Latin America Carbon Credit Market Size, Share, Trends and Forecast by Type, Project Type, End-Use, and Region, 2026-2034

Latin America Carbon Credit Market Summary:

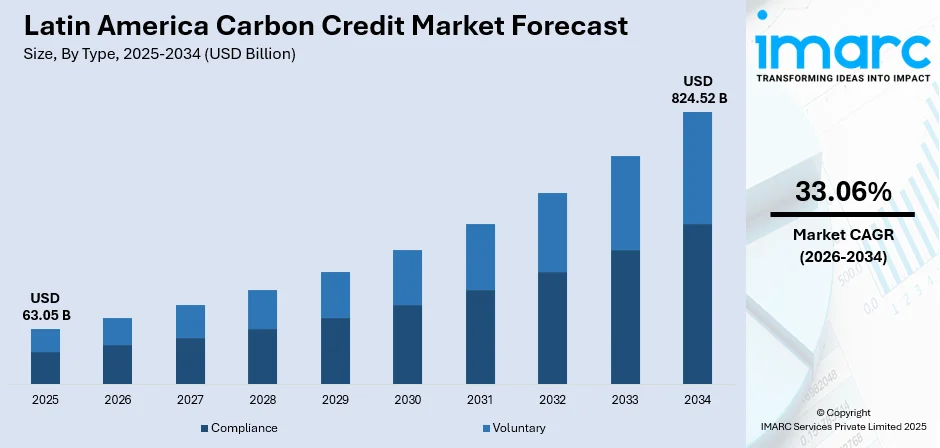

The Latin America carbon credit market size was valued at USD 63.05 Billion in 2025 and is projected to reach USD 824.52 Billion by 2034, growing at a compound annual growth rate of 33.06% from 2026-2034.

The Latin America carbon credit market is experiencing robust expansion, driven by increasing environmental consciousness among corporations and governments across the region. Legislative frameworks are strengthening as countries implement carbon pricing mechanisms and emissions trading systems to meet climate commitments. Corporate sustainability initiatives are accelerating, with multinational companies pursuing net-zero targets through verified carbon offset purchases. The abundant natural resources, particularly extensive forest ecosystems, position Latin America as a global leader in nature-based carbon credit generation.

Key Takeaways and Insights:

-

By Type: Voluntary dominates the market with a share of 58% in 2025, owing to growing corporate sustainability commitments and the flexibility offered to organizations seeking to offset emissions beyond regulatory requirements. Increasing environmental, social, and governance (ESG) reporting standards and stakeholder expectations are fueling expansion in this segment.

-

By Project Type: Avoidance/reduction projects lead the market with a share of 52% in 2025. This dominance reflects the region's vast forest resources and cost-effective implementation of deforestation prevention initiatives. Reducing Emissions from Deforestation and Forest Degradation (REDD+) programs and forest conservation efforts continue to attract significant international investment.

-

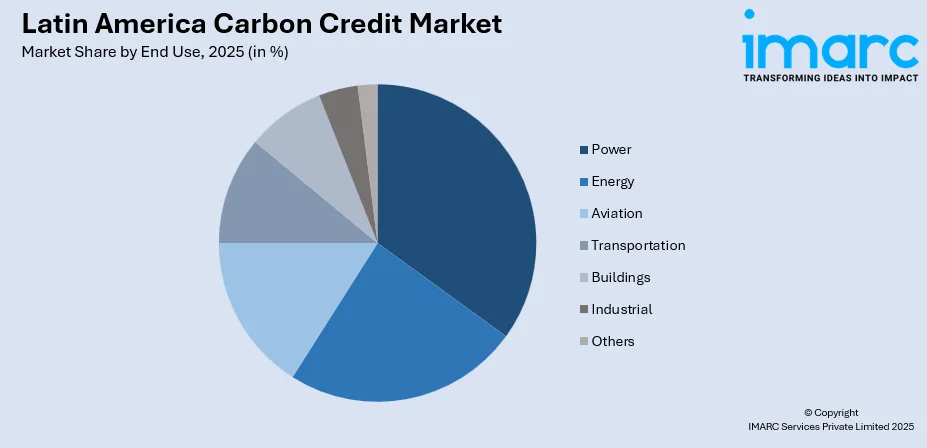

By End Use: Power represents the largest segment with a market share of 20% in 2025, driven by electricity generators seeking to offset emissions from thermal power plants and transition towards cleaner energy portfolios while meeting regulatory compliance requirements.

-

By Region: Brazil comprises the largest region with 35% share in 2025, reflecting its extensive Amazon rainforest resources, established regulatory frameworks, and position as a global leader in nature-based carbon credit generation and trading activities.

