Latin America Agricultural Equipment Market Size, Share, Trends and Forecast by Equipment, Application, and Region, 2026-2034

Latin America Agricultural Equipment Market Overview:

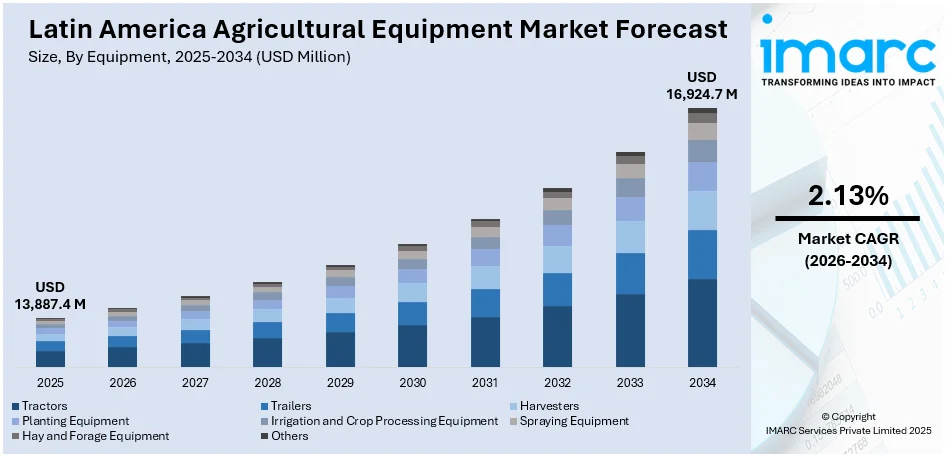

The Latin America agricultural equipment market size reached USD 13,887.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 16,924.7 Million by 2034, exhibiting a growth rate (CAGR) of 2.13% during 2026-2034. The increasing demand for food production, advancements in farming technology, government initiatives promoting modern agricultural practices, rising labor costs, the growing need for efficiency in farming operations, climate change impacts, and increasing sustainable farming practices are some of the major factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 13,887.4 Million |

| Market Forecast in 2034 | USD 16,924.7 Million |

| Market Growth Rate (2026-2034) | 2.13% |

Latin America Agricultural Equipment Market Trends:

Significant Technological Advancements

The widespread adoption of precision agriculture technologies, including GPS, drones, and IoT-enabled equipment, is enhancing productivity and efficiency in farming operations. These innovations allow farmers to optimize resource use and improve crop yields. For instance, in September 2024, Hydrosat, a climate technology firm leveraging thermal imaging to measure water stress in agriculture and fight climate change, has signed four new commercial agreements with strategic partners in Latin America: Rex Irrigación Huasteca, EE Print Pack, and Grupo INDERS. These new agreements greatly enhance Hydrosat's presence in the region, bringing advanced data-driven solutions to Mexican and Guatemalan growers to help optimize water utilization, improve crop yield, and encourage sustainable agriculture. As part of the program, EE Print Pack, a prominent agribusiness industry supplier, will bring Hydrosat's technology into Mexico via its just-launched Agrolika division. Also, Hydrosat signed a deal with Mexico's Grupo INDERS to guarantee its advanced technology on small, medium, and large-sized farms in Latin America.

To get more information on this market Request Sample

Growing Government Support and Investments

Governments of various countries in the region are implementing policies and initiatives to promote agricultural modernization. Subsidies, grants, and investment in rural infrastructure enhance farmers' access to advanced agricultural machinery, thereby facilitating growth in the market. In August 2023, Brazil's Ministry of Agriculture and Livestock launched the 2023/2024 Crop Plan, which set aside BRL 364.22 billion to finance national agricultural production up to June 2024. The funding covered rural credit programs like the National Support Program for Medium Rural Producers (Pronamp) and others. The allocation represented a 27% increase from the earlier financing of BRL 287.16 billion for Pronamp and associated programs.

The Crop Plan gave a lot of importance to assisting medium-sized rural producers by increasing access to credit and investment funds. Furthermore, the limit on annual gross income for Pronamp eligibility was increased from BRL 2.4 million to BRL 3 million to reflect increases in agricultural product prices. Farmers who are under Pronamp will also enjoy lower interest rates on the purchase of agricultural machinery and equipment under the Program for Modernization of the Fleet of Agricultural Tractors and Related Implements and Harvesters (Moderfrota). Under this program, Pronamp members are able to obtain financing at an annual interest rate of 10.5% with no ceiling on funding.

