Latin America Cold Chain Logistics Market Size, Share, Trends and Forecast by Type, Application, and Country, 2025-2033

Latin America Cold Chain Logistics Market Overview:

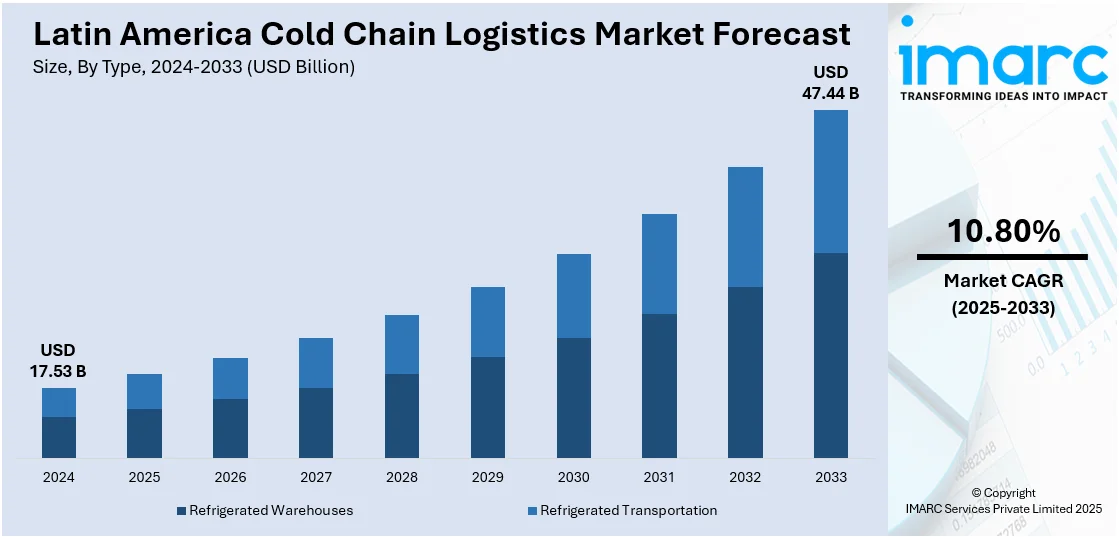

The Latin America cold chain logistics market size was valued at USD 17.53 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 47.44 Billion by 2033, exhibiting a CAGR of 10.80% from 2025-2033. The market is driven by the increasing demand for perishable food products, expansion in the pharmaceutical sector, rapid advancements in cold chain technologies, rising government investments in infrastructure and policies supporting logistics, and significant growth in the e-commerce sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 17.53 Billion |

| Market Forecast in 2033 | USD 47.44 Billion |

| Market Growth Rate 2025-2033 | 10.80% |

Latin America Cold Chain Logistics Market Trends:

Rising Demand for Perishable Goods

The growing consumer preference for fresh food and frozen products is boosting the cold chain logistics market in Latin America. This includes the transport and storage of fruits, vegetables, dairy products, and meats that require specific temperature conditions to maintain quality and safety. Moreover, the region's economic growth and urbanization have contributed to changing dietary habits, emphasizing higher consumption of perishable and high-value food products. Along with this, the rising need for quality and safety standards, propelling investments in better cold storage facilities and transportation technologies by companies that can handle temperature-sensitive goods efficiently, is providing a thrust to the market. For instance, in August 2024, the Global Cold Chain Foundation (GCCF) proudly announced the opening of Brazil's first Cold Chain Institute. The initial session, which included 31 students from seven different Cold Chain firms, began activities on August 13-15.

Expansion of the Pharmaceutical Sector

The pharmaceutical industry in Latin America is witnessing rapid growth, fueled by increased healthcare spending, government initiatives, and the emergence of biopharmaceuticals. Moreover, the heightened need for robust cold chain logistics solutions to secure vaccines, biologics, and other temperature-sensitive medical products is acting as a growth-inducing factor. Along with this, the growing need for reliable cold chain infrastructure to support vaccine distribution, which further catalyzed investments in this sector, is fueling the market growth. Apart from this, the ongoing demand for temperature-controlled logistics for pharmaceuticals, driving technological enhancements in cold storage and transportation solutions to meet compliance and safety standards, is providing a considerable boost to the market.

