Japan Warehouse Market Size, Share, Trends and Forecast by Sector, Ownership, Type of Commodities Stored, and Region, 2026-2034

Japan Warehouse Market Overview:

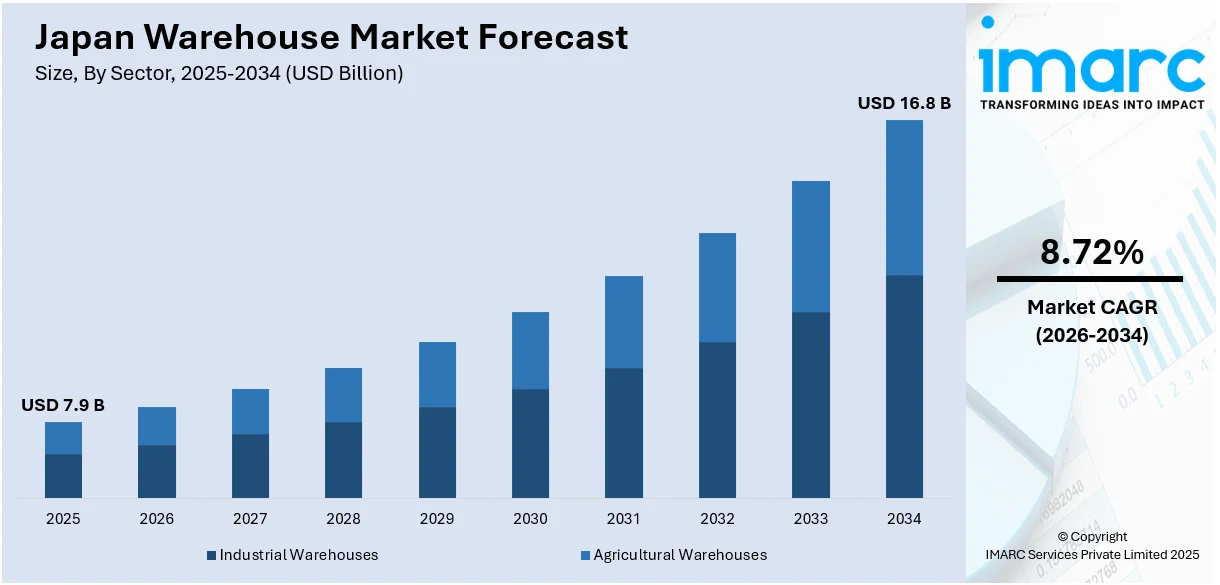

The Japan warehouse market size reached USD 7.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 16.8 Billion by 2034, exhibiting a growth rate (CAGR) of 8.72% during 2026-2034. The expanding e-commerce sector, rising demand for last-mile delivery, increasing automation and smart warehousing technologies, growing third-party logistics (3PL) adoption, expansion of cold storage facilities, supportive government policies, and the rising imports and exports are some of the key factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 7.9 Billion |

| Market Forecast in 2034 | USD 16.8 Billion |

| Market Growth Rate 2026-2034 | 8.72% |

Japan Warehouse Market Trends:

Surge in E-Commerce Driving Warehouse Demand

Japan’s booming e-commerce sector is driving robust expansion in its warehouse infrastructure to meet surging online shopping demand and consumer expectations for faster deliveries. The Japanese logistics market was valued at USD 337 billion in 2024 and is expected to reach USD 549 billion by 2033, with a compound annual growth rate (CAGR) of 5.6% from 2025 to 2033. This growth has spurred a wave of logistics facility construction. These developments aim to streamline order fulfillment processes and enhance last-mile delivery efficiency. However, the sector faces mounting labor shortages, exacerbated by new regulations introduced in April 2024 that limit overtime for truck drivers to reduce overwork and related accidents. While necessary, these rules have intensified competition for labor in the logistics sector. In response, companies are increasingly turning to automation and advanced technologies to mitigate labor challenges, boost productivity, and support the evolving needs of Japan’s e-commerce-driven warehouse market.

To get more information on this market Request Sample

Adoption of Smart Warehousing Technologies

The integration of smart warehousing technologies is transforming Japan’s warehouse market by significantly boosting efficiency and addressing acute labor shortages. Core innovations, such as automation, robotics, and AI-powered inventory management, are reshaping warehouse operations to meet rising consumer expectations for faster and more reliable deliveries. A notable example is Zebra Technologies’ 2023 launch of an advanced AI-driven warehouse management solution, which offers real-time analytics, predictive maintenance, and enhanced operational visibility. These technologies enable precise inventory tracking, reduce operational costs, and improve order fulfillment accuracy, helping businesses maintain a competitive edge in Japan’s rapidly evolving logistics landscape. Moreover, the incorporation of energy-efficient and scalable solutions supports the growing emphasis on sustainable warehouse practices. As the demand for streamlined logistics continues to escalate, driven by the expansion of e-commerce and the impact of labor-related regulations, investments in smart technologies are expected to play a pivotal role in the future growth of Japan’s warehouse sector. This technological evolution is shaping a more agile and resilient logistics ecosystem, thereby strengthening the market growth.

