Latin America Cloud Computing Market Size, Share, Trends and Forecast by Service, Workload, Deployment Mode, Organization Size, Vertical, and Region, 2026-2034

Latin America Cloud Computing Market Summary:

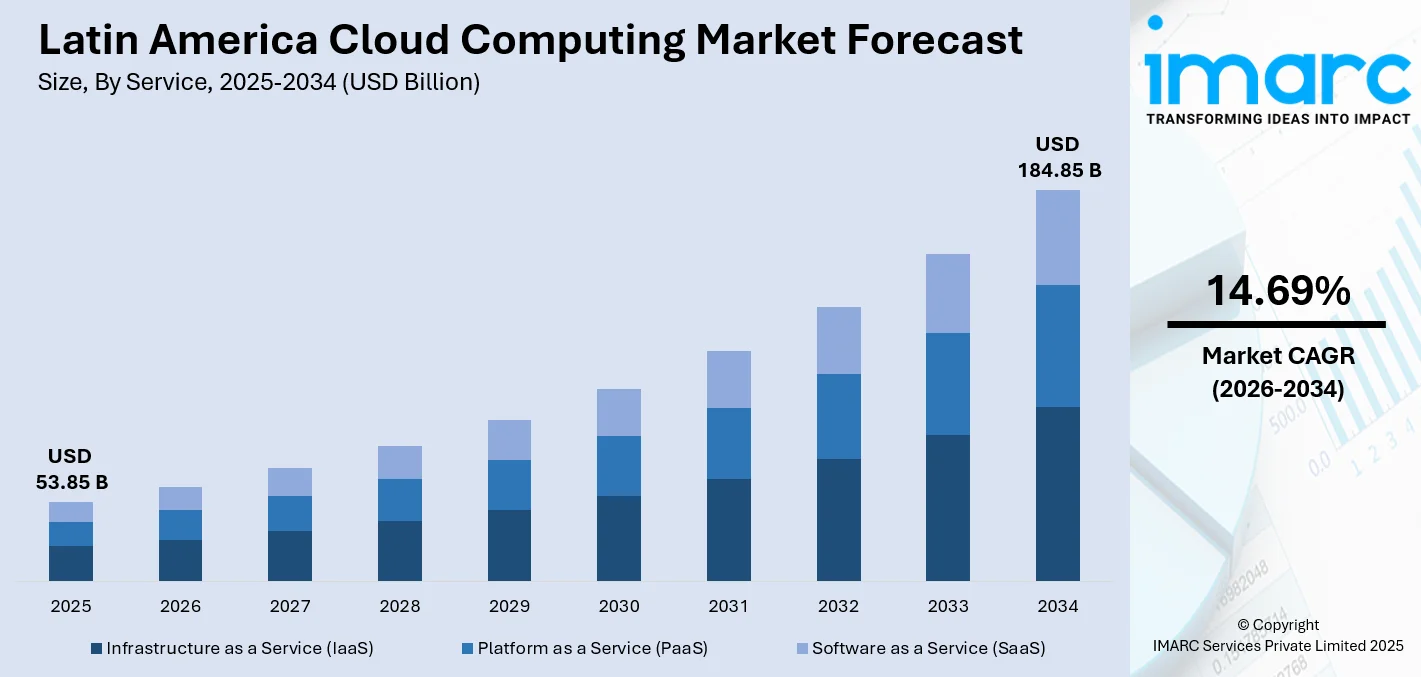

The Latin America cloud computing market size was valued at USD 53.85 Billion in 2025 and is projected to reach USD 184.85 Billion by 2034, growing at a compound annual growth rate of 14.69% from 2026-2034.

