Japan Veterinary Medicine Market Size, Share, Trends and Forecast by Product, Animal Type, Route of Administration, Distribution Channel, and Region, 2026-2034

Japan Veterinary Medicine Market Overview:

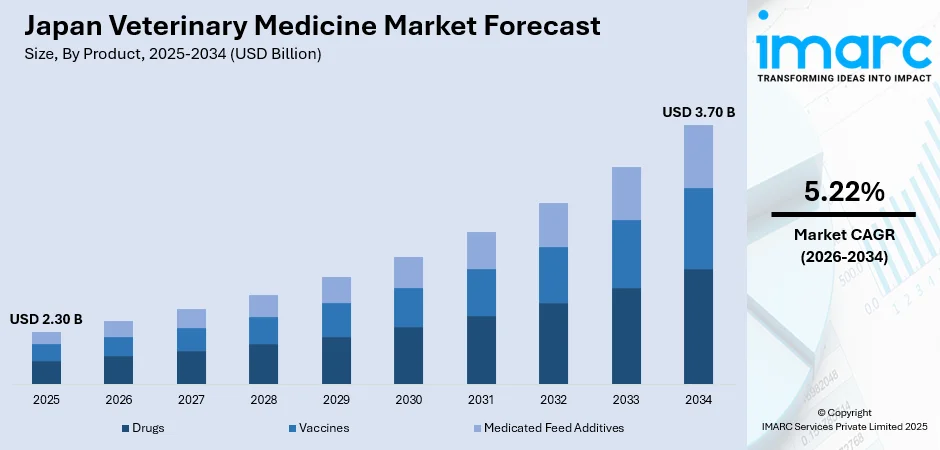

The Japan veterinary medicine market size reached USD 2.30 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 3.70 Billion by 2034, exhibiting a growth rate (CAGR) of 5.22% during 2026-2034. The rising pet ownership, growing awareness of animal health, increasing demand for companion animal care, expansion of veterinary clinics, government support for livestock disease control, and advancements in pharmaceutical formulations are some of the key factors driving the veterinary medicine market in Japan.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.30 Billion |

| Market Forecast in 2034 | USD 3.70 Billion |

| Market Growth Rate 2026-2034 | 5.22% |

Japan Veterinary Medicine Market Trends:

Growth in Companion Animal Ownership and Expenditure

Japan is witnessing a steady shift toward pet humanization, with households increasingly adopting companion animals and treating them as family members. According to industry reports, approximately 21% of respondents in Japan reported owning pets, with cats and dogs making up 28.1% of the total pet population in 2023. This highlights the strong presence of companion animals in Japanese households and their significant role in propelling the Japan veterinary medicine market growth. The high proportion of cats and dogs underscores a sustained demand for species-specific pharmaceutical products and veterinary services. In urban regions, the rise of single-person households and the growing elderly population are key factors driving the demand for companion animals. Pets offer emotional support and companionship, especially in densely populated cities where social isolation is more prevalent. This demographic trend is contributing to higher veterinary visits per animal and a notable rise in preventative treatments such as vaccinations, parasite control, and dental care. Pharmaceutical companies are responding by expanding their portfolio of canine and feline medications, which now include therapies for dermatological issues, gastrointestinal conditions, and cardiac care.

To get more information on this market Request Sample

Expansion of Veterinary Clinical Infrastructure and Technology

The veterinary services landscape in Japan is evolving through the modernization of clinical infrastructure and the integration of digital technologies. Veterinary clinics are increasingly adopting diagnostic imaging tools, electronic medical records, and advanced surgical equipment to enhance the accuracy and scope of animal healthcare, which is positively impacting Japan veterinary medicine market outlook. This trend is particularly visible in larger urban centers where multi-veterinarian practices and specialty hospitals are becoming more common. In addition to this, increasing investment in digital health platforms, including telemedicine for pets, is also gaining traction. This enables remote consultations and post-treatment monitoring, which is particularly important for aging pet owners or rural communities with limited access to in-person veterinary services. Additionally, diagnostic laboratories are expanding their offerings to include genetic testing, antimicrobial resistance screening, and early disease detection panels, which are now being used more regularly in small animal practices. This infrastructural development supports a broader pharmaceutical product range and higher compliance with prescribed treatments.

Focus on Livestock Disease Management and Biosecurity

Japan places strong regulatory emphasis on livestock disease control and biosecurity, driven by its high dependence on domestic animal products and a need to prevent outbreaks such as swine fever and avian influenza. Moreover, government policies and funding initiatives continue to support the nationwide implementation of disease surveillance systems, vaccination programs, and emergency response protocols. The Ministry of Agriculture, Forestry, and Fisheries (MAFF) actively collaborates with regional veterinary services and pharmaceutical companies to ensure a consistent supply of veterinary biologicals and therapeutics. Additionally, there is growing attention to antimicrobial stewardship in livestock. This is driving the adoption of precision medicine approaches, where drug administration is tailored to pathogen-specific data. As the sector moves toward sustainability and international compliance standards, veterinary pharmaceutical companies are developing alternatives to conventional antibiotics, which is further augmenting Japan veterinary medicine market share.

