Latin America Construction Chemicals Market Report by Type (Concrete Admixtures, Waterproofing and Roofing, Repair, Flooring, Sealants and Adhesives, and Others), Application (Residential, Non-Residential), and Country 2025-2033

Latin America Construction Chemicals Market Overview:

Latin America construction chemicals market size reached USD 3.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.7 Billion by 2033, exhibiting a growth rate (CAGR) of 6.4% during 2025-2033. Advancements in construction chemicals like eco-friendly formulations, green building materials, high-performance admixtures, and digital integration are fueling market growth by enhancing durability, sustainability, and efficiency in construction projects, meeting rising global demand for modern infrastructure and environmentally conscious solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Market Growth Rate (2025-2033) | 6.4% |

Construction chemicals refer to a broad range of specialty products used in the construction industry to enhance the performance, durability, and aesthetic qualities of buildings and infrastructure. These chemicals play a crucial role in various construction processes, including concrete production, waterproofing, adhesion, surface treatment, and protection against environmental factors. Common types of construction chemicals include admixtures, sealants, adhesives, waterproofing agents, and coatings. Admixtures, for example, are added to concrete or mortar to improve its properties, such as workability, strength, and durability. Waterproofing chemicals protect structures from water damage, while adhesives facilitate the bonding of different construction materials. The use of construction chemicals not only enhances the overall quality of construction projects but also contributes to the longevity and sustainability of structures, meeting the diverse needs of modern construction practices.

Latin America Construction Chemicals Market Trends:

Growing Demand for Green Building Materials

The Latin America construction market is experiencing significant growth due to increased demand for green building materials. Regulatory agencies in nations such as Brazil, Mexico, and Colombia are putting in place tougher environmental regulations, motivating builders to adopt green building methods. This transition is being influenced by increasing knowledge of climate change, carbon footprint reduction pressures, and the savings from long-term costs in energy-efficient buildings. Developers and builders are increasingly adding materials like low-VOC adhesives, green insulation, and recycled content-based admixtures to residential, commercial, and infrastructure development projects. Besides, certification schemes like LEED and EDGE are increasingly in demand, creating a positive climate for green construction materials. Investments by the public sector in urban development and green infrastructure also are driving the uptake of sustainable building solutions. The market is answering back with custom product portfolios that address performance as well as sustainability requirements. While construction activity picks up after the pandemic, particularly in cities, the need for certified green materials will continue to be robust. The trend is a key stimulus for construction chemical manufacturers and suppliers who are developing new products to meet environmental laws and consumer demands in the market.

Technological Advancements in Formulations

In Latin America, construction chemical formulation innovation is fueling market growth through improved product performance, efficiency, and durability. Industry leaders are spending capital on research and development to launch next-generation additives and admixtures that enhance workability, accelerate curing rates, and improve resistance to environmental stresses. These technologies benefit most in countries with harsh climate conditions or seismic activities. The creation of multi-functional products, e.g., admixtures that are both waterproofing and strength-enhancing, is gaining traction. Domestic and foreign producers are concentrating on custom-designed formulations that meet regional infrastructure requirements and conform to changing safety and quality standards. Formulations are also allowing for improved compatibility with new building technologies, such as modular and prefabricated systems. The introduction of nanotechnology-based additives and polymer-modified products is further expanding application possibilities in infrastructure, commercial buildings, and residential projects in LATAM construction chemicals market. Contractors and developers benefit from reduced material wastage, shorter project timelines, and improved lifecycle performance of structures. As competition intensifies and regulatory frameworks become more demanding, continued innovation in chemical formulations will remain a strategic lever for growth. Manufacturers that prioritize performance-driven, cost-effective, and sustainable formulations are well-positioned to capitalize on market opportunities throughout Latin America.

Shift Towards Ready-Mix Concrete

The growing preference for ready-mix concrete (RMC) in Latin America's construction industry is significantly influencing the demand for construction chemicals. Urbanization, rising labor costs, and the need for project efficiency are encouraging contractors to adopt RMC solutions that offer consistent quality, faster on-site operations, and reduced environmental impact. This shift is also supported by advancements in the Latin America construction equipment market , which facilitates efficient handling and placement of RMC. Furthermore, evolving preferences in building materials are driving demand for high-performance admixtures and additives that enhance the durability and sustainability of concrete structures. Construction chemicals, particularly admixtures such as plasticizers, retarders, and accelerators, play a central role in enhancing the performance of RMC. The increasing use of RMC in large-scale infrastructure, commercial developments, and residential projects is driving demand for customized chemical solutions that meet specific project requirements. Latin American markets are witnessing expanded RMC production networks, especially in Brazil and Mexico, where logistics and batching plant automation are advancing rapidly. This shift aligns with sustainability goals by minimizing material waste and energy consumption on-site. Moreover, the RMC trend supports compliance with quality standards and helps mitigate on-site variability in material handling. Suppliers of construction chemicals are leveraging this trend by offering product lines designed for efficient integration into RMC production processes. As construction activity increases across urban and peri-urban regions, the shift toward RMC will continue to serve as a catalyst for growth in the South America construction chemicals market, supporting demand for high-performance, application-specific chemical solutions across the region.

