Latin America Biomedical Sensors Market Size, Share, Trends and Forecast by Type, Sensor Type, Industry, Application, and Country, 2025-2033

Latin America Biomedical Sensors Market Size and Share:

The Latin America biomedical sensors market size reached USD 1,515.54 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,525.89 Million by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033 The market is expanding due to the growing adoption of advanced healthcare technologies, increased demand for remote patient monitoring, and rising investments in medical device innovation. Other key growth drivers include the escalating need for chronic disease management and rising aging populations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,515.54 Million |

| Market Forecast in 2033 | USD 2,525.89 Million |

| Market Growth Rate (2025-2033) | 5.80% |

Latin America Biomedical Sensors Market Trends:

Rising Adoption of Wearable Medical Devices

The growing incidence of chronic illnesses, including diabetes, cardiovascular diseases, and respiratory disorders, is fueling the adoption of wearable biomedical sensors in Latin America. For instance, according to industry reports, Brazil holds the fifth position worldwide in terms of diabetes prevalence, with 16.8 million adults aged 20 to 79 affected. The projection indicates the number of individuals with diabetes will increase to 21.5 million by 2030. These advanced wearable devices, equipped with cutting-edge sensors, facilitate continuous health monitoring and provide real-time data critical for effective disease management. The trend is further supported by growing awareness of preventive healthcare and technological advancements that enhance sensor miniaturization and precision. Countries are experiencing heightened demand, driven by their expanding middle-class populations and improved access to innovative healthcare solutions. Collaborative efforts between medical device manufacturers and technology firms are also contributing to the development of more accessible, efficient wearable devices tailored to regional healthcare needs, thus driving the Latin America biomedical sensors market growth.

Integration of IoT in Healthcare

The convergence of the Internet of Things (IoT) technologies with biomedical sensors is revolutionizing the healthcare sector in Latin America. For instance, according to industry reports, Brazil's IoT market is projected to reach approximately $7.8 billion by 2025, underscoring the region’s growing commitment to digital health solutions. IoT-enabled sensors help healthcare providers to monitor patients from afar and make diagnostic predictions while optimizing clinical processes which decreases healthcare expenses as well as delivers better results for patients. The increasing use of telemedicine has quickened the acceptance of IoT-integrated sensors throughout urban and rural regions. The trend will likely expand because local healthcare organizations place equal emphasis on data-based operational decisions and patient treatment enhancement. Additionally, the private sector together with tech companies invests in innovation that produces advanced user-friendly, and flexible solutions to solve healthcare problems in regional areas. As healthcare providers increasingly recognize the value of IoT-based systems, the adoption of connected sensor technologies is set to grow, enhancing the delivery of care and supporting improved health outcomes across the region, thereby boosting the Latin America biomedical sensors market share.

Government Support and Healthcare Investments

Government initiatives and increasing investments in healthcare infrastructure are significantly enhancing the Latin America biomedical sensors market outlook. Programs aimed at modernizing healthcare facilities and improving access to advanced diagnostic tools are driving demand for biomedical sensors across the region. Public and private sector collaborations are fostering innovation in sensor technologies, particularly in diagnostics, treatment monitoring, and surgical applications. For instance, in 2024, the Philips Foundation, in collaboration with SAS Brazil, established an innovation lab to advance digital health education and improve healthcare in Brazil’s underserved regions. In partnership with UNICAMP, this initiative is set to train 3,600 healthcare professionals and students, impacting 3.6 million people. By integrating tele-ultrasound, remote vital sign monitoring, ECGs, and cervical exams, the program enhances maternal care and broadens healthcare access. The strong focus on universal healthcare solutions is opening up new opportunities for the adoption of biomedical sensors, ensuring that these technologies remain affordable and accessible for a wide range of populations.

Latin America Biomedical Sensors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, sensor type, industry, and application.

Type Insights:

- Wired

- Wireless

The report has provided a detailed breakup and analysis of the market based on the type. This includes wired and wireless.

Sensor Type Insights:

- Temperature

- Pressure

- Image Sensors

- Biochemical

- Inertial Sensors

- Motion Sensors

- Electrocardiogram (ECG)

A detailed breakup and analysis of the market based on the sensor type have also been provided in the report. This includes temperature, pressure, image sensors, biochemical, inertial sensors, motion sensors, and electrocardiogram (ECG).

Industry Insights:

- Pharmaceutical

- Healthcare

The report has provided a detailed breakup and analysis of the market based on the industry. This includes pharmaceutical and healthcare.