Latin America Agricultural Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on equipment and application.

Equipment Insights:

- Tractors

- Trailers

- Harvesters

- Planting Equipment

- Irrigation and Crop Processing Equipment

- Spraying Equipment

- Hay and Forage Equipment

- Others

The report has provided a detailed breakup and analysis of the market based on the equipment. This includes tractors, trailers, harvesters, planting equipment, irrigation and crop processing equipment, spraying equipment, hay and forage equipment, and others.

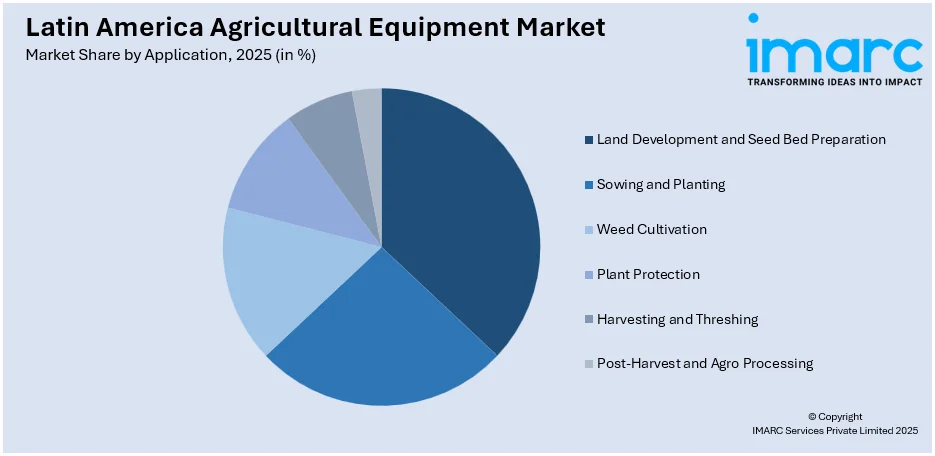

Application Insights:

Access the comprehensive market breakdown Request Sample

- Land Development and Seed Bed Preparation

- Sowing and Planting

- Weed Cultivation

- Plant Protection

- Harvesting and Threshing

- Post-Harvest and Agro Processing

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes land development and seed bed preparation, sowing and planting, weed cultivation, plant protection, harvesting and threshing, and post-harvest and agro processing.

Regional Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Agricultural Equipment Market News:

- In August 2024, FPT Industrial announced a partnership with Pauny, a producer of agricultural machinery in Argentina. The collaboration between the companies seeks to offer the Argentine agricultural market 100% national tractors, ensuring the product quality and durability, along with the development of cutting-edge technology and local production. The move is designed to enhance Argentine farmers' trust in locally produced tools, increasing job opportunities and the local economy.

- In August 2023, New Holland Agriculture, a CNH Industrial brand, has launched commercially the world's first accessible farm tractor. The TL5 'Acessível', manufactured at the Brand's factory in Curitiba (PR), has been specifically designed for individuals with lower limb disabilities, allowing them to work in fields autonomously. The undertaking of its manufacturing and eventual launch is backed by the Brazilian government financing line – the 'Rota 2030' (Route 2030), with most of the investment being gobbled up by the government in support and fostering socially inclusive innovation initiatives.

Latin America Agricultural Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment’s Covered | Tractors, Trailers, Harvesters, Planting Equipment, Irrigation and Crop Processing Equipment, Spraying Equipment, Hay and Forage Equipment, Others |

| Applications Covered | Land Development and Seed Bed Preparation, Sowing and Planting, Weed Cultivation, Plant Protection, Harvesting and Threshing, Post-Harvest and Agro Processing |

| Regions Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America agricultural equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America agricultural equipment market on the basis of equipment?

- What is the breakup of the Latin America agricultural equipment market on the basis of application?

- What is the breakup of the Latin America agricultural equipment market on the basis of region?

- What are the various stages in the value chain of the Latin America agricultural equipment market?

- What are the key driving factors and challenges in the Latin America agricultural equipment market?

- What is the structure of the Latin America agricultural equipment market and who are the key players?

- What is the degree of competition in the Latin America agricultural equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America agricultural equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America agricultural equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America agricultural equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)