Land Mobile Radio System Market Size, Share, Trends and Forecast by Type, Technology, Frequency, Application, and Region, 2025-2033

Land Mobile Radio System Market Size and Share:

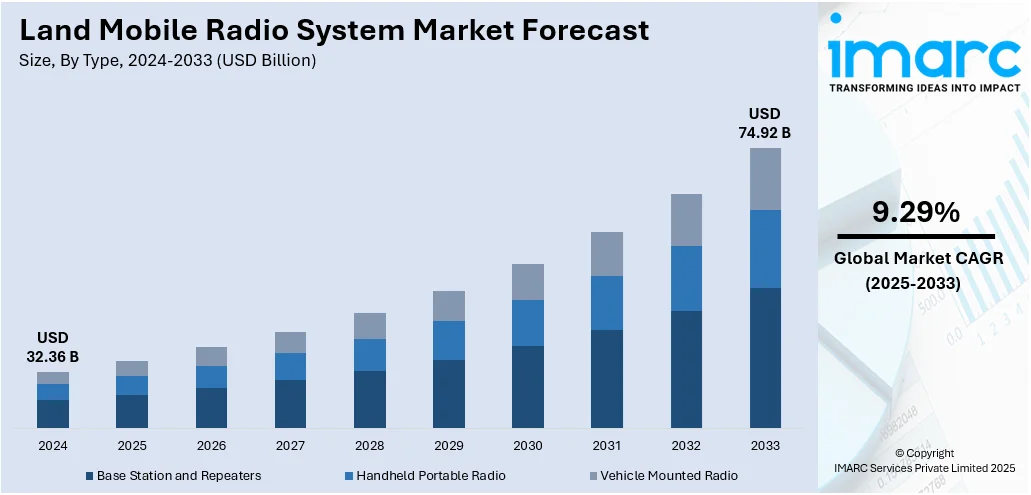

The global land mobile radio system market size was valued at USD 32.36 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 74.92 Billion by 2033, exhibiting a CAGR of 9.29% during 2025-2033. North America dominated the market in 2024, owing to strong public safety investments, advanced infrastructure, and widespread digital technology adoption. These factors are contributing to the land mobile radio system market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 32.36 Billion |

|

Market Forecast in 2033

|

USD 74.92 Billion |

| Market Growth Rate (2025-2033) | 9.29% |

The market is primarily driven by the growing need for reliable, secure, and real-time communication in sectors such as public safety, defense, transportation, and utilities. Governments and emergency response agencies rely on LMR systems for mission-critical communications due to their robustness and low latency. Technological advancements, such as the integration of digital LMR with LTE and broadband networks, are enhancing system capabilities, enabling better data and voice services. Additionally, the shift from analog to digital systems, improved interoperability, and increased investments in infrastructure are fueling the land mobile radio system market growth. Urbanization and rising concerns about public safety further contribute to demand. The market is also supported by regulations promoting standardized communication systems and the need for uninterrupted communication in remote or disaster-prone areas.

To get more information on this market, Request Sample

In the US, there is growing interest in compact repeater solutions that extend LMR coverage and enable seamless multiband interoperability. Enhanced communication capabilities across VHF, UHF, and 700/800 MHz are becoming essential, particularly for public safety and rescue missions operating in challenging environments with diverse radio frequency requirements. For instance, in April 2025, BK Technologies launched RelayONE, a portable repeater enhancing land mobile radio (LMR) range and multiband interoperability for first responders. The Larimer County Sheriff’s Office in Colorado made the first purchase, supporting search and rescue operations with improved VHF, UHF, and 700/800 MHz communications compatibility.

Land Mobile Radio System Market Trends:

Growing Adoption Driven by Expanding Transportation Needs

The land mobile radio system market outlook remains positive as global transportation networks continue to expand, particularly in aviation, driving the demand for efficient and secure communication solutions. Reliable voice and data systems play a vital role in coordinating operations, managing logistics, and ensuring safety across complex infrastructures. In environments where rapid response and constant connectivity are essential, land mobile radio systems are being increasingly utilized. Their ability to deliver clear, uninterrupted communication supports various functions, from routine coordination to emergency management. This shift reflects a broader movement toward upgrading communication frameworks in response to the evolving needs of large-scale mobility operations, especially in sectors where uninterrupted connectivity and operational reliability are critical for performance and safety. For example, the International Civil Aviation Organisation (ICAO) projected a yearly growth rate of 4.3%, indicating that passenger numbers could double by the mid-2030s.

