Japan Waterproof Textiles Market Size, Share, Trends and Forecast by Raw Material, Fabric Type, Application, and Region, 2026-2034

Japan Waterproof Textiles Market Overview:

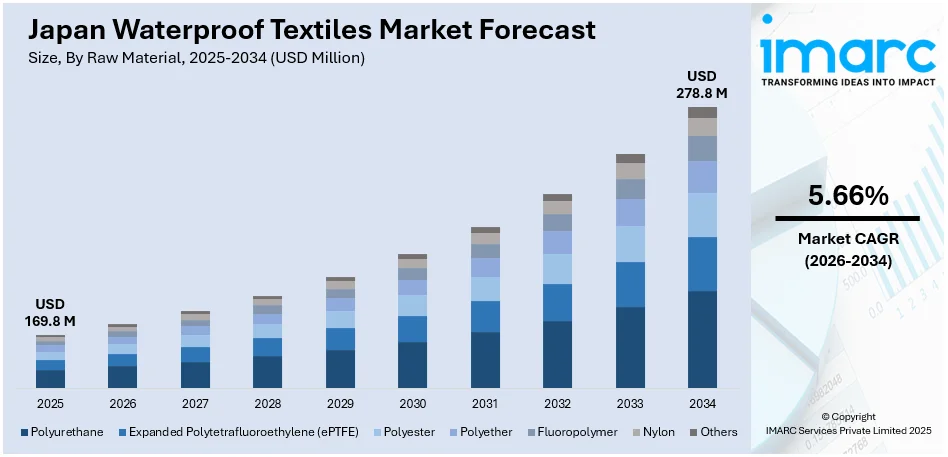

The Japan waterproof textiles market size reached USD 169.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 278.8 Million by 2034, exhibiting a growth rate (CAGR) of 5.66% during 2026-2034. The market is being driven by rising demand for sustainable, PFAS-free coatings and growing interest in luxury fabrics with water-resistant features. Innovations in eco-friendly materials and advanced fiber technologies are shaping product development across consumer and premium segments, supporting Japan waterproof textiles market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 169.8 Million |

| Market Forecast in 2034 | USD 278.8 Million |

| Market Growth Rate 2026-2034 | 5.66% |

Japan Waterproof Textiles Market Trends:

Shift Toward Sustainable and Chemical-Free Coatings

Japan’s waterproof textiles market is witnessing a strong push toward eco-friendly alternatives, particularly with the phasing out of harmful chemicals like PFAS. Growing global scrutiny and regulatory bans have accelerated innovation in water-repellent fabrics that use safer, plant-inspired technologies. The demand for textiles that offer water resistance without compromising health or environmental safety is becoming a key industry driver. Brands are prioritizing consumer health and environmental compliance while still maintaining high-performance standards. Consumer awareness of the risks associated with PFAS compounds has further fueled this demand, especially in everyday wear like jackets, umbrellas, and footwear. Manufacturers are now focusing on research-led developments and replacing older chemical treatments with nature-derived coatings and safe fiber processing techniques. A notable example was seen in November 2024, when UNIQLO launched its PFAS-free LifeWear, which mimics the natural water-repellent behavior of lotus leaves. This move not only demonstrated technical innovation but also set a benchmark for sustainable product development in the mainstream clothing sector. UNIQLO’s initiative aligns with Japan’s broader goals of clean manufacturing and circular fashion, influencing other players to adopt safer practices. Such efforts are encouraging a wider transition toward chemical-free waterproof textiles across multiple consumer segments, fostering long-term growth and compliance-driven innovation in the Japanese market.

To get more information on this market Request Sample

Integration of Luxury with Functional Durability

There is a growing demand in Japan’s waterproof textile sector for high-end materials that merge luxury with long-lasting performance. Buyers in the premium fashion category are increasingly looking for textiles that offer water resistance alongside comfort, softness, and visual appeal. This trend reflects a deeper shift where waterproofing is no longer limited to outdoor gear but is entering designer and luxury categories. The expanding middle- and high-income consumer base in Japan is driving this preference, where aesthetic quality is just as important as function. Textile developers are now blending organic fibers with technology to deliver a premium feel, enhanced durability, and water-resistant properties. The presence of Japanese craftsmanship combined with precision innovation further strengthens the country’s global standing in high-end textiles, contributing to Japan waterproof textiles market growth. In February 2024, IST Corporation introduced IST PLATINUMWOOL, a Merino wool fiber with exceptional resistance to water, wrinkles, and odors. This advancement applied the company’s earlier waterproofing expertise into a refined natural textile suitable for upscale fashion. With a fineness of 14.5 microns and RWS certification, it marked a new phase in Japan’s textile evolution. Such innovations are expanding the role of waterproof materials beyond functional utility, influencing product design, material sourcing, and consumer expectations in the high-end apparel industry, ultimately reshaping the luxury textile narrative.

