Latin America 5G Network Infrastructure Market Size, Share, Trends and Forecast by Component, Band, Deployment, and Country, 2025-2033

Latin America 5G Network Infrastructure Market Overview:

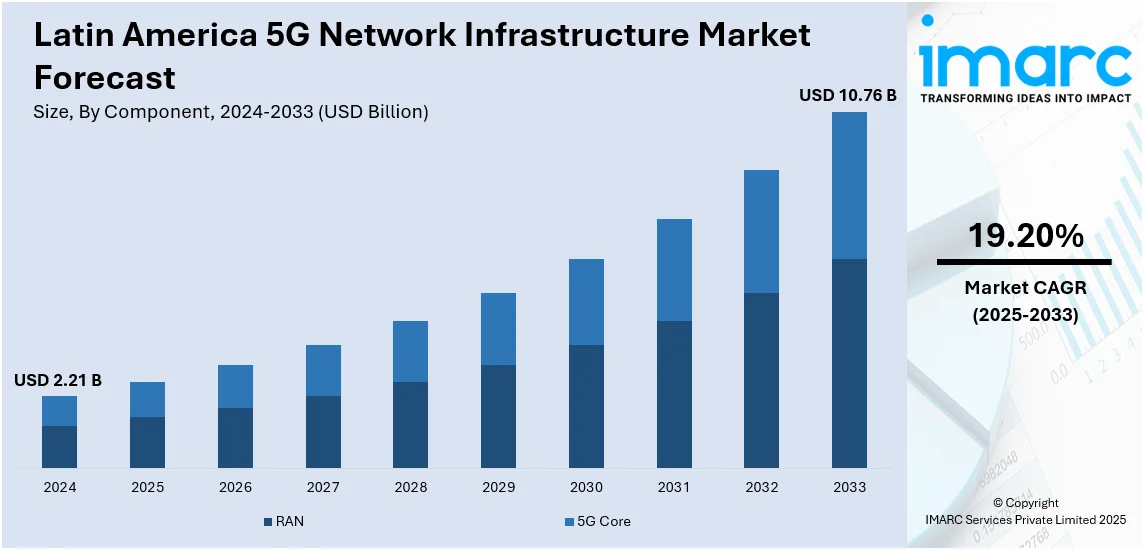

The Latin America 5G network infrastructure market size reached USD 2.21 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.76 Billion by 2033, exhibiting a growth rate (CAGR) of 19.20% during 2025-2033. The Latin America 5G network infrastructure market share is expanding, driven by the growing demand for high-speed mobile broadband, increasing implementation of government policies and public-sector initiatives, and rising shift towards digital transformation in industries, such as logistics, healthcare, agriculture, and manufacturing.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.21 Billion |

| Market Forecast in 2033 | USD 10.76 Billion |

| Market Growth Rate (2025-2033) | 19.20% |

Latin America 5G Network Infrastructure Market Trends:

Rising Demand for High-Speed Mobile Broadband

The increasing demand for high-speed mobile broadband is impelling the Latin America 5G network infrastructure market growth. With mobile Internet becoming essential in everyday life, people and companies are looking for quicker and more dependable connections, which 5G technology can offer. This requirement is visible in nations, such as Brazil, Mexico, and Argentina, where city dwellers are seeking fast Internet, and the adoption of smartphones is growing significantly. Additionally, offerings within the 5G infrastructure domain like radio access networks (RAN) and large multiple-input multiple-output (MIMO) antennas are being swiftly implemented to meet this demand. For example, in 2024, TIM Brasil collaborated with Nokia to improve its 5G radio access network (RAN) coverage in 15 Brazilian states starting January 2025. TIM recognized key areas needing enhancement, such as comprehensive visibility, automation, and network performance.

Government Initiatives and Policy Support for Digital Infrastructure

Government policies and public-sector initiatives are offering a favorable Latin America 5G network infrastructure market outlook. Government agencies in key countries, including Brazil, Chile, and Colombia, are implementing regulatory frameworks and financial incentives to attract investments in 5G infrastructure. For instance, in 2024, Brazilian President, Luiz Inácio Lula da Silva welcomed Mexican businessman, Carlos Slim, the founder and chairman of the América Móvil Group - Grupo América Móvil (AMX), to discuss about the growth of optic fiber and 5G networks in Brazil. They also talked about chances for business collaborations in the telecommunications industry and the enhancement of Brazil's economic landscape. These government initiatives not only provide the spectrum needed for 5G but also encourage telecom operators to wager on both the core and edge infrastructure required to support advanced 5G applications. Core network infrastructure, which includes products and services like cloud-native cores and network slicing technology, is gaining traction due to its capability to optimize network performance and reduce latency for end-users.