The Latin America cloud computing market is experiencing robust expansion as businesses and governments prioritize digital transformation and modernize legacy infrastructure. Growing adoption of scalable, cost-effective cloud solutions enables organizations to enhance operational efficiency while reducing capital expenditures. The proliferation of artificial intelligence, machine learning, and data analytics applications is accelerating enterprise cloud migration across diverse industry verticals. Expanding internet connectivity and mobile broadband penetration are democratizing cloud access, enabling businesses of all sizes to leverage advanced computing capabilities. Strategic investments from global hyperscalers in regional data center infrastructure are strengthening the ecosystem, improving service latency, and ensuring data sovereignty compliance. Regulatory frameworks promoting data protection and cybersecurity are encouraging organizations to transition sensitive workloads to secure cloud environments, thereby expanding the Latin America cloud computing market share.

Key Takeaways and Insights:

- By Service: Infrastructure as a Service (IaaS) dominates the market with a share of 38% in 2025, driven by enterprises migrating on-premises workloads to scalable virtual infrastructure platforms. The flexibility to provision computing resources on-demand without significant capital investment attracts organizations seeking operational agility and rapid deployment capabilities.

- By Workload: Data storage and backup lead the market with a share of 25% in 2025. The exponential growth of digital data across enterprises necessitates robust storage solutions with enhanced security, disaster recovery capabilities, and seamless accessibility from distributed locations.

- By Deployment Mode: Public is the biggest segment with a market share of 52% in 2025. Cost-effectiveness, scalability, and ease of deployment make public cloud especially attractive for businesses seeking rapid digital transformation without substantial upfront infrastructure investments.

- By Organization Size: Large enterprise exhibits a clear dominance with 62% share in 2025, reflecting the high digital maturity of major corporations and their substantial investments in comprehensive cloud transformations supporting multi-cloud and hybrid cloud strategies.

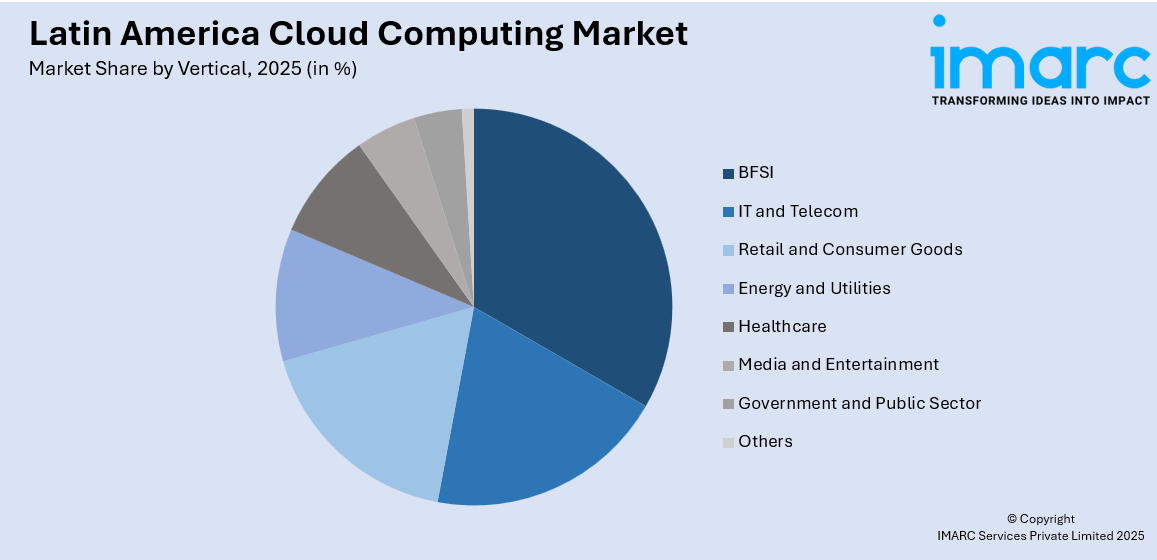

- By Vertical: BFSI represents the leading segment with a market share of 24% in 2025, as financial institutions prioritize digital transformation to modernize core banking systems, enhance customer experiences through AI-driven analytics, and ensure regulatory compliance.

