Japan Used Cooking Oil Market Size, Share, Trends and Forecast by Source, Application, and Region, 2026-2034

Japan Used Cooking Oil Market Overview:

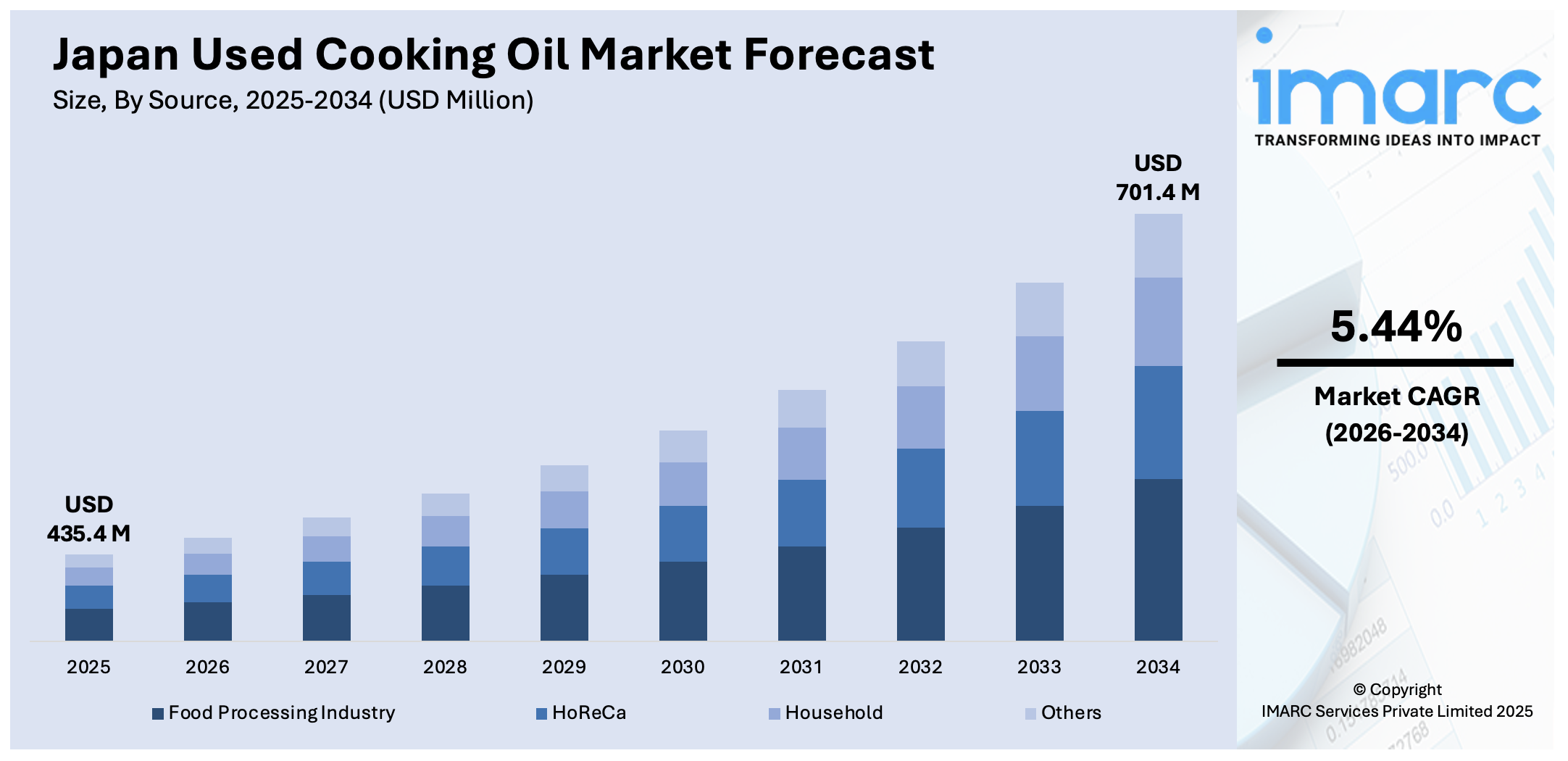

The Japan used cooking oil market size reached USD 435.4 Million in 2025. The market is projected to reach USD 701.4 Million by 2034, exhibiting a growth rate (CAGR) of 5.44% during 2026-2034. National and local government bodies are proactively encouraging biodiesel as a component of Japan’s climate and energy plans, providing subsidies, tax breaks, and financial support for projects that transform used cooking oil into clean fuel. Besides this, the broadening of retail outlets, including supermarkets with hot food sections, is contributing to the expansion of the Japan used cooking oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 435.4 Million |

| Market Forecast in 2034 | USD 701.4 Million |

| Market Growth Rate 2026-2034 | 5.44% |

Japan Used Cooking Oil Market Trends:

