain of the Japan thermal processing equipment market?

- What are the key driving factors and challenges in the Japan thermal processing equipment market?

- What is the structure of the Japan thermal processing equipment market and who are the key players?

- What is the degree of competition in the Japan thermal processing equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan thermal processing equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan thermal processing equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan thermal processing equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)