Jet Fuel Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition

Jet Fuel Price Trend, Index and Forecast

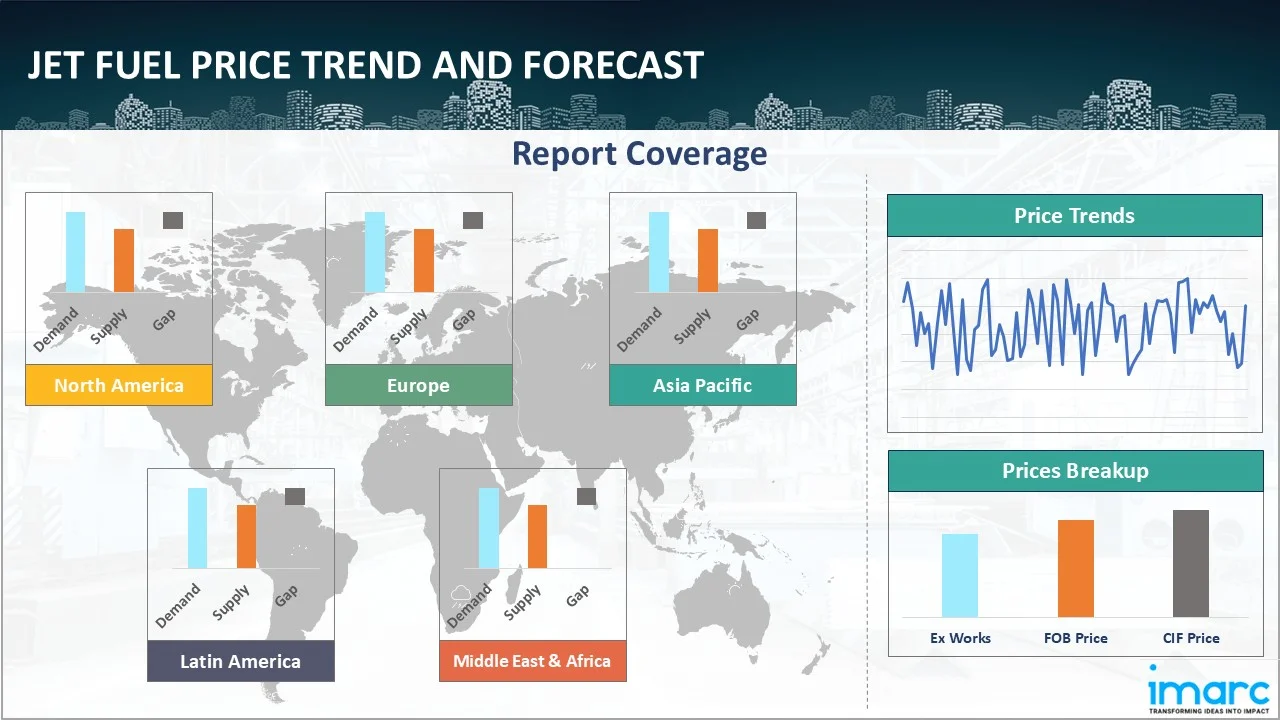

Track the latest insights on jet fuel price trend and forecast with detailed analysis of regional fluctuations and market dynamics across North America, Latin America, Central Europe, Western Europe, Eastern Europe, Middle East, North Africa, West Africa, Central and Southern Africa, Central Asia, Southeast Asia, South Asia, East Asia, and Oceania.

Jet Fuel Prices Outlook Q3 2025

- USA: USD 2.149/Gallon

- United Kingdom: USD 2.095/Gallon

- Japan: USD 2.080/Gallon

- Brazil: USD 2.138/Gallon

- Belgium: USD 2.093/Gallon

Jet Fuel Price Chart

Get real-time access to monthly/quarterly/yearly prices Request Sample

During the third quarter of 2025, the jet fuel prices in the USA reached 2.149 USD/Gallon in September. Prices increased from the previous quarter as refiners dealt with tighter supply arising from fluctuating crude procurement and periodic maintenance at several Gulf Coast facilities. Strong domestic flight activity and persistent aviation demand elevated procurement levels, while weather-related disruptions affected distribution schedules across major terminals.

