Kuwait PVC Pipes Market Size, Share, Trends and Forecast by Application, 2025-2033

Market Overview 2025-2033:

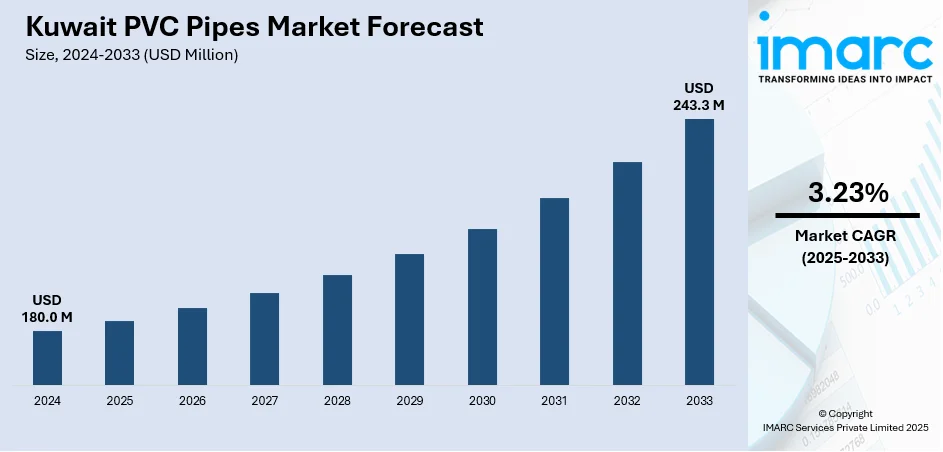

The Kuwait PVC pipes market size reached USD 180.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 243.3 Million by 2033, exhibiting a growth rate (CAGR) of 3.23% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 180.0 Million |

|

Market Forecast in 2033

|

USD 243.3 Million |

| Market Growth Rate (2025-2033) | 3.23% |

PVC or polyvinyl chloride pipes are lightweight, non-corrosive, cost-effective, and easy-to-install. They have high tensile strength and can withstand high fluid pressure, on account of which they have rapidly replaced conventional metal pipes in plumbing applications in Kuwait. These pipes also offer advantages such as smooth internal bore, a range of diameters and high impact strength due to which they are widely used in telephone ducting and electrical conduits in the country. They are also being utilized in sewage projects and water utility services.

To get more information on this market, Request Sample

Kuwait PVC pipes Market Trends:

Kuwait’s coast is located near one of the shallowest and most saline sections of the Arabian Gulf, owing to which the country depends on the desalination process for meeting its potable water requirements. As the continuous discharge from the desalination plants poses a potential threat to the marine environment, the government is constructing water treatment plants to mitigate the negative impact of the wastewater. These projects are expected to provide a positive thrust to the PVC pipes market growth in the region. Apart from this, the Kuwait Public Housing Authority is increasingly using PVC pipes in mega-housing projects to accommodate the growing population in the country.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Kuwait PVC pipes market report, along with forecasts for the period 2025-2033. Our report has categorized the market based on application.

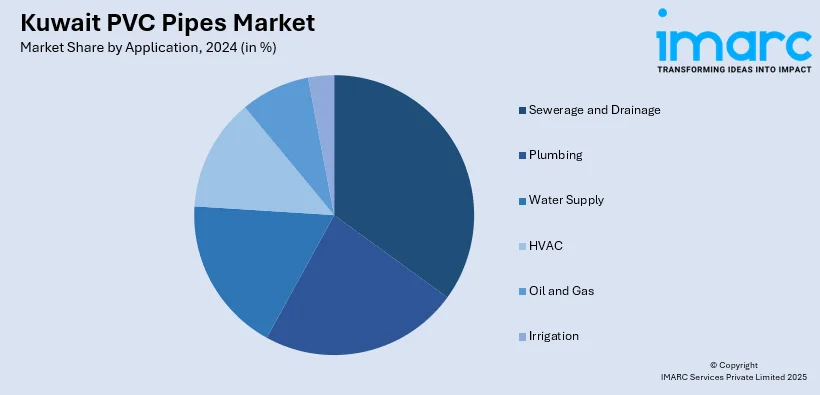

Breakup by Application:

- Sewerage and Drainage

- Plumbing

- Water Supply

- HVAC

- Oil and Gas

- Irrigation

Currently, sewerage and drainage represent the largest application segments as the Ministry of Public Works has been working to improve the sewerage and drainage infrastructure in Kuwait.

Competitive Landscape:

The competitive landscape of the Kuwait PVC pipes market has also been examined. Some of the leading players operating in the market are:

- Aladasani

- National Industries Company

- Khorafi Plastic Industries Co.

- Al Amal Company

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD, ‘000 Tons |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Applications Covered | Sewerage and Drainage, Plumbing, Water Supply, HVAC, Oil and Gas, Irrigation |

| Companies Covered | Aladasani, National Industries Company, Khorafi Plastic Industries Co. and Al Amal Company |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Kuwait PVC pipes market performed so far and how will it perform in the coming years?

- What are the key application segments in the Kuwait PVC pipes market?

- What has been the impact of COVID-19 on the Kuwait PVC pipes market?

- What are the price trends of PVC pipes?

- What are the various stages in the value chain of the Kuwait PVC pipes market?

- What are the key driving factors and challenges in the Kuwait PVC pipes market?

- What is the structure of the Kuwait PVC pipes market and who are the key players?

- What is the degree of competition in the Kuwait PVC pipes market?

- What are the profit margins in the Kuwait PVC pipes industry?

- What are the key requirements for setting up a PVC pipes manufacturing plant?

- How are PVC pipes manufactured?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)