Expansion of Mission-Critical Communication Infrastructure

There is a growing emphasis on enhancing mission-critical communication systems to support public safety and emergency services. Governments and agencies are increasingly investing in advanced land mobile radio solutions to strengthen operational coordination and response capabilities. Based on the land mobile radio system market forecast, these systems are expected to offer secure, real-time communication essential for law enforcement, disaster management, and other public service functions. The move toward large-scale, city-wide deployments reflects the need for robust infrastructure that can support high user density and seamless connectivity. As urban centers face evolving security and logistical challenges, the adoption of integrated, resilient radio networks is becoming more prominent, enabling faster decision-making and improved inter-agency collaboration across diverse operational scenarios. For instance, the Government of NCT Delhi’s TETRA project, India’s largest, executed by TCIL in nine months, includes 54 base stations and 5,000 radios, primarily serving Delhi Police and other public safety agencies.

Rising Emphasis on Secure Communication Solutions

With increasing focus on safeguarding digital infrastructure, organizations worldwide are prioritizing secure communication across all operational layers. Public safety and critical services, in particular, are reinforcing their use of land mobile radio systems that offer encrypted, interference-free connectivity. As concerns over cyber threats and data breaches grow, the integration of secure communication platforms is becoming more widespread. These systems not only support operational efficiency but also provide the resilience needed against evolving security challenges. The broader shift toward investing in information protection underscores the value of trusted communication technologies, especially in sectors where the integrity of voice and data transmission is paramount for effective and safe operations. Land mobile radio system market trends reflect this increasing emphasis on security and reliability in communication networks. For example, global end user spending on information security is expected to reach USD 212 Billion in 2025, marking a 15.1% increase from 2024, according to a new forecast.

Land Mobile Radio System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global land mobile radio system market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, technology, frequency, and application.

Analysis by Type:

- Base Station and Repeaters

- Handheld Portable Radio

- Vehicle Mounted Radio

Handheld portable radio stood as the largest type in 2024. These devices offer crucial advantages such as mobility, ease of use, and instant push-to-talk communication, making them essential tools for first responders, military personnel, transportation workers, and utility service providers. Their compact size and ability to function reliably in harsh environments make them ideal for field operations, where quick and clear communication is critical. As public safety and disaster management efforts grow globally, the need for robust and portable communication tools continues to rise. Moreover, technological advancements in digital handheld radios, including better voice clarity, GPS integration, and extended battery life, are further accelerating their adoption. This growing reliance on portable radios is significantly propelling the overall growth of the LMR system market.

Analysis by Technology:

- Analog Technology

- Digital Technology

Digital technology was the most widely adopted technology in 2024. Digital LMR offers superior audio clarity, better signal coverage, and efficient spectrum usage, which are critical for mission-critical communications in sectors like public safety, defense, transportation, and utilities. Digital systems also enable advanced features such as GPS tracking, text messaging, encryption, and interoperability between different networks and devices. These capabilities enhance operational efficiency, coordination, and security, factors increasingly demanded by organizations managing emergency response, logistics, and infrastructure. Furthermore, the transition from analog to digital LMR is being supported by regulatory mandates and the need for scalable, future-ready communication infrastructure. As more industries modernize their communication systems, the digital technology segment continues to drive significant growth in the LMR market.

Analysis by Frequency:

- 25 MHz–174 MHz (VHF)

- 450 MHz–512 MHz (UHF)

- 700 MHz and Above (SHF)

700 MHz and above (SHF) stood as the highest frequency in 2024 due to its ability to support high-capacity, high-speed communication. Frequencies in the 700 MHz band offer an optimal balance between coverage and bandwidth, making them ideal for public safety, emergency services, and large-scale commercial operations. These bands allow for improved signal penetration in urban environments and better performance in congested areas. Additionally, SHF bands enable the deployment of advanced digital features such as real-time video transmission, location tracking, and data sharing, which are becoming essential for modern mission-critical communications. Government initiatives to allocate and utilize 700 MHz spectrum for public safety networks, such as FirstNet in the US, are further accelerating the demand for LMR systems operating in this frequency range, driving market growth.

