Japan Wallpaper Market Size, Share, Trends and Forecast by Wallpaper Type, Distribution Channel, End User, and Region, 2026-2034

Japan Wallpaper Market Summary:

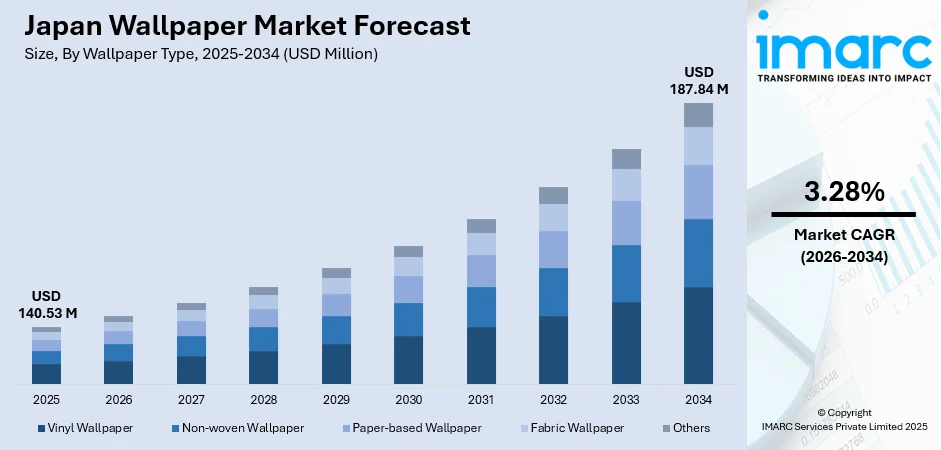

The Japan wallpaper market size was valued at USD 140.53 Million in 2025 and is projected to reach USD 187.84 Million by 2034, growing at a compound annual growth rate of 3.28% from 2026-2034.

The Japan wallpaper market is experiencing steady expansion driven by increasing demand for aesthetic interior solutions across residential and commercial sectors. The country's deep-rooted appreciation for design excellence, combined with growing urbanization and rising renovation activities, continues to propel market growth. Technological innovations in printing techniques, eco-friendly material preferences, and the fusion of traditional Japanese aesthetics with modern designs are reshaping consumer choices and strengthening the Japan wallpaper market share.

Key Takeaways and Insights:

-

By Wallpaper Type: Vinyl wallpaper dominates the market with a share of 36.95% in 2025, driven by its superior durability, moisture resistance, and cost-effective maintenance requirements for commercial applications.

-

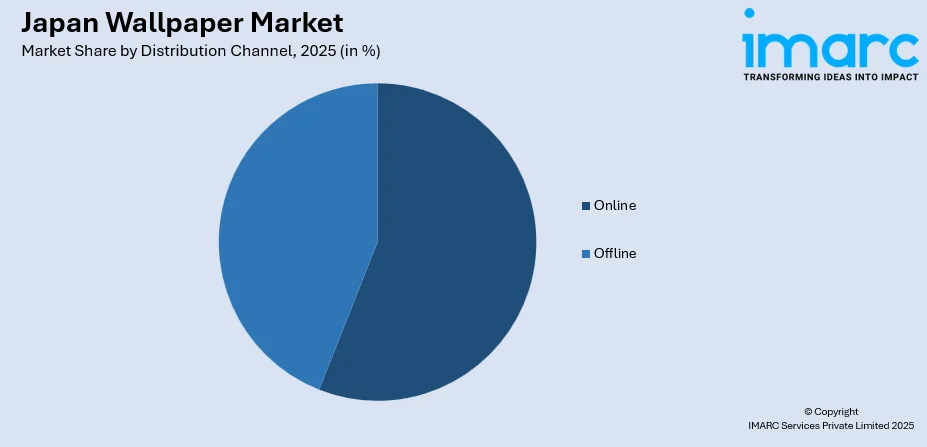

By Distribution Channel: Offline leads the market with a share of 55.99% in 2025, supported by tactile product evaluation preferences, personalized consultation services, and established retailer networks.

-

By End User: Commercial represents the largest segment with a market share of 54.12% in 2025, propelled by expanding hospitality construction, office renovation projects, and retail space development.

-

Key Players: The Japan wallpaper market exhibits a moderately competitive landscape with established domestic manufacturers maintaining strong market positions through extensive product portfolios, design innovation capabilities, nationwide distribution networks, and strategic partnerships with interior design professionals.

