Japan Weight Management Market Size, Share, Trends and Forecast by Diet, Service, Equipment, and Region, 2026-2034

Japan Weight Management Market Summary:

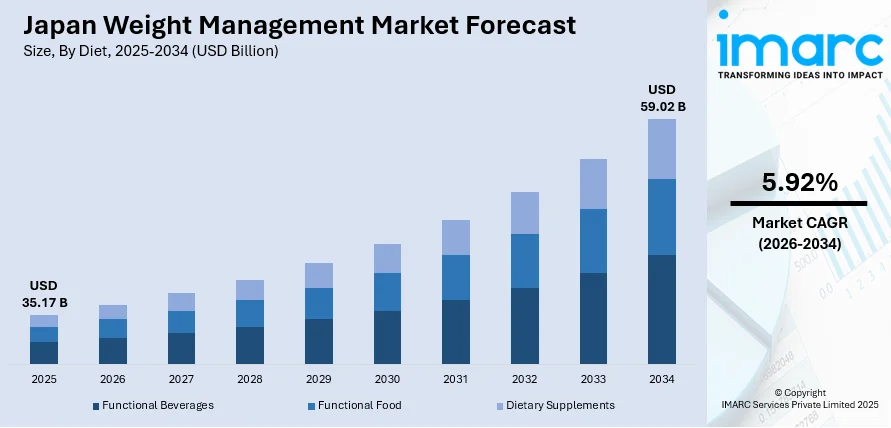

The Japan weight management market size was valued at USD 35.17 Billion in 2025 and is projected to reach USD 59.02 Billion by 2034, growing at a compound annual growth rate of 5.92% from 2026-2034.

The market is largely driven by Japan's rapidly aging population, increasingly concerned with healthy aging and preventive health measures. Changing urban lifestyles marked by sedentary behavior and an awareness of health issues among the younger population are hastening the demand for weight management solutions. Growing incidence of obesity and diabetes, along with increasing interest in innovative treatments like functional foods, dietary supplements, and advanced fitness technologies, continues to spur the share of the Japan weight management market.

Key Takeaways and Insights:

- By Diet: Functional Food dominated the market with approximately 46.3% revenue share in 2025, driven by strong consumer preference for science-backed products certified under the Foods with Function Claims regulatory framework and the cultural emphasis on incorporating health benefits into everyday dietary choices.

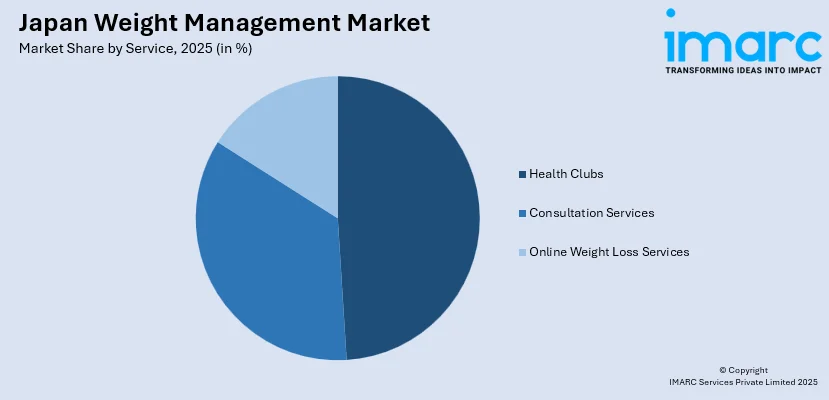

- By Service: Health Clubs segment led the market with a revenue share of 49.3% in 2025, owing to the growing awareness about physical fitness among the elderly population, the proliferation of boutique fitness studios, and corporate wellness programs offering gym memberships as employee benefits.

- By Equipment: Fitness Equipment accounted for the largest revenue share of approximately 62.2% in 2025. This dominance is driven by the rising adoption of smart fitness devices, the increasing popularity of home workout solutions, and technological advancements in cardiovascular and strength training equipment.

- By Region: Kanto region represented the largest segment with a market share of 35.8% in 2025, attributed to the high concentration of health-conscious urban population in the Tokyo metropolitan area, extensive fitness facility infrastructure, and the presence of major dietary supplement and functional food manufacturers.

- Key Players: The Japan weight management market exhibits moderate competitive intensity, featuring a mix of domestic health and wellness corporations, international fitness chains, pharmaceutical companies, and specialized functional food manufacturers competing across various product and service categories.