- By Region: Brazil is the largest region with 38% share in 2025, establishing itself as the primary hub for cloud computing infrastructure investment in Latin America due to its mature digital ecosystem and substantial enterprise demand.

- Key Players: Leading providers shape the Latin America cloud computing market through continuous infrastructure investments, strategic partnerships with regional enterprises, expansion of data center footprints, and development of localized solutions addressing compliance requirements and language preferences.

To get more information on this market Request Sample

The Latin America cloud computing market is advancing as organizations embrace digital transformation initiatives to enhance competitiveness and operational resilience. Cloud platforms provide enterprises with unprecedented capabilities to deploy sophisticated applications, leverage advanced analytics, and access enterprise-grade computing resources without substantial capital investments in physical infrastructure. The region's improving digital connectivity creates favorable conditions for widespread cloud adoption as businesses and consumers gain reliable access to internet services. Government initiatives actively promote technology modernization through comprehensive programs supporting industrial digital transformation encompassing cloud computing, artificial intelligence, and big data infrastructure. Major hyperscale cloud providers continue expanding regional presence through significant investments in data center construction across key markets. National development banks and financial institutions demonstrate institutional commitment to expanding cloud infrastructure through dedicated credit lines and investment programs. The convergence of expanding digital infrastructure, supportive regulatory frameworks, and growing enterprise demand positions Latin America as an increasingly important cloud computing market globally.

Latin America Cloud Computing Market Trends:

Multi-Cloud Strategy Adoption Accelerates Enterprise Flexibility

Organizations across Latin America are increasingly implementing multi-cloud strategies to enhance operational flexibility and avoid vendor lock-in dependencies. Enterprises deploy workloads across multiple cloud providers to optimize cost-effectiveness, improve redundancy, and access specialized tools tailored to specific business requirements. Financial services companies and healthcare organizations particularly embrace this approach to maintain stringent compliance while leveraging best-of-breed capabilities from different vendors. This trend drives demand for sophisticated cloud management platforms enabling seamless orchestration across diverse environments, significantly supporting the Latin America cloud computing market growth.

Edge Computing Integration Transforms Real-Time Processing

Edge computing emerges as a transformative trend within the market as organizations prioritize faster data processing and reduced latency for mission-critical applications. The proliferation of Internet of Things devices and expansion of fifth-generation wireless networks accelerate implementation of edge solutions complementing traditional cloud infrastructure. Manufacturing facilities, retail operations, and telecommunications providers increasingly deploy edge computing nodes to enable real-time analytics at data generation points. Technology providers are expanding their regional facilities with enhanced edge computing, robotics, and automation capabilities to address escalating demand for localized processing solutions that minimize data transmission delays and support time-sensitive operational requirements.

Artificial Intelligence Services Drive Cloud Platform Innovation

Cloud providers are embedding artificial intelligence and machine learning capabilities throughout their service offerings, transforming how enterprises leverage cloud infrastructure. Financial institutions deploy AI-powered fraud detection and customer analytics platforms hosted on cloud environments, while retailers implement intelligent demand forecasting and personalization engines. Healthcare organizations utilize cloud-based AI for medical imaging analysis and clinical decision support systems. Strategic partnerships between global cloud providers and regional enterprises demonstrate the growing importance of developing AI-powered services specifically tailored for Latin American markets, enabling businesses to access sophisticated intelligent solutions addressing local requirements and industry-specific needs.

