Kraft Paper Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition

Kraft Paper Price Trend, Index and Forecast

Track the latest insights on kraft paper price trend and forecast with detailed analysis of regional fluctuations and market dynamics across North America, Latin America, Central Europe, Western Europe, Eastern Europe, Middle East, North Africa, West Africa, Central and Southern Africa, Central Asia, Southeast Asia, South Asia, East Asia, and Oceania.

Kraft Paper Prices Outlook Q4 2025

- China: USD 881/MT

- France: USD 1453/MT

- Argentina: USD 861/MT

- Thailand: USD 1003/MT

- United Kingdom: USD 1345/MT

Kraft Paper Price Chart

Get real-time access to monthly/quarterly/yearly prices Request Sample

During the fourth quarter of 2025, the kraft paper prices in China reached 881 USD/MT in December. Tighter availability of recycled fiber and persistent operational discipline among domestic producers drove the market's higher pricing momentum. Higher mill utilization and tougher negotiations were supported by Southeast Asia's continually increasing export demand. Production efficiency was nevertheless impacted by environmental compliance regulations, and inventory rotation was restricted by logistical issues at important ports.

During the fourth quarter of 2025, the kraft paper prices in France reached 1453 USD/MT in December. Due to low packaging demand from the food and consumer products industries, the market was under pressure to lower prices. Increased supplier competitiveness resulted from buyers delaying purchases due to high inventory levels across distribution channels. Domestic pricing sentiment was further impacted by reduced export activity within Europe.

During the fourth quarter of 2025, the kraft paper prices in Argentina reached 861 USD/MT in December. Prices declined amid subdued industrial activity and cautious purchasing behavior from end users. Currency volatility influenced import competitiveness, encouraging buyers to favor domestic supply while negotiating aggressively. Local producers faced pressure from reduced construction and agricultural packaging demand.

During the fourth quarter of 2025, the kraft paper prices in Thailand reached 1003 USD/MT in December. The market recorded price gains supported by healthy export demand and improved packaging consumption from the food and electronics sectors. Reduced inflows from competing regional suppliers tightened supply conditions. Rising input costs and steady mill operating rates strengthened sellers’ bargaining power.

During the fourth quarter of 2025, the kraft paper prices in the United Kingdom reached 1345 USD/MT in December. As demand from the retail and industrial packaging industries decreased, prices declined. Suppliers were under more pressure to compete due to high stock levels and little export prospects. In the face of greater economic uncertainty, buyers took a wait-and-see strategy. Suppliers put volume retention ahead of margin protection, despite the fact that production costs remained high.

Kraft Paper Prices Outlook Q3 2025

- China: USD 868/MT

- France: USD 1479/MT

- Argentina: USD 880/MT

- Thailand: USD 989/MT

- UK: USD 1365/MT

During the third quarter of 2025, the kraft paper prices in China reached 868 USD/MT in September. Prices declined due to a combination of domestic supply adjustments and slower industrial consumption. Key influencing factors included moderated demand from packaging and manufacturing sectors, temporary reductions in raw material availability, and operational efficiencies at local production facilities. Additional cost determinants included fluctuations in logistics, port handling delays, and regulatory compliance expenses. Currency stability helped mitigate extreme volatility in imported pulp costs.

During the third quarter of 2025, the kraft paper prices in France reached 1479 USD/MT in September. The price trend exhibited a downward movement, influenced by constrained demand from the industrial packaging and retail sectors. Supply-side considerations, including transportation adjustments and regional mill output, contributed to the moderation. European energy costs and port logistics played a role in overall cost structures. Compliance with EU chemical safety and environmental standards added incremental expense. The combination of stable production, moderate demand, and operational efficiency contributed to a decrease in prices during this quarter.

During the third quarter of 2025, the kraft paper prices in Argentina reached 880 USD/MT in September. Prices softened, primarily influenced by reduced industrial activity in paper-intensive sectors and shifts in local manufacturing demand. Supply-side factors such as regional pulp availability, transportation adjustments, and customs handling costs affected pricing. Currency fluctuations and domestic logistics costs were additional determinants. Compliance with regulatory and environmental standards contributed marginally to costs. Overall, market conditions resulted in a moderate reduction in kraft paper prices.

During the third quarter of 2025, the kraft paper prices in Thailand reached 989 USD/MT in September. Prices were influenced by balanced supply and demand conditions. Industrial consumption in packaging, food, and e-commerce sectors maintained a steady requirement for kraft paper. Supply factors, including regional mill outputs and logistics efficiency, stabilized costs. Regulatory compliance for product quality and environmental standards added nominal incremental costs.

