Japan Toys and Games Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Japan Toys and Games Market Overview:

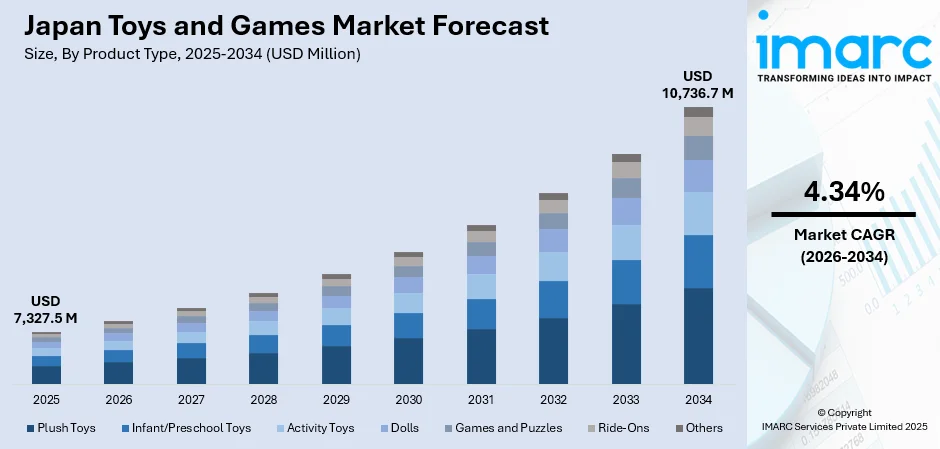

The Japan toys and games market size reached USD 7,327.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 10,736.7 Million by 2034, exhibiting a growth rate (CAGR) of 4.34% during 2026-2034. The market is driven by a strong demand for educational toys, technological innovation in interactive products, rising popularity of anime-based merchandise, and growing adult fanbase seeking collectibles. Cultural trends and media influence also shape consumer preferences and drive continued market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 7,327.5 Million |

| Market Forecast in 2034 | USD 10,736.7 Million |

| Market Growth Rate 2026-2034 | 4.34% |

Japan Toys and Games Market Trends:

Influence of Anime and Pop Culture Franchises

Anime, manga, and gaming culture are deeply embedded in Japanese society and significantly shape the market. Popular franchises like Pokémon, Dragon Ball, and One Piece drive demand for character merchandise across all age groups. Toys tied to anime series or game releases, such as action figures, card games, and collectibles, are among the top sellers. These franchises create a strong emotional connection with consumers through storylines, nostalgia, and fan communities, which translate into repeat purchases and brand loyalty. Merchandising strategies often synchronize with media releases, ensuring a constant buzz around new products, which is fueling the Japan toys and games market share. The ability to cross-market through anime, mobile games, films, and toys strengthens the brand presence and creates a wide consumer base. This connection between media and merchandise plays a central role in Japan’s toy ecosystem, reinforcing the cultural relevance of licensed products and making character-driven toys a major growth engine for the industry. For instance, in March 2025, NHN Corporation collaborated with the Japanese entertainment firm KADOKAWA to develop a puzzle game inspired by the intellectual property (IP) of the famous Japanese TV anime '[OSHI NO KO]'. This project represents the inaugural game created from the '[OSHI NO KO]' IP, which has enchanted anime enthusiasts across the globe, including in Japan, Korea, North America, and Europe. The anime has recently received increased attention following the announcement of its third season, scheduled to premiere in Japan in 2026.

To get more information on this market Request Sample

Expansion of the Adult Consumer Segment ("Kidults")

