Japan Vehicle Leasing Market Size, Share, Trends and Forecast by Type, Mode of Booking, and Region, 2026-2034

Japan Vehicle Leasing Market Overview:

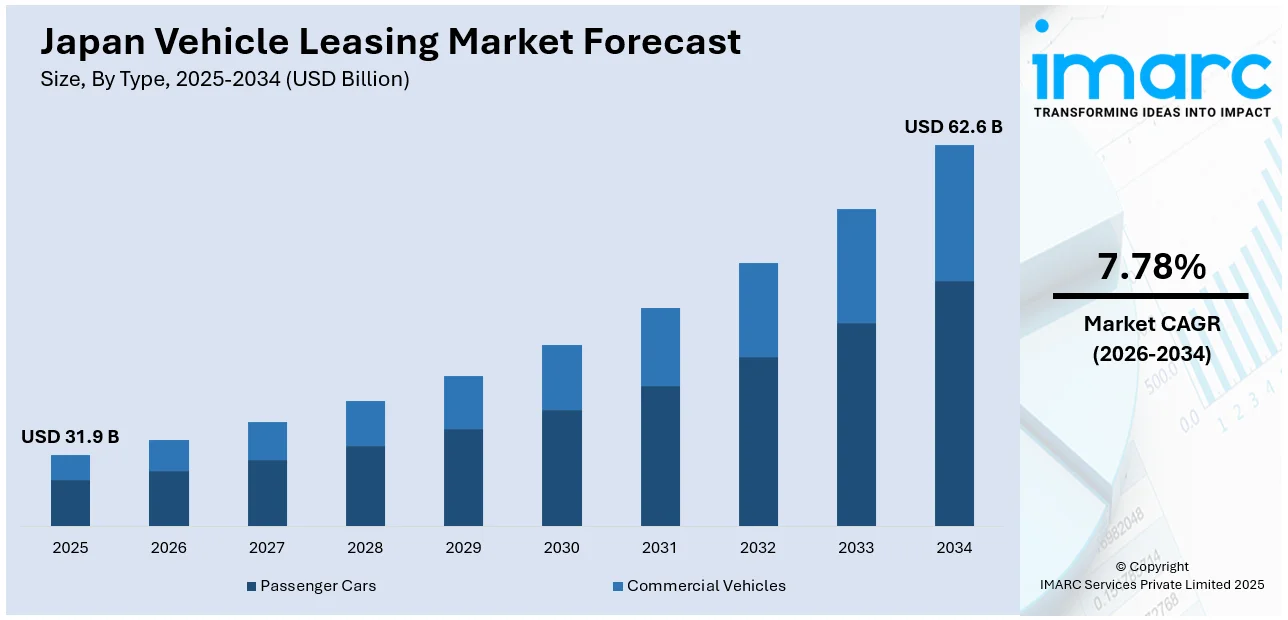

The Japan vehicle leasing market size reached USD 31.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 62.6 Billion by 2034, exhibiting a growth rate (CAGR) of 7.78% during 2026-2034. At present, numerous companies are providing customized electric vehicle (EV) leasing options that comprise maintenance, insurance, and battery performance assurances, enhancing their attractiveness. Besides this, rising tourism activities, which are leading people to choose economical and comfortable transportation solutions, are contributing to the expansion of the Japan vehicle leasing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 31.9 Billion |

| Market Forecast in 2034 | USD 62.6 Billion |

| Market Growth Rate 2026-2034 | 7.78% |

Japan Vehicle Leasing Market Trends:

Increasing usage of EVs

The market in Japan is now being positively impacted by the growing use of EVs. In Japan, more people and businesses are moving to electric vehicles (EVs) as environmental concerns get greater attention and government initiatives encourage greener mobility. The hefty initial cost of buying an EV, however, frequently serves as a deterrent. By lowering the cost and giving consumers access to the newest models without requiring a long-term commitment, leasing offers an alluring solution. Fleet electrification through leasing is helping businesses achieve their sustainability objectives and reduce maintenance expenses. Additionally, leasing enables consumers to keep up with the quick improvements in technology by upgrading to newer EV models more regularly. As charging infrastructure keeps growing, leasing trust in EV adoption is further increased. Many leasing firms in Japan are offering tailored EV leasing packages that include maintenance, insurance, and battery performance guarantees, making it more appealing. The leasing model also aligns well with Japan's urban population, where owning a personal vehicle is less convenient. As EV manufacturers are introducing more compact and efficient models suited for Japanese cities, leasing is becoming a popular option. Thus, the growth of EVs is directly contributing to the rising demand for flexible and sustainable vehicle leasing solutions in Japan. As per industry reports, Japan's EV market is set to grow to nearly USD 111.10 Billion by 2030, showing a compound annual growth rate (CAGR) of 15.58%.