Japan Warehouse Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on sector, ownership type, and commodities stored.

Sector Insights:

- Industrial Warehouses

- Agricultural Warehouses

The report has provided a detailed breakup and analysis of the market based on the sector. This includes industrial warehouses and agricultural warehouses.

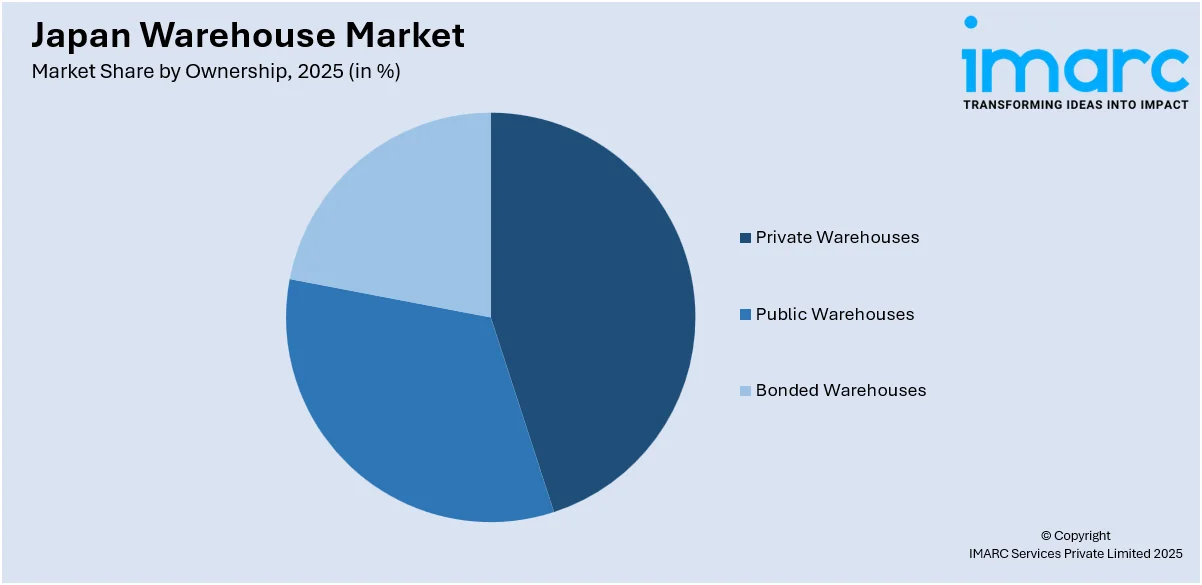

Ownership Insights:

Access the comprehensive market breakdown Request Sample

- Private Warehouses

- Public Warehouses

- Bonded Warehouses

A detailed breakup and analysis of the market based on ownership have also been provided in the report. This includes private warehouses, public warehouses, and bonded warehouses.

Type of Commodities Stored Insights:

- General Warehouses

- Speciality Warehouses

- Refrigerated Warehouses

The report has provided a detailed breakup and analysis of the market based on the type of commodities stored. This includes general warehouses, speciality warehouses, and refrigerated warehouses.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Warehouse Market News:

- January 2025: WPIC opened a new 40,000-square-foot warehouse in Narita, Japan, near Narita International Airport. This state-of-the-art facility enhances import efficiency and rapid nationwide distribution using AI-powered inventory systems.

- December 2024: JD Logistics opened its first self-operated warehouse in Japan. This new facility is designed to offer comprehensive e-commerce supply chain solutions for businesses in Japan, South Korea, and international brands entering these markets.

Japan Warehouse Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Industrial Warehouses, Agricultural Warehouses |

| Ownerships Covered | Private Warehouses, Public Warehouses, Bonded Warehouses |

| Types of Commodities Stored Covered | General Warehouses, Speciality Warehouses, Refrigerated Warehouses |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinavo Region,Tohoku Region,Chugo Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan warehouse market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan warehouse market on the basis of sector?

- What is the breakup of the Japan warehouse market on the basis of ownership?

- What is the breakup of the Japan warehouse market on the basis of type of commodities stored?

- What is the breakup of the Japan warehouse market on the basis of region?

- What are the various stages in the value chain of the Japan warehouse market?

- What are the key driving factors and challenges in the Japan warehouse market?

- What is the structure of the Japan warehouse market and who are the key players?

- What is the degree of competition in the Japan warehouse market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan warehouse market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan warehouse market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan warehouse industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)