Rapid Technological Advancements in Cold Chain Solutions

The rising technological innovation that transforms the cold chain logistics industry in Latin America is bolstering the market growth. Moreover, the development of the Internet of Things (IoT), temperature monitoring, global positioning system (GPS) tracking, and automation that help companies maintain optimal conditions throughout the supply chain is promoting the market growth. Furthermore, the introduction of real-time monitoring technologies to ensure that temperature-sensitive products are maintained within specific ranges, preventing spoilage or damage, is enhancing the market growth. Apart from this, the burgeoning integration of advanced logistics management software that streamlines operations, enhances efficiency and reduces costs is fostering the market growth. For instance, DP World, a world leader in supply chain and logistics solutions, announced in December 2024 that it intends to greatly grow its freight forwarding business in Brazil during the following two years. To show its dedication to enhancing end-to-end supply chain solutions in Latin America, the company plans to open six new offices by 2026. The company is expected to improve tech-driven cold chain solutions, increasing food safety and decreasing spoilage, with more offices and a wider network.

Latin America Cold Chain Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Refrigerated Warehouses

- Refrigerated Transportation

- Railways

- Airways

- Roadways

- Waterways

The report has provided a detailed breakup and analysis of the market based on the type. This includes refrigerated warehouses and refrigerated transportation (railways, Airways, roadways, and waterways).

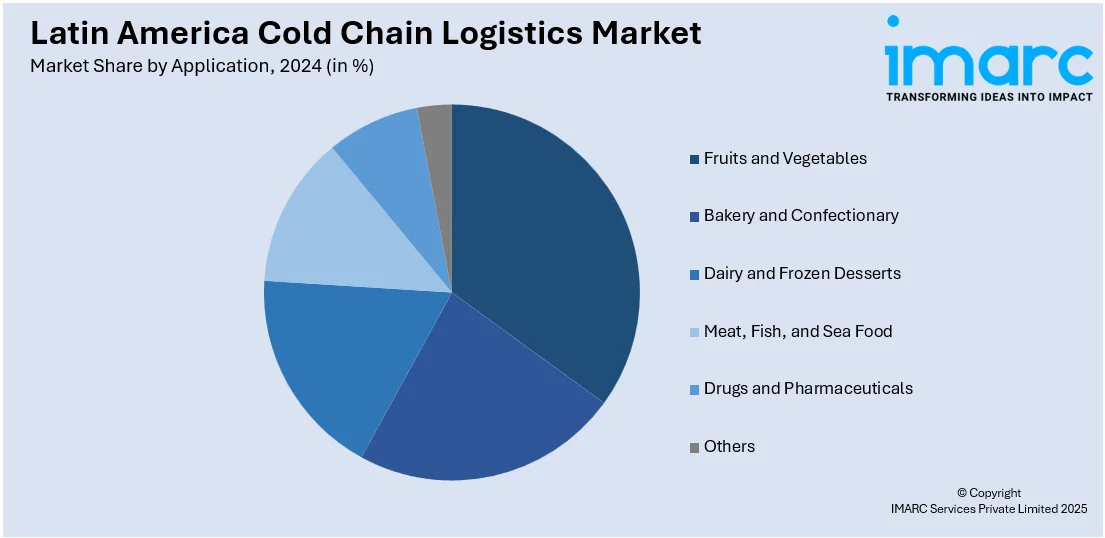

Application Insights:

- Fruits and Vegetables

- Bakery and Confectionary

- Dairy and Frozen Desserts

- Meat, Fish, and Sea Food

- Drugs and Pharmaceuticals

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes fruits and vegetables, bakery and confectionary, dairy and frozen desserts, meat, fish, and sea food, drugs and pharmaceuticals, and others.

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Cold Chain Logistics Market News:

- In October 2024, Emergent Cold Latin America, the biggest supplier of temperature-controlled food storage and logistics solutions in Latin America, announced two projects to increase the capacity of its storage infrastructure in Colombia by 22,000 pallet slots.

- In December 2024, Canadian Pacific Kansas City (CPKC), an intermodal freight transportation leader, and Americold Realty Trust, a global leader in temperature-controlled logistics, plan to explore co-development opportunities in Mexico to optimize temperature-sensitive commodity flows between the United States, Mexico, and Canada.

Latin America Cold Chain Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Applications Covered | Fruits and Vegetables, Bakery and Confectionary, Dairy and Frozen Desserts, Meat, Fish, and Sea Food, Drugs and Pharmaceuticals, Others |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America cold chain logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America cold chain logistics market on the basis of type?

- What is the breakup of the Latin America cold chain logistics market on the basis of application?

- What is the breakup of the Latin America cold chain logistics market on the basis of country?

- What are the various stages in the value chain of the Latin America cold chain logistics market?

- What are the key driving factors and challenges in the Latin America cold chain logistics market?

- What is the structure of the Latin America cold chain logistics market and who are the key players?

- What is the degree of competition in the Latin America cold chain logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America cold chain logistics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America cold chain logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America cold chain logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)