Industrial and Enterprise Digital Transformation

The rapid digital transformation in industries like logistics, healthcare, manufacturing, and agriculture is creating the need for robust 5G network infrastructure in Latin America. Enterprises are increasingly adopting Industry 4.0 technologies, such as artificial intelligence (AI), the Internet of Things (IoT), and machine learning (ML), which require reliable and high-speed connectivity. To support these industries, telecom providers are focusing on products and services tailored to enterprise needs, such as private 5G networks and edge computing solutions. For example, in 2024, Brazilian mobile operator TIM partnered with Nokia to deploy a private 5G network at Brazil’s Santos port. The project entailed the installation of eight sites (antennas and related equipment) for the coverage of Brasil Terminal Portuário’s (BTP’s) terminal area, along with Nokia’s Digital Automation Cloud (DAC) platform.

Latin America 5G Network Infrastructure Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on component, band, and deployment.

Component Insights:

- RAN

- 5G Core

The report has provided a detailed breakup and analysis of the market based on the components. This includes RAN and 5G core.

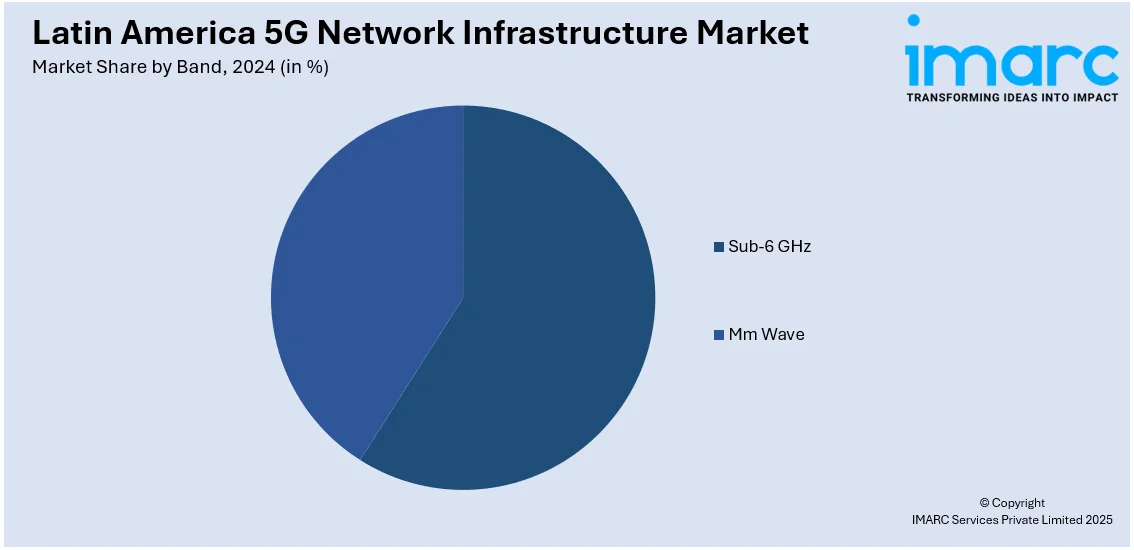

Band Insights:

- Sub-6 GHz

- Mm Wave

A detailed breakup and analysis of the market based on the bands have also been provided in the report. This includes sub-6 GHz and Mm wave.

Deployment Insights:

- Standalone

- Non- Standalone

The report has provided a detailed breakup and analysis of the market based on the deployments. This includes standalone and non- standalone.

Country Insights:

- Brazil

- Mexico

- Argentina

- Columbia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Columbia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America 5G Network Infrastructure Market News:

- In October 2024, Nokia and Radiográfica Costarricense SA revealed that they had launched the first 5G standalone network in Costa Rica, Brazil. The initiative sought to deliver high-speed, low-latency 5G connectivity to vital urban areas like San Jose, Cartago, and Limon, as well as rural regions throughout the nation, representing a significant advancement in Costa Rica's digital transformation.

- In January 2024, Telecom Argentina released its strategy to broaden its 5G standalone network in Argentina, activating 68 5G antennas operating in the 3.5 GHz band in various cities nationwide. It also stated it was the first provider in the nation to introduce 5G standalone technology.

Latin America 5G Network Infrastructure Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | RAN, 5G Core |

| Bands Covered | Sub-6 GHz, Mm Wave |

| Deployments Covered | Standalone, Non- Standalone |

| Countries Covered | Brazil, Mexico, Argentina, Columbia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America 5G network infrastructure market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America 5G network infrastructure market on the basis of component?

- What is the breakup of the Latin America 5G network infrastructure market on the basis of band?

- What is the breakup of the Latin America 5G network infrastructure market on the basis of deployment?

- What are the various stages in the value chain of the Latin America 5G network infrastructure market?

- What are the key driving factors and challenges in the Latin America 5G network infrastructure?

- What is the structure of the Latin America 5G network infrastructure market and who are the key players?

- What is the degree of competition in the Latin America 5G network infrastructure market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America 5G network infrastructure market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America 5G network infrastructure market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America 5G network infrastructure industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)