Japan Ventricular Assist Devices Market Size, Share, Trends and Forecast by Product, Flow Type, Design, Application, End User, and Region, 2026-2034

Japan Ventricular Assist Devices Market Summary:

The Japan ventricular assist devices market size was valued at USD 135.50 Million in 2025 and is projected to reach USD 285.77 Million by 2034, growing at a compound annual growth rate of 8.65% from 2026-2034.

Japan's rapidly aging population and escalating heart failure prevalence are fundamentally transforming the mechanical circulatory support landscape. The nation's demographic shift has positioned it among countries experiencing the most severe heart failure challenges globally, with approximately one million chronic heart failure patients currently under treatment. Continuous technological innovations in magnetic levitation systems and miniaturized device designs have dramatically improved patient outcomes while reducing complication rates, driving increased adoption across major cardiovascular centers. These converging factors position Japan's ventricular assist devices market share for sustained expansion as healthcare infrastructure adapts to meet the growing demand for advanced mechanical circulatory support.

Key Takeaways and Insights:

-

By Product: Left ventricular assist device (LVAD) dominates the market with a share of 62% in 2025, driven by superior clinical outcomes and widespread adoption of continuous-flow magnetic levitation systems.

-

By Flow Type: Non-pulsatile or continuous flow leads the market with a share of 78% in 2025, reflecting industry-wide transition toward third-generation centrifugal pumps.

-

By Design: Implantable ventricular assist devices represent the largest segment with a market share of 71% in 2025, supported by destination therapy approval and improved durability of fully magnetically levitated systems.

-

By Application: Bridge-to-transplant (BTT) therapy dominates the market with a share of 34% in 2025, addressing the critical organ shortage with waiting times extending six to eight years.

-

By End User: Hospital leads the market with a share of 81% in 2025, concentrating advanced mechanical circulatory support within specialized cardiovascular surgery centers.

