Japan Water Pumps Market Size, Share, Trends and Forecast by Type, Pump Type, Pump Capacity, Application, and Region, 2025-2033

Japan Water Pumps Market Overview:

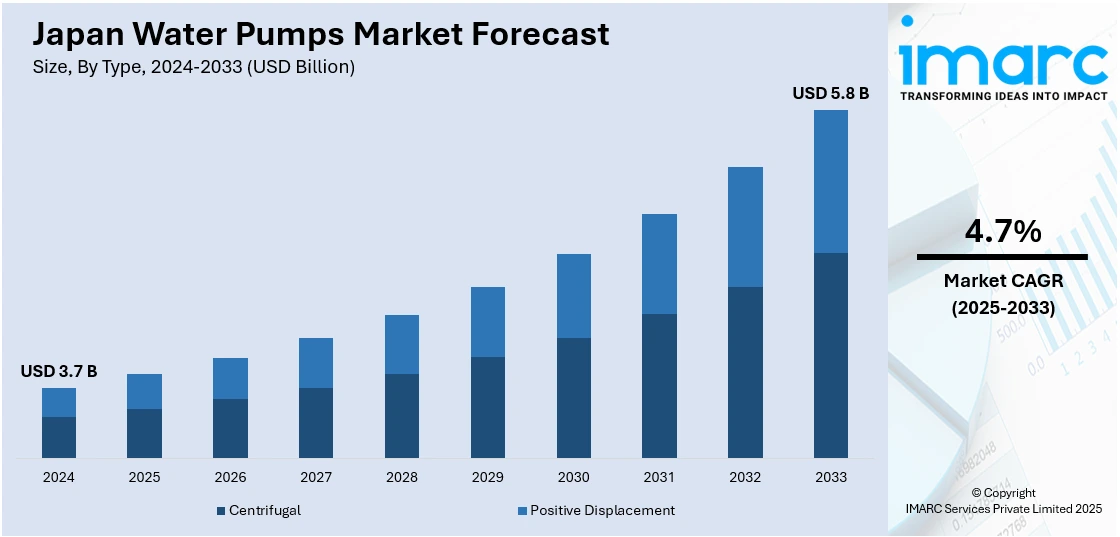

The Japan water pumps market size reached USD 3.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.8 Billion by 2033, exhibiting a growth rate (CAGR) of 4.7% during 2025-2033. The market is driven by the aging of water infrastructure for municipal usage, heavy dependency of industries on different pump systems for operations like cooling, fluid transfer, water circulation, and wastewater treatment, and the increasing adoption of tough environmental regulations that target carbon emissions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.7 Billion |

| Market Forecast in 2033 | USD 5.8 Billion |

| Market Growth Rate 2025-2033 | 4.7% |

Japan Water Pumps Market Trends:

Aging Water Infrastructure and Need for Modernization

Japan's water infrastructure for municipal use is aging, with much of the pipelines and pumping systems having already exceeded their design operational lifespans. Such deterioration raises the likelihood of leaks, water loss, and inefficient energy consumption. To counter such problems, the public and private sectors are focusing on upgrading and modernizing systems in place. The government is starting different programs for rehabilitation of infrastructure, such as the upgrade of old pumps to newer models that are energy-efficient and more technologically advanced. In 2024, Japan's water supply and sewage management were centralized in April under the aegis of the infrastructure ministry, marking a change from the earlier system when the health ministry handled the operation and maintenance of water supply. During fiscal 2024, after the realignment of water supply management, the ministry promoted the adoption of the Water PPP, or public-private partnership, program. In the program, local government assigned the maintenance, management and replacement of water supply and sewage infrastructure to the private sector as an integrated package.

Growth in Industrial Manufacturing and Process Industries

Japan's powerful industrial sector, especially in areas like automotive, electronics, and chemicals, is driving the demand of water pumps. These sectors have a heavy dependency on different pump systems for operations like cooling, fluid transfer, water circulation, and wastewater treatment. With manufacturing companies aiming for greater operational efficiency and environmental legislations, the use of sophisticated pump technologies is becoming more prevalent. Variable frequency drives (VFDs), corrosion-resistant materials, and intelligent control systems are being incorporated into pump systems to maximize performance and minimize energy consumption. Moreover, the formation of high-tech manufacturing facilities and innovations in the clean energy industries like hydrogen production and battery manufacturing, also drive the demand for tailored and resilient pumping solutions. The IMARC Group predicts that the Japan hydrogen generation market size is anticipated to reach USD 14.0 Billion by 2033.