To get more information on this market Request Sample

Rising tourism activities

Increasing tourism activities are fueling the Japan vehicle leasing market growth. Japan attracts millions of tourists each year with its unique blend of traditional culture, modern cities, and natural beauty. According to the Japan National Tourism Organization, a historic 36.9 Million foreign tourists visited Japan in 2024, representing a 47.1% rise compared to 2023. Many tourists prefer exploring the country at their own pace, especially in regions where public transportation is limited. Vehicle leasing offers a practical solution, allowing travelers to rent cars for short or extended periods without the responsibility of ownership. Tourism in rural areas and scenic routes like Hokkaido and Okinawa is driving the demand for leased vehicles, especially among families and groups. Leasing companies are responding by offering multilingual support, global positioning system (GPS)-equipped vehicles, and customized plans for tourists. With international travel rebounding, airport-based leasing services are experiencing higher activity. Tourists are also choosing eco-friendly options, which is further catalyzing leasing demand.

Japan Vehicle Leasing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and mode of booking.

Type Insights:

- Passenger Cars

- Commercial Vehicles

The report has provided a detailed breakup and analysis of the market based on the type. This includes passenger cars and commercial vehicles.

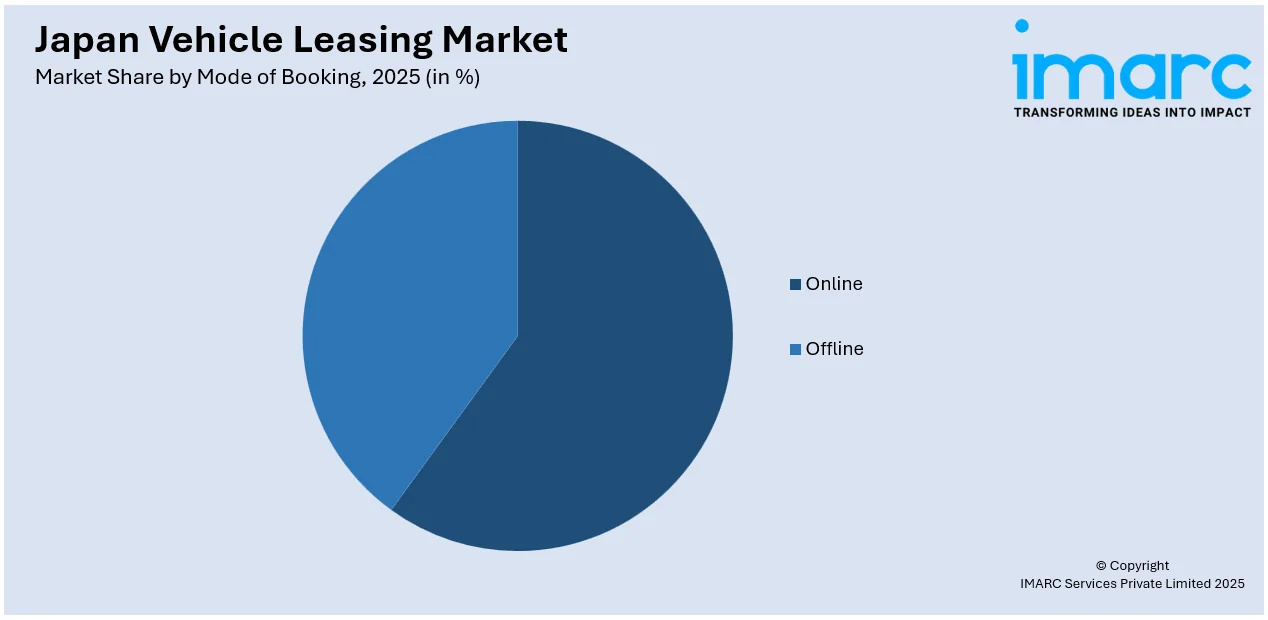

Mode of Booking Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

A detailed breakup and analysis of the market based on the mode of booking have also been provided in the report. This includes online and offline.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Vehicle Leasing Market News:

- In January 2025, Sumitomo Mitsui Auto Service (SMAS), Japan's top auto leasing firm, took a stake in the car-sharing service Tribecar to advance greener transportation. Collaborating with Tribecar allowed SMAS to acquire advanced car-sharing technologies and knowledge. This partnership aimed to hasten the creation of cutting-edge personal mobility solutions in the country.

- In July 2024, Honda announced that it was set to launch its new hydrogen-oriented plug-in hybrid vehicle (HV) in Japan, with a suggested retail price of ¥8,094,900 (USD 51,729). This model would not be sold and would only be available for lease. The firm intended to lease just 70 units of the CR-V e:FCEV in its domestic market during the initial year.

Japan Vehicle Leasing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Passenger Cars, Commercial Vehicles |

| Modes of Booking Covered | Online, Offline |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan vehicle leasing market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan vehicle leasing market on the basis of type?

- What is the breakup of the Japan vehicle leasing market on the basis of mode of booking?

- What is the breakup of the Japan vehicle leasing market on the basis of region?

- What are the various stages in the value chain of the Japan vehicle leasing market?

- What are the key driving factors and challenges in the Japan vehicle leasing market?

- What is the structure of the Japan vehicle leasing market and who are the key players?

- What is the degree of competition in the Japan vehicle leasing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan vehicle leasing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan vehicle leasing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan vehicle leasing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)