To get more information on this market Request Sample

The Japan wallpaper market continues to evolve as manufacturers increasingly integrate traditional craftsmanship with contemporary design sensibilities to meet diverse consumer preferences. The country's thriving hospitality sector, with multiple luxury hotel projects underway, creates sustained demand for premium wallcovering solutions. For instance, the Takanawa Gateway Urban Development project in Tokyo, featuring a JW Marriott Hotel opened in October 2025, exemplifies the ongoing commercial construction boom driving wallpaper demand. Environmental consciousness among Japanese consumers is accelerating adoption of eco-friendly wallpapers made from natural fibers, recycled content, and low-VOC inks, aligning with broader sustainability trends in interior design.

Japan Wallpaper Market Trends:

Fusion of Traditional Japanese Aesthetics with Contemporary Designs

Japanese consumers increasingly embrace wallpapers that blend traditional motifs such as cherry blossoms, bamboo patterns, and washi textures with modern interior concepts. This trend resonates particularly with young professionals seeking to personalize compact urban living spaces. Interior manufacturers have responded by launching collections featuring reimagined heritage designs that honor cultural craftsmanship while incorporating contemporary color palettes and innovative materials. The harmonious balance between minimalist Japanese philosophy and modern functionality continues driving consumer preference toward these hybrid design solutions, supporting the Japan wallpaper market growth.

Rising Demand for Functional and Eco-Friendly Wallpapers

Consumer preferences are shifting toward wallpapers offering enhanced functionality including antibacterial coatings, moisture resistance, odor-absorbing properties, and humidity regulation capabilities suited to Japan's climate conditions. Simultaneously, environmental awareness is driving demand for wallpapers composed of sustainable materials, recycled content, and non-toxic inks. Japanese manufacturers are expanding eco-friendly product portfolios featuring natural fibers, biodegradable substrates, and low-VOC printing processes aligned with broader sustainability trends. This dual emphasis on practical performance and environmental responsibility reflects evolving consumer values prioritizing both interior comfort and ecological consciousness in purchasing decisions.

Digital Printing Technology and Customization Innovation

Advanced digital printing technologies are transforming Japan's wallpaper industry by enabling highly customizable designs, on-demand production, and photorealistic imagery capabilities. Urban residents in metropolitan areas like Tokyo, Osaka, and Yokohama increasingly seek personalized wallpaper solutions incorporating family photographs, abstract art, or bespoke patterns. Retailers are also integrating virtual and augmented reality applications allowing consumers to visualize wallpaper selections within their actual living spaces before purchase, enhancing the customer experience and driving conversion rates.

Market Outlook 2026-2034:

The Japan wallpaper market outlook remains positive as ongoing urbanization, expanding commercial construction, and renovation activities sustain demand growth through the forecast period. The hospitality sector's recovery and expansion, with numerous luxury hotel projects underway across major metropolitan areas, creates substantial opportunities for premium wallcovering suppliers. Rising consumer interest in interior personalization and aesthetic enhancement continues driving residential segment growth, while corporate office modernization programs generate consistent commercial demand. Technological advancements enabling greater design customization and functional performance improvements further strengthen market prospects. Additionally, the growing emphasis on sustainable interior solutions positions eco-friendly wallpaper manufacturers favorably as environmental consciousness influences purchasing decisions across both commercial and residential end-user segments. The market generated a revenue of USD 140.53 Million in 2025 and is projected to reach a revenue of USD 187.84 Million by 2034, growing at a compound annual growth rate of 3.28% from 2026-2034.

Japan Wallpaper Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Wallpaper Type |

Vinyl Wallpaper |

36.95% |

|

Distribution Channel |

Offline |

55.99% |

|

End User |

Commercial |

54.12% |

Wallpaper Type Insights:

- Vinyl Wallpaper

- Non-woven Wallpaper

- Paper-based Wallpaper

- Fabric Wallpaper

- Others

Vinyl wallpaper dominates with a market share of 36.95% of the total Japan wallpaper market in 2025.

Vinyl wallpaper maintains market leadership in Japan owing to its exceptional durability, moisture resistance, and straightforward maintenance characteristics that make it particularly suitable for high-traffic commercial environments and residential applications alike. The material's fire-resistant properties enhance its appeal for installation in offices, hotels, restaurants, and healthcare facilities where safety compliance is paramount. Japanese manufacturers continue to expand vinyl wallpaper portfolios with innovative designs ranging from realistic wood and stone textures to contemporary geometric patterns.

The convenience of vinyl wallpaper installation and removal processes, combined with its cost-effectiveness relative to alternative materials, drives sustained consumer preference across market segments. Additionally, vinyl wallpaper's compatibility with advanced digital printing technologies enables manufacturers to offer extensive customization options meeting diverse design requirements. Industry data indicates that vinyl wallpaper consumption in Japan remains robust, supported by the product's ability to deliver aesthetic versatility without compromising functional performance in humid climate conditions.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

Offline leads with a share of 55.99% of the total Japan wallpaper market in 2025.