Application Insights:

- Diagnostics

- Therapeutic

- Medical Imaging

- Monitoring

- Fitness and Wellness

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes diagnostics, therapeutic, medical imaging, monitoring, and fitness and wellness.

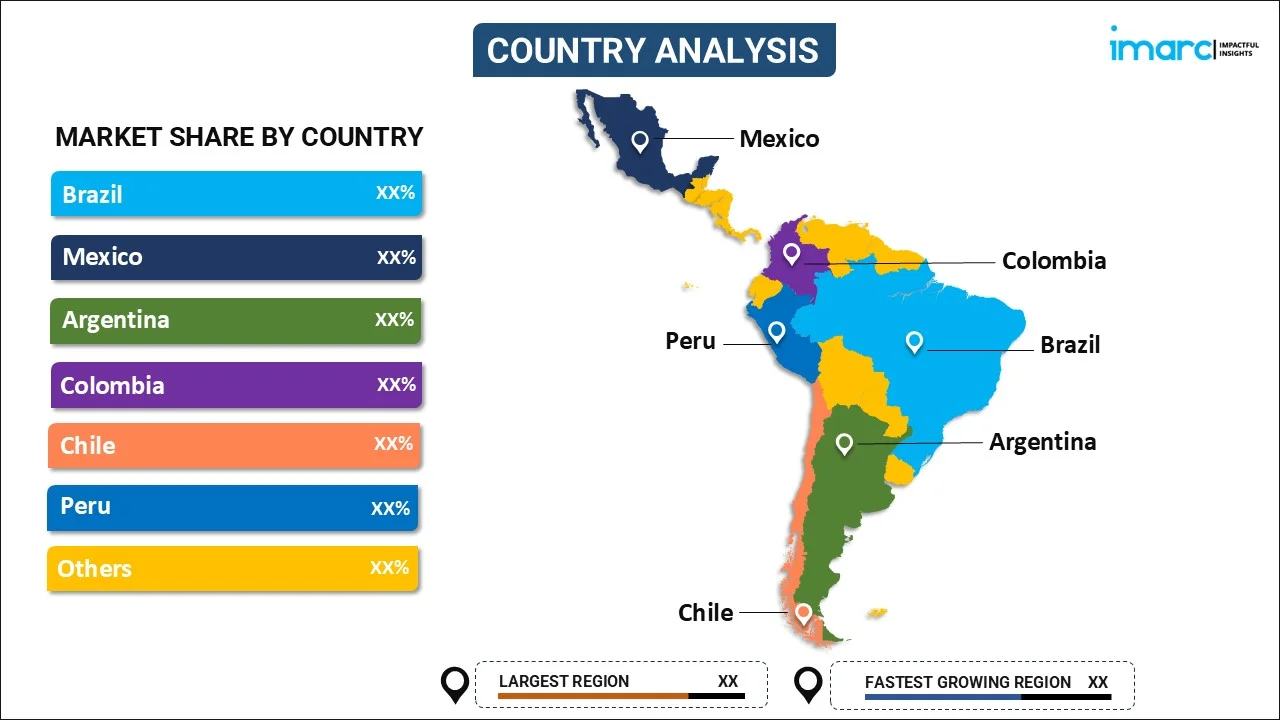

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Biomedical Sensors Market News:

-

In November 2024, GE HealthCare announced that it had received FDA clearance for the SIGNA MAGNUS, a 3.0T held-only MRI scanner designed to advance neuroimaging and biomarker research. The device features a high-performance gradient coil achieving 300 mT/m and 750 T/m/s, offering faster imaging with enhanced resolution.

Latin America Biomedical Sensors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Wired, Wireless |

| Sensor Types Covered | Temperature, Pressure, Image Sensors, Biochemical, Inertial Sensors, Motion Sensors, Electrocardiogram (ECG) |

| Industries Covered | Pharmaceutical, Healthcare |

| Applications Covered | Diagnostics, Therapeutic, Medical Imaging, Monitoring, Fitness and Wellness |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America biomedical sensors market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America biomedical sensors market on the basis of type?

- What is the breakup of the Latin America biomedical sensors market on the basis of sensor type?

- What is the breakup of the Latin America biomedical sensors market on the basis of industry?

- What is the breakup of the Latin America biomedical sensors market on the basis of application?

- What is the breakup of the Latin America biomedical sensors market on the basis of country?

- What are the various stages in the value chain of the Latin America biomedical sensors market?

- What are the key driving factors and challenges in the Latin America biomedical sensors?

- What is the structure of the Latin America biomedical sensors market and who are the key players?

- What is the degree of competition in the Latin America biomedical sensors market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America biomedical sensors market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America biomedical sensors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America biomedical sensors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)