Japan White Cement Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Japan White Cement Market Summary:

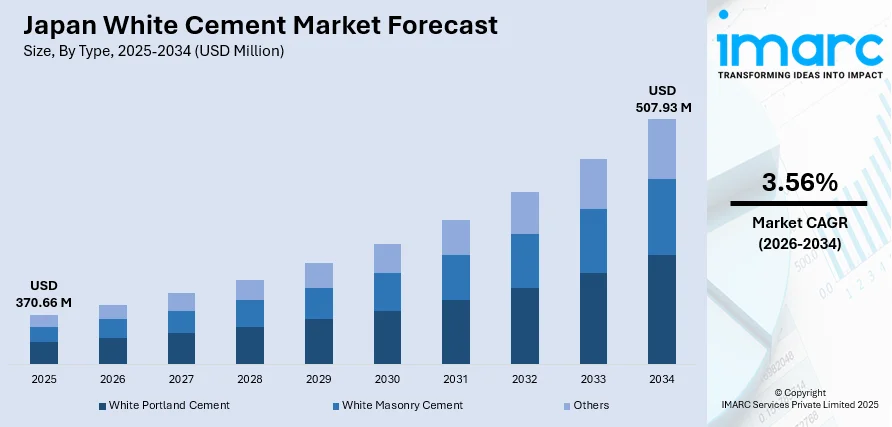

The Japan white cement market size was valued at USD 370.66 Million in 2025. Looking forward, the market is projected to reach USD 507.93 Million by 2034, growing at a compound annual growth rate of 3.56% from 2026-2034.

The Japan white cement market is primarily driven by the expanding commercial construction sector and increasing demand for premium architectural finishes across metropolitan areas. The country's ongoing urban redevelopment initiatives, coupled with rising investment in earthquake-resistant structures featuring high-quality decorative facades, are bolstering product consumption. Additionally, the growing preference for aesthetically superior construction materials in hospitality, retail, and residential projects is reinforcing Japan white cement market share.

Key Takeaways and Insights:

-

By Type: White Portland cement dominates the market with a share of 39.56% in 2025, driven by its superior strength, durability, and exceptional whiteness that enables vibrant color customization for architectural applications, including precast facades, decorative panels, and premium tile installations.

-

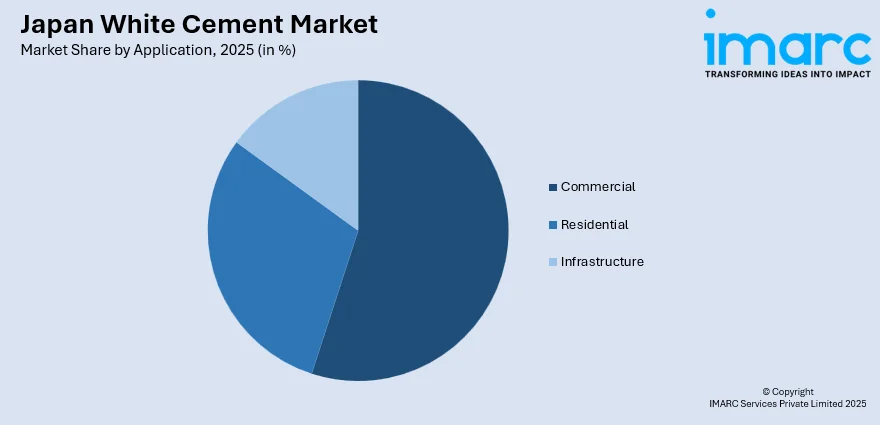

By Application: Commercial leads the market with a share of 54.74% in 2025, owing to extensive investment in office buildings, retail complexes, shopping centers, and hospitality establishments that prioritize aesthetic appeal and high-reflectivity finishes.

-

Key Players: Key players are expanding production capacities, improving product quality, and introducing advanced formulations that enhance durability and aesthetics. Their strong distribution networks, strategic partnerships with construction firms, and continuous innovations help boost market penetration and support steady demand across architectural and decorative applications.

