Japan Water Heater Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2026-2034

Japan Water Heater Market Overview:

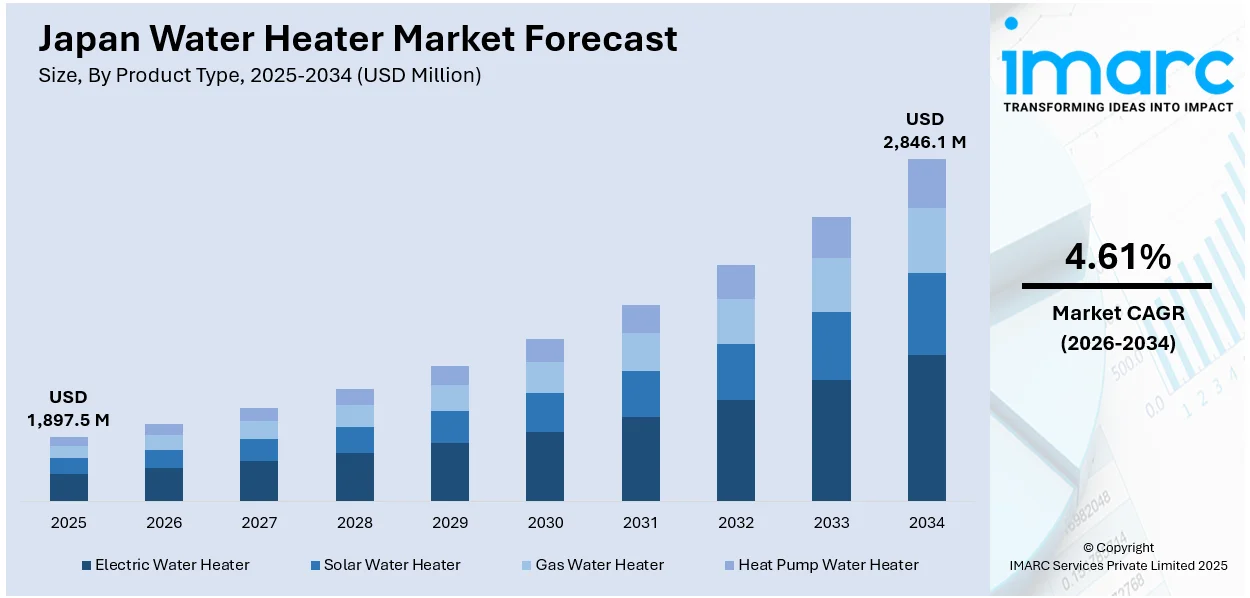

The Japan water heater market size reached USD 1,897.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,846.1 Million by 2034, exhibiting a growth rate (CAGR) of 4.61% during 2026-2034. The market is advancing with a strong focus on energy efficiency, hydrogen-based systems, and eco-friendly refrigerants. Rising carbon neutrality goals and export-led innovation are encouraging manufacturers to develop cleaner, high-performance technologies suited for both domestic and global use.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,897.5 Million |

| Market Forecast in 2034 | USD 2,846.1 Million |

| Market Growth Rate 2026-2034 | 4.61% |

Japan Water Heater Market Trends:

Push Towards Low-Carbon Heating Alternatives

The Japan water heater market is witnessing a notable transition toward clean, low-emission technologies, largely driven by the push for carbon neutrality and the anticipated decline of fossil fuel reliance. With global focus turning to decarbonization, Japanese manufacturers are accelerating research and field implementation of next-generation systems powered by non-conventional fuels. Hydrogen, in particular, has emerged as a critical area of interest due to its clean-burning properties and alignment with future energy frameworks. In December 2024, Noritz, in partnership with Dux and Australian energy firm ATCO, initiated a field trial of a 100% hydrogen combustion residential water heater at ATCO’s hydrogen house in Western Australia. The heater, developed by Noritz, is designed to safely and reliably supply hot water using pure hydrogen and will be tested over two years. This effort demonstrates Japan’s early readiness for hydrogen infrastructure and positions its water heater industry as a leader in sustainable innovation. The development also reinforces Japan’s export potential for hydrogen-compatible appliances, helping shape global standards for safe hydrogen use in residential applications. As hydrogen gains ground internationally, such trials are expected to influence both domestic and international product development strategies for Japan-based water heater manufacturers.