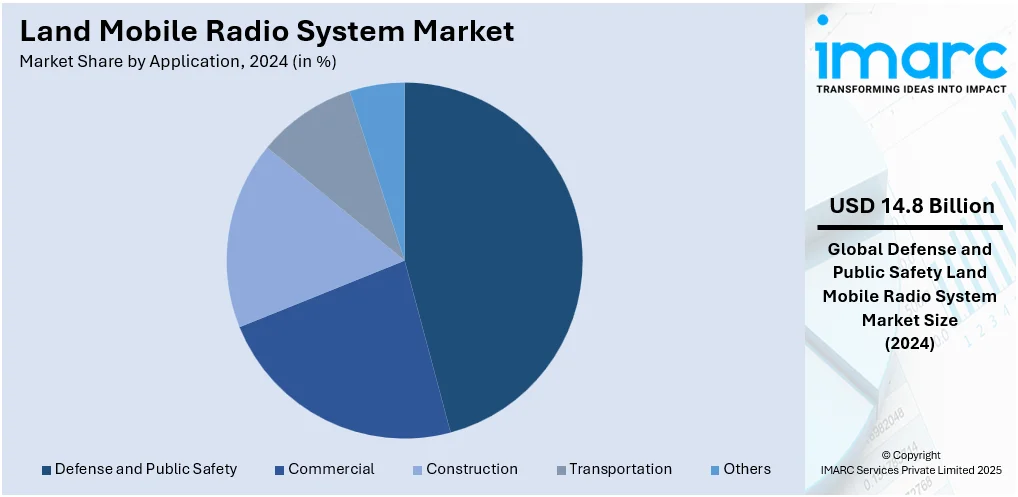

Analysis by Application:

- Defense and Public Safety

- Commercial

- Construction

- Transportation

- Others

Defense and public safety led the market in 2024, owing to its critical need for reliable, secure, and real-time communication. Military forces, law enforcement agencies, fire departments, and emergency medical services rely heavily on LMR systems for mission-critical operations where instant voice communication can mean the difference between life and death. LMR systems offer high durability, encrypted communication, and the ability to function in remote or disaster-affected areas where other networks may fail. As global threats such as terrorism, natural disasters, and civil unrest rise, governments are increasingly investing in modernizing their communication infrastructure. The integration of advanced digital LMR technologies—such as GPS, interoperability, and data transmission—further enhances coordination and operational efficiency, making defense and public safety a key driver of LMR market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share due to significant investments in public safety, defense, and emergency communication infrastructure. The region's strong emphasis on national security and rapid response capabilities has driven widespread adoption of advanced LMR technologies across law enforcement, fire services, and emergency medical services. The presence of leading LMR manufacturers and technology providers in the US and Canada further supports innovation and market growth. Additionally, government initiatives and funding programs, such as the US FirstNet project, have accelerated the deployment of interoperable and mission-critical communication systems. The transition from analog to digital LMR systems is well-advanced in the region, enabling better voice clarity, coverage, and data capabilities. High demand from transportation, utilities, and commercial sectors also contributes to North America's market leadership.

Key Regional Takeaways:

United States Land Mobile Radio System Market Analysis

The United States land mobile radio system market is primarily driven by the heightened focus on dependable emergency response communications, ensuring robust and uninterrupted connectivity for public safety agencies. In accordance with this, the rising frequency of natural disasters and severe weather conditions is compelling upgrades to resilient and redundant LMR infrastructure. As such, in 2024, NOAA reported 27 U.S. weather and climate disasters, each causing over USD 1 Billion in damage, totaling approximately USD 182.7 Billion and resulting in 568 deaths, just below the 2023 record of 28 events. The widespread adoption of multiband and software-defined radios, which enable greater interoperability across agencies and jurisdictions, is further propelling market growth. Similarly, the expansion of LMR applications in the transportation and logistics sectors, which augments demand for advanced dispatch and fleet coordination solutions, is impelling the market. The growing integration of LMR with LTE and broadband networks, creating hybrid communication systems, is driving operational efficiency for first responders. Additionally, increased federal funding and grants to modernize public safety communications are supporting new deployments. Moreover, continual advancements in portable and wearable LMR devices are enhancing field productivity and market coverage.