To get more information on this market Request Sample

The Japan white cement market is experiencing steady growth amid the nation's comprehensive urban transformation and infrastructure modernization programs. The ongoing large-scale redevelopment projects across Tokyo and Osaka are creating substantial demand for premium construction materials that combine structural integrity with visual sophistication. In January 2025, Mitsubishi UBE Cement Corporation invested USD 5 Million in MCi Carbon, an Australian cleantech firm that was creating mineral carbonation technology for carbon capture and use. This reflects the industry's commitment to sustainable production methods while maintaining quality standards in Japan. The emphasis on earthquake-resistant construction, incorporating decorative concrete elements, continues to position white cement as a material of choice for architects and developers seeking both functionality and design excellence in Japan's evolving built environment.

Japan White Cement Market Trends:

Rising Demand for Sustainable and Eco-Friendly Construction Materials

The Japan white cement market is witnessing increased adoption of environmentally conscious building practices aligned with the government's carbon neutrality goals by 2050. Manufacturers are investing in low-emission production technologies and incorporating alternative raw materials to reduce environmental footprint. The growing emphasis on green building certifications is encouraging developers to specify sustainable materials for premium construction projects across commercial and residential sectors.

Growing Preferences for Decorative and High-Performance Architectural Finishes

Japanese architects and developers are increasingly specifying white cement for creating distinctive facades and interior finishes that reflect contemporary design aesthetics. The material's superior whiteness enables bright, consistent coloring when mixed with pigments, making it essential for terrazzo flooring, mosaic tiles, and precast architectural panels. The trend of employing parametric design and customized patterns in commercial buildings is driving the demand for white cement-based products that offer both visual appeal and structural durability.

Expansion of Mixed-Use Urban Development Projects

Japan's metropolitan areas are experiencing a surge in integrated commercial-residential developments that require premium finishing materials. The shift towards mixed-use complexes featuring retail, office, and hospitality components is creating diverse application opportunities for white cement in facades, decorative elements, and public spaces. As per IMARC Group, the Japan hospitality market size reached USD 24.6 Billion in 2025. The emphasis on creating aesthetically cohesive urban environments is reinforcing demand for high-quality cement products that enable design flexibility.

Market Outlook 2026-2034:

Continued investments in urban redevelopment, infrastructure modernization, and commercial construction activities will support market expansion. The market generated a revenue of USD 370.66 Million in 2025 and is projected to reach a revenue of USD 507.93 Million by 2034, growing at a compound annual growth rate of 3.56% from 2026-2034. The increasing focus on premium architectural finishes, coupled with government initiatives promoting resilient infrastructure development, is expected to generate substantial demand across application segments. Continuous innovations in color retention, surface smoothness, and strength performance further expand its application range.

Japan White Cement Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | White Portland Cement | 39.56% |

| Application | Commercial | 54.74% |

Type Insights:

- White Portland Cement

- White Masonry Cement

- Others

White Portland cement dominates with a market share of 39.56% of the total Japan white cement market in 2025.

White Portland cement holds prominence due to its exceptional attributes that meet diverse architectural requirements across construction applications. The segment's superior strength and durability make it the preferred choice for projects demanding high-performance concrete with consistent visual appearance.

The growing utilization of white Portland cement in precast architectural concrete, decorative facades, and tile installation applications continues to strengthen its market position. The material's ability to retain bright, uniform coloring when combined with pigments enables architects to achieve vibrant aesthetic effects in both interior and exterior applications. The expanding travel, hospitality, and retail industries, which prioritize premium finishes for brand differentiation, are generating sustained demand for white Portland cement products across major urban markets. In 2024, the count of inbound tourists hit 37 Million in Japan, easily exceeding the former peak of 32 Million in 2019.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Infrastructure

Commercial leads with a share of 54.74% of the total Japan white cement market in 2025.

The commercial segment maintains leadership in the Japan white cement market driven by extensive construction activity across office buildings, retail complexes, and hospitality establishments. The Japan commercial construction market reached USD 224.3 Billion in 2025, reflecting strong investment momentum that directly supports demand for premium finishing materials. The shift towards smart, mixed-use developments featuring modern architectural aesthetics is creating robust consumption patterns for white cement in facade systems and decorative applications.

