Japan Tyre Market Size, Share, Trends and Forecast by Vehicle Type, OEM And Replacement Segment, Import and Export, Radial and Bias Tyres, and Tube and Tubeless Tyres, 2025-2033

Japan Tyre Market Size and Share:

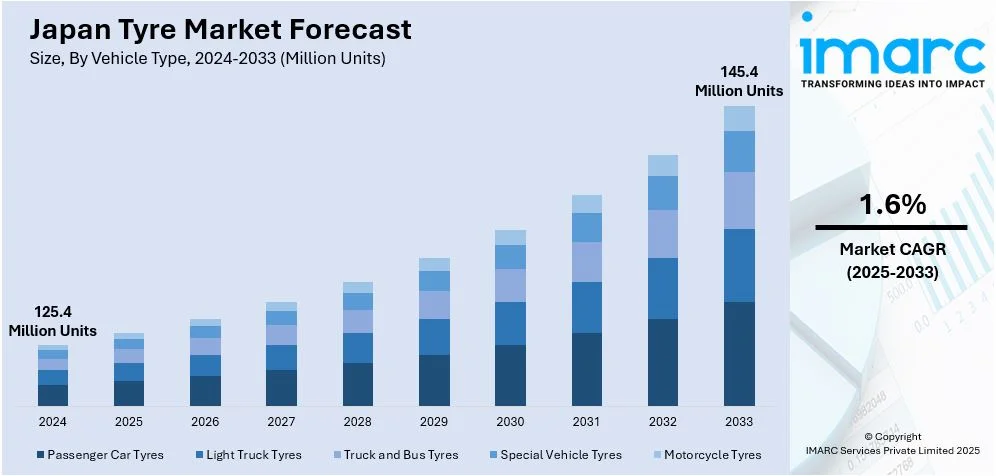

The Japan tyre market size was valued at 125.4 Million Units in 2024. Looking forward, IMARC Group estimates the market to reach 145.4 Million Units by 2033. exhibiting a CAGR of 1.6% from 2025-2033. The Japan tyre market is driven by factors such as increasing automotive production, growing demand for fuel-efficient and eco-friendly tyres, and advancements in tyre technology. Additionally, stringent government regulations on vehicle safety and emissions, along with rising consumer preference for premium tyres, further contribute to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 125.4 Million Units |

| Market Forecast in 2033 | 145.4 Million Units |

| Market Growth Rate (2025-2033) | 1.6% |

The increasing demand for fuel-efficient and environmentally friendly tyres holds a good mass in the Japanese market. Consumers and manufacturers have shifted focus to sustainability and cost-effectiveness. Fuel-efficient tyres reduce rolling resistance and consume less fuel, which in turn saves the environment from emitting carbon into the atmosphere. All the automobile manufacturing giants in Japan, including the powerhouses of Toyota, Honda, and Nissan, have tremendous investment in climate-conscious innovation. For instance, Mazda has vowed to reduce the level of emissions by 50% below that of 2010 by the year 2030 and eventually targets a reduction of 90% by the year 2050. This involves the designing of tyres in line with manufacturing efforts to have reduced fuel efficiency while contributing towards lower overall emissions, which satisfies growing consumer requirements for eco-conscious, cost-effective products.

Stringent government regulations regarding vehicle safety and emissions also drive the tyre market in Japan. The government imposes strict standards for tyre performance, including safety features such as wet traction, braking distance, and durability. These regulations push manufacturers to develop high-performance tyres that meet or exceed these standards. Additionally, Japan's commitment to reducing greenhouse gases (GHG) emissions encourages the adoption of tyres that improve fuel efficiency and reduce environmental impact. This regulatory pressure has spurred innovation within the market, with manufacturers continuously advancing tyre technologies to comply with evolving safety and environmental regulations.

Japan Tyre Market Trends:

Shift Towards Sustainable and Green Tyres

A strong trend in the Japan tyre market is sustainable and green tyres due to the rise in environmental issues. Consumers and businesses are more inclined to adopt solutions that can help them decrease their footprint. In 2023, nearly 78 million tyres were generated from replacement alone, of which a huge quantity was recycled or reused. In efforts to become ecologically friendly and increase the number of low- GHG products used by Japanese producers, tyre makers have turned attention toward using material, like the rubber used by tyres, and manufacturing tyres specifically with improved fuel efficiency. Indeed, with continued rises in customer environmental awareness and sensitivity, innovation and usage trends continue to progress towards combining tyres' performance standards with sustainable uses.

Advancements in Smart Tyre Technology

The rise of electric vehicles in Japan is accelerating smart tyre technology at a very rapid pace. For instance, with 3.45 million new electric vehicles in 2023and their representation of 7% in total vehicle registrations, the demand for advanced tyremarket solutions has surged ahead. These are advanced tyres that offer sensors that monitor such factors as the pressure of the tire, the temperature of the tire, and the tread-wearing issues of the tires. These tyres boost safety and performance through real time provision of data to the drivers and fleet operators, which allow better maintenance. Additionally, digital technology integration allows for predictive maintenance, reducing downtime. This shift towards smart tyres is fueled by Japan’s focus on automotive connectivity and innovation, with the rise of EVs further driving the adoption of these high-tech solutions.