Offline distribution channels maintain dominance in Japan's wallpaper market as consumers prefer tactile product evaluation before purchase, particularly for premium and specialty wallcoverings where texture, color accuracy, and material quality require physical assessment. Specialty interior stores, home improvement centers, and dedicated wallpaper showrooms provide personalized consultation services that facilitate informed purchasing decisions. The presence of trained staff offering installation guidance and design recommendations enhances the offline shopping experience significantly.

Traditional distribution networks benefit from established relationships between manufacturers, wholesalers, and professional interior designers who influence commercial and residential specification decisions. Showrooms operated by major manufacturers enable comprehensive product displays showcasing extensive wallpaper collections across various price points and style categories. While online channels are gaining traction, particularly among younger demographics seeking convenience and price comparison capabilities, the offline segment's emphasis on service quality and product authenticity continues sustaining its market leadership position.

End User Insights:

- Residential

- Commercial

Commercial holds the largest share with 54.12% of the total Japan wallpaper market in 2025.

The commercial segment drives Japan's wallpaper market as businesses across hospitality, retail, and corporate sectors increasingly recognize wallcoverings as essential elements in creating distinctive brand environments and enhancing customer experiences. Hotels represent a particularly significant demand source, with Japan's tourism recovery and multiple luxury hotel development projects creating substantial wallpaper specification opportunities. The Janu Tokyo, which opened in March 2024 featuring 122 rooms and suites within the Azabudai Hills development, exemplifies the hospitality sector's commitment to premium interior finishes.

Office renovation activities and retail space modernization programs continue generating consistent commercial wallpaper demand throughout Japan's major metropolitan areas. Commercial end users typically specify wallpapers meeting enhanced durability, fire resistance, and maintenance requirements, driving preference toward vinyl and non-woven products. The growing emphasis on workplace aesthetics and employee wellbeing has elevated wallpaper's role in creating productive, visually appealing office environments that reflect corporate identity and values.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region dominates Japan's wallpaper market, driven by Tokyo's concentrated commercial construction activity, luxury hotel developments, and high-density residential renovation demand. Major projects including the Takanawa Gateway Urban Development and numerous hospitality investments generate substantial wallcovering specification opportunities across premium segments.

The Kansai/Kinki Region represents a significant market driven by Osaka's commercial expansion and Kyoto's hospitality sector investments catering to cultural tourism. The Imperial Hotel Kyoto development exemplifies regional demand for premium interior finishes, while urban renovation activities sustain consistent wallpaper consumption.

The Central/Chubu Region benefits from Nagoya's manufacturing industry headquarters presence and corporate office development driving commercial wallpaper demand. Home to leading interior companies including Sangetsu Corporation, the region maintains strong distribution infrastructure supporting both commercial and residential market segments.

The Kyushu-Okinawa Region experiences growing wallpaper demand from tourism-related hospitality construction and resort development projects. Fukuoka's urban expansion and Okinawa's resort industry investments create opportunities for premium wallcoverings, while residential renovation activities support steady market growth across the region.

The Tohoku Region contributes to Japan's wallpaper market through residential renovation projects and regional commercial development initiatives. Post-reconstruction activities and tourism infrastructure investments in cities like Sendai drive demand for durable, functional wallcoverings suited to the region's climate conditions.

The Chugoku Region maintains steady wallpaper demand through commercial development in Hiroshima and regional urban centers. Tourism infrastructure serving historical and cultural destinations generates hospitality sector requirements, while residential modernization projects support consistent consumption of both vinyl and decorative wallpapers.

The Hokkaido Region presents wallpaper market opportunities through Sapporo's commercial construction and tourism-driven hospitality development. The region's distinct climate creates demand for functional wallpapers offering moisture resistance and insulation properties, while ski resort and hotel renovations sustain premium product requirements.

The Shikoku Region contributes to Japan's wallpaper market through residential renovation activities and regional commercial developments. Tourism infrastructure serving pilgrimage routes and cultural heritage sites generates hospitality demand, while urban centers like Takamatsu and Matsuyama support steady commercial wallcovering consumption.

Market Dynamics:

Growth Drivers:

Why is the Japan Wallpaper Market Growing?

