Japan Welding Consumables Market Size, Share, Trends and Forecast by Product Type, Welding Technique, End-Use Industries, and Region, 2026-2034

Japan Welding Consumables Market Overview:

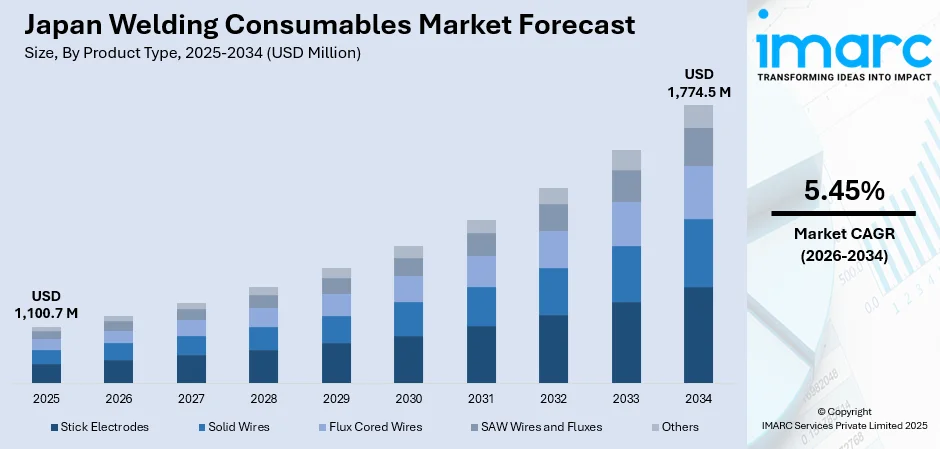

The Japan welding consumables market size reached USD 1,100.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,774.5 Million by 2034, exhibiting a growth rate (CAGR) of 5.45% during 2026-2034. Rising shipbuilding activity, growth in electric vehicle (EV) production, automation in manufacturing, surging aerospace demand, export-oriented fabrication, stringent quality standards, and increasing the consumption of advanced electrodes, wires, and fluxes across industrial sectors are supporting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,100.7 Million |

| Market Forecast in 2034 | USD 1,774.5 Million |

| Market Growth Rate 2026-2034 | 5.45% |

Japan Welding Consumables Market Trends:

Expansion in Renewable Energy Projects

Japan’s energy strategy has undergone significant shifts in recent years, leading to increased investment in renewable infrastructure, including offshore wind, biomass, and solar energy facilities. These projects require large-scale fabrication of towers, frames, and support structures, which involve extensive welding work using heavy-duty consumables. Offshore wind turbines, in particular, require welding consumables that offer superior corrosion resistance and mechanical strength under harsh marine conditions. As Japan accelerates its decarbonization agenda, the fabrication of energy components such as mounting structures, storage tanks, and frames relies on high-grade welding electrodes, fluxes, and wires. With government-backed targets to expand renewable energy’s share in the national grid, the associated infrastructure growth ensures a strong and sustained demand for welding consumables specialized for energy-sector applications, which is boosting the Japan wielding consumables market share.

To get more information on this market Request Sample

Infrastructure Refurbishment Projects

The country’s aging infrastructure presents significant opportunities for welding consumables manufacturers, particularly in the civil engineering and construction sectors. With a large portion of the country's bridges, tunnels, and public structures dating back to the mid-20th century, the government has intensified repair and reinforcement efforts, which is providing a positive Japan welding consumables market outlook. Projects aimed at earthquake resistance, corrosion control, and structural longevity heavily rely on arc welding techniques, increasing the demand for electrodes, fluxes, and filler wires. In 2025, the Japanese government unveiled a comprehensive plan to invest over approximately USD 134 billion from fiscal 2026 to enhance the nation's resilience against natural disasters, including potential megaquakes along the Nankai Trough. Welding consumables tailored for weathered steel and high-stress environments are especially in demand. In urban centers, refurbishments of rail networks, overpasses, and water systems further boost market consumption. Public-private partnerships and national stimulus programs have enhanced funding availability for such projects, translating into long-term contracts for welding material suppliers.