Commercial developers increasingly specify white cement for projects requiring high-reflectivity surfaces, vibrant colored finishes, and sophisticated design elements that enhance brand identity and customer experience. The material's application in shopping malls, hotels, and corporate headquarters supports the segment's continued dominance. Government incentives promoting sustainable commercial construction and urban redevelopment policies are further accelerating adoption of white cement products that combine aesthetic excellence with environmental performance credentials across Japan's major metropolitan centers.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region represents a major share of Japan’s white cement market due to its dense population, large construction volume, and continuous redevelopment projects. High demand for premium architectural finishes, commercial complexes, and infrastructure upgrades strengthens regional consumption, making Kanto a key hub for white cement adoption.

The Kansai/Kinki Region benefits from steady construction in Osaka, Kyoto, and Kobe, driving consistent white cement usage. Renovation of heritage sites, growth in commercial real estate, and demand for aesthetic building materials support market expansion. Strong industrial activities and ongoing urban improvements also contribute to rising regional white cement consumption.

The Central/Chubu Region sees strong white cement demand driven by industrial clusters, transportation infrastructure, and manufacturing-related construction. Cities like Nagoya promote modern architectural designs requiring high-quality cement products. Public infrastructure upgrades, residential projects, and specialized construction applications further support stable regional growth in white cement consumption.

The Kyushu-Okinawa Region shows rising white cement use due to tourism-driven construction, resort development, and coastal infrastructure upgrades. Demand is supported by renovation of hotels, cultural facilities, and urban expansion across major cities. The region’s climatic needs also increase preference for durable and visually appealing cement-based structures.

The Tohoku Region’s white cement demand is shaped by reconstruction activities, public infrastructure development, and growth in residential projects. Harsh weather conditions encourage the use of durable, high-performance cement materials. Gradual urban redevelopment and investment in transport projects also strengthen the region’s white cement requirement.

The Chugoku Region experiences stable demand for white cement due to industrial development, port infrastructure expansion, and commercial construction. Architectural projects emphasizing aesthetic finishes further drive consumption. Growing modernization across cities, such as Hiroshima, supports steady use of high-quality cement products in both public and private construction.

The Hokkaido Region’s cold climate increases the need for durable, weather-resistant construction materials, boosting white cement usage. Public infrastructure maintenance, tourism-related development, and urban improvement projects drive consistent demand. The region’s focus on resilient housing and modern architectural designs also supports continued white cement adoption.

The Shikoku Region shows moderate but steady white cement demand, driven by regional infrastructure upgrades, local commercial projects, and small-scale manufacturing development. Tourism facilities and residential construction add to consumption. Growing interest in aesthetic building materials helps support white cement use across emerging urban and coastal development projects.

Market Dynamics:

Growth Drivers:

Why is the Japan White Cement Market Growing?

Rising Demand for Premium Architectural Aesthetics

The Japan white cement market is strongly driven by the growing preference for high-end architectural aesthetics across residential, commercial, and public buildings. White cement enables smooth finishes, decorative elements, and contemporary designs that align with Japan’s modern construction standards. Developers increasingly use it for facades, flooring, artistic structures, and interior applications that require clean, bright, and uniform surfaces. Its versatility also supports innovative architectural expressions in luxury homes, boutique hotels, retail spaces, and cultural facilities. With urban centers like Tokyo, Osaka, and Nagoya emphasizing visually appealing environments, white cement continues to gain relevance. Additionally, the rise of minimalist and light-toned design trends amplifies its use in both renovations and new developments. This sustained focus on aesthetic value significantly boosts ongoing demand, positioning white cement as a preferred material in Japan’s evolving construction landscape.