-

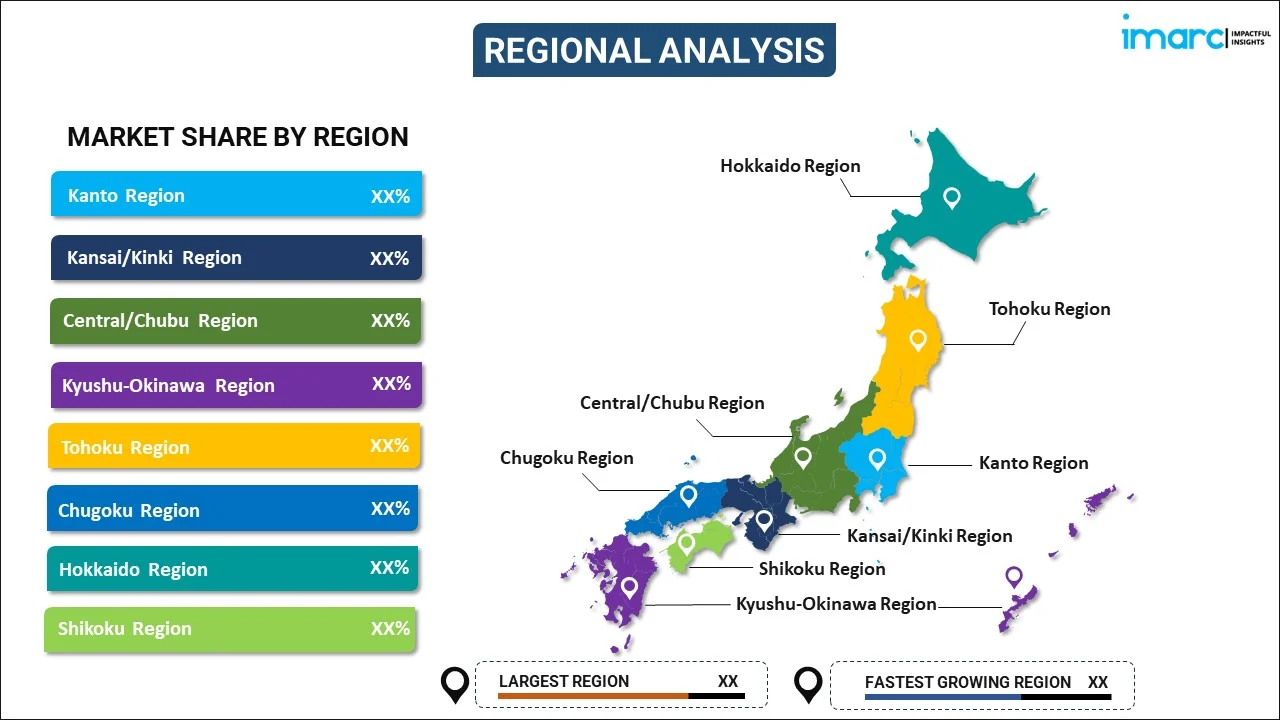

By Region: Kanto Region represents the largest segment with a market share of 34% in 2025, benefiting from dense concentration of certified heart transplant facilities and academic medical centers.

-

Key Players: The market exhibits moderate competitive intensity, with multinational medical technology corporations deploying continuous-flow LVAD systems featuring magnetic levitation technology alongside specialized Japanese manufacturers focused on domestic patient populations.

Japan confronts unprecedented demographic pressures as its super-aged society grapples with escalating heart failure burden. The nation's longevity achievements have paradoxically intensified cardiovascular disease challenges, with heart failure prevalence reaching between two and four percent among adults aged 65 and older. This epidemic has transformed ventricular assist devices from bridge-to-transplant solutions into essential destination therapy platforms, particularly following regulatory approval in 2021. In 2025, Helioverse Innovations launched fully wireless artificial heart build by a highly skilled technical team including Japan’s Murata Manufacturing. The convergence of demographic necessity, technological sophistication, and expanded therapeutic indications has established mechanical circulatory support as indispensable within Japan's cardiovascular care infrastructure, driving sustained market momentum. Moreover, A small artificial heart created using induced pluripotent stem (iPS) cells, anticipated to be a key display at the 2025 World Expo in Osaka. A team of researchers headed by Yoshiki Sawa, a specially appointed cardiovascular surgery professor at Osaka University, intends to showcase a pulsating "iPS heart" at the pavilion of temp staffing agency Pasona Group Inc.

Japan Ventricular Assist Devices Market Trends:

Miniaturization and Magnetic Levitation Technology Advancement

The evolution from axial-flow to centrifugal-flow pumps with full magnetic levitation represents the most significant technological leap in mechanical circulatory support. Third-generation devices eliminate mechanical bearings through complete magnetic suspension of rotating elements, drastically reducing shear stress and blood trauma. This technological shift has enabled miniaturization without compromising hemodynamic performance, facilitating less invasive implantation procedures and improved patient mobility. Manufacturers are concentrating research on wireless power transmission systems to eliminate driveline infections, which represent the most persistent complication in long-term VAD support. In 2024, Guided by UC Associate Professor in Mechanical Engineering Debbie Munro, a group of UC Biomedical Club students showcased their prototype of an Artificial Heart in Japan. The team also managing externally to ensure the ongoing success of the medical project.

Expansion of Destination Therapy and Minimally Invasive Implantation

The approval of destination therapy in Japan fundamentally altered treatment paradigms for patients with end-stage heart failure ineligible for transplantation. This regulatory milestone recognized the maturation of LVAD technology into durable, long-term support systems capable of serving as permanent cardiac replacement. Concurrent with destination therapy expansion, surgical teams have pioneered minimally invasive implantation techniques employing upper hemisternotomy combined with anterolateral thoracotomy approaches. These less traumatic procedures preserve pericardial integrity, reducing postoperative right ventricular dysfunction and accelerating patient recovery. The techniques particularly benefit elderly destination therapy recipients with multiple comorbidities who face elevated surgical risk from conventional full sternotomy. As facilities develop expertise in destination therapy management, the convergence of minimally invasive surgery and permanent mechanical support is reshaping long-term heart failure treatment, establishing mechanical circulatory support as viable alternative to transplantation for carefully selected patient populations. IMARC Group predicts that the Japan minimally invasive surgery market is projected to attain USD 4.5 Billion by 2033.