During the third quarter of 2025, the kraft paper prices in the UK reached 1365 USD/MT in September. Prices reflected stable demand across industrial packaging and retail applications. Supply-side dynamics, including mill production capacity, domestic logistics, and port handling efficiency, maintained equilibrium. Costs related to regulatory compliance and environmental standards remained stable.

Kraft Paper Prices Outlook Q2 2025

- USA: USD 2,106/MT

- China: USD 1,130/MT

- France: USD 1,760/MT

- Argentina: USD 1,681/MT

- Brazil: USD 1,634/MT

During the second quarter of 2025, the kraft paper prices in the USA reached 2,106 USD/MT in June. In the United States, kraft paper prices in Q2 2025 were influenced by steady demand from the packaging and e-commerce sectors. Rising labor and transportation costs increased overall input expenses, while fluctuations in recovered paper supply created inconsistencies in raw material availability. Mill maintenance outages and logistical bottlenecks in rail and trucking networks contributed to delays in deliveries and production adjustments.

During the second quarter of 2025, kraft paper prices in China reached 1,130 USD/MT in June. In China, kraft paper pricing was affected by tight environmental regulations on recycled paper usage and emissions control, which impacted mill operations. Demand from the food packaging and export-oriented sectors remained strong, while port congestion and shipping container shortages disrupted imports of pulp. Additionally, fluctuations in electricity availability in industrial regions impacted production consistency and led to output scheduling challenges.

During the second quarter of 2025, the kraft paper prices in France reached 1,760 USD/MT in June. In France, kraft paper prices were shaped by elevated energy input costs, particularly electricity and natural gas used in pulping operations. The packaging and retail sectors sustained stable demand, but constrained fiber supply from domestic and cross-border sources impacted production costs. Ongoing labor-related disruptions in transportation and mill operations further affected supply chain continuity and material lead times.

During the second quarter of 2025, the kraft paper prices in Argentina reached 1,681 USD/MT in June. In Argentina, kraft paper prices were influenced by persistent inflationary pressure on labor and operational costs. Currency volatility impacted the pricing of imported raw materials, including pulp and chemicals. Demand from the agricultural packaging sector remained steady, while periodic power outages and transportation disruptions affected production stability. Regulatory shifts in export and import policies also created planning uncertainty among manufacturers.

During the second quarter of 2025, the kraft paper prices in Brazil reached 1,634 USD/MT in June. In Brazil, kraft paper pricing trends in Q2 2025 were affected by high domestic and international demand for sustainable packaging. Seasonal weather disruptions impacted forestry operations and pulp transportation, while rising fuel costs influenced logistics across production hubs. Demand from the food processing and consumer goods sectors remained elevated, and fluctuations in domestic pulp output created raw material availability issues for paper manufacturers.

Kraft Paper Prices Outlook Q1 2025

- USA: USD 2130/MT

- China: USD 1120/MT

- France: USD 1800/MT

- Argentina: USD 1650/MT

- Brazil: USD 1700/MT

During the first quarter of 2025, the kraft paper prices in the USA reached 2130 USD/MT in March. As per the kraft paper price chart, there was a slight decline in the market. New tariff rules upset pricing tactics, even if raw material prices remained mostly stable. Businesses raised prices to preserve margins as a result of weaker demand. However, due in large part to the consistent rise of internet retail, domestic demand remained stable.

During the first quarter of 2025, kraft paper prices in China reached 1120 USD/MT in March. There was an instability in the industry. Despite logistical delays and fluctuations in raw materials, producers were able to maintain consistent prices. The impact of weak traditional demand was lessened by the use of retail packaging, which was aided by digital commerce. Although mills changed their output to prevent stockpiling, cost pressures persisted because of fiber shortages and growing transportation costs.

During the first quarter of 2025, the kraft paper prices in France reached 1800 USD/MT in March. The market started 2025 with stable price patterns. Movement was aided by the demand for packaging, particularly from the FMCG and online retail industries. Short-term supply was impacted by delays in certain production sites caused by maintenance on their machinery. Buyers tolerated small changes despite rising raw material costs.

During the first quarter of 2025, the kraft paper prices in Argentina reached 1650 USD/MT in March. After a period of economic downturn, the paper products market began to stabilize, with opportunities emerging for growth in the packaging segment, influencing pricing trends.

During the first quarter of 2025, the kraft paper prices in Brazil reached 1700 USD/MT in March. Prices in Brazil were influenced by a combination of factors, including pulp prices, demand trends, and regional economic conditions. Besides, demand for paper products also played a crucial role in determining price trends.