Rising government support for biodiesel

Increasing government support for biodiesel is impelling the market growth in Japan. National and local government agencies are actively promoting biodiesel as part of Japan’s climate and energy strategies, offering subsidies, tax incentives, and funding for demonstration projects that convert used cooking oil into clean fuel. As per the IMARC Group, the Japan biodiesel market size reached USD 2,726.4 Million in 2024. These initiatives are catalyzing the demand by encouraging the adoption of biodiesel in public transport fleets, garbage trucks, agricultural machinery, and municipal services, which in turn is creating the need for reliable supplies of used cooking oil. Regulatory measures also require responsible waste management practices, motivating restaurants, food manufacturers, and households to recycle used oil rather than discard it. Additionally, the government is facilitating research and development (R&D) activities that lead to the creation of cleaner and more efficient conversion technologies, helping improve yield and quality from used cooking oil. Local authorities are partnering with communities and schools to establish collection programs, embedding sustainability into daily life. This integrated policy approach is not only minimizing environmental impact but also boosting local economies by fostering green jobs and encouraging innovations. As a result, government backing for biodiesel is turning used cooking oil into a central component of Japan’s transition to a low-carbon and resource-efficient society.

To get more information on this market Request Sample

Expanding logistics infrastructure

The broadening of the logistics infrastructure is propelling the Japan used cooking oil market growth. With a highly developed transport network, including urban delivery systems and rural access routes, used cooking oil can be collected from restaurants, food factories, schools, and households with minimal delay or disruption. This reliability supports the steady supply needed for biodiesel production and other recycling applications. In densely populated urban areas, efficient routing and compact collection systems help overcome space constraints, while in rural regions, coordinated municipal programs and cooperatives ensure that even small volumes of used oil are captured and utilized. Cold-chain logistics, where needed, maintain oil quality during transit. Moreover, Japan’s utilization of digital technologies for tracking, scheduling, and compliance is enhancing transparency and efficiency throughout the supply chain. This logistical strength lowers operational costs and encourages wider participation in oil recycling. Additionally, the expansion of the retail outlets, including supermarkets with hot food counters and ready-meal providers, is contributing to higher cooking oil employment, increasing the volume of recoverable used cooking oil and strengthening the overall recycling ecosystem. As per the data released by the government officials, Japanese retail sales grew by 2.8% in November 2024 compared to November 2023.

Japan Used Cooking Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on source and application.

Source Insights:

- Food Processing Industry

- HoReCa

- Household

- Others

The report has provided a detailed breakup and analysis of the market based on the source. This includes food processing industry, HoReCa, household, and others.

