Japan Truck Market Size, Share, Trends and Forecast by Vehicle Type, Tonnage Capacity, Fuel Type, Application, and Region, 2026-2034

Japan Truck Market Overview:

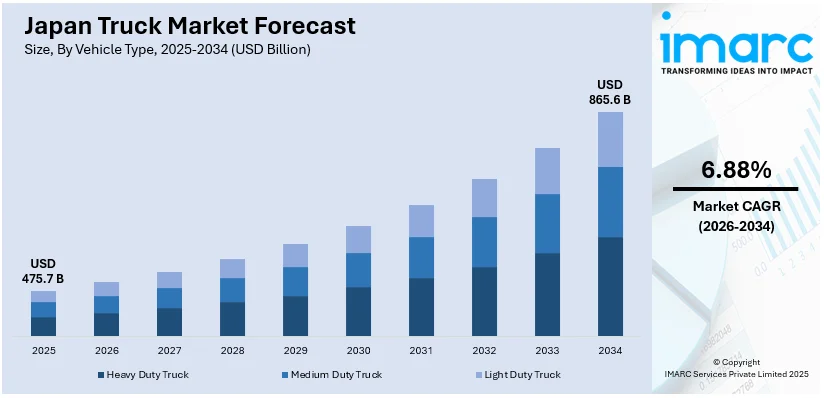

The Japan truck market size reached USD 475.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 865.6 Billion by 2034, exhibiting a growth rate (CAGR) of 6.88% during 2026-2034. The truck market in Japan is shaped by an aging workforce and labor shortages, which are driving automation and recruitment innovations, while also prioritizing sustainability through eco-friendly, fuel-efficient technologies that reduce emissions, improve efficiency, and help meet international environmental standards.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 475.7 Billion |

| Market Forecast in 2034 | USD 865.6 Billion |

| Market Growth Rate 2026-2034 | 6.88% |

Japan Truck Market Trends:

Technological Advancements and Sustainability

The growing investments in the development of eco-friendly and fuel-efficient vehicles in Japan is offering a favorable market outlook. With a strong focus on reducing carbon emissions, Japan is at the forefront of adopting greener transportation technologies to meet international sustainability goals. This change is apparent in an increase of electric trucks, self-driving vehicle, and telematics technologies, all of which are contributing to transforming the market by enhancing operational efficiency, reducing emissions, and decreasing expenses. These innovations not only allow truck companies for adhering to stringent environmental regulations but also improve safety and efficiency. In 2024, Isuzu Motors launched new F-Series medium-duty trucks in Japan, featuring the Cummins-developed 6.7-liter DB6A engine. These trucks, with a gross vehicle weight of 15-22 tonnes, offered improved power and efficiency, supporting Isuzu's goal for a carbon-neutral society. The partnership with Cummins marked a significant advancement in the medium-duty diesel powertrain sector, emphasizing the industry's sustained dedication to minimizing transportation's environmental effect while preserving performance.

To get more information on this market Request Sample

Aging Workforce and Labor Shortages

With the rapidly aging population in Japan, the pool of available truck drivers is shrinking, and many experienced drivers are retiring without enough younger workers to replace them. This issue is particularly acute in the trucking sector, where the shortage of qualified drivers is forcing companies to rethink their approach to workforce recruitment and logistics operations. To address this gap, Japan is turning to both technological advancements and policy changes. The demand for automation is growing, with businesses exploring autonomous trucks to maintain efficiency without relying on human drivers. In addition to automation, efforts to improve working conditions, such as offering better wages, reducing working hours, and improving job satisfaction, are essential to attracting younger workers to the profession. In 2024, Isuzu Japan launched the diesel Elf Mio truck, designed to address the country's driver labor shortage. Weighing under 3.5 tons, the truck can be operated with a regular driver’s license, making it accessible to small delivery operators and expanding the pool of potential drivers. This strategic move aims to ease the burden of labor shortages by enabling more people to operate trucks, offering a practical response to a critical workforce challenge facing the industry.

Japan Truck Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on vehicle type, tonnage capacity, fuel type, and application.

Vehicle Type Insights:

- Heavy Duty Truck

- Medium Duty Truck

- Light Duty Truck

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes heavy duty truck, medium duty truck, and light duty truck.

Tonnage Capacity Insights:

- 3.5 – 7.5 Tons

- 7.5 – 16 Tons

- 16 – 30 Tons

- Above 30 Tons

A detailed breakup and analysis of the market based on the tonnage capacity have also been provided in the report. This includes 3.5 – 7.5 tons, 7.5 – 16 tons, 16 – 30 tons, and above 30 tons.

Fuel Type Insights:

- Diesel

- Petrol

- CNG & LNG

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes diesel, petrol, and CNG & LNG.

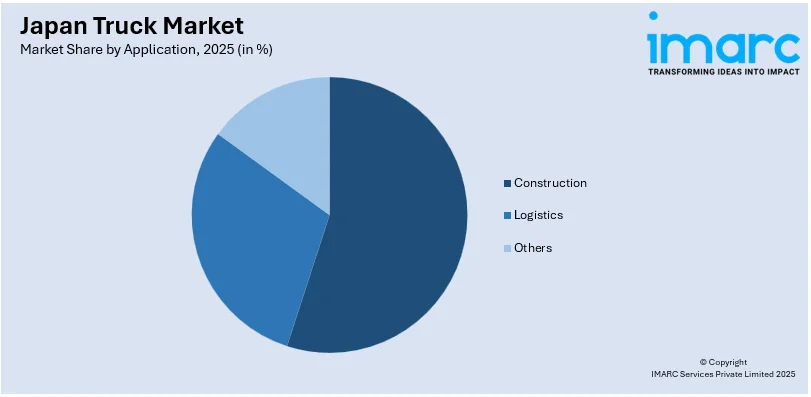

Application Insights:

Access the comprehensive market breakdown Request Sample

- Construction

- Logistics

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes construction, logistics, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Truck Market News:

- In November 2024, Isuzu announced plans to launch autonomous trucks starting in 2027 in Japan. In collaboration with US startup Applied Intuition, Isuzu aimed to equip its Giga trucks with Level 4 autonomous systems. These trucks were set to initially operate on selected routes, though drivers would still need to monitor and intervene when necessary.

- In August 2024, Mitsubishi Fuso began a battery-swapping demonstration for its Fuso e-Canter electric truck in Kyoto, Japan, in collaboration with Ample and ENEOS. The process, aimed at improving EV truck efficiency, involved robotized battery swaps completed in five minutes. This initiative was part of Mitsubishi Fuso's goal to expand electric truck use and promote carbon-neutral logistics.

Japan Truck Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Heavy Duty Truck, Medium Duty Truck, Light Duty Truck |

| Tonnage Capacities Covered | 3.5 – 7.5 Tons, 7.5 – 16 Tons, 16 – 30 Tons, Above 30 Tons |

| Fuel Types Covered | Diesel, Petrol, CNG & LNG |

| Applications Covered | Construction, Logistics, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan truck market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan truck market on the basis of vehicle type?

- What is the breakup of the Japan truck market on the basis of tonnage capacity?

- What is the breakup of the Japan truck market on the basis of fuel type?

- What is the breakup of the Japan truck market on the basis of application?

- What is the breakup of the Japan truck market on the basis of region?

- What are the various stages in the value chain of the Japan truck market?

- What are the key driving factors and challenges in the Japan truck market?

- What is the structure of the Japan truck market and who are the key players?

- What is the degree of competition in the Japan truck market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan truck market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan truck market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan truck industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)