Rising Demand from Shipbuilding Industry

Japan’s shipbuilding industry is experiencing renewed growth, driven by rising global demand for liquefied natural gas (LNG) carriers, hydrogen transport vessels, and specialized marine equipment. In 2024, Mitsui O.S.K. Lines (MOL) announced plans to increase its LNG carrier fleet to approximately 150 vessels by 2030, up from around 100 vessels as of early 2025. These vessels require extensive welding processes involving heavy steel plates, high-tensile alloys, and corrosion-resistant materials. Additionally, there is robust demand for consumables such as submerged arc wires, flux-cored wires, and low-hydrogen electrodes. Welding consumables used in shipbuilding must meet strict performance standards related to tensile strength, crack resistance, and durability in extreme marine environments. Additionally, shipbuilders are increasingly adopting automation and hybrid welding techniques, necessitating consistent-quality consumables that can perform reliably in high-volume production environments, which is driving the Japan welding consumables market growth. Japanese shipyards, particularly those located in Nagasaki, Hiroshima, and Ehime, are ramping up production capacities to fulfill international orders, which is directly boosting procurement volumes of welding consumables.

Japan Welding Consumables Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on product type, welding technique, and end-use industries.

Product Type Insights:

- Stick Electrodes

- Solid Wires

- Flux Cored Wires

- SAW Wires and Fluxes

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes stick electrodes, solid wires, flux cored wires, SAW wires and fluxes, and others.

Welding Technique Insights:

- Arc Welding

- Resistance Welding

- Oxy-fuel Welding

- Ultrasonic Welding

- Others

A detailed breakup and analysis of the market based on the welding technique have also been provided in the report. This includes arc welding, resistance welding, oxy-fuel welding, ultrasonic welding, and others.

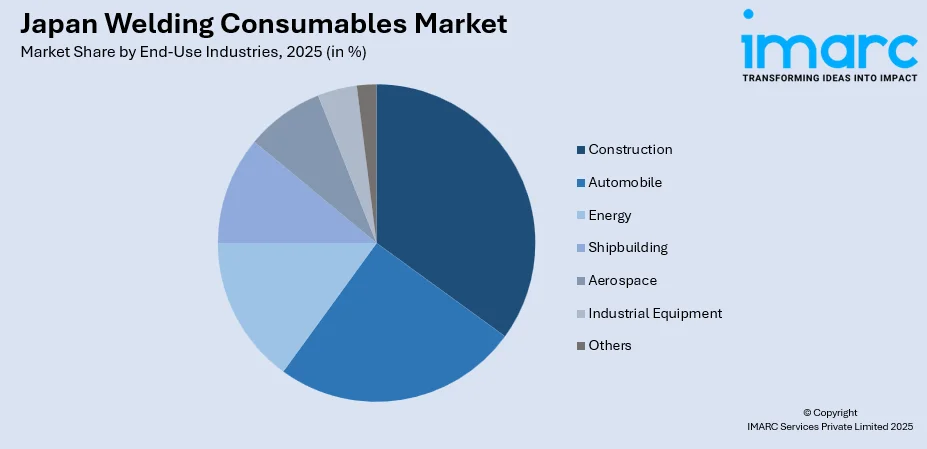

End-Use Industries Insights:

Access the comprehensive market breakdown Request Sample

- Construction

- Automobile

- Energy

- Shipbuilding

- Aerospace

- Industrial Equipment

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use industries. This includes construction, automobile, energy, shipbuilding, aerospace, industrial equipment, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto, Kansai/Kinki, Central/Chubu, Kyushu-Okinawa, Tohoku, Chugoku, Hokkaido, and Shikoku.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Welding Consumables Market News:

- At JIMTOF 2024, AMADA unveiled three next-gen machines—the Regius 3015 AJ, Alcis 1008, and FLW 6000 ENSIS—featuring high-power lasers, AI-driven automation, and IoT connectivity. These innovations target sheet metal and EV manufacturing. AMADA also launched an Autonomous Mobile Robot (AMR) to streamline factory workflows through fully integrated material transport and production automation.

Japan Welding Consumables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Stick Electrodes, Solid Wires, Flux Cored Wires, SAW Wires and Fluxes, Others |

| Welding Techniques Covered | Arc Welding, Resistance Welding, Oxy-fuel Welding, Ultrasonic Welding, Others |

| End-Use Industries Covered | Construction, Automobile, Energy, Shipbuilding, Aerospace, Industrial Equipment, Others |

| Regions Covered | Kanto, Kansai/Kinki, Central/Chubu, Kyushu-Okinawa, Tohoku, Chugoku, Hokkaido, Shikoku |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan welding consumables market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan welding consumables market on the basis of product type?

- What is the breakup of the Japan welding consumables market on the basis of welding technique?

- What is the breakup of the Japan welding consumables market on the basis of end-use industries?

- What is the breakup of the Japan welding consumables market on the basis of region?

- What are the various stages in the value chain of the Japan welding consumables market?

- What are the key driving factors and challenges in the Japan welding consumables market?

- What is the structure of the Japan welding consumables market and who are the key players?

- What is the degree of competition in the Japan welding consumables market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan welding consumables market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan welding consumables market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan welding consumables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)