To get more information on this market Request Sample

The Japan weight management market is experiencing sustained growth as consumers increasingly prioritize preventive healthcare and holistic wellness approaches. The integration of traditional dietary practices with modern nutritional science has created a unique market environment where functional foods bearing regulatory certifications command significant consumer trust. Health clubs and fitness centers continue to evolve their offerings to cater to diverse demographic needs, from specialized programs for seniors to high-intensity boutique fitness experiences for younger consumers. Meanwhile, some Japanese firms are already acting on this trend: in June 2025, ITOCHU Corporation launched a ready‑to‑drink protein beverage called Tanpaku Charge, which is now sold across ~16,300 convenience‑store outlets nationwide, signalling corporate confidence in demand for everyday nutritional products. The market is further characterized by strong technological adoption, with smart fitness equipment and digital wellness platforms gaining considerable traction among health-conscious individuals.

Japan Weight Management Market Trends:

Rising Adoption of Digital and Smart Fitness Solutions

The convergence of technology and fitness is reshaping the weight management landscape as consumers embrace smart fitness equipment, wearable devices, and digital wellness platforms. Smart mirrors with artificial intelligence-powered form correction, connected fitness equipment with real-time performance tracking, and mobile applications offering personalized workout plans are gaining substantial popularity. In June 2024, Casio rolled out the G-SHOCK “G‑SQUAD GBD‑300”, a slim, shock-resistant smartwatch equipped with step counting, distance tracking, and integration with the G‑SHOCK MOVE app, enabling users to log workouts and track activity data directly from their wrist. This technological integration caters to the preferences of time-constrained urban professionals seeking convenient and effective exercise solutions.

Growing Preference for Science-Backed Functional Foods

Consumer demand for functional foods with verified health claims is intensifying as awareness of preventive nutrition expands across demographics. The Foods with Function Claims (FFC) regulatory framework in Japan continues to shape the market: as of mid‑2025, a substantial number of FFC‑approved products have been notified, and manufacturers are increasingly registering ingredients claiming weight‑management, metabolic health and fat‑control benefits. Botanical extracts, amino acids, and metabolism-targeting formulations aligned with traditional Japanese dietary preferences are experiencing notable market traction.

Expansion of Specialized Fitness Programs for Aging Population

The demographic shift toward an older population is driving the development of tailored fitness and wellness programs designed to address age-related health concerns. Health clubs are introducing low-impact exercise classes, rehabilitation-focused training, and comprehensive wellness services specifically targeting seniors seeking to maintain mobility, strength, and overall vitality. For instance, Curves in Japan, which operates nearly 1,978 clubs nationwide as of early 2025, continues to focus on circuit‑training designs that combine strength, aerobic, and stretch exercises with hydraulic machines whose intensity can be finely adjusted, making them especially suitable for older adults or those with lower baseline fitness levels. This segment represents a growing opportunity as older adults increasingly prioritize active and healthy aging strategies.

Market Outlook 2026-2034:

The Japan weight management market is positioned for continued expansion as demographic trends and evolving consumer preferences create sustained demand for diverse weight management solutions. The aging population's focus on healthy longevity will drive growth in functional foods, dietary supplements, and senior-focused fitness services. Technological innovation in smart fitness equipment and digital wellness platforms will attract younger demographics seeking personalized and convenient solutions. The regulatory environment supporting science-backed functional foods will encourage product innovation and market diversification. The market generated a revenue of USD 35.17 Billion in 2025 and is projected to reach a revenue of USD 59.02 Billion by 2034, growing at a compound annual growth rate of 5.92% from 2026-2034.

Japan Weight Management Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Diet | Functional Food | 46.3% |

| Service | Health Clubs | 49.3% |

| Equipment | Fitness Equipment | 62.2% |

| Region | Kanto Region | 35.8% |

Diet Insights:

- Functional Beverages

- Functional Food

- Dietary Supplements

The functional food dominates with a market share of 46.3% of the total Japan weight management market in 2025.

The strong leadership of functional foods reflects the cultural alignment between traditional Japanese dietary principles and modern nutritional science. Consumers demonstrate strong preference for food products that deliver health benefits beyond basic nutrition, particularly those certified under regulatory frameworks that verify efficacy claims. The Foods with Function Claims system has enabled the rapid expansion of products targeting weight management, metabolism support, and appetite regulation through natural ingredients and scientifically validated formulations. For example, in February 2025, Japanese company I‑ne (through its brand Teaflex) launched a new “Slim Cleanse Green Tea” under FFC labelling, with functional claims for reducing visceral fat and waist circumference, indicating how firms are leveraging regulatory‑approved functional foods to appeal to health- and weight‑conscious consumers in Japan.

The functional foods segment benefits from established distribution channels including convenience stores, supermarkets, and specialty health food retailers that provide widespread accessibility. Product innovations featuring traditional ingredients such as green tea extracts, fermented foods, and plant-based compounds with demonstrated metabolic benefits continue to attract health-conscious consumers seeking sustainable dietary approaches to weight management.

Service Insights:

Access the Comprehensive Market Breakdown Request Sample

- Health Clubs

- Consultation Services

- Online Weight Loss Services

The health clubs lead with a share of 49.3% of the total Japan weight management market in 2025.