Market Outlook 2026-2034:

The Latin America cloud computing market demonstrates strong growth prospects driven by accelerating digital transformation initiatives across enterprise and government sectors. Increasing adoption of hybrid and multi-cloud architectures enables organizations to balance performance, security, and cost optimization requirements effectively. The market generated a revenue of USD 53.85 Billion in 2025 and is projected to reach a revenue of USD 184.85 Billion by 2034, growing at a compound annual growth rate of 14.69% from 2026-2034. Expansion of hyperscale data center infrastructure across key markets including Brazil, Mexico, Chile, and Colombia strengthen service delivery capabilities and ensures compliance with data sovereignty requirements. The proliferation of artificial intelligence workloads creates substantial demand for high-performance computing resources, driving infrastructure investments throughout the region. Small and medium enterprises represent a rapidly growing segment as cloud platforms democratize access to enterprise-grade technologies previously available only to large corporations. Government digital modernization programs continue supporting cloud adoption across public sector agencies, expanding addressable market opportunities.

Latin America Cloud Computing Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Service |

Infrastructure as a Service (IaaS) |

38% |

|

Workload |

Data Storage and Backup |

25% |

|

Deployment Mode |

Public |

52% |

|

Organization Size |

Large Enterprise |

62% |

|

Vertical |

BFSI |

24% |

|

Region |

Brazil |

38% |

Service Insights:

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

Infrastructure as a Service (IaaS) dominates with a market share of 38% of the total Latin America cloud computing market in 2025.

Infrastructure as a Service represents the foundational layer enabling enterprises to provision virtualized computing resources including servers, storage, and networking capabilities without maintaining physical hardware. Organizations leverage IaaS platforms to rapidly scale infrastructure in response to fluctuating demand patterns while converting capital expenditures into predictable operational costs. The segment experiences strong growth as businesses migrate legacy data center workloads to cloud environments seeking improved agility, disaster recovery capabilities, and geographic distribution of computing resources across multiple availability zones.

Major enterprises across banking, telecommunications, and retail sectors increasingly adopt IaaS solutions to support digital transformation initiatives requiring substantial computing power and storage capacity. In January 2024, Amazon Web Services received approval to establish its inaugural data center in Chile with a USD 205 Million investment, delivering comprehensive IaaS capabilities including computing, storage, networking, and analytics services to Chilean enterprises and institutions. The continuous expansion of hyperscale infrastructure throughout the region enhances service reliability and reduces latency for mission-critical applications.

Workload Insights:

- Application Development and Testing

- Analytics and Reporting

- Data Storage and Backup

- Integration and Orchestration

- Resource Management

- Others

Data storage and backup lead with a share of 25% of the total Latin America cloud computing market in 2025.

Data storage and backup workloads represent critical enterprise priorities as organizations generate exponentially increasing volumes of digital information requiring secure, accessible, and resilient storage infrastructure. Cloud-based storage solutions provide enterprises with virtually unlimited capacity scaling while eliminating capital investments in physical storage hardware and associated maintenance overhead. Organizations implement comprehensive backup strategies leveraging geographic redundancy across multiple cloud regions to ensure business continuity and disaster recovery capabilities. The ability to replicate data across geographically distributed facilities protects against localized disruptions and enables rapid recovery following unexpected incidents.

Regulatory compliance requirements across sectors including financial services and healthcare drive adoption of cloud storage platforms offering advanced encryption, access controls, and audit capabilities. The growing emphasis on data protection following implementation of privacy regulations such as Brazil's General Personal Data Protection Law encourages organizations to leverage cloud providers offering sophisticated security frameworks. In August 2024, Scala Data Centers announced renewable energy supply agreements in Latin America, providing wind power capacity of 393 megawatts to support hyperscale data centers handling storage-intensive workloads.

Deployment Mode Insights:

- Public

- Private

- Hybrid

Public cloud is the largest segment with a 52% share of the total Latin America cloud computing market in 2025.

Public cloud deployment continues dominating the market as organizations prioritize rapid digital transformation without substantial upfront infrastructure investments. The pay-as-you-go consumption model enables businesses to align technology expenditures with actual usage patterns while accessing enterprise-grade computing capabilities previously available only to large corporations. Small and medium enterprises particularly benefit from public cloud platforms providing immediate access to sophisticated software applications, development tools, and computing resources that would otherwise require prohibitive capital outlays for on-premises deployment.