Europe Land Mobile Radio System Market Analysis

The European market is experiencing growth due to increased investments in upgrading critical public safety communication networks supported by national and EU-level funding initiatives. In line with this, growing cross-border security collaboration is augmenting demand for interoperable LMR systems that meet European standards. The heightened awareness of civil defense and disaster readiness driving the adoption of mission-critical radio networks is impelling the market. Furthermore, the region’s strong emphasis on secure and encrypted communications for defense and emergency services is propelling the market expansion. The expanding large-scale transport infrastructure, including railways and urban transit systems, is encouraging the deployment of reliable LMR solutions for operational safety. Accordingly, in July 2024, the EU invested a record EUR 7 Billion in 134 transport projects under the CEF, focusing on rail, waterways, ports, ITS, air traffic, and upgrades to Ukraine-EU cross-border infrastructure. Additionally, the rapid integration of TETRA and DMR standards in the utilities and industrial sectors is streamlining asset management and workforce coordination, thereby stimulating market appeal. Besides this, various smart city initiatives promoting resilient communication systems are expanding their market reach.

Asia Pacific Land Mobile Radio System Market Analysis

The Asia Pacific land mobile radio (LMR) System Market is experiencing significant growth, driven by the increasing demand for secure and reliable communication systems across various industries such as public safety, transportation, utilities, and defense. As such, India’s defence production has grown at an extraordinary pace since the launch of the "Make in India" initiative, reaching a record ₹1.27 lakh crore in FY 2023-24, with defence exports rising to an all-time high of ₹23,622 crore in FY 2024-25. LMR systems are essential for facilitating real-time communication among teams operating in critical environments, especially in emergency response and law enforcement operations. The market is also benefiting from technological advancements, including the integration of digital LMR systems with broadband networks, enhancing voice and data transmission capabilities. With the rise of smart cities and the growing need for public safety infrastructure, the Asia Pacific region is witnessing substantial investments in LMR technology. Furthermore, countries like China, India, Japan, and Australia are key contributors to this market’s growth due to their expanding industrial sectors and government initiatives focusing on improving communication networks for security and disaster management.

Latin America Land Mobile Radio System Market Analysis

In Latin America, the land mobile radio system market is growing due to increased investments in modernizing public safety and emergency response networks, especially in cities tackling higher crime rates. According to the IMF, crime directly costs the region more than 3 percent of GDP and lowers growth. In addition to this, the expansion of vital energy and mining industries is driving the adoption of reliable LMR systems to ensure seamless field communications in remote and challenging environments. Furthermore, supportive government initiatives to upgrade transportation infrastructure, including railways and ports, are strengthening market demand, which enhances operational safety and coordination. Moreover, the growing focus on secure, encrypted communications for public events and border control, encouraging interagency collaboration and situational awareness in Latin America, is creating a positive market outlook.

Middle East and Africa Land Mobile Radio System Market Analysis

The market is driven by the region's need for secure, reliable, and efficient communication systems across various sectors, including public safety, military, transportation, and utilities. In particular, the growing emphasis on enhancing public safety infrastructure and improving emergency response systems is propelling demand for LMR solutions. As the region faces challenges such as urbanization, political instability, and natural disasters, the adoption of LMR technology has become increasingly vital for government agencies and security organizations to ensure effective coordination and rapid response. The number of African countries rated high or extreme risk for civil unrest now stands at 37, up from 28 six years ago. Furthermore, the MEA market is seeing a shift towards digital LMR systems, with advancements in encryption, data transmission, and interoperability with other communication networks. Countries in the Middle East, such as the UAE, Saudi Arabia, and Qatar, are leading the market growth, driven by significant investments in defense, security, and infrastructure development projects.