During the third quarter of 2025, the jet fuel prices in the United Kingdom reached 2.095 USD/Gallon in September. Prices rose relative to the earlier quarter as suppliers navigated constrained refinery output and intermittent North Sea feedstock variability. Airline demand remained firm, particularly due to heightened travel volumes. Importers also faced higher logistics and handling costs associated with shifting supply routes and longer maritime transit patterns.

During the third quarter of 2025, the jet fuel prices in Japan reached 2.080 USD/Gallon in September. Prices increased compared with the second quarter as refiners managed fluctuating input availability and rising regional aviation consumption. Flight operations saw continued recovery, prompting more consistent sourcing from domestic and imported streams. Tightness in some East Asian supply chains also contributed to a more active purchasing environment among aviation fuel distributors.

During the third quarter of 2025, the jet fuel prices in Brazil reached 2.138 USD/Gallon in September. Prices moved higher than in the previous quarter due to constrained refinery throughput and shifting crude intake patterns. Demand from both domestic carriers and international routes strengthened. Regional distribution networks also encountered seasonal logistics challenges, prompting heightened tactical buying among aviation suppliers.

During the third quarter of 2025, the jet fuel prices in Belgium reached 2.093 USD/Gallon in September. Prices increased from the previous quarter as importers faced longer lead times for maritime shipments and higher freight-linked expenses. European aviation activity remained steady, supporting procurement volumes. Refinery maintenance schedules in nearby regions also contributed to reduced short-term flexibility for resupply.

Jet Fuel Prices Outlook Q2 2025

- USA: USD 2.102/Gallon

- United Kingdom: USD 2.036/Gallon

- Japan: USD 2.057/Gallon

- Brazil: USD 2.114/Gallon

- Belgium: USD 2.036/Gallon

During the second quarter of 2025, the jet fuel prices in the USA reached 2.102 USD/Gallon in June. With supply relatively stable and demand outlook deteriorating, jet fuel prices trended lower through Q2. Buyers held off on long-term contracts, expecting further declines. Trump’s steep, wide-ranging tariffs disrupted global trade flows and confidence. These tariffs hit cross-border shipping and supply chains, directly affecting air freight and indirectly undermining business travel demand, reinforcing expectations of weaker fuel consumption. The combination of these factors led to soft spot buying in jet fuel markets, pushing refiners to discount to offload inventories.

During the second quarter of 2025, jet fuel prices in the United Kingdom reached 2.036 USD/Gallon in June. As per the jet fuel price chart, prices in the UK were significantly affected by the implementation of Sustainable Aviation Fuel blending mandate. This policy shift, while numerically modest, carried major cost and supply implications. UK refiners and fuel suppliers passed those costs on to airlines, which in turn nudged jet fuel contract prices up across the board. Some fuel procurement contracts were restructured to accommodate variable SAF costs, breaking with traditional fixed-term pricing models.

During the second quarter of 2025, the jet fuel prices in Japan reached 2.057 USD/Gallon in June. Conventional jet fuel prices in Japan stayed firm, supported by stable kerosene crack spreads and slow progress in SAF deployment. There was no significant shift in blended jet fuel pricing in Q2, as SAF remained a negligible part of total supply due to cost. Moreover, airlines continued to rely on imports of conventional jet fuel or foreign SAF from cheaper sources.

During the second quarter of 2025, the jet fuel prices in Brazil reached 2.114 USD/Gallon in June. Jet fuel prices in Brazil were influenced by Petrobras’s decision to reduce its average jet fuel prices to distributors, starting 1st June. The price reduction came at a time when fuel costs were already under pressure from global crude dynamics. Moreover, carriers operating within Brazil, particularly domestic routes, experienced a drop in fuel expenditure during the latter half of Q2. This helped improve short-term margins, which were squeezed earlier in the quarter by currency depreciation and global oil price volatility.