Government initiatives across the region encourage public sector agencies to adopt cloud-based systems improving service delivery efficiency and citizen engagement. The increasing sophistication of public cloud security frameworks addresses enterprise concerns regarding data protection and regulatory compliance. Major hyperscale providers continue expanding regional infrastructure footprints, establishing dedicated cloud regions that enhance service accessibility and reduce latency for local businesses. These investments strengthen public cloud positioning by enabling organizations to maintain data within national boundaries while benefiting from global provider expertise and innovation capabilities. In May 2024, Microsoft inaugurated its first hyperscale cloud data center region in Mexico located in Queretaro, expanding public cloud accessibility for businesses throughout the country and establishing Mexico as a strategic hub for regional cloud services delivery.

Organization Size Insights:

- Large Enterprise

- Small and Medium Enterprise

Large enterprise exhibits a clear dominance with a 62% share of the total Latin America cloud computing market in 2025.

Large enterprises command the predominant market share due to their substantial technology budgets, complex infrastructure requirements, and strategic prioritization of digital transformation initiatives. These organizations implement sophisticated multi-cloud and hybrid cloud architectures to modernize legacy systems, improve operational efficiency, and scale digital initiatives across geographically distributed operations. Banking institutions, telecommunications operators, and national retailers represent the primary enterprise cloud spenders leveraging platforms for AI-driven analytics and customer experience enhancements. Large corporations possess dedicated IT teams capable of managing complex cloud environments and negotiating enterprise-level agreements with multiple service providers.

Regulatory mandates around data governance and cybersecurity push large enterprises toward trusted cloud providers offering regional presence and compliance certifications aligned with local requirements. The complexity of enterprise IT environments necessitates comprehensive cloud transformation strategies involving application modernization, workforce training, and change management processes. Manufacturing organizations increasingly position cloud infrastructure as foundational technology enabling advanced analytics, supply chain optimization, and industrial automation capabilities. These enterprises recognize cloud platforms as essential enablers of competitive differentiation, operational resilience, and innovation acceleration in rapidly evolving market conditions throughout Latin America.

Vertical Insights:

Access the comprehensive market breakdown Request Sample

- BFSI

- IT and Telecom

- Retail and Consumer Goods

- Energy and Utilities

- Healthcare

- Media and Entertainment

- Government and Public Sector

- Others

BFSI represents the leading segment with a 24% share of the total Latin America cloud computing market in 2025.

The banking, financial services, and insurance sector leads cloud adoption driven by urgent digital transformation requirements and the necessity for scalable, secure, and compliant cloud infrastructures. Financial institutions migrate core banking systems, payment processing gateways, and fraud detection mechanisms to cloud platforms enhancing operational agility and reducing infrastructure maintenance burdens. The proliferation of digital banking services and fintech competition accelerates cloud investment as traditional banks modernize customer-facing applications and back-office operations to meet evolving customer expectations for seamless digital experiences.

Open banking initiatives and real-time payment systems generate substantial data volumes requiring robust cloud infrastructure for processing and analytics. Financial regulators increasingly accept cloud deployment for regulated workloads provided appropriate security and compliance frameworks exist. Cloud platforms enable financial institutions to implement advanced artificial intelligence capabilities for personalized customer services, risk assessment, and regulatory reporting automation. Strategic partnerships between global cloud providers and regional financial institutions demonstrate how cloud technologies enable sector-specific innovation and competitive differentiation. The combination of regulatory acceptance, competitive pressures, and customer demand for digital services positions the financial sector as the leading vertical driving cloud computing adoption throughout Latin America.

Regional Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

Brazil holds the largest share with 38% of the total Latin America cloud computing market in 2025.