-

Key Players: Key players drive the Latin America carbon credit market by developing innovative verification methodologies, expanding nature-based project portfolios, and establishing partnerships with international corporations seeking high-quality offsets. Their investments in technology, transparency platforms, and community engagement strengthen market credibility.

To get more information on this market Request Sample

The Latin America carbon credit market is witnessing transformative growth, as regulatory developments and corporate sustainability commitments converge to create unprecedented demand for verified emissions offsets. The region's extensive forest ecosystems provide substantial capacity for carbon sequestration projects. In June 2024, BTG Pactual Timberland Investment Group committed to supply Microsoft with up to 8 Million nature-based carbon reduction credits by 2043 through a USD 1 Billion forestry and restoration program, representing the largest carbon dioxide elimination credit transaction to date. The deal underscored the considerable opportunity for restoration in Latin America to provide climate benefits while also supporting biodiversity and communities. International technology companies are increasingly establishing long-term offset agreements, recognizing Latin America's potential as a premium source of high-integrity carbon credits that deliver measurable climate impact alongside biodiversity and community benefits.

Latin America Carbon Credit Market Trends:

Rising Demand for Large-Scale Nature-Based Offset Agreements

In Latin America, the carbon credit market is witnessing a significant shift towards multi-year, large-scale agreements between multinational corporations and regional project developers. Organizations are entering long-term contracts emphasizing forestry and land restoration initiatives to secure verified credits. In September 2024, Meta agreed to purchase up to 3.9 Million carbon offset credits from Brazilian investment bank BTG Pactual's forestry arm through 2038, supporting reforestation efforts involving over 7 Million seedlings. This trend reflects growing corporate preference for guaranteed credit supply chains that align with long-term decarbonization strategies and sustainability reporting requirements.

Expansion of Regulatory Frameworks and Emissions Trading Systems

Latin American governments are accelerating the development of comprehensive carbon pricing mechanisms to meet national climate commitments. Countries including Brazil, Colombia, Mexico, and Chile are implementing or expanding carbon taxes and emissions trading systems that create compliance-driven demand. In December 2024, Brazil enacted Law 15,042/2024, establishing the Brazilian Greenhouse Gas Emissions Trading System (SBCE), targeting firms emitting above 10,000 tCO2e annually and 25,000 tCO2e yearly. These regulatory advances are harmonizing domestic markets with international standards and attracting institutional investment.

Integration of Blockchain Technology in Carbon Credit Trading

Digital transformation is reshaping carbon credit markets through blockchain-based platforms that enhance transparency, traceability, and transaction efficiency. Technology providers are developing tokenization solutions that enable secure trading and fractional ownership of carbon credits. These innovations are improving market accessibility, reducing transaction costs, and building confidence among international buyers seeking verified, tamper-proof records of carbon offset ownership. Integration of artificial intelligence (AI)-driven monitoring and satellite data further strengthens verification accuracy and real-time emissions tracking.

Market Outlook 2026-2034:

The Latin America carbon credit market outlook remains exceptionally positive, as the convergence of regulatory mandates, corporate sustainability commitments, and international climate finance creates sustained demand growth through the forecast period. The market generated a revenue of USD 63.05 Billion in 2025 and is projected to reach a revenue of USD 824.52 Billion by 2034, growing at a compound annual growth rate of 33.06% from 2026-2034. Nature-based solutions will continue to dominate credit generation as international buyers increasingly prioritize high-integrity forestry and land-use projects.

Latin America Carbon Credit Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Voluntary |

58% |

|

Project Type |

Avoidance/Reduction Projects |

52% |

|

End Use |

Power |

20% |

|

Region |

Brazil |

35% |

Type Insights:

- Compliance

- Voluntary

Voluntary dominates with a market share of 58% of the total Latin America carbon credit market in 2025.

The voluntary segment's dominance reflects the growing commitment of corporations across diverse industries to achieve carbon neutrality and meet stakeholder sustainability expectations. Companies are increasingly leveraging voluntary carbon credits to demonstrate environmental leadership, enhance brand reputation, and align with international ESG reporting frameworks. The flexibility inherent in voluntary markets allows organizations to select offset projects that align with corporate values and supply chain priorities.

Corporate sustainability initiatives have accelerated demand for voluntary carbon credits as businesses recognize the strategic advantages of proactive emissions management. In September 2024, Amazon and five other companies committed USD 180 Million through the LEAF Coalition to purchase carbon offset credits protecting the Amazon rainforest in Brazil's Para state. This transaction exemplifies the scale at which multinational corporations are engaging with voluntary carbon markets to achieve climate targets while supporting forest conservation and local community development.