Rising Popularity of High-Performance Tyres

The demand for high-performance tyres is growing in Japan, driven by a rise in consumer preference for premium and specialized products. Japanese consumers are becoming more discerning in their tyre choices, seeking tyres that offer superior handling, durability, and ride comfort. This trend is particularly strong in the sports and luxury vehicle segments, where the need for tyres that enhance vehicle performance is critical. Additionally, manufacturers are developing high-performance tyres that cater to specific needs, such as tyres designed for wet or snowy conditions, as well as tyres optimized for electric vehicles. This trend reflects Japan's evolving automotive market, where performance and safety are top priorities.

Japan Tyre Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Japan tyre market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on vehicle type, OEM and replacement segment, import and export, radial and bias tyres, and tube and tubeless tyres.

Analysis by Vehicle Type:

- Passenger Car Tyres

- Light Truck Tyres

- Truck and Bus Tyres

- Special Vehicle Tyres

- Motorcycle Tyres

Passenger car tyres holds the majority of Japan tyre market share due to the country’s large automotive market, with a high number of private car owners. Japan's extensive road network and significant car ownership have led to a consistent demand for tyres in the passenger vehicle segment. Additionally, the growing preference for high-performance and fuel-efficient tyres in this category further accelerates growth. The eco-friendly and technologically advanced tyres like low rolling resistance cater to the environment-conscious consuming base of the country. The domination of the domestic automobile manufacturers, coupled with a strong inclination on the part of consumers towards quality and safety in passenger car tyres, continues to drive up the expansion of this segment in Japan's tyre market. The trend of replacing and maintaining tyres is increasing year after year, contributing to the outlook of tyre market in Japan.

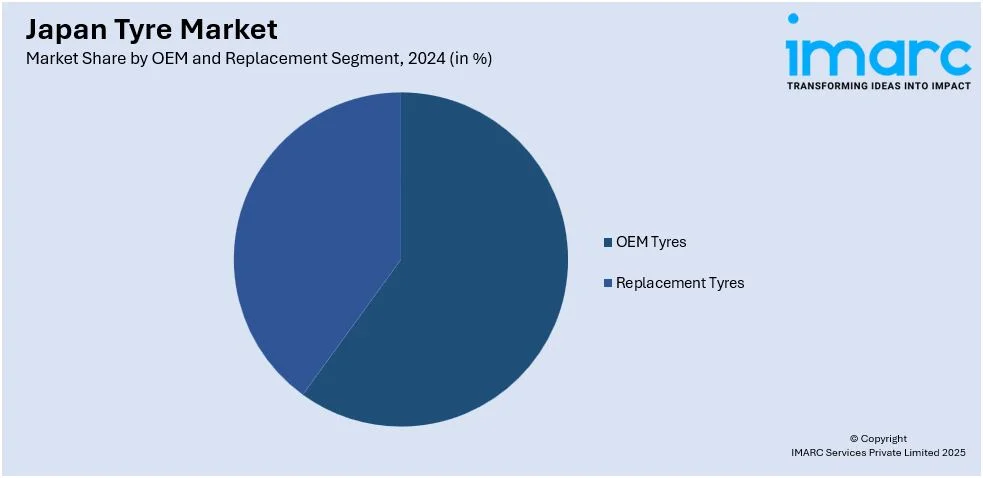

Analysis by OEM and Replacement Segment:

- OEM Tyres

- Passenger Car Tyres

- Light Truck Tyres

- Truck and Bus Tyres

- Special Vehicle Tyres

- Motorcycle Tyres

- Replacement Tyres

- Passenger Car Tyres

- Light Truck Tyres

- Truck and Bus Tyres

- Special Vehicle Tyres

- Motorcycle Tyres

Replacement tyres dominate the Japanese tyre market due to several factors, including the country’s high vehicle ownership rate and the need for regular tyre maintenance. As vehicles age, the demand for replacement tyres increases to maintain safety, performance, and fuel efficiency. Consumers prioritize replacing worn-out tyres to ensure optimal handling, braking, and road traction, especially in a market focused on vehicle safety standards. Additionally, Japanese consumers are increasingly opting for high-quality replacement tyres, driven by advancements in tyre technology that offer improved fuel efficiency and durability. The competitive pricing of replacement tyres and frequent tyre changes further contribute to this segment's dominance. With the rise of online sales and enhanced distribution channels, the ease of purchasing replacement tyres has also played a role in boosting Japan tyre market growth.

Analysis by Imports and Exports:

- Imports

- Exports

Japan imports tyres primarily to meet the demand for various vehicle types, including passenger cars, trucks, and specialty vehicles. Imported tyres offer consumers a wider range of options, including high-performance and budget-friendly models. Import regulations and quality standards ensure that tyres meet Japan’s stringent safety and environmental requirements.