Integration of Remote Monitoring and Telemedicine Platforms

Digital health integration into mechanical circulatory support management represents a transformative trend enabling continuous patient surveillance and early complication detection. Modern VAD systems incorporate wireless communication capabilities allowing real-time transmission of pump parameters, power consumption, and alarm data to specialized monitoring centers. This connectivity facilitates prompt clinical response to device malfunctions or physiological deterioration, potentially preventing serious adverse events. Remote monitoring platforms enable comprehensive support for patients residing distant from implanting institutions, expanding treatment access beyond major metropolitan areas. In 2025, Monitor Corporation, a South Korean medical AI firm, started marketing its lung cancer diagnostic software in Japan via a collaboration with Doctor-NET, a Japanese digital health service provider. The AI-driven tool MONCAD CTLN helps radiologists identify lung cancer through chest CT scans. Doctor-NET, providing remote image analysis services to over 1,300 healthcare facilities, has secured manufacturing and sales certification for its software in Japan. The organization enables more than 3 million teleconsultations each year.

Market Outlook 2026-2034:

Japan's ventricular assist devices market trajectory through 2034 reflects the convergence of demographic imperatives and technological maturation. The market generated a revenue of USD 135.50 Million in 2025 and is projected to reach a revenue of USD 285.77 Million by 2034, growing at a compound annual growth rate of 8.65% from 2026-2034. This expansion stems primarily from the destination therapy segment's rapid development following regulatory approval, as healthcare institutions establish dedicated programs for permanent mechanical support. The aging population's continued growth ensures persistent heart failure patient volume increases, while improvements in device durability and complication management expand the eligible patient pool.

Japan Ventricular Assist Devices Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Left Ventricular Assist Device (LVAD) | 62% |

| Flow Type | Non-Pulsatile or Continuous Flow | 78% |

| Design | Implantable Ventricular Assist Devices | 71% |

| Application | (Bridge-to-Transplant (BTT) Therapy | 34% |

| End User | Hospital | 81% |

| Region | Kanto Region | 34% |

Product Insights:

To get more information on this market, Request Sample

- Left Ventricular Assist Device (LVAD)

- Right Ventricular Assist Device (RVAD)

- Biventricular Assist Device (BiVAD)

- Others

Left ventricular assist device (LVAD) dominates with a market share of 62% of the total Japan ventricular assist devices market in 2025.

Left ventricular assist devices (LVADs) offer meaningful benefits for patients with advanced heart failure when the heart can no longer pump enough blood on its own. By mechanically supporting the left ventricle, LVADs help restore blood flow to vital organs, easing symptoms like severe fatigue, breathlessness, and fluid buildup. Many patients report improved energy levels, better sleep, and the ability to return to daily activities that were previously difficult or impossible. LVADs are often used as a bridge to heart transplantation, helping patients survive and remain stable while waiting for a donor heart. In other cases, they serve as long-term therapy for people who are not eligible for transplant. This long-term support can extend survival and improve quality of life compared to medication alone.

Another key benefit lies in organ protection. By improving circulation, LVADs reduce strain on the kidneys, liver, and lungs, which are often affected in late-stage heart failure. Better organ function can also lower hospitalization rates and reduce emergency complications. Psychological benefits are also reported. Regaining independence and physical strength often boosts confidence and emotional well-being. While LVADs require careful monitoring and lifestyle adjustments, their ability to stabilize heart function and enhance daily living makes them a valuable option in advanced cardiac care.

Flow Type Insights:

- Pulsatile Flow

- Non-Pulsatile or Continuous Flow

Non-pulsatile or continuous flow leads with a share of 78% of the total Japan ventricular assist devices market in 2025.