Japan Waterproof Textiles Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2026-2034. Our report has categorized the market based on raw material, fabric type, and application.

Raw Material Insights:

- Polyurethane

- Expanded Polytetrafluoroethylene (ePTFE)

- Polyester

- Polyether

- Fluoropolymer

- Nylon

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes polyurethane, expanded polytetrafluoroethylene (ePTFE), polyester, polyether, fluoropolymer, nylon, and others.

Fabric Type Insights:

- Dense Woven

- Laminated or Coated Woven

- Others

A detailed breakup and analysis of the market based on the fabric type have also been provided in the report. This includes dense woven, laminated or coated woven, and others.

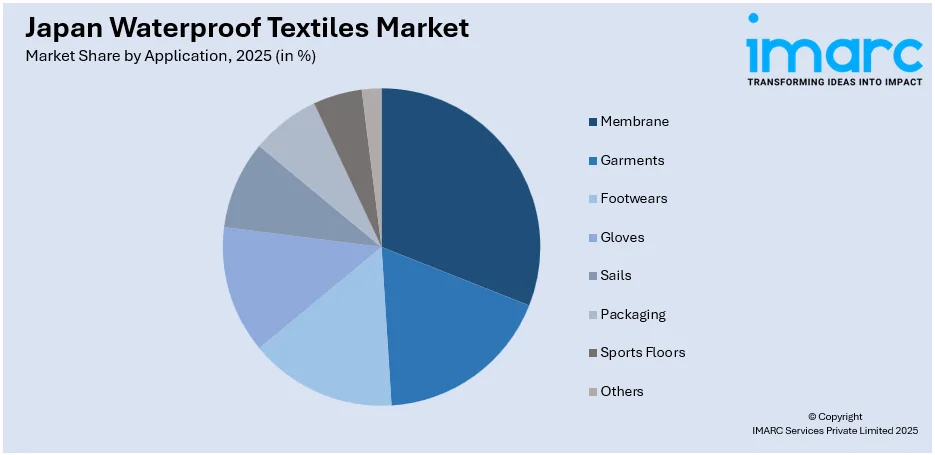

Application Insights:

Access the comprehensive market breakdown Request Sample

- Membrane

- Garments

- Jackets

- Waterproof Jackets

- Leisurewear

- Others

- Footwears

- Gloves

- Sails

- Packaging

- Sports Floors

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes membrane, garments (jackets, waterproof jackets, leisurewear, and others), footwears, gloves, sails, packaging, sports floors, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Waterproof Textiles Market News:

- March 2025: Kering hosted the first Kering Generation Award x Japan, spotlighting sustainable fashion innovations. Start-ups focused on alternative materials and manufacturing, encouraging eco-friendly waterproof textiles. This supported domestic innovation, boosting demand for sustainable, high-performance textiles in Japan.

- March 2025: Pertex and its partner introduced backpack-specific fabrics Pertex 07RS-PC and 21RS-PC featuring nylon with tear strength nearing UHMWPE and ECOPAK waterproof bases. Launched in Japan, this advanced material rollout enhanced durability and waterproofing, strengthening the country’s high-performance waterproof textiles segment.

Japan Waterproof Textiles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Polyurethane, Expanded Polytetrafluoroethylene (ePTFE), Polyester, Polyether, Fluoropolymer, Nylon, Others |

| Fabric Types Covered | Dense Woven, Laminated or Coated Woven, Others |

| Applications Covered |

|

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan waterproof textiles market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan waterproof textiles market on the basis of raw material?

- What is the breakup of the Japan waterproof textiles market on the basis of fabric type?

- What is the breakup of the Japan waterproof textiles market on the basis of application?

- What is the breakup of the Japan waterproof textiles market on the basis of region?

- What are the various stages in the value chain of the Japan waterproof textiles market?

- What are the key driving factors and challenges in the Japan waterproof textiles market?

- What is the structure of the Japan waterproof textiles market and who are the key players?

- What is the degree of competition in the Japan waterproof textiles market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan waterproof textiles market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan waterproof textiles market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan waterproof textiles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)