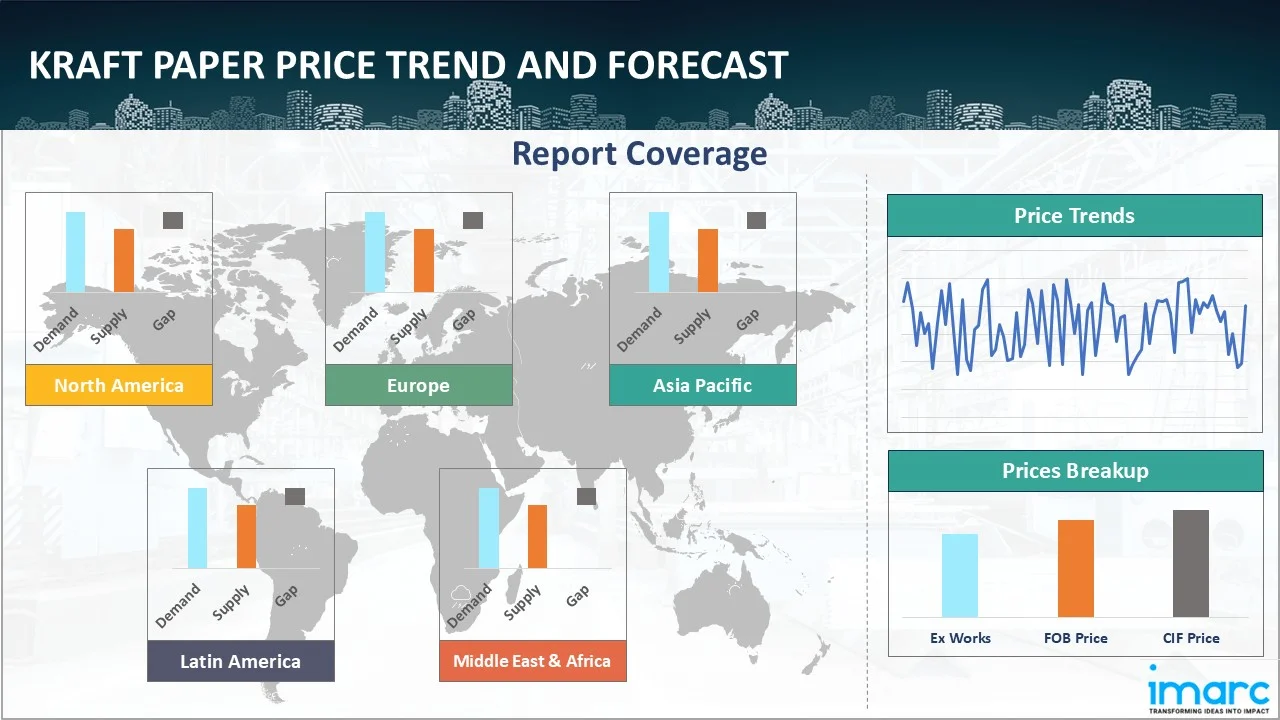

Regional Coverage

The report provides a detailed analysis of the market across different regions, each with unique pricing dynamics influenced by localized market conditions, supply chain intricacies, and geopolitical factors. This includes price trends, price forecast and supply and demand trends for each region, along with spot prices by major ports. The report also provides coverage of FOB and CIF prices, as well as the key factors influencing kraft paper prices.

Europe Kraft Paper Price Trend

Q4 2025:

Europe experienced a downward trend in kraft paper prices driven by persistent weakness in downstream demand across major packaging sectors. Reduced consumer spending and slower industrial output curtailed purchasing activity, prompting buyers to limit spot market participation. Elevated inventory levels across mills and distributors intensified competition, forcing suppliers to offer price concessions to secure volumes. Export opportunities remained constrained due to subdued global demand, further increasing domestic supply pressure.

Q3 2025:

During Q3 2025, the kraft paper price index in Europe reflected pressures from industrial and e-commerce packaging demand. Supply-side factors, such as limited raw pulp availability and processing capacities, affected production schedules. Operational costs, including domestic transport, port handling, and energy expenditures, influenced pricing. Compliance with environmental and sustainability certifications contributed to incremental costs. Currency fluctuations among European currencies further shaped pricing across the region.

Q2 2025:

As per the kraft paper price index, European kraft paper prices in Q2 2025 were influenced by increased energy costs and stricter environmental compliance measures across the paper manufacturing sector. Limited availability of recycled fiber and disruptions in cross-border logistics created supply chain inefficiencies. Steady demand from the retail packaging and foodservice sectors maintained pressure on mill capacities, while labor shortages in the transportation and production sectors further constrained output and distribution.