Project Type Insights:

- Avoidance/Reduction Projects

- Removal/Sequestration Projects

- Nature-based

- Technology-based

Avoidance/reduction projects lead with a share of 52% of the total Latin America carbon credit market in 2025.

Avoidance/ reduction projects maintain market leadership due to the region's extensive tropical forest coverage and the proven effectiveness of REDD+ initiatives in preventing deforestation. These projects offer cost-effective emissions mitigation by preserving existing carbon stocks rather than requiring new planting investments. The established methodologies and certification standards for forest preservation provide international buyers with confidence in credit integrity and environmental impact verification.

In addition, avoidance/ reduction projects generate co-benefits, such as biodiversity conservation, watershed protection, and livelihood support for local communities, increasing their attractiveness to corporate buyers. Strong alignment with national climate strategies and international climate finance mechanisms further supports project scalability. The ability to generate large volumes of credits over extended periods enhances supply reliability, while relatively lower implementation risks compared to restoration projects improve investor confidence. These combined advantages continue to reinforce the dominant position of avoidance/ reduction projects in the regional carbon credit market.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Power

- Energy

- Aviation

- Transportation

- Buildings

- Industrial

- Others

Power exhibits a clear dominance with a 20% share of the total Latin America carbon credit market in 2025.

The power sector's leading position reflects substantial carbon credit demand from electricity generators operating thermal power plants and seeking to transition toward cleaner energy portfolios. Regulatory frameworks increasingly require power producers to offset emissions or participate in emissions trading systems, driving consistent purchasing activity. The sector's large-scale emissions profile and visibility in sustainability reporting make carbon credit procurement a strategic priority for utility companies throughout the region.

Power generation companies are integrating carbon credits into comprehensive decarbonization strategies that complement investments in renewable energy capacity. Energy investments in the Latin America and the Caribbean region were set to reach USD 185 Billion in 2024, with renewables representing approximately 60% of the regional power mix. Power sector participants utilize carbon credits to address residual emissions from baseload thermal generation while accelerating transitions to wind, solar, and hydroelectric sources, creating synergies between offset procurement and clean energy deployment initiatives.

Regional Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

Brazil represents the leading region with a 35% share of the total Latin America carbon credit market in 2025.

Brazil leads the Latin America carbon credit market due to its vast natural capital, mature project ecosystem, and strong integration with global voluntary markets. The country hosts extensive tropical forests, particularly within the Amazon biome, enabling large-scale avoidance and reduction projects that generate high volumes of cost-effective, nature-based carbon credits. Established REDD+ initiatives benefit from proven methodologies, long monitoring histories, and strong international credibility, attracting sustained demand from multinational buyers.

Brazil also possesses a well-developed network of project developers, certification bodies, and technical experts, supporting efficient project execution and verification. Strong co-benefits, such as biodiversity conservation, indigenous community support, and ecosystem protection, enhance the appeal of Brazilian credits for ESG-focused buyers. In addition, growing adoption of digital monitoring tools, satellite data, and transparent registries improves credit integrity and traceability. Long-term offtake agreements and consistent credit issuance provide supply reliability. Combined, these structural advantages position Brazil as the dominant and most trusted carbon credit supplier in Latin America.

Market Dynamics:

Growth Drivers:

Why is the Latin America Carbon Credit Market Growing?

Abundant Natural Resources and Large-Scale Nature-Based Projects

Latin America’s abundant natural resources are a primary driver of the carbon credit market, particularly its vast tropical forests, wetlands, and biodiversity-rich ecosystems. The region offers ideal conditions for nature-based solutions such as REDD+, afforestation, reforestation, and conservation projects that generate high-quality carbon credits. These projects can deliver large-scale emissions reductions at comparatively lower costs than industrial decarbonization initiatives. Long project lifecycles and high sequestration potential enable consistent credit generation over extended periods. In addition, nature-based projects often deliver co-benefits including biodiversity protection, water regulation, and community livelihood support, increasing their attractiveness to international buyers. Strong alignment with global climate goals enhances demand from corporates seeking credible offsets. The availability of land and established forestry practices further support project scalability. Together, these natural advantages position Latin America as a leading global supplier of carbon credits, sustaining long-term market growth.