Competitive Landscape:

The current land mobile radio (LMR) system market is witnessing significant developments through product launches, strategic partnerships, government initiatives, and research advancements. Companies are introducing advanced digital LMR systems with features like LTE integration, enhanced security, and improved audio quality. Strategic collaborations and agreements are increasingly common, allowing firms to expand interoperability and integrate LMR with broadband technologies. Governments worldwide are investing in public safety and emergency communication infrastructure, supporting the adoption of modern LMR systems. Additionally, contracts and funding from defense and law enforcement agencies are driving growth. Among these developments, partnerships and collaborations have emerged as the most common practice, as they enable faster innovation, better service delivery, and broader market reach in the evolving communications landscape.

The report provides a comprehensive analysis of the competitive landscape in the land mobile radio system market with detailed profiles of all major companies, including:

- BK Technologies

- Cisco Systems Inc.

- CODAN Limited

- Hytera Communications Corporation Limited

- JVCKenwood Corporation

- L3Harris Technologies Inc.

- Motorola Solutions Inc.

- Raytheon Technologies Corporation

- Simoco Wireless Solutions

- Tait Communications

- TE Connectivity Ltd.

- Thales Group

Latest News and Developments:

- June 2025: Anritsu launched an Auto Test and Alignment system for Motorola APX and APX NEXT P25 radios using the LMR Master S412E. Approved by Motorola, it automates RF testing and tuning, simplifies maintenance, generates detailed reports, and ensures peak radio performance for critical communications.

- May 2025: TTM Technologies launched five new high-performance RF components for telecom, test and measurement, and COTS Mil-Aero sectors. These include broadband transformers, hybrid couplers for land mobile radio (LMR) and VHF, and a cost-effective RF termination, all rigorously tested to enhance mobile infrastructure, radar, and Mil-Comms applications.

- March 2025: BK Technologies rebranded and expanded its SaaS Solutions unit under the BK ONE brand, launching interoperability-focused tools like InteropONE, LocateONE, and RelayONE. This move strengthens its land mobile radio (LMR) and broadband offerings, supporting unified, reliable communications for first responders during planned and emergency events.

- April 2025: SEL launched a land mobile radio (LMR) solution developed with Whitman County Emergency Management to improve emergency communications. The system enhances network security, monitoring, and timing for first responders, using advanced networking devices and satellite clocks, delivering clearer, more reliable calls than legacy systems.

Land Mobile Radio System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Base Station and Repeaters, Handheld Portable Radio, Vehicle Mounted Radio |

| Technologies Covered | Analog Technology, Digital Technology |

| Frequencies Covered | 25 MHz–174 MHz (VHF), 450 MHz–512 MHz (UHF), 700 MHz and Above (SHF) |

| Applications Covered | Defense and Public Safety, Commercial, Construction, Transportation, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BK Technologies, Cisco Systems Inc., CODAN Limited, Hytera Communications Corporation Limited, JVCKenwood Corporation, L3Harris Technologies Inc., Motorola Solutions Inc., Raytheon Technologies Corporation, Simoco Wireless Solutions, Tait Communications, TE Connectivity Ltd. and Thales Group |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the land mobile radio system market from 2019-2033.

- The land mobile radio system market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the land mobile radio system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The land mobile radio system market was valued at USD 32.36 Billion in 2024.

The land mobile radio system market is projected to exhibit a CAGR of 9.29% during 2025-2033, reaching a value of USD 74.92 Billion by 2033.

The land mobile radio system market is driven by increasing demand for reliable communication in the public safety, military, and transportation sectors. Key factors include technological advancements, growing need for mission-critical communication, interoperability, enhanced coverage, cost-effectiveness, and integration with LTE networks for improved data and voice communication capabilities.

North America dominated the land mobile radio system market in 2024 due to high public safety investments, advanced infrastructure, widespread adoption of digital technologies, and the strong presence of key industry players.

Some of the major players in the land mobile radio system market include BK Technologies, Cisco Systems Inc., CODAN Limited, Hytera Communications Corporation Limited, JVCKenwood Corporation, L3Harris Technologies Inc., Motorola Solutions Inc., Raytheon Technologies Corporation, Simoco Wireless Solutions, Tait Communications, TE Connectivity Ltd., Thales Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)