Continuous-flow ventricular assist devices represent the current standard of care in mechanical circulatory support, having supplanted earlier pulsatile systems through superior durability, reduced device size, and improved patient outcomes. These devices employ rotary blood pumps, either axial or centrifugal design, to generate steady blood flow without pulsatile action. The continuous-flow paradigm enables dramatic device miniaturization while delivering adequate hemodynamic support, facilitating implantation through less invasive surgical approaches. Third-generation centrifugal-flow pumps with magnetic levitation technology have further advanced the field by eliminating mechanical bearing surfaces, reducing blood trauma and thrombogenic potential.

Clinical evidence consistently demonstrates continuous-flow devices' superiority in terms of durability, with contemporary systems exceeding five-year support capability in many patients. Continuous-flow devices also permit outpatient management and return to active lifestyles, critical considerations for destination therapy populations. The segment's dominance will persist as manufacturers refine existing platforms and develop next-generation systems with enhanced durability and reduced complication profiles. In 2024, according to government data, Japan's senior population has reached a historic peak of 36.25 million individuals, with nearly one-third of the Japanese being 65 years old or older. This is further driving the need for continuous-flow devices to maintain steady blood flow.

Design Insights:

- Implantable Ventricular Assist Devices

- Non-Implantable Ventricular Assist Devices

Implantable ventricular assist devices exhibit a clear dominance with a 71% share of the total Japan ventricular assist devices market in 2025.

Implantable ventricular assist devices represent the definitive mechanical circulatory support solution for patients requiring medium to long-term cardiac assistance. These systems feature intracorporeal pumps surgically positioned within or adjacent to the heart, with drivelines crossing the abdominal wall to connect with external controllers and power sources. The implantable design enables patient mobility and facilitates return to active daily living, essential considerations for bridge-to-transplant candidates awaiting organ availability and destination therapy recipients requiring permanent support. Contemporary implantable systems employ continuous-flow centrifugal pumps with magnetic levitation, achieving remarkable miniaturization without compromising hemodynamic performance.

In 2025, Medtronic Japan K.K. revealed that the Aurora EV-ICDTM MRI device and the Epsila EVTM MRI Lead, utilized for treating ventricular arrhythmias, have been successively introduced in Japan. The implantable cardioverter defibrillator (ICD) is a device placed in the body that automatically identifies sudden episodes of ventricular fibrillation or ventricular tachycardia and delivers electrotherapy to return the heart to its normal rhythm. The Aurora EV-ICD system is a groundbreaking technology that positions the ICD lead beneath the sternum, a procedure that has not been accomplished previously. This removes the requirement to insert leads within the blood vessels, rendering it a more minimally invasive implantable device than traditional transvenous ICDs.

Application Insights:

- Bridge-to-Transplant (BTT) Therapy

- Destination Therapy

- Bridge to Recovery and Bridge to Candidacy

Bridge-to-transplant (BTT) therapy leads with a share of 34% of the total Japan ventricular assist devices market in 2025.

Bridge-to-transplant (BTT) therapy represents the original and most established indication for ventricular assist device implantation, sustaining patients with end-stage heart failure awaiting cardiac transplantation. Japan faces particularly acute challenges in this domain, with heart transplant waiting times extending six to eight years due to limited donor availability and stringent organ allocation criteria. This prolonged bridge period necessitates durable mechanical support systems capable of multi-year operation while maintaining quality of life. Contemporary continuous-flow LVADs with magnetic levitation technology have transformed bridge-to-transplant outcomes, enabling extended support duration with acceptable complication profiles.

Japanese registry data indicates approximately 1,400 implantable VAD procedures performed as of December 2022, predominantly for bridge-to-transplant indications at 45 specialized institutions. However, the extended waiting period presents challenges, with approximately 24 percent of registered transplant candidates dying before receiving organs and some patients becoming ineligible for transplantation during prolonged support. The application segment demonstrates ongoing evolution as destination therapy expands, with increasing recognition that some bridge-to-transplant candidates will require lifelong mechanical support due to organ scarcity and evolving eligibility criteria.