The dominance of health clubs reflects the established fitness culture and growing health awareness among the Japanese population. Traditional full-service facilities catering primarily to older demographics with comprehensive amenities including swimming, group exercise classes, and rehabilitation services generate substantial revenue. Simultaneously, boutique fitness studios and international franchise chains have expanded their metropolitan presence to serve the preferences of younger, urban consumers seeking specialized workout experiences. Meanwhile, corporate wellness initiatives are gaining real momentum. For instance, in September 2025, LifeFit, a 24‑hour gym chain, refreshed its “corporate plan,” offering discounted memberships and 24/7 access to employees across its 160 + locations nationwide, reflecting rising demand from companies investing in employee health as part of their benefits strategy.

Corporate wellness initiatives providing gym membership benefits to employees have contributed significantly to membership growth across all facility types. The integration of technology through fitness tracking, virtual classes, and personalized training programs enhances member engagement and retention. The segment continues to evolve with diversified offerings ranging from traditional weight training to specialized formats including boxing, cycling, and martial arts-inspired fitness programs.

Equipment Insights:

- Fitness Equipment

- Cardiovascular Training Equipment

- Strength Training Equipment

- Others

- Surgical Equipment

- Minimally Invasive/Bariatric Equipment

- Non-Invasive Surgical Equipment

The fitness equipment dominates with a market share of 62.2% of the total Japan weight management market in 2025.

The substantial market share of fitness equipment reflects the growing adoption of home fitness solutions and the modernization of health club facilities with advanced exercise devices. Smart treadmills, connected exercise bicycles, and artificial intelligence-powered strength training equipment have gained significant popularity as consumers seek personalized workout experiences with real-time performance feedback. The convenience of exercising at home, combined with the ability to track progress digitally, appeals to busy urban professionals and technology-oriented consumers. In fact, in 2024 the IMARC Group estimated that Japan’s sports and fitness goods market, which includes home gym equipment, reached about USD 4,238 million, with rising demand for in‑home workouts and increasing adoption of wearables and connected devices supporting this growth.

The expansion of e-commerce channels has enhanced accessibility to fitness equipment, enabling consumers to research, compare, and purchase products conveniently. Virtual try-on experiences and detailed product demonstrations through digital platforms are improving purchase confidence. Wearable fitness trackers and devices providing comprehensive health metrics have become increasingly popular, supporting the broader trend toward data-driven weight management approaches.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto region exhibits a clear dominance with a 35.8% share of the total Japan weight management market in 2025.

The Kanto region's market leadership reflects the high concentration of health-conscious consumers in the Tokyo metropolitan area, where urban lifestyle factors drive strong demand for weight management products and services. The region hosts the highest density of health clubs, boutique fitness studios, and specialized wellness centers, creating a competitive environment that fosters innovation and service quality. The presence of major functional food and dietary supplement manufacturers supports product availability and consumer access.

Tokyo's status as a global business center attracts young professionals with disposable income and strong health awareness, contributing to demand across all market segments. The region also benefits from advanced retail infrastructure, including extensive convenience store networks and specialty health food retailers that facilitate distribution of weight management products. Corporate headquarters concentrated in the region support workplace wellness initiatives that drive health club memberships and functional food consumption.

Market Dynamics:

Growth Drivers:

Why is the Japan Weight Management Market Growing?

Aging Population and Focus on Healthy Longevity

The demographic structure characterized by a significant elderly population represents a fundamental driver of market expansion. With a substantial proportion of the population aged sixty-five and above, there is growing emphasis on maintaining health, mobility, and quality of life through proactive weight management. Seniors increasingly seek products and services that support healthy aging, including dietary supplements for bone and joint health, low-impact fitness programs, and nutritionally optimized functional foods. For example, in 2025, the launch of a new joint‑health functional ingredient under the Foods with Function Claims (FFC) system, OptiMSM, was approved in Japan, enabling makers to formulate products specifically targeted at aging‑related joint and mobility concerns. This demographic shift creates sustained demand across multiple market segments as older adults prioritize preventive healthcare measures to extend their active and independent years. Healthcare providers and wellness professionals increasingly recommend weight management interventions as part of comprehensive geriatric care protocols.

Rising Prevalence of Lifestyle Diseases and Health Awareness

The increasing incidence of lifestyle-related health conditions including obesity, diabetes, and cardiovascular diseases is driving consumer awareness and action regarding weight management. Urban lifestyles characterized by sedentary work patterns, irregular eating habits, and limited physical activity contribute to health concerns that motivate demand for weight management solutions. Public health campaigns and media coverage highlighting the connection between weight and chronic disease risk have enhanced consumer understanding of preventive measures. In fact, in November 2023, Kirin Holdings Company, Limited launched a functional‑food supplement under its Kirin iMUSE and Healthya brands, the “Kirin iMUSE Immune Care & Healthya Visceral Fat Down,” a dual‑care product targeting both immunity and visceral‑fat reduction, underlining how major food and beverage firms are responding directly to rising lifestyle‑related health concerns. Healthcare professionals increasingly incorporate weight management counseling into patient care, reinforcing the importance of maintaining healthy body composition. This heightened awareness translates to greater engagement with functional foods, fitness services, and dietary supplements positioned to address metabolic health concerns.