Latin America Construction Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Concrete Admixtures

- Waterproofing and Roofing

- Repair

- Flooring

- Sealants and Adhesives

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes concrete admixtures, waterproofing and roofing, repair, flooring, sealants and adhesives, and others.

Application Insights:

- Residential

- Non-Residential

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential and non-residential.

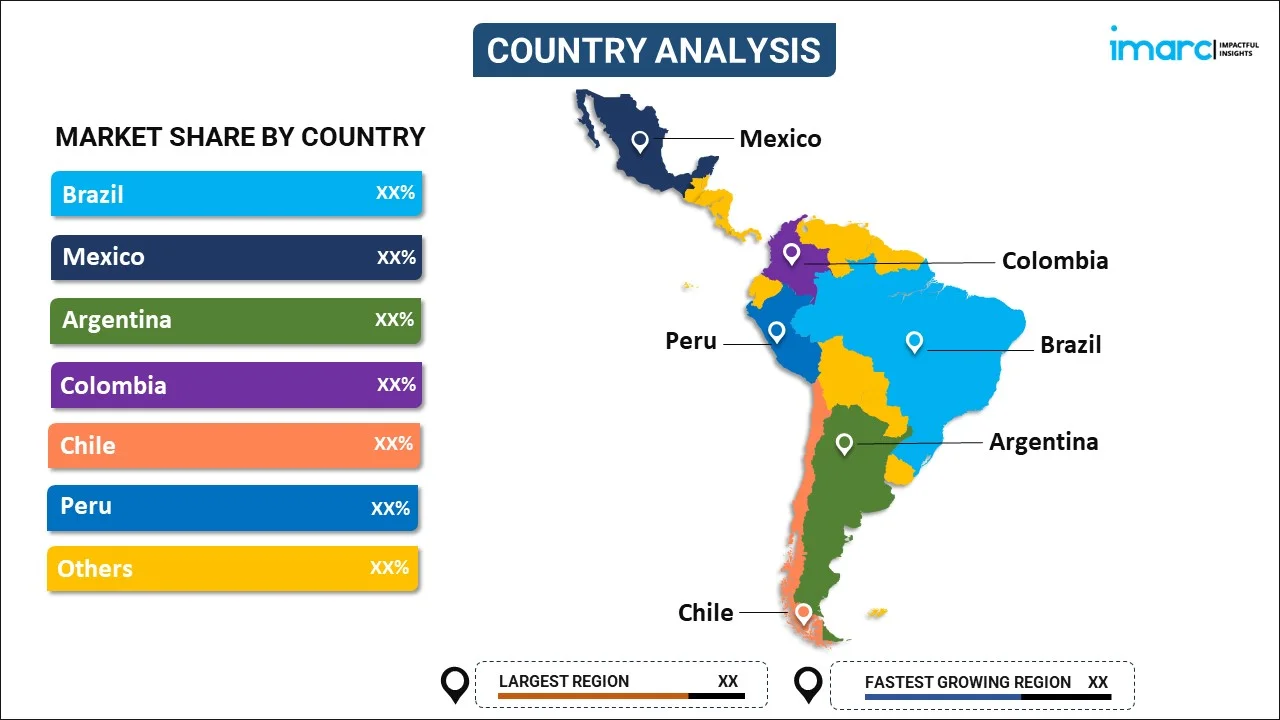

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Construction Chemicals Market News:

- March 2025: Thermax partnered with Brazil’s OCQ to establish a joint venture in India for acrylic resin production. This move strengthened OCQ’s Latin American chemical footprint, supported global expansion, and enhanced supply capabilities for construction chemicals across infrastructure, waterproofing, adhesives, and coatings sectors.

- February 2025: SMC Global established SMC Argentina to expand its construction chemicals operations in Latin America. The move improved local supply chain efficiency, enabled transactions in Argentine pesos, reduced delivery times, and enhanced market accessibility, supporting regional demand for specialized chemical products.

- December 2024: MC-Bauchemie inaugurated a modern construction chemicals plant in Santa Cruz, Bolivia, producing admixtures, waterproofing agents, and curing solutions. With a one-million-litre monthly capacity, it strengthened regional supply, boosted local employment, and positioned Bolivia as a strategic hub for South American exports.

Latin America Construction Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Concrete Admixtures, Waterproofing and Roofing, Repair, Flooring, Sealants and Adhesives, Others |

| Applications Covered | Residential, Non-Residential |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America construction chemicals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America construction chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America construction chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The construction chemicals market in Latin America was valued at USD 3.8 Billion in 2024.

The Latin America construction chemicals market is projected to exhibit a CAGR of 6.4% during 2025-2033, reaching a value of 6.7 Billion by 2033.

Key factors driving the Latin America construction chemicals market include rising infrastructure investments, demand for sustainable and green building materials, urbanization, growth in ready-mix concrete usage, technological advancements in formulations, and expanding regional presence of global players through new plants, partnerships, and localized service networks.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)