End User Insights:

- Ambulatory Surgery Centers

- Hospital

- Others

Hospital exhibits a clear dominance with 81% share of the total Japan ventricular assist devices market in 2025.

Hospitals dominate ventricular assist device utilization due to the complex infrastructure, specialized expertise, and multidisciplinary support required for successful mechanical circulatory support programs. VAD implantation necessitates advanced cardiac surgery capabilities, extracorporeal circulation technology, intensive care resources, and comprehensive post-operative management protocols available only at major medical centers. Japan maintains 45 certified bridge-to-transplant VAD implant institutions and 19 approved destination therapy centers, concentrated primarily at academic medical centers and large community hospitals with established cardiac surgery programs. These facilities employ multidisciplinary teams including cardiac surgeons, heart failure cardiologists, perfusionists, specialized nurses, physical therapists, social workers, and palliative care specialists essential for comprehensive patient management.

Hospitals also maintain relationships with implanting device manufacturers for technical support, continuing education, and device troubleshooting. The concentration within hospital settings reflects not only technical requirements but also regulatory oversight mandating specific facility certifications for VAD implantation. Patient monitoring during the critical early post-implant period requires intensive care unit resources unavailable in outpatient settings. However, as patient stability improves, care increasingly transitions to outpatient management with regular clinic follow-up, though the hospital remains the hub for comprehensive VAD programs. In 2025, Fujita Health University Hospital has been designated as a "cardiology center" by the Ministry of Health, Labor and Welfare for the "Stroke, Heart Disease, etc. Comprehensive Support Center Model Project aimed at creating a complete support system for patients with cardiovascular diseases, with the broader goal for Aichi Prefecture of increasing healthy life expectancy by over three years and lowering age-adjusted mortality rates related to cardiovascular diseases by 2040.

Regional Insights:

To get detailed regional analysis of this market, Request Sample

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto Region leads with a share of 34% of the total Japan ventricular assist devices market in 2025.

The Kanto Region's market leadership stems from its dense concentration of advanced cardiac care infrastructure and specialized heart failure treatment centers. The region encompasses Japan's capital Tokyo along with Kanagawa, Saitama, Chiba, Gunma, Tochigi, and Ibaraki prefectures, forming the nation's most populous and economically developed area. Major academic medical centers within this region operate certified heart transplant programs and maintain comprehensive mechanical circulatory support capabilities. The University of Tokyo Hospital, Tokyo Women's Medical University, and National Cerebral and Cardiovascular Center represent leading institutions with extensive VAD experience and high annual implant volumes.

The region benefits from proximity to medical device manufacturers and distributors, facilitating access to latest-generation technology and technical support resources. Apart from this, urban concentration enables efficient patient referral networks connecting community hospitals with tertiary care centers for complex procedures. Moreover, the Kanto Region's dominance extends beyond sheer population size to reflect healthcare infrastructure sophistication and concentration of medical expertise essential for successful mechanical circulatory support programs. Patients in this area do not face the hassle of transferring to major metropolitan centers for VAD evaluation and implantation.

Market Dynamics:

Growth Drivers:

Why is the Japan Ventricular Assist Devices Market Growing?

Rapidly Aging Population and Heart Failure Epidemic

Japan confronts unprecedented demographic challenges as the world's most aged society, with 29.3% of the population exceeding 65 years old. This demographic transformation directly drives heart failure prevalence, as the condition disproportionately affects elderly populations with heart failure recorded as the second leading cause of death in the country. Current estimates suggest a large number of Japanese adults suffer from chronic heart failure. The aging population's expansion ensures persistent growth in advanced heart failure patient volumes requiring mechanical circulatory support. Japan's healthcare expenditure on cardiovascular treatment is exceeding annually, reflecting the massive resource commitment required to manage this growing patient population. The demographic imperative creates sustained demand for ventricular assist devices as essential therapeutic tools for managing end-stage heart failure across an expanding elderly population.