Q1 2025:

As per the kraft paper price index, the market recorded a mild price increase through Q1 2025, hinting at renewed momentum after stagnation. Strong activity in e-commerce and consistent demand for wrapping and inner packaging kept order books active. Raw material scarcity nudged prices higher, which the market seemed ready to absorb. Some domestic production hiccups created slight delays in exports, but these were not enough to derail market balance.

This analysis can be extended to include detailed kraft paper price information for a comprehensive list of countries.

| Region | Countries Covered |

|---|---|

| Europe | Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece, among other European countries. |

North America Kraft Paper Price Trend

Q4 2025:

The kraft paper price index in North America demonstrated varied trends reflecting a well-balanced market structure. Producers maintained disciplined operating rates, preventing oversupply while ensuring consistent material availability. Downstream demand from discretionary sectors remained cautious due to restrained consumer spending and inventory optimization efforts. However, stable consumption from food packaging, pharmaceuticals, and other essential goods provided a reliable demand base that supported price levels. Efficient transportation networks and predictable logistics performance minimized disruptions and prevented unexpected cost escalations.

Q3 2025:

During Q3 2025, the kraft paper price index in North America was influenced by sustained industrial and retail packaging demand. Supply-chain challenges, including domestic production capacity and import dependency, impacted costs. Logistics, storage, and distribution expenses contributed to overall pricing. Energy consumption in manufacturing and regulatory compliance requirements for safety and environmental standards further influenced the market. Currency stability and import-export considerations affected regional price levels.

Q2 2025:

As per the kraft paper price index, in North America, kraft paper pricing was impacted by fluctuations in the availability of recovered paper and higher transportation costs driven by fuel price variability. The packaging and industrial supply sectors maintained consistent demand, while extended maintenance shutdowns at certain mills affected supply volumes. Forest product harvesting delays and port congestion also contributed to longer lead times and higher input costs for manufacturers.

Q1 2025:

The market saw a minor downturn at the beginning of 2025. The incoming administration's policy changes, particularly those pertaining to tariffs, caused cost-related issues for manufacturers even while raw material prices remained stable. Consumer goods manufacturers raised prices to stay profitable in the face of weak demand. Purchasing activity was impacted by seasonal lulls, as packaging clients placed few large purchases. Nonetheless, the steady movement in digital sales was maintained by the increasing impact of e-commerce.

Specific kraft paper prices and historical data within the United States and Canada can also be provided.

| Region | Countries Covered |

|---|---|

| North America | United States and Canada |

Middle East and Africa Kraft Paper Price Trend

Q4 2025:

The report explores the kraft paper trends and kraft paper chart in the Middle East and Africa, considering factors like regional industrial growth, the availability of natural resources, and geopolitical tensions that uniquely influence market prices.

Q3 2025:

As per kraft paper price chart, the prices in the Middle East and Africa fluctuated due to a complex interplay of factors, primarily driven by supply chain disruptions, seasonal demand shifts, and geopolitical influences.

Q2 2025:

A tight supply from refineries, exacerbated by maintenance rounds and unplanned outages, put pressure on prices. Simultaneously, demand from the agrochemical sector during the planting season contributed to price changes.

In addition to region-wise data, information on kraft paper prices for countries can also be provided.

| Region | Countries Covered |

|---|---|

| Middle East & Africa | Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries. |

Asia Pacific Kraft Paper Price Trend

Q4 2025:

Asia Pacific markets recorded bullish kraft paper pricing supported by a combination of demand strength and supply discipline. Export demand from major manufacturing hubs remained robust, particularly for packaging linked to consumer goods and electronics. Producers exercised caution in capacity utilization, avoiding excessive output and maintaining tight supply conditions. Rising input costs increased cost pressures along the value chain, encouraging suppliers to defend higher price levels.

Q3 2025:

During the third quarter of 2025, kraft paper prices in Asia Pacific reflected a mixed trend. China experienced declines due to weakened domestic demand, while a few nations maintained stable pricing supported by industrial and export consumption. Production costs, energy expenses, and logistics moderately influenced prices across the region. Regulatory compliance added minor cost increments, while adequate supply levels ensured price stability in major markets. Overall, Asia Pacific presented a balanced pricing environment with mild regional variations.

Q2 2025:

In the Asia Pacific region, kraft paper prices were shaped by high demand from the e-commerce, food packaging, and consumer goods sectors. Raw material costs fluctuated due to supply inconsistencies in wood pulp and recovered paper. Environmental restrictions in key producing countries impacted operational schedules at several mills, while regional shipping disruptions and container shortages affected timely procurement and delivery.

