Japan Vehicle Financing Market Size, Share, Trends and Forecast by Vehicle Type, Loan Provider, Vehicle Condition, Purpose Type, and Region, 2026-2034

Japan Vehicle Financing Market Overview:

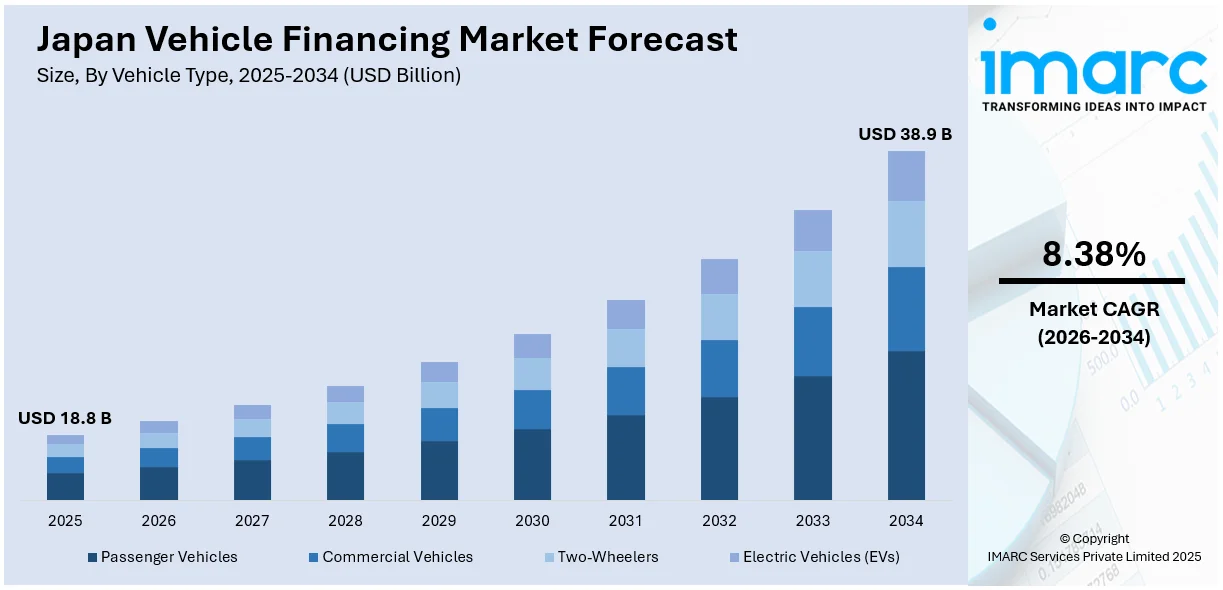

The Japan vehicle financing market size reached USD 18.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 38.9 Billion by 2034, exhibiting a growth rate (CAGR) of 8.38% during 2026-2034. The market is propelled by rising urbanization, increasing vehicle ownership costs, and technological integration in financial services. Favorable interest rates, digital financing platforms, and a strong used-car market also contribute significantly to the Japan vehicle financing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 18.8 Billion |

| Market Forecast in 2034 | USD 38.9 Billion |

| Market Growth Rate 2026-2034 | 8.38% |

Japan Vehicle Financing Market Trends:

Emergence of Subscription-Based Vehicle Financing Models

An emerging trend in the Japan vehicle financing market is the growth of subscription-based vehicle ownership options. Under this approach, consumers pay a recurring fee that includes vehicle usage, maintenance, insurance, and taxation without the requirement for conventional loans or leases. It is especially attractive to younger urban dwellers who value flexibility over ownership. Auto manufacturers and financial institutions are partnering to provide these plans as part of their changing financing portfolios. For instance, in June 2024, Volkswagen Financial Services Japan Ltd. (VWFSJ) was assigned an A-1+ CP rating by Rating and Investment Information, Inc. (R&I). This reflects the strong creditworthiness of its parent company, Volkswagen AG, as VWFSJ is supported by Volkswagen Financial Services AG. VWFSJ offers captive finance services including auto loans, leasing, and insurance for brands like Volkswagen, Audi, and Lamborghini. Its financing structure is secure, with low exposure to risks and strong liquidity. The strategy not only streamlines the ownership cycle but also promotes quicker renewal cycles and uptake of fresh models. The trend is gathering pace in Japan's aging auto market, providing new scope for diversifying revenues as well as consumer interaction. Consequently, subscription financing is likely to be a key driver for Japan vehicle financing market growth.

To get more information on this market Request Sample

Expansion of Green Vehicle Financing Initiatives

Another notable trend driving Japan vehicle financing market growth is the increasing focus on green and eco-friendly vehicle financing. As the Japanese government continues to push for decarbonization and emission reduction, both public and private financing institutions are offering incentives for electric and hybrid vehicle purchases. These include lower interest rates, tax exemptions, and tailored loan packages for environmentally conscious buyers. Financial service providers are also aligning their portfolios with ESG (Environmental, Social, Governance) goals, thereby influencing borrower preferences. The expanding availability of affordable green vehicle loans not only supports the country's climate commitments but also stimulates demand for next-generation automobiles. This push toward sustainability is expected to further strengthen innovation and consumer trust in Japan's financial ecosystem, accelerating Japan vehicle financing market growth. For instance, in January 2024, Mahindra & Mahindra secured an INR 400 Crore investment from the India-Japan Fund (IJF) in its Last Mile Mobility business, which includes electric three-wheelers and small commercial vehicles. This partnership aims to promote sustainable, low-carbon mobility solutions and boost the electric vehicle market in India. The investment will help Mahindra enhance its electric vehicle offerings and drive growth in last-mile connectivity, aligning with environmental goals.