Technological Advancement in Continuous-Flow Magnetic Levitation Systems

Third-generation ventricular assist devices incorporating full magnetic levitation technology represent transformative innovations fundamentally altering mechanical circulatory support capabilities. These systems employ magnetic fields to completely suspend rotating pump elements without mechanical bearing contact, dramatically reducing shear stress, hemolysis, and thrombogenic potential. These technological refinements enable extended device durability supporting multi-year implantation with acceptable complication profiles. The miniaturization enabled by continuous-flow designs permits implantation through less invasive surgical approaches, reducing operative trauma and facilitating faster recovery. Japanese multicenter studies have confirmed excellent outcomes in domestic patient populations, demonstrating the technology's applicability across diverse demographic and physiologic characteristics. In 2025, Boston Scientific Corporation unveiled its COGNIS® cardiac resynchronization therapy defibrillator (CRT-D) and TELIGEN® implantable cardioverter defibrillator (ICD) in Japan. The Japanese Ministry of Health, Labor and Welfare (MHLW) approved these devices in August, and they got reimbursement approval in September. COGNIS and TELIGEN emerged from a multi-year research and development initiative aimed at offering physicians improved clinical choices for their patients.

Expansion of Destination Therapy and Regulatory Framework Evolution

The May 2021 approval of destination therapy for implantable ventricular assist devices in Japan represents a watershed regulatory development fundamentally expanding market potential. This milestone acknowledges mechanical circulatory support's evolution from bridge-to-transplant applications into permanent cardiac replacement technology for patients ineligible for heart transplantation. Destination therapy addresses critical unmet needs for elderly patients, those with multiple comorbidities, or individuals lacking suitable transplant candidacy due to other contraindications. The patient population potentially benefiting from destination therapy substantially exceeds bridge-to-transplant candidates, given limited organ availability and stringent transplant eligibility criteria. Destination therapy provides definitive treatment options for these populations previously lacking alternatives. The regulatory approval prompted establishment of certified destination therapy implant centers developing specialized expertise in permanent mechanical support management. Healthcare policy evolution to accommodate reimbursement for long-term device support reflects government recognition of mechanical circulatory support's essential role in comprehensive heart failure treatment.

Market Restraints:

What Challenges the Japan Ventricular Assist Devices Market is Facing?

High Device Costs and Healthcare Expenditure Pressures

Ventricular assist device systems represent extraordinarily expensive medical technologies, with implantation procedures and long-term management creating substantial healthcare expenditure burdens. Contemporary continuous-flow LVADs cost hundreds of thousands of dollars including the pump, external components, surgical implantation, hospitalization, and follow-up care. Japan's healthcare financing system faces mounting pressure from demographic transitions, with total annual health expenditure exceeding 40 trillion yen and continuing to rise. The government maintains strict reimbursement controls through biennial medical fee revisions, implementing downward pricing pressure on established technologies. Healthcare providers must demonstrate clear clinical value and cost-effectiveness to justify premium reimbursement for innovative devices. These financial constraints may limit facility expansion into mechanical circulatory support, restrict patient access in resource-limited settings, and create pressure for demonstration of cost-effectiveness relative to alternative heart failure management approaches.

Limited Specialized Healthcare Infrastructure and Caregiver Shortages

Japan maintains only 45 certified bridge-to-transplant VAD implant institutions and 19 approved destination therapy centers nationwide, concentrating advanced mechanical circulatory support within specialized facilities predominantly located in major metropolitan areas. This geographic distribution creates access barriers for patients in peripheral regions who must transfer to distant tertiary centers for evaluation and treatment. The limited facility network also restricts capacity to meet growing demand as destination therapy indications expand and aging populations increase heart failure prevalence. Healthcare workforce constraints compound infrastructure limitations, with specialized personnel including cardiac surgeons, heart failure cardiologists, and VAD-trained nurses in limited supply. The nation faces projected caregiver shortages of 570,000 by 2040, creating challenges for long-term VAD patient management requiring comprehensive support infrastructure. Family caregiver availability represents a critical consideration in Japan's cultural context, where traditional multi-generational households have declined substantially.