The Japan toys and games market growth is also driven by the rise of adult consumers, often referred to as “kidults.” These buyers seek high-quality, collectible, or nostalgic toys that connect them to their childhood or favorite franchises. This segment includes everything from scale models and vintage toys to limited-edition figures and intricate board games. Adult collectors are willing to spend more for premium designs, exclusivity, and authenticity. Toy companies now actively target this demographic by rereleasing retro toys, collaborating with artists, and offering merchandise themed around classic anime and gaming icons. Online communities and fan conventions further boost demand by creating social spaces around collecting and trading. The emotional and artistic appeal of these toys often transcends play, transforming them into lifestyle or décor items. As the population ages and disposable income increases among working adults, the kidult market continues to grow, creating a positive impact on the Japan toys and games market outlook. For instance, in November 2024, a prominent international game developer, LIGHTSPEED STUDIOS, revealed the opening of LightSpeed Japan Studio, its latest game development studio dedicated to creating original AAA action game titles, signaling a significant advancement in LIGHTSPEED STUDIOS' global growth. The renowned game director, Hideaki Itsuno will head LightSpeed Japan Studio. Originating from Osaka, Itsuno is a veteran of Capcom, where he not only envisioned the Street Fighter Alpha series but also directed iconic franchise series like Power Stone, Rival Schools, and Capcom VS. SNK, Dragon's Dogma, and Devil May Cry.

Japan Toys and Games Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Plush Toys

- Infant/Preschool Toys

- Activity Toys

- Dolls

- Games and Puzzles

- Ride-Ons

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes plush toys, infant/preschool toys, activity toys, dolls, games and puzzles, ride-ons, and others.

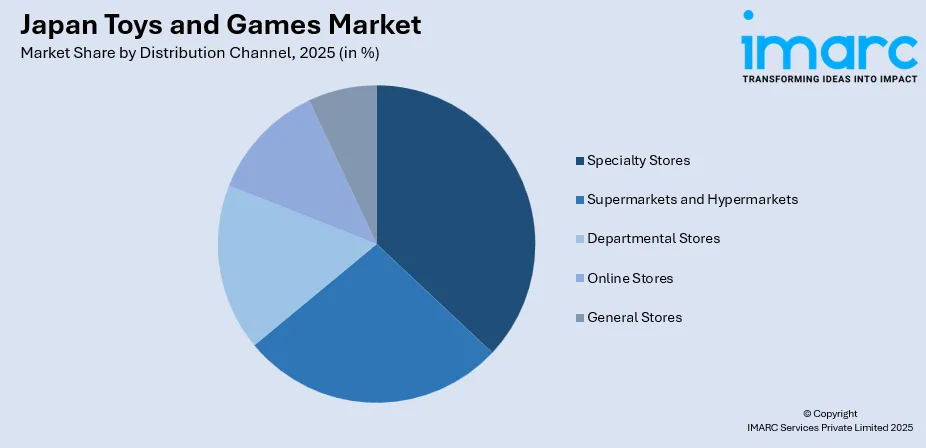

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Specialty Stores

- Supermarkets and Hypermarkets

- Departmental Stores

- Online Stores

- General Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes specialty stores, supermarkets and hypermarkets, departmental stores, online stores, and general stores.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include the Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Toys and Games Market News:

- In April 2024, Japanese toy manufacturer Tomy Co. introduced a driving game designed to assist visually-impaired players in navigating a vehicle through various voice prompts, including instructions like "Turn left" or "(The rival car) is in the center."

- In May 2024, Spin Master announced to release Punirunes, a squeezable virtual pet that had enchanted enthusiasts of Japanese anime culture. Initially launched in 2021 by the Japanese toy firm Takara Tomy, Spin Master plans to broaden its distribution to additional international markets as passionate fans elevate anime culture to prominence.

Japan Toys and Games Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Plush Toys, Infant/Preschool Toys, Activity Toys, Dolls, Games and Puzzles, Ride-Ons, Others |

| Distribution Channels Covered | Specialty Stores, Supermarkets and Hypermarkets, Departmental Stores, Online Stores, General Stores |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan toys and games market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan toys and games market on the basis of product type?

- What is the breakup of the Japan toys and games market on the basis of distribution channel?

- What is the breakup of the Japan toys and games market on the basis of region?

- What are the various stages in the value chain of the Japan toys and games market?

- What are the key driving factors and challenges in the Japan toys and games market?

- What is the structure of the Japan toys and games market and who are the key players?

- What is the degree of competition in the Japan toys and games market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan toys and games market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan toys and games market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan toys and games industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)