Japan Vehicle Financing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on vehicle type, loan provider, vehicle condition, and purpose type.

Vehicle Type Insights:

- Passenger Vehicles

- Commercial Vehicles

- Two-Wheelers

- Electric Vehicles (EVs)

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger vehicles, commercial vehicles, two-wheelers, and electric vehicles (EVs).

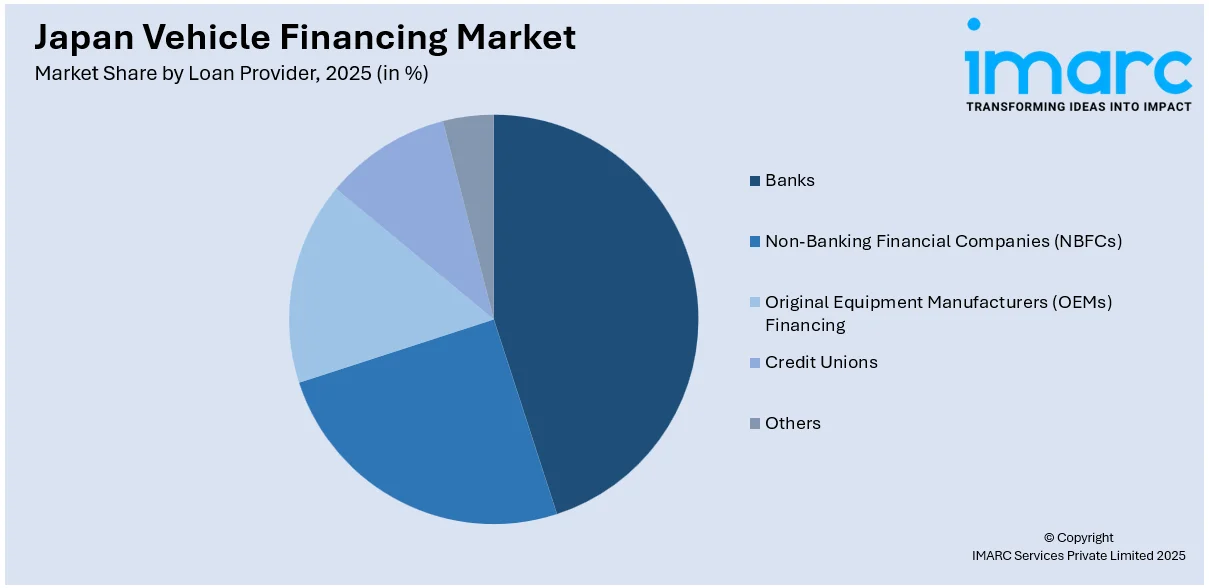

Loan Provider Insights:

Access the comprehensive market breakdown Request Sample

- Banks

- Non-Banking Financial Companies (NBFCs)

- Original Equipment Manufacturers (OEMs) Financing

- Credit Unions

- Others

The report has provided a detailed breakup and analysis of the market based on the loan provider. This includes banks, non-banking financial companies (NBFCs), original equipment manufacturers (OEMs) financing, credit unions, and others.

Vehicle Condition Insights:

- New Vehicles

- Used Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle condition. This includes new vehicles and used vehicles.

Purpose Type Insights:

- Loan

- Leasing

The report has provided a detailed breakup and analysis of the market based on the purpose type. This includes loan and leasing.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto, Kansai/Kinki, Central/ Chubu, Kyushu-Okinawa, Tohoku, Chugoku, Hokkaido, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Vehicle Financing Market News:

- In February 2025, Japanese trading house Itochu invested in a Thai automotive loan company to tap into the rising demand for used cars among Thailand’s growing middle class. As new car sales declined 26% in 2024 to a 15-year low, used vehicles have become a cost-effective alternative. Itochu, already active in Thailand's consumer finance sector, aims to strengthen its position in Southeast Asia through this strategic move.

- In February 2025, Malaysian used car platform Carsome expanded its auto loan and financing services through a strategic partnership with Japan's Jaccs, which will acquire a 49% stake in Carsome Capital for $23 million. The deal aims to enhance Carsome’s offerings for consumers and dealers by integrating Jaccs’ credit risk expertise.

- In June 2024, Citi launched its Commercial Bank (CCB) in Japan to support mid-sized companies with global growth ambitions. This move aligns with Citi’s strategy to expand CCB in key markets, offering tailored financial solutions like trade finance, liquidity management, and advisory services. This expansion builds on CCB’s presence in 11 other Asian markets and reinforces Citi’s commitment to Japan’s dynamic mid-market sector, particularly in technology and automotive innovation.

Japan Vehicle Financing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Electric Vehicles (EVs) |

| Loan Providers Covered | Banks, Non-Banking Financial Companies (NBFCs), Original Equipment Manufacturers (OEMs) Financing, Credit Unions, Others |

| Vehicle Conditions Covered | New Vehicles, Used Vehicles |

| Purpose Types Covered | Loan, Leasing |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan vehicle financing market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan vehicle financing market on the basis of vehicle type?

- What is the breakup of the Japan vehicle financing market on the basis of loan provider?

- What is the breakup of the Japan vehicle financing market on the basis of vehicle condition?

- What is the breakup of the Japan vehicle financing market on the basis of purpose type?

- What is the breakup of the Japan vehicle financing market on the basis of region?

- What are the various stages in the value chain of the Japan vehicle financing market?

- What are the key driving factors and challenges in the Japan vehicle financing market?

- What is the structure of the Japan vehicle financing market and who are the key players?

- What is the degree of competition in the Japan vehicle financing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan vehicle financing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan vehicle financing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan vehicle financing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)