Furthermore, the country exports high-quality tyres to regions with growing automotive markets. These tyres, imported from Japan, are renowned for their technologically advanced qualities and performance and durability. In terms of geography, Japanese tyre manufacturers export a wide variety of products, including premium tyres targeting luxury vehicles and eco-friendly tyres, to globally maintain competitive market presence.

Analysis by Radial and Bias Tyres:

- Bias Tyres

- Radial Tyres

Radial tyres currently lead the market in Japan as they are far superior in terms of performance, with widespread application in passenger as well as commercial vehicles. Construction, including radial steel belts across the tyre, results in improved fuel efficiency, durability, and traction over bias tyres. Radial tires provide comfort with reduced rolling resistance and longer tread life, offering consumers performance, safety, and value. High standards of autos in Japan combined with the requirement for quality over there makes it a market demanding radial tires, both for luxurious and everyday usage. The development in technology and new materials in radial tyres is supposed to push them forward more in the market, gaining more market shares and improving their competitiveness toward other types of tyres.

Analysis by Tube and Tubeless Tyres:

- Tube Tyres

- Tubeless Tyres

Tube tyres are traditional tyres that require an inner tube to hold air. They are commonly used in older vehicle models and certain low-cost applications. While they provide good durability, they are more prone to punctures and require more maintenance compared to tubeless tyres.

Besides this, tubeless tyres do not require an inner tube as they are designed to hold air directly within the tyre itself. They offer improved safety, as air loss from punctures is slower, reducing the risk of sudden deflation. Tubeless tyres are also more durable and require less maintenance.

Competitive Landscape:

The Japan tyre market research report features established global players and the strong presence of local manufacturers. Competition in this market happens to be based on product innovation, quality, and technology. It is evident that there is a concentration on the development of fuel-efficient, eco-friendly, and high-performance tyres in the midst of evolving consumer demands. This can be attributed to a significant investment by manufacturers in research and development (R&D) activities, thereby enabling the use of smart technologies, such as sensors for real-time monitoring and maximizing tyre longevity. Price competitiveness also plays an important role here. Companies can now offer tyres for both premium and budget-conscious segments. Furthermore, strategic partnerships and collaborations with vehicle manufacturers are key tactics for strengthening market position and expanding distribution networks. The market remains dynamic, with continuous innovation driving the competition.

The report provides a comprehensive analysis of the competitive landscape in the Japan tyre market with detailed profiles of all major companies.

Latest News and Developments:

- In January 2025, Yokohama announced the launch of the ADVAN V61, a premium SUV tyre designed for optimal fuel efficiency, handling, and quietness, making it suitable for both city driving and long-distance touring. Available in 17 sizes ranging from 17 to 22 inches, the tyre will be offered as original equipment for new vehicles. Set for global release (excluding North America) starting February 2025, the ADVAN V61 targets the growing midsize to large premium SUV market.

- In November 2024, Bridgestone Corporation is investing approximately ¥27bn (US$174.8m) to expand production at its Hikone, Tosu, and Tochigi plants in Japan, focusing on high-rim diameter tyres for the premium segment. The expansion, set for completion by 2028, will increase daily production by 3,000 tyres. This strategic investment supports Bridgestone’s premium tyre business, leveraging its Enliten technology and Bridgestone Common Modularity Architecture (BCMA) to enhance efficiency and sustainability.

- In October 2024, TVS Srichakra's Eurogrip brand is set to launch next-gen fuel-efficient tyres for electric vehicles (EVs), targeting the Indian market. The share of new products has grown significantly, contributing 35% of revenue in FY24, up from 22% in FY21. With over 40 new product launches in the last three years, the company has shifted focus to premium, high-performance, and off-road tyres, strengthening its presence in domestic and international markets.

- In May 2024, YOKOHAMA plans to invest ¥3.8 billion to expand motorsports tyre production at its Mishima Plant, increasing capacity by 35%. The new production line, focusing on 18-inch and larger tyres, is set to begin construction in Q3 2024, with operations starting by late 2026 and full capacity reached by 2027. This expansion supports increased sales of high-performance ADVAN tyres, aligning with YOKOHAMA’s strategy to enhance its global flagship tyre offerings under the Yokohama Transformation 2026 plan.

Japan Tyre Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Units, Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Passenger Car Tyres, Light Truck Tyres, Truck and Bus Tyres, Special Vehicle Tyres, Motorcycle Tyres |

| OEM and Replacement Segments Covered |

|

| Import and Exports Covered | Imports, Exports |

| Radia and Bias Tyres Covered | Bias Tyres, Radial Tyres |

| Type and Tubeless Tyres Covered | Tube Tyres, Tubeless Tyres |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan tyre market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Japan tyre market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan tyre industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Japan tyre market was valued at 125.4 Million Units in 2024.

The Japan tyre market was valued at 145.4 Million Units in 2033 exhibiting a CAGR of 1.6% during 2025-2033.

The growth of the Japan tyre market is driven by factors such as increasing vehicle production and ownership, rising demand for fuel-efficient and eco-friendly tyres, advancements in tyre technology (including smart tyres), and stringent safety and environmental regulations. Additionally, the growing trend of vehicle maintenance and replacement tyres further contributes to market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)