During the second quarter of 2025, the jet fuel prices in Belgium reached 2.036 USD/Gallon in June. The EU’s tightening biofuel blend requirements affected jet fuel economics. Belgium, aligned with EU mandates and began sourcing higher-cost SAF (sustainable aviation fuel) to meet blend targets. The small but growing SAF share nudged average costs upward, particularly for carriers operating international routes. Besides, refinery maintenance schedules also impacted local supply.

Regional Coverage

The report provides a detailed analysis of the market across different regions, each with unique pricing dynamics influenced by localized market conditions, supply chain intricacies, and geopolitical factors. This includes price trends, price forecast and supply and demand trends for each region, along with spot prices by major ports. The report also provides coverage of FOB and CIF prices, as well as the key factors influencing the jet fuel prices.

Europe Jet Fuel Price Trend

Q3 2025:

As per the jet fuel price index, markets across Europe experienced a firmer pricing environment driven by resilient aviation demand and tighter supply from several refineries undergoing scheduled maintenance. Longer shipping durations for imported product, combined with fluctuating crude sourcing patterns, influenced procurement planning across Western and Central European hubs. Airports with higher international passenger volumes registered increased fueling activity, prompting distributors to balance inventories more carefully. The region also experienced shifts in cross-border transport flows as suppliers diversified intake routes to mitigate logistical constraints.

Q2 2025:

The announcement of Germany’s draft bill in Q2 added a clear financial penalty to non-compliance with future e-SAF obligations. This shifted sentiment in the spot market. Buyers and sellers began pricing in future regulatory burdens. While this did not drive an immediate spike in jet fuel prices, it nudged forward contract pricing and hedging activity as fuel producers reassessed their cost structures. The immediate market was still driven by seasonal demand recovery, refinery output, and crude oil trends.

This analysis can be extended to include detailed jet fuel price information for a comprehensive list of countries.

| Region | Countries Covered |

|---|---|

| Europe | Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece, among other European countries. |

North America Jet Fuel Price Trend

Q3 2025:

As per the jet fuel price index, North America saw firmer price trends as carriers operated fuller flight schedules and refiners managed intermittent feedstock variability. Gulf Coast and West Coast terminals reported stronger offtake, which required more frequent coordination of supply allocations. Transport bottlenecks in certain inland regions contributed to variations in regional deliveries. Aviation hubs with heavy long-haul traffic exerted additional pressure on local fuel distributors, prompting more strategic balancing of inventories across supply points.

Q2 2025:

Jet fuel prices in North America during Q2 2025 were under pressure from several directions. Despite a seasonal rise in airline consumption, prices slid due to ample refinery output, weak oil benchmarks, and disciplined buying. The month-on-month rise in consumption in May did not trigger higher prices because it was countered by a drop in per-gallon cost and stable supply. As a result, overall market tone remained soft, with no pricing breakout even as travel season picked up.

Specific jet fuel prices and historical data within the United States and Canada can also be provided.

| Region | Countries Covered |

|---|---|

| North America | United States and Canada |

Middle East and Africa Jet Fuel Price Trend

Q3 2025:

As per the jet fuel price chart, the prices in the Middle East and Africa fluctuated due to a complex interplay of factors, primarily driven by supply chain disruptions, seasonal demand shifts, and geopolitical influences.

Q2 2025:

The report explores the jet fuel pricing trends and jet fuel price chart in the Middle East and Africa, considering factors like regional industrial growth, the availability of natural resources, and geopolitical tensions that uniquely influence market prices.

In addition to region-wise data, information on jet fuel prices for countries can also be provided.

| Region | Countries Covered |

|---|---|

| Middle East & Africa | Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries. |

Asia Pacific Jet Fuel Price Trend

Q3 2025:

Asia Pacific saw firm pricing as rising aviation activity across major travel corridors increased regional fuel consumption. Refiners in several markets navigated shifts in crude intake, influencing output distribution. Import-reliant economies in Southeast Asia faced variable arrival times for shipments, contributing to tighter inventory windows. Increased long-haul and regional flight frequencies forced distributors to refine stocking strategies. Overall, steady passenger growth and port congestion in key trade hubs contributed to strengthening procurement conditions.