Complex Anticoagulation Management and Device-Related Complications

Despite substantial technological improvements, ventricular assist devices continue carrying significant complication risks requiring intensive management throughout support duration. Anticoagulation therapy balancing thromboembolism prevention against bleeding risk represents persistent challenges, with delicate therapeutic windows necessitating frequent monitoring and adjustment. Although third-generation magnetic levitation devices demonstrate reduced thrombogenic potential, all mechanical circulatory support systems maintain some thromboembolism risk. Right ventricular failure following LVAD implantation complicates procedures, potentially necessitating biventricular support with attendant mortality risk. These complications require comprehensive management protocols, specialized nursing expertise, and patient education systems. The ongoing complication burden, while substantially reduced compared to earlier device generations, continues representing a significant restraint limiting broader mechanical circulatory support adoption.

Competitive Landscape:

The Japan ventricular assist devices market demonstrates moderate competitive intensity characterized by multinational medical technology corporations deploying advanced continuous-flow systems alongside specialized domestic manufacturers focused on regional patient populations. Market participants pursue strategies emphasizing clinical evidence generation through registry studies and real-world data analysis to support reimbursement negotiations and physician adoption. Manufacturers invest heavily in physician training programs, establishing centers of excellence partnerships with leading institutions, and developing comprehensive patient support services differentiating product offerings beyond device specifications. The regulatory environment requiring facility certification for VAD implantation creates barriers to entry while favoring established manufacturers with extensive clinical support infrastructure and proven safety profiles.

Recent Developments:

-

In May 2025, iVascular and Hirata from Medico recently revealed that Japan’s Ministry of Health, Labour, and Welfare has granted regulatory approval for the Vascular Luminor drug-coated balloon (DCB). iVascular is located in Barcelona, Spain, while Medico’s Hirata is a medical firm from Japan that focuses on distributing innovative health care solutions. iVascular announced that it has created a Luminor device tailored for Japan—the rapid-exchange Luminor 18 RX DCB. The firm indicated that this customized method aims to provide a solution specifically designed for the clinical practices of Japanese health care professionals.

Japan Ventricular Assist Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Left Ventricular Assist Device (LVAD), Right Ventricular Assist Device (RVAD), Biventricular Assist Device (BiVAD), Others |

| Flow Types Covered | Pulsatile Flow, Non-Pulsatile or Continuous Flow |

| Designs Covered | Implantable Ventricular Assist Devices, Non-Implantable Ventricular Assist Devices |

| Applications Covered | Bridge-to-Transplant (BTT) Therapy, Destination Therapy, Bridge to Recovery and Bridge to Candidacy |

| End Users Covered | Ambulatory Surgery Centers, Hospital, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The ventricular assist devices market in Japan was valued at USD 135.5 Million in 2025.

The Japan ventricular assist devices market is expected to grow at a compound annual growth rate of 8.65% from 2026-2034 to reach USD 285.77 Million by 2034.

Left ventricular assist device (LVAD) dominates the product segment with 62% market share, driven by superior clinical outcomes with continuous-flow magnetic levitation systems and broad applicability across bridge-to-transplant and destination therapy indications. The segment benefits from extensive clinical evidence demonstrating excellent survival rates and reduced complication profiles with third-generation devices.

Key factors driving the Japan ventricular assist devices market include Japan's rapidly aging population with escalating heart failure prevalence approaching one million patients, technological advancements in continuous-flow magnetic levitation systems demonstrating superior safety and durability profiles, and destination therapy regulatory approval in May 2021 expanding treatment access beyond transplant candidates to permanent mechanical support applications.

Major challenges include high device costs exceeding several hundred thousand dollars per implantation with ongoing management expenses straining healthcare budgets under demographic pressure, limited specialized infrastructure with limited implant facilities creating geographic access barriers, caregiver shortages complicating long-term patient management, and persistent device-related complications including thromboembolism, driveline infections, and gastrointestinal bleeding requiring intensive surveillance and intervention despite technological improvements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)