Expansion of Tourism-Oriented Construction and Hospitality Projects

Tourism remains a powerful catalyst for white cement demand in Japan, driven by steady investment in hospitality and cultural infrastructure. As per the Japan National Tourism Organization (JNTO), the projected count of international visitors to Japan in September 2025 was 3,266,800 (+13.7% from 2024). New hotels, resorts, museums, retail districts, and entertainment venues require modern and visually appealing designs, for which white cement is ideal. Its ability to deliver premium finishes, durable exteriors, and versatile decorative elements makes it a staple material in tourism-oriented projects. Coastal regions, historical cities, and major travel hubs increasingly adopt white cement in walkways, plazas, recreational facilities, and landmark structures. Renovation of older tourist attractions and traditional buildings also boosts usage, as white cement enhances durability while retaining aesthetic beauty. As Japan continues to attract global visitors and expand facilities for international events, the demand for high-quality construction materials, especially those supporting elegant and minimalist design, remains strong, propelling market growth.

Rising Adoption in Prefabricated and Modular Construction

Japan’s shift towards prefabricated and modular construction methods is contributing to greater use of white cement. As per IMARC Group, the Japan modular construction market size reached USD 18.1 Billion in 2025. Prefab components for walls, panels, tiles, and architectural details often rely on white cement formulations that offer consistent quality, clean appearance, and easy customization. These materials support fast construction timelines, design efficiency, and low-maintenance requirements. Additionally, white cement enhances the structural and visual quality of factory-made building elements, making them suitable for urban housing, commercial facilities, and public infrastructure. Manufacturers are incorporating white cement into high-performance composites, decorative precast units, and energy-efficient façade systems. As modular construction is gaining traction due to cost-effectiveness, reduced waste, and sustainability benefits, the demand for reliable, aesthetically superior materials continues to rise. This shift directly supports white cement growth in both metropolitan and regional construction markets.

Market Restraints:

What Challenges the Japan White Cement Market is Facing?

Higher Production Costs Compared to Conventional Cement

White cement manufacturing requires specialized raw materials with minimal iron and manganese content, resulting in elevated production costs. The stringent quality requirements and controlled manufacturing processes contribute to price premiums that limit adoption in cost-sensitive construction segments.

Declining Domestic Construction Activities in Rural Regions

Japan's demographic challenges, including population decline and aging demographics, are reducing construction demand in rural and secondary cities. The concentration of development activities in major metropolitan areas limits geographic expansion opportunities for white cement suppliers.

Competition from Alternative Decorative Finishing Materials

Competition from alternative decorative finishing materials is affecting the Japan white cement market by offering designers and builders more versatile, cost-efficient, and low-maintenance options, such as resin coatings, ceramics, and engineered stones. These substitutes often provide wider color choices, smoother finishes, and faster installation, making them attractive for modern interiors. As a result, white cement faces reduced demand in premium decorative applications, pushing manufacturers to innovate and reposition their products to stay competitive.

Competitive Landscape:

The Japan white cement market exhibits a moderately consolidated competitive structure characterized by established domestic manufacturers and selective participation from international specialty producers. Market participants compete through product quality differentiation, technical service capabilities, and distribution network strength. Companies are investing in sustainable production technologies and developing low-emission formulations aligned with Japan's environmental objectives. Strategic partnerships between cement producers and construction materials distributors facilitate market access across regional segments. Innovation focus areas include enhanced durability properties, improved workability characteristics, and expanded color customization options that address evolving architectural specifications.

Japan White Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | White Portland Cement, White Masonry Cement, Others |

| Applications Covered | Residential, Commercial, Infrastructure |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan white cement market size was valued at USD 370.66 Million in 2025.

The Japan white cement market is expected to grow at a compound annual growth rate of 3.56% from 2026-2034 to reach USD 507.93 Million by 2034.

White Portland cement represented the largest segment with market share of 39.56%, driven by its superior strength, durability, and consistent whiteness for architectural applications.

Key factors driving the Japan white cement market include accelerating urban redevelopment initiatives, expanding commercial construction investment, growing emphasis on earthquake-resistant decorative construction, and increasing demand for premium architectural finishes.

Major challenges include higher production costs compared to conventional cement, declining construction activities in rural regions due to demographic changes, competition from alternative decorative finishing materials, and supply chain constraints affecting raw material availability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)