Expanding Hospitality and Commercial Construction Sector

Japan's hospitality industry expansion significantly propels wallpaper market growth as numerous hotel development and renovation projects create sustained demand for premium wallcovering solutions. The country's tourism recovery trajectory and preparations for increasing international visitor arrivals drive investment in accommodation facilities requiring sophisticated interior finishes. Luxury hotel developments across major metropolitan areas prioritize distinctive interior environments utilizing high-quality wallpapers, directly benefiting market participants. Commercial spaces including retail establishments, restaurants, and corporate offices further contribute to demand as businesses recognize wallcoverings as essential elements in creating memorable brand experiences and enhancing customer perceptions. This sustained construction activity ensures consistent specification opportunities for wallpaper manufacturers and suppliers.

Residential Renovation and Home Improvement Activities

Growing emphasis on home aesthetics and living environment personalization drives residential wallpaper demand as Japanese consumers increasingly invest in interior upgrades. Urbanization trends creating compact living spaces motivate homeowners to maximize design impact through creative wall treatments rather than furniture arrangements. Japan's robust construction industry reflects sustained renovation activity including residential remodeling programs across urban and suburban areas. The rising influence of interior design content on social media platforms further stimulates consumer interest in transforming living spaces through wallpaper applications. This cultural shift toward home-centric lifestyles continues elevating wallpaper's role as an accessible yet impactful interior enhancement solution.

Technological Innovation in Wallpaper Materials and Manufacturing

Continuous technological advancement in wallpaper production enhances product functionality, design versatility, and installation convenience, expanding market appeal across consumer segments. Innovations include functional wallpapers featuring antibacterial properties, deodorizing capabilities, and humidity regulation suited to Japan's climate conditions. Leading manufacturers offer extensive product ranges including self-adhesive decorative films facilitating renovation projects without professional installation requirements. Digital printing technology advancements enable cost-effective customization, photorealistic imaging, and rapid design iteration responding to evolving consumer preferences. These technological improvements lower barriers to adoption while simultaneously elevating product performance standards, strengthening wallpaper's competitive position against alternative wall covering solutions.

Market Restraints:

What Challenges the Japan Wallpaper Market is Facing?

Competition from Alternative Wall Covering Solutions

Interior paint products, decorative wall panels, and other alternative wall treatment options present ongoing competitive pressure within Japan's interior decoration market. Consumer perception of paint as a simpler, more cost-effective solution for basic applications limits wallpaper penetration in certain residential segments requiring straightforward aesthetic improvements.

Installation Complexity and Professional Dependency

Traditional wallpaper installation typically requires professional expertise, creating additional costs and scheduling dependencies that may deter some consumers. While self-adhesive and peel-and-stick products address DIY demand, premium wallpapers often necessitate skilled installers for optimal results, limiting spontaneous purchase decisions and adding project complexity.

Raw Material Price Volatility and Supply Chain Pressures

Fluctuations in raw material costs including vinyl resins, specialty papers, and fabric substrates impact manufacturer margins and potentially consumer pricing. Supply chain disruptions affecting imported materials create operational challenges, while increasing environmental regulations necessitate investment in sustainable production processes potentially elevating manufacturing costs.

Competitive Landscape:

The Japan wallpaper market features a moderately consolidated competitive landscape characterized by established domestic manufacturers maintaining strong positions through comprehensive product portfolios, extensive distribution networks, and long-standing relationships with interior design professionals. Leading companies compete through design innovation, functional product differentiation, and service excellence including design consultation and installation support. Strategic initiatives encompass product portfolio expansion addressing diverse aesthetic preferences, sustainability-focused development utilizing eco-friendly materials, and technology investments enabling customization capabilities. International partnerships and licensing agreements provide access to global design trends while maintaining domestic manufacturing presence.

Japan Wallpaper Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Wallpaper Types Covered | Vinyl Wallpaper, Non-woven Wallpaper, Paper-based Wallpaper, Fabric Wallpaper, Others |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Residential, Commercial |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan wallpaper market size was valued at USD 140.53 Million in 2025.

The Japan wallpaper market is expected to grow at a compound annual growth rate of 3.28% from 2026-2034 to reach USD 187.84 Million by 2034.

Vinyl wallpaper, holding the largest revenue share of 36.95%, remains essential for Japan's wallpaper market owing to its superior durability, moisture resistance, fire-resistant properties, and versatile design capabilities suitable for commercial and residential applications.

Key factors driving the Japan wallpaper market include expanding hospitality and commercial construction activities, rising residential renovation demand, technological innovations in wallpaper materials, growing preference for eco-friendly products, and increasing consumer interest in interior personalization.

Major challenges include competition from alternative wall covering solutions like paint and panels, professional installation requirements adding costs and complexity, raw material price volatility affecting margins, and supply chain pressures impacting production efficiency.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)