Japan Toluene Market Size, Share, Trends and Forecast by Technology, Application, and Region, 2026-2034

Japan Toluene Market Overview:

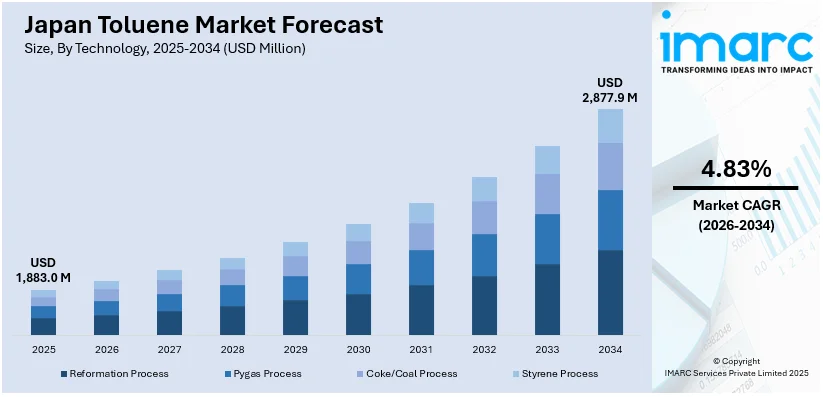

The Japan toluene market size reached USD 1,883.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,877.9 Million by 2034, exhibiting a growth rate (CAGR) of 4.83% during 2026-2034. The increasing demand from the automotive, paints, and coatings industries and the growing use of toluene in the production of solvents and adhesives are driving market growth. In addition to this, the rise in industrial activities, continual advancements in manufacturing technologies, a strong focus on improving production, and the need for high-quality, eco-friendly products are some of the major factors augmenting Japan toluene market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,883.0 Million |

| Market Forecast in 2034 | USD 2,877.9 Million |

| Market Growth Rate 2026-2034 | 4.83% |

Japan Toluene Market Trends:

Growing Demand from the Automotive Sector

The Japanese automobile sector remains the key driver of high demand for toluene, mostly as a solvent in vehicle manufacturing adhesives, coatings, and paints. In 2023, motor vehicle production in Japan stood at 8.99 million units, with production of passenger cars increasing by 18.3% to 7.77 million units, as per industry reports. The growth in vehicle production is directly associated with the growth in demand for high-performance coatings, which generally rely on toluene for their composition. With Japan still being a world leader in auto production, demand for high-grade paints and coatings with toluene is growing. Furthermore, the shift towards more advanced and environmentally friendly coatings that are stronger and scratch-resistant is giving a positive market outlook. In addition, with the increasing emphasis on light vehicle weight and energy efficiency, the automotive sector is increasingly focusing on materials that require specialist solvents like toluene for their manufacture, thus aiding Japan toluene market growth. With the automobile sector further developing, especially with the rising production of electric vehicles (EVs), the need for high-tech, high-performance coatings will further aid toluene's consumption growth in Japan.

To get more information on this market Request Sample

Expanding Applications in the Electronics Industry

The electronics industry of Japan, which is one of the most advanced in the world, is increasingly depending on toluene in the production of semiconductor devices and printed circuit boards (PCBs). Toluene is used as a solvent in the manufacturing process of coatings, cleaners, and chemicals applied in the sensitive operations of assembling and cleaning electronic components. According to industry reports, the country’s electronics device manufacturing in 2023 was 322,198 units, or about 111.0% of earlier levels. This reflects the growing size of Japan's electronics sector, with leading world players in consumer electronics, mobile devices, and industrial equipment. Toluene is ideal for electronics because it possesses solvent power and can dissolve a variety of resins and adhesives without damaging delicate components. Also, with the increasing international demand for smartphones, IoT devices, and AI technologies, Japan's electronics sector is experiencing higher production levels, which is broadening the market. In addition, the continuous technological developments in miniature components in the electronics sector and the development of next-generation devices highlight the increasingly important role toluene is taking in the sector, solidifying its importance in the production of high-technology, high-performance electronics.

Japan Toluene Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels 2026-2034. Our report has categorized the market based on technology and application.

Technology Insights:

- Reformation Process

- Pygas Process

- Coke/Coal Process

- Styrene Process

The report has provided a detailed breakup and analysis of the market based on the technology. This includes reformation process, pygas process, coke/coal process, and styrene process.

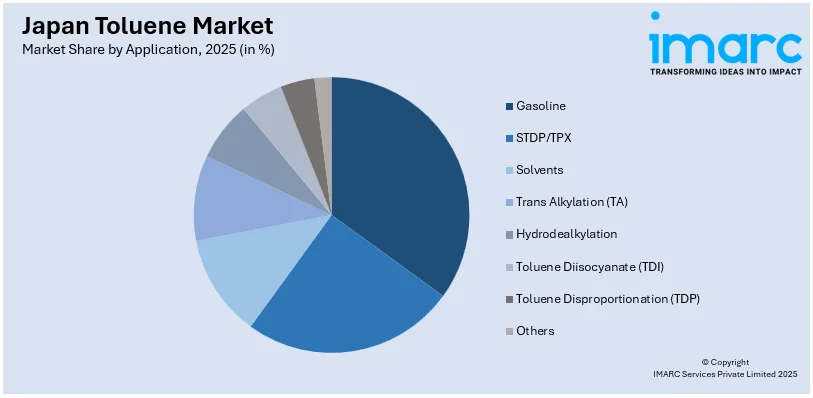

Application Insights:

Access the comprehensive market breakdown Request Sample

- Gasoline

- STDP/TPX

- Solvents

- Trans Alkylation (TA)

- Hydrodealkylation

- Toluene Diisocyanate (TDI)

- Toluene Disproportionation (TDP)

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes gasoline, STDP/TPX, solvents, trans alkylation (TA), hydrodealkylation, toluene diisocyanate (TDI), toluene disproportionation (TDP), and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central /Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Toluene Market News:

- On March 28, 2023, Mitsui Chemicals announced plans to optimize the production capacity of its toluene diisocyanate (TDI) plant at Omuta Works, reducing output from 120,000 Tons to around 50,000 tons annually by July 2025. This move aligns with the company's strategy to enhance competitiveness and focus on high-performance products. The optimization is part of Mitsui Chemicals' VISION 2030 plan to restructure its polyurethane business and drive growth through value-added products and a circular economy approach.

Japan Toluene Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Reformation Process, Pygas Process, Coke/Coal Process, Styrene Process |

| Applications Covered | Gasoline, STDP/TPX, Solvents, Trans Alkylation (TA), Hydrodealkylation, Toluene Diisocyanate (TDI), Toluene Disproportionation (TDP), Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan toluene market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan toluene market on the basis of technology?

- What is the breakup of the Japan toluene market on the basis of application?

- What is the breakup of the Japan toluene market on the basis of region?

- What are the various stages in the value chain of the Japan toluene market?

- What are the key driving factors and challenges in the Japan toluene market?

- What is the structure of the Japan toluene market and who are the key players?

- What is the degree of competition in the Japan toluene market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan toluene market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan toluene market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan toluene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)