Rising Emphasis on Energy Efficiency and Environmental Regulations

Japan is a leader in adopting tough environmental regulations that target carbon emissions and ensure sustainable utilization of resources. These policies are resulting in high take-up rates of energy-efficient technology in numerous sectors, including water pumping equipment. The Basic Act on Energy Policy and other policies under Japan's decarbonization strategy promote environment-friendly and low-consumption devices. As a result, end-users are shifting to conventional pumps towards energy-efficient pumps that have smart monitoring systems and auto-control functions. These advanced versions assist in curbing the electricity usage, operation costs, and carbon footprint. In addition, Japan's carbon neutrality drive to reach carbon zero by 2050 is encouraging business and municipal communities to move toward greener technology. Manufacturers of water pumps whose products fit within these sustainability objectives are enjoying greater market uptake. In 2024, Japanese electrical and electronics equipment manufacturer Mitsubishi Electric has launched a high-temperature water-to-water heat pump for commercial and industrial uses that demand high-temperature water of up to 78 C. The product comes in four types with capacities of 73 kW, 86 kW, 105.2 kW, and 129.3 kW.

Japan Water Pumps Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, pump type, pump capacity, and application.

Type Insights:

- Centrifugal

- Positive Displacement

The report has provided a detailed breakup and analysis of the market based on the type. This includes centrifugal and positive displacement.

Pump Type Insights:

- Submersible Pumps

- Multistage Pumps

- End Suction Pumps

- Split Case Pumps

- Engineered Pumps

- Others

A detailed breakup and analysis of the market based on the pump type have also been provided in the report. This includes submersible pumps, multistage pumps, end suction pumps, split case pumps, engineered pumps, and others.

Pump Capacity Insights:

- Up to 3 HP

- 3-5 HP

- 5-10 HP

- 10-15 HP

- 15-20 HP

- 20-30 HP

- More Than 30 HP

A detailed breakup and analysis of the market based on the pump capacity have also been provided in the report. This includes up to 3 HP, 3-5 HP, 5-10 HP, 10-15 HP. 15-20 HP, 20-30 HP, and more than 30 HP.

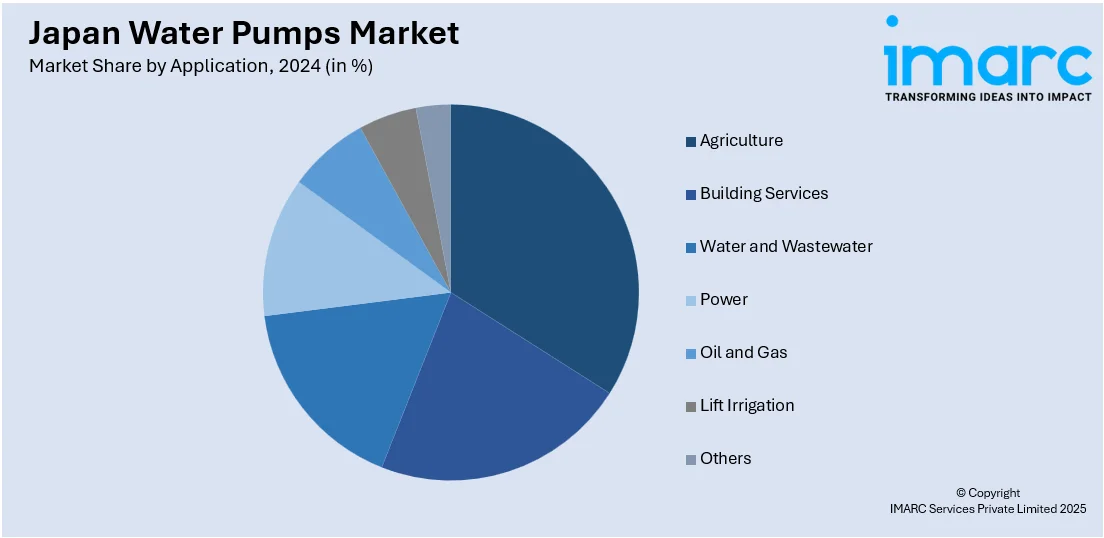

Application Insights:

- Agriculture

- Building Services

- Water and Wastewater

- Power

- Oil and Gas

- Lift Irrigation

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes agriculture, building services, water and wastewater, power, oil and gas, lift irrigation, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Water Pumps Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Centrifugal, Positive Displacement |

| Pump Types Covered | Submersible Pumps, Multistage Pumps, End Suction Pumps, Split Case Pumps, Engineered Pumps, Others |

| Pump Capacities Covered | Up to 3 HP, 3-5 HP, 5-10 HP, 10-15 HP. 15-20 HP, 20-30 HP, More Than 30 HP |

| Applications Covered | Agriculture, Building Services, Water and Wastewater, Power, Oil and Gas, Lift Irrigation, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan water pumps market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan water pumps market on the basis of type?

- What is the breakup of the Japan water pumps market on the basis of pump type?

- What is the breakup of the Japan water pumps market on the basis of pump capacity?

- What is the breakup of the Japan water pumps market on the basis of application?

- What is the breakup of the Japan water pumps market on the basis of region?

- What are the various stages in the value chain of the Japan water pumps market?

- What are the key driving factors and challenges in the Japan water pumps?

- What is the structure of the Japan water pumps market and who are the key players?

- What is the degree of competition in the Japan water pumps market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan water pumps market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan water pumps market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan water pumps industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)