Regulatory Support for Functional Food Innovation

The regulatory framework supporting verified health claims on food products has created favorable conditions for market growth and product innovation. The Foods with Function Claims system enables manufacturers to communicate scientifically substantiated benefits to consumers, building trust in weight management-focused products. For instance, in July 2025, the ingredient OptiMSM received official FFC approval under the FFC system, becoming the first MSM‑based ingredient in Japan allowed to carry joint‑health related health claims on packaging, demonstrating how the regulatory framework continues to evolve and enable new functional‑food innovations. This regulatory clarity encourages investment in research and development of novel functional ingredients and formulations. The certification process provides competitive advantage to compliant manufacturers while protecting consumers from unsubstantiated claims. The system has fostered rapid expansion of the functional foods market segment, with products targeting weight management, metabolic support, and appetite regulation gaining significant consumer acceptance. Regulatory alignment with international standards also facilitates opportunities for export and cross-border commerce.

Market Restraints:

What Challenges the Japan Weight Management Market is Facing?

Cultural Attitudes Toward Physical Activity and Gym Participation

Despite growing health awareness, cultural factors influence patterns of gym membership and organized fitness participation. Many consumers prefer exercising outdoors or at home rather than in commercial fitness facilities, limiting the growth potential of health club segments. The reluctance to allocate household budgets toward fitness memberships, particularly among price-sensitive consumers, presents ongoing challenges for service providers. Work culture emphasizing long hours reduces available time for regular gym attendance among working-age populations.

Regulatory Complexity for Weight Loss Treatments

Stringent regulatory requirements governing weight loss treatments and pharmaceutical interventions create barriers to market access for certain product categories. Prescription requirements and specialist referral pathways limit accessibility to advanced medical weight management options. The off-label use of medications for weight loss faces regulatory scrutiny, with health authorities emphasizing proper indication-based prescribing. These constraints affect the growth trajectory of medical and pharmaceutical segments within the broader weight management market.

Market Saturation in Urban Areas

Intense competition among fitness facilities and health food retailers in major metropolitan areas creates pricing pressures and limits profitability for market participants. The proliferation of health clubs and specialty food stores in urban centers has resulted in market saturation that challenges both established operators and new entrants. Differentiating offerings and maintaining member loyalty require continuous investment in facilities, programming, and customer experience enhancements.

Competitive Landscape:

The Japan weight management market features a diverse competitive landscape comprising domestic food and beverage conglomerates, international fitness chains, pharmaceutical companies, and specialized wellness service providers. Major functional food manufacturers leverage their research capabilities and distribution networks to maintain leadership positions in dietary product segments. International fitness franchises compete with established domestic operators through differentiated service concepts and brand recognition. The market is characterized by ongoing consolidation as larger players acquire complementary businesses to expand service portfolios and geographic coverage. Competition increasingly focuses on technological innovation, personalization capabilities, and the ability to deliver integrated wellness solutions spanning products, services, and digital platforms.

Recent Developments:

- In February 2025, Issin Holdings raised ¥630 million to advance its smart bathroom scale and lifestyle‑improvement offerings. The “smart bath‑mat” tracks up to 15 body metrics, while services like Smart 5min and Smart Daily support daily wellness. Funds will boost R&D, expansion, and entry into sleep‑tech.

Japan Weight Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Diets Covered | Functional Beverages, Functional Food, Dietary Supplements |

| Services Covered | Health Clubs. Consultation Services, Online Weight Loss Services |

| Equipments Covered |

|

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan weight management market size was valued at USD 35.17 Billion in 2025.

The Japan weight management market is expected to grow at a compound annual growth rate of 5.92% from 2026-2034 to reach USD 59.02 Billion by 2034.

Functional Foods dominated the diet segment with approximately 46.3% revenue share, driven by strong consumer preference for science-backed products certified under regulatory frameworks and cultural emphasis on health-enhancing dietary choices.

Key factors driving the Japan weight management market include the aging population focused on healthy longevity, rising prevalence of lifestyle diseases, increasing health consciousness among urban populations, and regulatory support for functional food innovation.

Major challenges include cultural attitudes limiting gym participation rates, regulatory complexity for pharmaceutical weight loss treatments, market saturation in urban areas, high competition among fitness facilities, and price sensitivity among certain consumer segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)