Japan Veterinary Medicine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product, animal type, route of administration, and distribution channel.

Product Insights:

- Drugs

- Anti-infective

- Anti-inflammatory

- Parasiticide

- Vaccines

- Inactivated Vaccines

- Attenuated Vaccines

- Recombinant Vaccines

- Medicated Feed Additives

- Amino Acids

- Antibiotics

The report has provided a detailed breakup and analysis of the market based on the product. This includes drugs (anti-infective, anti-inflammatory, and parasiticide), vaccines (inactivated vaccines, attenuated vaccines, and recombinant vaccines), and medicated feed additives (amino acids and antibiotics).

Animal Type Insights:

- Production

- Companion

A detailed breakup and analysis of the market based on the animal type have also been provided in the report. This includes production and companion.

Route of Administration Insights:

- Oral

- Parenteral

- Topical

The report has provided a detailed breakup and analysis of the market based on the route of administration. This includes oral, parenteral, and topical.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Veterinary Hospitals and Clinics

- Point-of-Care Testing/In-house Testing

- Others

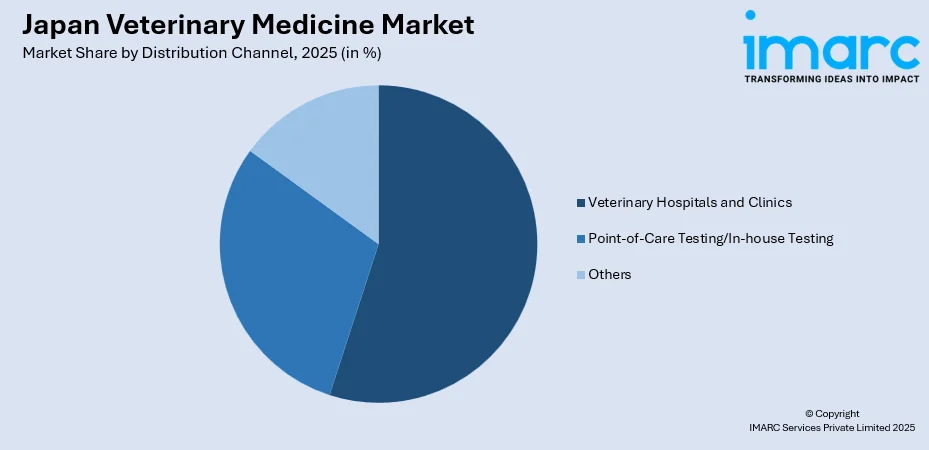

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes veterinary hospitals and clinics, point-of-care testing/in-house testing, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Veterinary Medicine Market News:

- On May 22, 2024, Zpeer Inc., a Tokyo-based veterinary technology company, announced it had secured JPY 550 Million (about USD 3.57 Million) in funding through a third-party allocation of new shares to investors, including Nissay Capital, T&D Innovation Fund, and Animal Spirits Ltd. This investment will be used to enhance its digital platforms, Vetpeer and Animato, serving over 13,000 veterinarians and 8,000 animal clinics across Japan. The capital will support platform development, innovative product and service creation, and organizational growth aimed at advancing digital transformation in veterinary medicine.

- On May 23, 2024, EXORPHIA Inc. announced a strategic partnership with Kyoritsu Holdings and Kyoritsu Seiyaku to develop exosome-based therapeutics for pets. This collaboration aims to address conditions with high unmet medical needs, such as chronic kidney disease, heart disease, enteritis, and dermatitis, by combining EXORPHIA's proprietary exosome drug discovery platform with Kyoritsu Seiyaku's expertise in veterinary medicine. Under the agreement, Kyoritsu Seiyaku will hold exclusive distribution rights for these therapies in Japan, while EXORPHIA plans to leverage the insights gained for future human therapeutic applications.

Japan Veterinary Medicine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Animal Types Covered | Production, Companion |

| Route of Administrations Covered | Oral, Parenteral, Topical |

| Distribution Channels Covered | Veterinary Hospitals and Clinics, Point-of-Care Testing/In-house Testing, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan veterinary medicine market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan veterinary medicine market on the basis of product?

- What is the breakup of the Japan veterinary medicine market on the basis of animal type?

- What is the breakup of the Japan veterinary medicine market on the basis of route of administration?

- What is the breakup of the Japan veterinary medicine market on the basis of distribution channel?

- What is the breakup of the Japan veterinary medicine market on the basis of region?

- What are the various stages in the value chain of the Japan veterinary medicine market?

- What are the key driving factors and challenges in the Japan veterinary medicine market?

- What is the structure of the Japan veterinary medicine market and who are the key players?

- What is the degree of competition in the Japan veterinary medicine market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan veterinary medicine market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan veterinary medicine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan veterinary medicine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)