To get more information on this market Request Sample

Rise of High-Efficiency, Propane-Based Systems

The rising shift toward compact, high-efficiency systems using eco-friendly refrigerants is also acting as a growth inducing factor in the Japanese market. Regulatory changes and customer demand for energy savings have pushed Japanese firms to adopt propane (R290) and other natural refrigerants that deliver strong performance with lower environmental impact. This shift is especially evident in the heat pump segment, where the use of R290 enables stable operation even in extreme climates. In December 2024, Daikin introduced its Altherma 4 H line of air-to-water heat pumps designed for single-family homes. These systems use R290 refrigerant, offer outputs between 6 kW and 14 kW, and can deliver hot water up to 75°C. They are capable of operating in temperatures as low as -28°C and include advanced safety features. While manufactured in Europe, the technology reflects the expertise of Daikin’s Japanese engineering and showcases how Japan is shaping global trends in sustainable heating. The use of R290 is particularly relevant for countries seeking alternatives to high-global warming-potential refrigerants. Japan’s development and export of such solutions enhance its competitiveness in overseas markets and demonstrate a strong alignment with next-generation environmental policies. The demand for efficient, low-impact systems is likely to grow, reinforcing this direction in Japan’s water heater sector.

Japan Water Heater Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type and application.

Product Type Insights:

- Electric Water Heater

- Solar Water Heater

- Gas Water Heater

- Heat Pump Water Heater

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes electric water heater, solar water heater, gas water heater, and heat pump water heater.

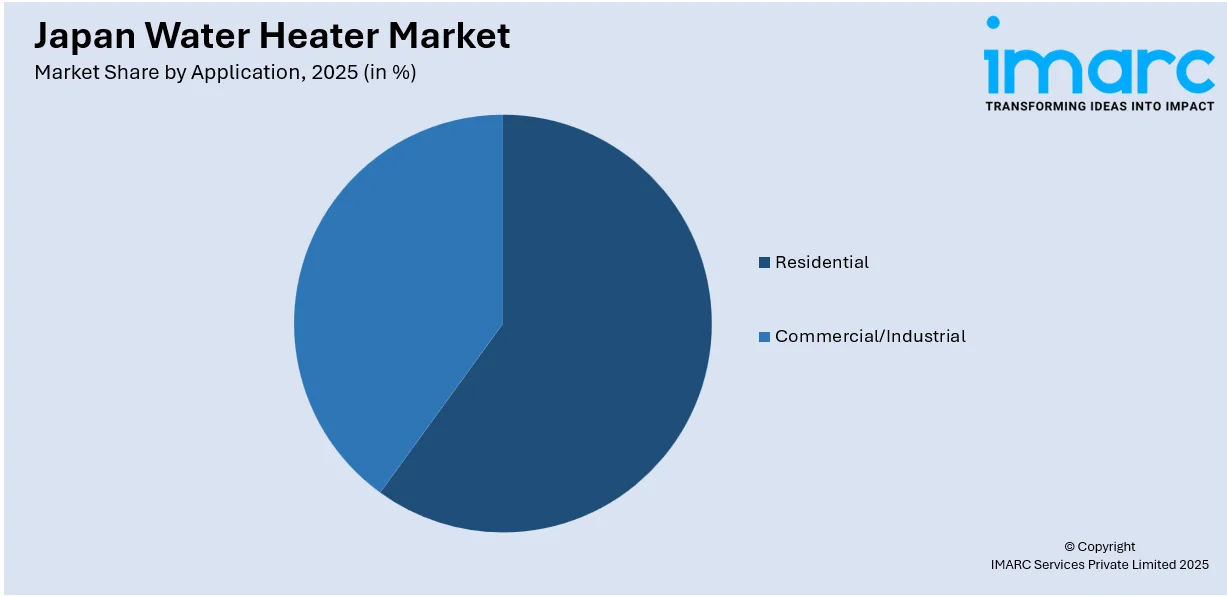

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial/Industrial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential and commercial/industrial .

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Water Heater Market News:

- February 2025: Panasonic and A. O. Smith showcased their jointly developed CO₂ heat pump water heaters at AHR Expo 2025. Their collaboration marked a key development in the U.S. market, promoting energy-efficient alternatives and influencing Japan’s water heater innovation and global competitiveness.

- January 2025: Midea launched a high-efficiency Heat Pump Water Heater in North America, featuring up to 400% efficiency and compliance with top-tier energy standards. This advanced air-source technology strengthened Japan’s global presence, pushing innovation and sustainability in the residential water heater segment.

Japan Water Heater Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Electric Water Heater, Solar Water Heater, Gas Water Heater, Heat Pump Water Heater |

| Applications Covered | Residential, Commercial/Industrial |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan water heater market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan water heater market on the basis of product type?

- What is the breakup of the Japan water heater market on the basis of application?

- What is the breakup of the Japan water heater market on the basis of region?

- What are the various stages in the value chain of the Japan water heater market?

- What are the key driving factors and challenges in the Japan water heater market?

- What is the structure of the Japan water heater market and who are the key players?

- What is the degree of competition in the Japan water heater market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan water heater market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan water heater market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan water heater industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)