Brazil maintains its position as the dominant cloud computing market in Latin America on account of its mature digital ecosystem, substantial enterprise base, and concentrated hyperscale infrastructure investments. São Paulo serves as the primary data center hub benefiting from access to major submarine cable routes connecting South America with global networks. The country's digital transformation policies coupled with widespread adoption of Internet of Things and big data solutions support continuous investment in cloud infrastructure throughout the region. Government initiatives actively promote cloud adoption across public and private sectors through dedicated investment programs and regulatory frameworks supporting technology modernization.

In September 2024, Amazon Web Services announced a USD 1.8 Billion investment to expand data center operations in Brazil through 2034, reinforcing the country's position as the primary destination for cloud infrastructure investment in Latin America. Microsoft and Google maintain significant presence in the Brazilian market with data center facilities supporting enterprise and public sector digital transformation programs. The concentration of major hyperscale providers, regional cloud specialists, and telecommunications operators creates a competitive ecosystem driving service innovation and expanding cloud accessibility for organizations across diverse industry verticals throughout Brazil.

Market Dynamics:

Growth Drivers:

Why is the Latin America Cloud Computing Market Growing?

Accelerating Digital Transformation and Government Initiatives

Government-led digital transformation programs across Latin American economies create substantial momentum for cloud computing adoption as public and private sectors prioritize technology modernization. National strategies emphasize cloud infrastructure as essential for economic competitiveness, enabling businesses to access advanced computing capabilities without substantial capital investments. Brazil's comprehensive Mission 4 program exemplifies this commitment toward industrial digital transformation encompassing cloud computing, artificial intelligence, big data, and Internet of Things technologies. These initiatives create enabling environments through regulatory frameworks, financial incentives, and public-private partnerships accelerating cloud adoption across enterprise and government organizations. The recognition of cloud computing as critical infrastructure supporting national digital economies drives coordinated investment strategies throughout the region.

Expanding Hyperscale Data Center Infrastructure

Major hyperscale cloud providers continue substantial infrastructure investments throughout Latin America, establishing data center facilities that improve service availability, reduce latency, and ensure compliance with local data sovereignty requirements. These investments address growing enterprise demand for reliable, high-performance cloud services while creating competitive dynamics that benefit customers through improved service offerings and pricing. Google's USD 850 Million investment announced in August 2024 for its second Latin American data center in Uruguay demonstrates sustained commitment to regional infrastructure expansion. The proliferation of data center facilities across Brazil, Mexico, Chile, Colombia, and other markets enhances ecosystem maturity and service delivery capabilities.

Rising Internet Penetration and Digital Connectivity

Expanding internet accessibility and improved digital connectivity throughout Latin America create favorable conditions for cloud computing adoption across organizations of all sizes. Internet penetration across the region increased substantially over the past decade, with mobile broadband access reaching significant thresholds in major economies. Several countries lead regional connectivity by surpassing global averages and creating strong foundations for cloud-based service delivery. The expansion of fixed and mobile broadband networks, including fifth-generation wireless deployment, enables reliable access to cloud applications and services from diverse locations. Telecommunications operators invest substantially in infrastructure modernization, with companies expanding fiber networks and deploying edge computing capabilities to support cloud service delivery throughout urban and increasingly rural areas. These connectivity improvements democratize cloud access by enabling businesses in previously underserved regions to leverage enterprise-grade computing resources and software applications.

Market Restraints:

What Challenges the Latin America Cloud Computing Market is Facing?

Cybersecurity Vulnerabilities and Data Protection Concerns

Latin America faces significant cybersecurity challenges that create hesitation among organizations considering cloud migration for sensitive workloads. The region experiences elevated cyber incident growth rates while maintaining relatively lower protection levels compared to other global markets. Organizations handling sensitive financial, healthcare, and government data express concerns regarding cloud security architectures despite improvements in provider security frameworks. Data protection compliance requirements introduce complexity as organizations navigate varying regulatory landscapes across different countries within the region.