Strong Demand from International Voluntary Carbon Markets

Strong demand from international voluntary carbon markets is significantly fueling the growth of the market in Latin America. Corporations across North America, Europe, and Asia are increasingly purchasing credits from Latin America to meet net-zero and ESG commitments. Buyers are attracted by the region’s cost-effective credits, robust project pipelines, and strong environmental integrity. Latin American credits are widely accepted due to established verification standards and transparent methodologies. Multinational companies also value the social and biodiversity co-benefits associated with regional projects. Long-term offtake agreements provide revenue certainty for developers, encouraging new project investments. Growing pressure from investors and consumers for credible climate action further fuels demand. As voluntary markets expand faster than compliance mechanisms, international corporate participation continues to channel capital into Latin America, reinforcing the region’s dominant role in global carbon credit supply.

Advancements in Digital Monitoring, Verification, and Trading Platforms

Advancements in digital monitoring, verification, and trading platforms are accelerating growth of the Latin America carbon credit market. Technologies, such as satellite imaging, remote sensing, blockchain, and AI, improve transparency, traceability, and accuracy of emissions data. As per IMARC Group, the Latin America AI market size was valued at USD 4.71 Billion in 2024. These tools reduce verification costs and increase trust among international buyers. Digital platforms also enable faster transactions, broader market access, and price discovery. Tokenization and digital registries allow fractional ownership and improve liquidity in voluntary markets. Improved monitoring capabilities strengthen confidence in project permanence and additionality. As technology adoption increases, smaller project developers gain access to global buyers. These digital innovations modernize market infrastructure, reduce inefficiencies, and support scalable growth, making the carbon credit market more accessible, credible, and competitive across Latin America.

Market Restraints:

What Challenges the Latin America Carbon Credit Market is Facing?

Credit Integrity and Verification Concerns

Market participants face ongoing challenges related to carbon credit quality assurance and verification methodology consistency. Concerns regarding additionality, permanence, and accurate baseline measurements have prompted increased scrutiny from buyers and regulators. Developing robust monitoring systems and standardized verification protocols remains essential for maintaining market credibility and attracting institutional investment.

Regulatory Complexity and Policy Uncertainty

Varying carbon pricing frameworks, tax structures, and compliance requirements across Latin American jurisdictions create operational complexity for project developers and credit buyers. Policy instability and changing government priorities introduce investment risks that may discourage long-term project commitments. Harmonizing regional regulations and establishing clear guidelines for cross-border credit transactions remain ongoing challenges.

Limited Market Infrastructure and Access

Developing efficient trading platforms, registry systems, and financial instruments to support market growth presents infrastructure challenges. Smaller project developers and indigenous communities may face barriers accessing carbon markets due to high transaction costs, technical complexity, and limited financing options. Expanding market infrastructure while ensuring equitable participation requires coordinated investment from public and private stakeholders.

Competitive Landscape:

The Latin America carbon credit market exhibits a dynamic competitive landscape, characterized by diverse participants including project developers, financial institutions, verification bodies, and trading platforms. Major financial groups have established dedicated carbon credit divisions, while specialized startups focus on innovative project development and technology solutions. Competition centers on project quality, verification standards, and the ability to deliver credits meeting international integrity criteria. Market participants are differentiating through technology integration, including blockchain-based platforms that enhance transparency and transaction efficiency. Strategic partnerships between project developers and multinational corporations are increasingly common, creating long-term supply agreements that provide revenue stability while securing credit access for buyers.

Recent Developments:

-

In November 2025, Petrobras and the Brazilian Development Bank (BNDES) launched a public request for proposals through the ProFloresta+ initiative to acquire 5 Million high-integrity carbon credits related to Amazon restoration. The initiative aimed to enhance the restoration of forests in the Amazon. It would establish a definitive price standard for restoration credits and draw investment in the restoration industry.

Latin America Carbon Credit Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Compliance and Voluntary |

| Project Types Covered |

|

| End-Uses Covered | Power, Energy, Aviation, Transportation, Buildings, Industrial, and Others |

| Regions Covered | Brazil, Mexico, Argentina, Columbia, Chile, Peru, and Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Latin America carbon credit market size was valued at USD 63.05 Billion in 2025.

The Latin America carbon credit market is expected to grow at a compound annual growth rate of 33.06% from 2026-2034 to reach USD 824.52 Billion by 2034.

Voluntary dominated the market with a share of 58%, due to strong corporate sustainability commitments, flexible participation frameworks, and growing demand for nature-based offsets. Companies actively use voluntary credits to meet net-zero goals, enhance ESG performance, and support regional conservation and reforestation projects.

Key factors driving the Latin America carbon credit market include strengthening legislative frameworks, accelerating corporate net-zero commitments, abundant nature-based solutions, and growing international demand for verified forest carbon credits.

Major challenges include credit integrity verification concerns, regulatory complexity across jurisdictions, limited market infrastructure, high transaction costs for smaller developers, and policy uncertainty affecting long-term investment decisions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)