Q2 2025:

Jet fuel prices in the Asia Pacific region during Q2 2025 were shaped by a muted recovery in demand, particularly due to slower international travel activity out of China and other parts of the region. A key drag was the decline in long-haul international flights, especially outbound travel from China. Consumers in China remained cautious with discretionary spending, and overseas trips were among the first to be scaled back. This sharply reduced the need for jet fuel, particularly the higher volumes associated with long-haul routes. Besides, the additional developments in Indonesia and continued aircraft efficiency gains had a reinforcing effect on the already soft jet fuel market in Asia Pacific. In June 2025, seat capacity on domestic and international flights in Indonesia dropped. This helped extend the price weakness that began earlier in the year, discouraging bullish positioning and keeping jet fuel firmly under pressure across key regional benchmarks.

This jet fuel price analysis can be expanded to include a comprehensive list of countries within the region.

| Region | Countries Covered |

|---|---|

| Asia Pacific | China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries. |

Latin America Jet Fuel Price Trend

Q3 2025:

Latin America's jet fuel market is predominantly influenced by its rich natural reserves, particularly in countries like Chile and Brazil. However, political instability and inconsistent regulatory frameworks can lead to significant volatility in jet fuel prices.

Q2 2025:

Infrastructure challenges and logistical inefficiencies often impact the supply chain, affecting Latin America’s ability to meet international demand consistently. Moreover, the jet fuel price index, economic fluctuations, and currency devaluation are critical factors that need to be considered when analyzing jet fuel pricing trends in this region.

This comprehensive review can be extended to include specific countries within the region.

| Region | Countries Covered |

|---|---|

| Latin America | Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin American countries. |

Jet Fuel Pricing Report, Market Analysis, and News

IMARC's latest publication, “Jet Fuel Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition,” presents a detailed examination of the jet fuel market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of jet fuel at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed jet fuel price trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting jet fuel pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Jet Fuel Industry Analysis

The global jet fuel industry size reached USD 194.72 Billion in 2025. By 2034, IMARC Group expects the market to reach USD 471.31 Billion, at a projected CAGR of 10.32% during 2026-2034. Growth is supported by the continued expansion of commercial aviation, rising passenger traffic, increasing long-haul flight operations, and broader economic recovery that strengthens airline fuel demand worldwide.

Latest News and Developments:

- November 2025: LanzaJet achieved a milestone by reportedly producing the world’s first commercial-scale jet fuel from ethanol at its Freedom Pines Fuels plant in Soperton, Georgia. The facility’s success validates that ethanol can serve as a viable feedstock for aviation-grade fuel and marks a major leap in sustainable aviation fuel adoption.

Product Description

Jet fuel is a type of aviation fuel designed specifically for aircraft powered by gas-turbine engines, such as commercial airliners, cargo planes, and military jets. It is a refined petroleum product, primarily composed of hydrocarbons, and manufactured to strict quality standards to ensure safety, performance, and consistency at high altitudes and varying temperatures.

The two main types of jet fuel are Jet A and Jet A-1, both used in civil aviation. Jet A-1, the most commonly used globally, has a lower freezing point and is preferred for international flights. Military aircraft typically use a different variant known as JP-8, which includes additives for corrosion resistance and anti-icing. Jet fuel is favored for its high energy density and ability to perform reliably in extreme conditions. It must be clean-burning and stable, with properties that prevent engine issues like freezing or combustion instability. Traditionally, jet fuel is derived from crude oil, but there is a growing shift toward alternatives like Sustainable Aviation Fuel (SAF), made from renewable sources such as ethanol, waste oils, or algae. SAF is chemically similar to conventional jet fuel, allowing it to blend seamlessly with existing supply chains and aircraft systems, helping reduce carbon emissions without redesigning infrastructure.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Jet Fuel |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Ammonia Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, Peru* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of jet fuel pricing, covering global and regional trends, spot prices at key ports, and a breakdown of FOB and CIF prices.

- The study examines factors affecting jet fuel price trend, including input costs, supply-demand shifts, and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The jet fuel price charts ensure our clients remain at the forefront of the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)