Skilled Workforce Limitations and Talent Gaps

The scarcity of qualified cloud computing professionals across Latin America constrains market growth as organizations struggle to find talent capable of designing, implementing, and managing sophisticated cloud environments. Cloud architects, security specialists, and DevOps engineers remain in high demand with insufficient supply from educational institutions and training programs. This talent shortage increases project implementation timelines and operational costs while limiting organizations' abilities to fully leverage advanced cloud capabilities. Small and medium enterprises particularly struggle to compete for skilled professionals against larger organizations offering competitive compensation packages.

Legacy System Integration Complexity

Organizations operating substantial legacy infrastructure face considerable challenges integrating cloud services with existing systems that were not designed for cloud connectivity. Monolithic application architectures prevalent among established enterprises create technical barriers requiring significant modernization investments before cloud migration becomes feasible. Data compatibility issues, custom integrations, and interdependencies between legacy systems complicate cloud adoption strategies, extending implementation timelines and increasing project complexity. These integration challenges prove particularly challenging for heavily regulated industries where system stability and compliance represent critical priorities.

Competitive Landscape:

The Latin America cloud computing market exhibits an increasingly competitive landscape with global hyperscalers commanding dominant positions while regional providers and specialized vendors pursue niche opportunities. Amazon Web Services, Microsoft Azure, and Google Cloud maintain substantial market presence through extensive infrastructure investments, comprehensive service portfolios, and continuous innovation across compute, storage, analytics, and artificial intelligence capabilities. These providers differentiate through regional data center expansion, compliance certifications addressing local regulatory requirements, and partnerships with system integrators and channel partners. Regional telecommunications operators leverage existing customer relationships and network infrastructure to offer cloud services, often partnering with global providers to enhance capabilities. Competition intensifies as providers expand service offerings, improve pricing structures, and develop industry-specific solutions addressing unique requirements of banking, healthcare, retail, and government sectors.

Recent Developments:

- In May 2025, Pátria Investimentos introduced Omnia, a USD 1 Billion AI-ready hyperscale data center platform focused on cloud services across Brazil, Mexico, and Chile. The platform utilizes exclusively renewable energy sources and targets major global technology companies as demand for cloud and artificial intelligence infrastructure surges throughout Latin America.

- In February 2025, Alibaba Cloud inaugurated its first data center in Mexico, expanding presence with 87 availability zones distributed across 29 global regions. This investment positions Alibaba as a competitive alternative to established providers while addressing growing enterprise demand for diverse cloud service options in the rapidly expanding Mexican market.

Latin America Cloud Computing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS)) |

| Workloads Covered | Application Development and Testing, Analytics and Reporting, Data Storage and Backup, Integration and Orchestration, Resource Management, Others |

| Deployment Modes Covered | Public, Private, Hybrid |

| Organization Sizes Covered | Large Enterprise, Small and Medium Enterprise |

| Verticals Covered | BFSI, IT and Telecom, Retail and Consumer Goods, Energy and Utilities, Healthcare, Media and Entertainment, Government and Public Sector, Others |

| Regions Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Latin America cloud computing market size was valued at USD 53.85 Billion in 2025.

The Latin America cloud computing market is expected to grow at a compound annual growth rate of 14.69% from 2026-2034 to reach USD 184.85 Billion by 2034.

Infrastructure as a Service (IaaS) dominated the market with a share of 38%, driven by enterprise migration of on-premises workloads to scalable virtual infrastructure platforms enabling operational agility and rapid deployment capabilities.

Key factors driving the Latin America cloud computing market include accelerating digital transformation initiatives, expanding hyperscale data center infrastructure, rising internet penetration, government cloud adoption programs, and increasing enterprise demand for scalable, cost-effective IT solutions.

Major challenges include cybersecurity vulnerabilities and data protection concerns, skilled workforce limitations and talent gaps, legacy system integration complexity, varying regulatory requirements across countries, and infrastructure disparities between urban and rural areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)