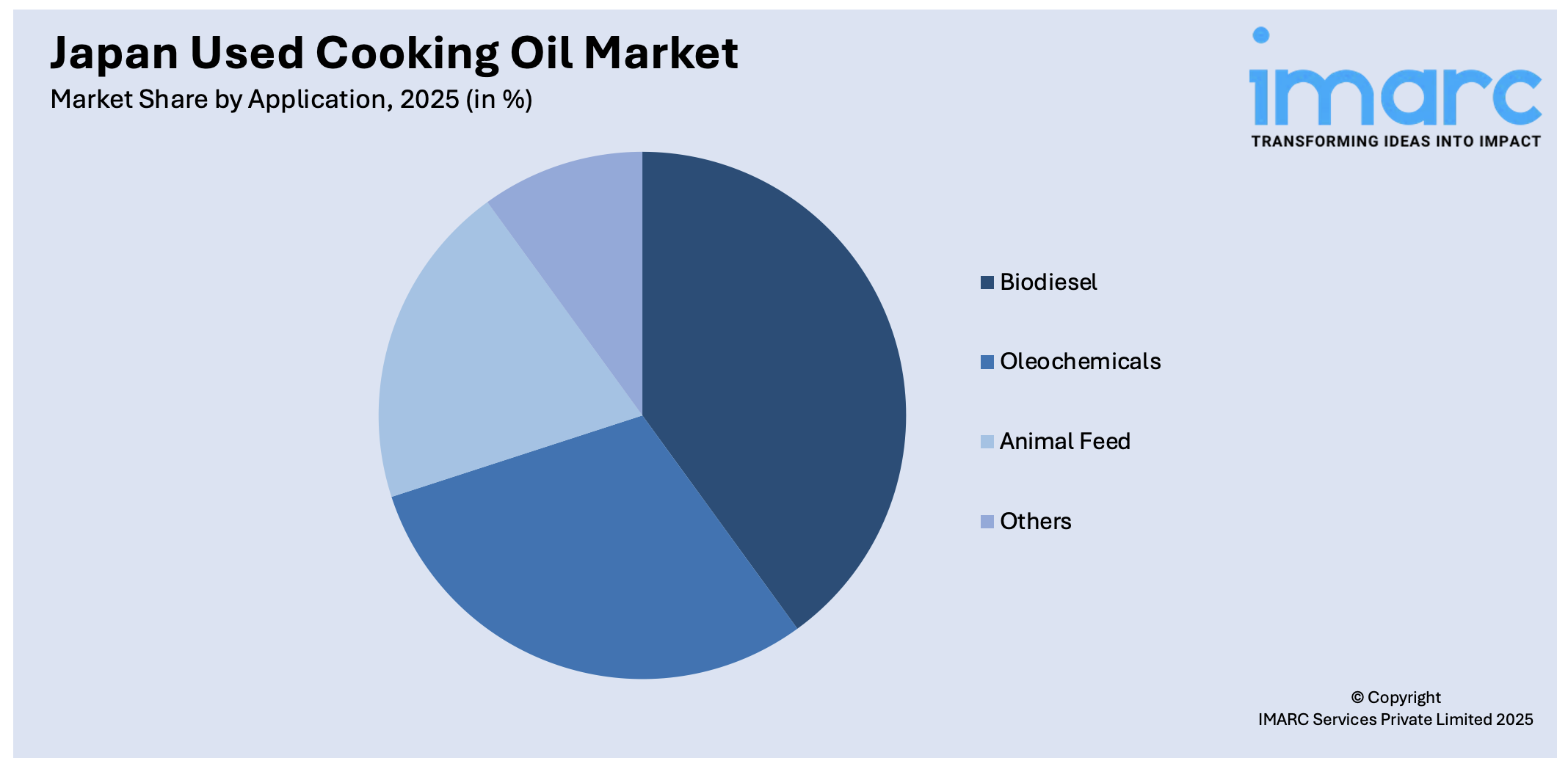

Application Insights:

Access the comprehensive market breakdown Request Sample

- Biodiesel

- Oleochemicals

- Animal Feed

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes biodiesel, oleochemicals, animal feed, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Used Cooking Oil Market News:

- In May 2025, Nippon Yuka Kogyo Co., Ltd. announced the launch of BioxiGuard, Japan's first antioxidant uniquely designed for marine biodiesel fuel. Biofuel attracted high interest in the maritime industry as it was produced from a variety of raw materials, including grains and used cooking oil. This facilitated the shift towards reduced carbon and decarbonized ship operations.

- In October 2024, Indorama Ventures, Suntory, Neste, ENEOS, Mitsubishi Corporation, and Iwatani introduced the ‘world’s first’ bio-PET bottle in Japan, made from used cooking oil. PET bottles manufactured with this technology could notably decrease CO2 emissions from products.

Japan Used Cooking Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Food Processing Industry, HoReCa, Household, Others |

| Applications Covered | Biodiesel, Oleochemicals, Animal Feed, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan used cooking oil market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan used cooking oil market on the basis of source?

- What is the breakup of the Japan used cooking oil market on the basis of application?

- What is the breakup of the Japan used cooking oil market on the basis of region?

- What are the various stages in the value chain of the Japan used cooking oil market?

- What are the key driving factors and challenges in the Japan used cooking oil market?

- What is the structure of the Japan used cooking oil market and who are the key players?

- What is the degree of competition in the Japan used cooking oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan used cooking oil market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan used cooking oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan used cooking oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)