Q1 2025:

In the first quarter of 2025, the Indian kraft paper industry showed a mix of steadiness and difficulty. Although ongoing challenges in obtaining pulp and wood increased input costs, pricing trends stayed largely stable. In order to combat excess stock, a number of plants in Uttar Pradesh and the northern areas temporarily reduced their operations. Unviable pricing made exporters less appealing, which led to a focus on domestic markets.

This kraft paper price analysis can be expanded to include a comprehensive list of countries within the region.

| Region | Countries Covered |

|---|---|

| Asia Pacific | China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries. |

Latin America Kraft Paper Price Trend

Q4 2025:

Latin America experienced a clear downward trend in kraft paper prices driven primarily by weak industrial and manufacturing activity across key economies. Demand from construction, consumer goods, and export-oriented packaging segments softened, leading to reduced procurement volumes. Buyers remained cautious, prioritizing inventory drawdowns over new purchases, which intensified competitive pricing pressure among suppliers. Adequate regional supply availability further limited sellers’ ability to maintain price levels.

Q3 2025:

During the third quarter of 2025, kraft paper prices in Latin America showed a moderate downward trend. Argentina’s market experienced price decreases due to reduced demand in industrial and food packaging sectors. Local production remained stable, and transportation costs were moderate. Trade policies and currency fluctuations contributed marginally to price adjustments. Overall, sufficient supply combined with subdued consumption supported the downward pricing trend across the region.

Q2 2025:

In Latin America, kraft paper pricing dynamics were influenced by inflationary pressure on labor and fuel, along with variable pulp production due to adverse weather conditions. Demand from the agriculture and food packaging sectors remained resilient, while transportation bottlenecks and occasional regulatory changes in import-export processes created uncertainty for producers. Currency fluctuations also affected the cost of imported chemicals and production equipment.

Q1 2025:

As per the kraft paper price index, prices in Latin America experienced pressure due to increasing raw material and energy costs. This trend was particularly evident in Brazil, where the packaging sector's demand remained strong, and in Argentina, where domestic consumption showed signs of recovery. The fluctuations in costs were influenced by higher fiber and energy prices across the region.

This comprehensive review can be extended to include specific countries within the region.

| Region | Countries Covered |

|---|---|

| Latin America | Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin America countries. |

Kraft Paper Pricing Report, Market Analysis, and News

IMARC's latest publication, “Kraft Paper Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition,” presents a detailed examination of the kraft paper market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of kraft paper at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed kraft paper prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting kraft paper pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Kraft Paper Industry Analysis

The global kraft paper industry size reached USD 19.7 Billion in 2025. By 2034, IMARC Group expects the market to reach USD 32.5 Billion, at a projected CAGR of 5.47% during 2026-2034. The market is primarily driven by the increasing adoption of sustainable and recyclable materials, expansion of e-commerce and retail distribution, and infrastructure development.

Latest News and Developments:

- August 2025: Mondi introduced Ad/Vantage Smooth Brown Semi Extensible, a next-generation kraft paper designed to meet demanding industrial and packaging requirements. This innovative paper offers a unique combination of superior strength and flexibility, allowing it to withstand significant mechanical stress while maintaining structural integrity.

- October 2024: Lintec introduced an uncolored and unbleached variety of kraft paper to its range of water-repellent papers that prevent rainwater from penetrating. Lintec mainly suggested using it for the logistics industry as it is very well suited for processing into carrier bags and envelopes.

Product Description

Kraft paper is a durable and eco-friendly paper material produced through the kraft process, which involves the chemical conversion of wood into wood pulp. In this method, wood chips are treated with a mixture of sodium hydroxide and sodium sulfide to break down lignin and cellulose, resulting in strong and coarse brown paper. The term “kraft” comes from the German word for “strength,” reflecting the material’s high tear resistance and tensile strength. Kraft paper is available in both bleached and unbleached forms, with unbleached kraft paper being the more environmentally friendly option due to its minimal processing.

Widely used in packaging and industrial applications, kraft paper is valued for its toughness, flexibility, and recyclability. It is commonly used to manufacture paper bags, wrapping materials, envelopes, cartons, and protective packaging. The material’s natural resistance to punctures and moisture also makes it suitable for food packaging and heavy-duty uses.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Kraft Paper |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Kraft Paper Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of kraft paper pricing, covering global and regional trends, spot prices at key ports, and a breakdown of FOB and CIF prices.

- The study examines factors affecting kraft paper price trend, including input costs, supply-demand shifts, and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The kraft paper price charts ensure our clients remain at the forefront of the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)