Latin America Contract Logistics Market Size, Share, Trends, and Forecast by Type, End User, and Country, 2026-2034

Latin America Contract Logistics Market Overview:

The Latin America contract logistics market size reached USD 21.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 37.4 Billion by 2034, exhibiting a growth rate (CAGR) of 6.34% during 2026-2034. The market is driven by an increasing focus on last-mile delivery solutions, significant growth in foreign direct investment (FDI), the expansion of the healthcare and pharmaceutical industry, strong regulatory support for logistics sector modernization, continual technological advancements in fleet management, the rising need for third-party logistics (3PL) services, and the growing focus on sustainability and green logistics practices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 21.5 Billion |

| Market Forecast in 2034 | USD 37.4 Billion |

| Market Growth Rate (2026-2034) | 6.34% |

Access the full market insights report Request Sample

Latin America Contract Logistics Market Trends:

Significant Growth of Online Retailing and E-Commerce

The expansion of e-commerce and online shopping is a key determinant of the market growth in Latin America. According to industry reports, the region accommodates an estimated 300 million digital shoppers, a number anticipated to expand by an exceptional 44% by the year 2029. The increase in the number of consumers engaging in online shopping is placing an emphasis on the rapid digital advancement of countries, such as Brazil, Mexico, and Argentina, thereby generating significant demand for contract logistics. Within a single year, 2023, online retail sales in Latin America stood at roughly $272 billion dollars, alluding to the various sectors’ economic impact. Since online sellers must efficiently manage stock, warehousing, and the distribution of goods to their clients, transitioning to online sales entails a significant financial burden. In order to solve these problems, contract logistics service providers are offering solutions that can be adjusted in order to facilitate deliveries and the supply chain process better. In addition to this, the augmenting demand for quick deliveries, such as same-day or one-day deliveries, has been another factor stimulating the overall contract logistics network. This has translated to an increase in investment in the latest technology like automated storage and retrieval systems and GPS systems to satisfy the demand of the customers.

Increasing Demand for Efficient Supply Chain Management

The heightening requirement for effective supply chain management is a significant driver of the Latin America contract logistics market. Businesses across the region are striving to improve operational effectiveness, minimize costs, and deliver superior consumer experiences. This need for streamlined supply chain processes is propelling companies to outsource logistics functions to specialized providers with the expertise and resources to optimize operations. Latin America’s dynamic market landscape, characterized by a diverse industrial base and growing cross-border trade, adds complexity to supply chains. For instance, as per industry reports, the Latin America and Caribbean region witnessed robust trade growth during H1 2024 in comparison to H1 2023, with exports exhibiting year-on-year growth of 5%. Contract logistics providers play a crucial role by offering integrated solutions such as inventory management, transportation optimization, and warehousing services. Their ability to leverage advanced technologies, such as tracking in real-time, automation, as well as predictive analytics, facilitates better visibility and control over supply chain activities, which is resulting in a higher uptake of these services.

Latin America Contract Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on type and end user.

Type Insights:

To get detailed segment analysis of this market Request Sample

- Insourced

- Outsourced

The report has provided a detailed breakup and analysis of the market based on the type. This includes insourced and outsourced.

End User Insights:

- Automotive

- Consumer and Retail

- Energy

- Hi-Tech and Healthcare

- Industrial and Aerospace

- Technology

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes automotive, consumer and retail, energy, hi-tech and healthcare, industrial and aerospace, technology, and others.

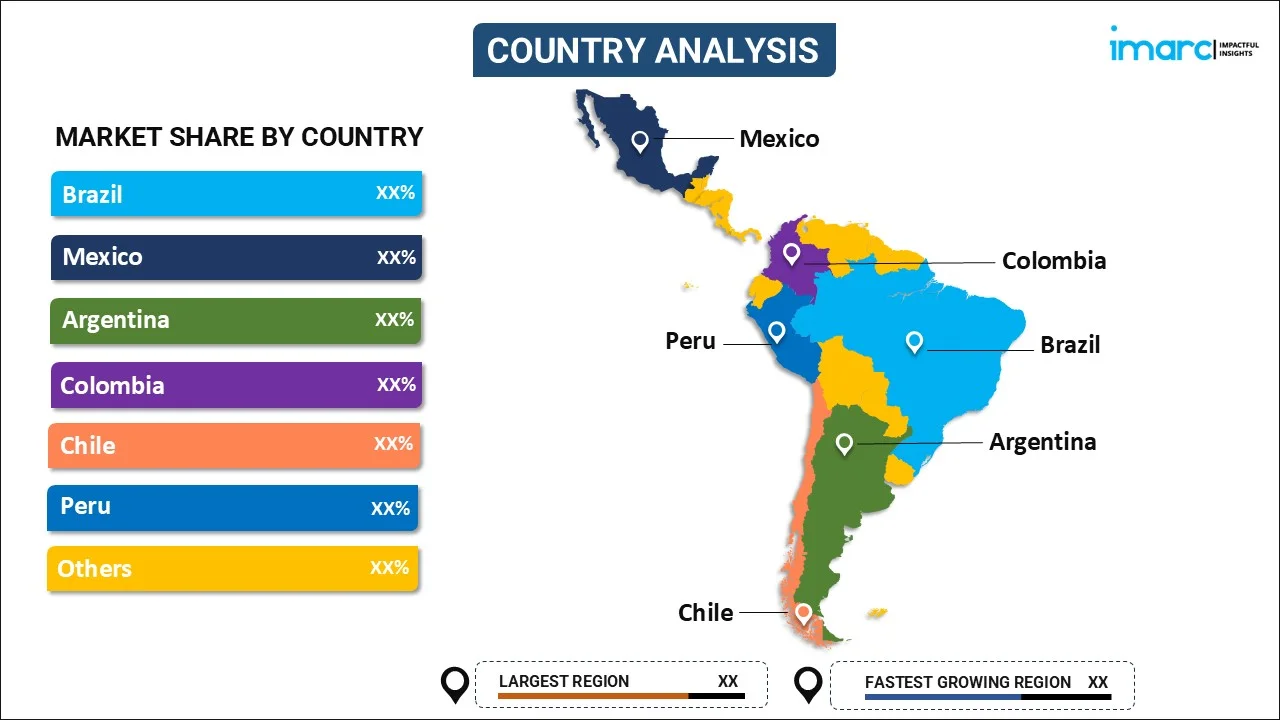

Country Insights:

To get detailed regional analysis of this market Request Sample

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Contract Logistics Market News:

- September 25, 2024: Scan Global Logistics (SGL), a global logistics solutions provider, is bolstering its presence in Latin America through a mix of market entries, expansions, and strategic acquisitions. The company has opened new offices in Argentina and Colombia while enhancing service operations in key locations such as Chile, Peru, and Mexico. In a significant move, SGL has also finalized the acquisition of BLU Logistics, a prominent freight forwarder in Brazil. This acquisition strengthens SGL's capabilities, particularly in trade lanes connecting China and Southeast Asia with Latin America, adding valuable expertise to its global operations.

Latin America Contract Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Insourced, Outsourced |

| End Users Covered | Automotive, Consumer and Retail, Energy, Hi-Tech and Healthcare, Industrial and Aerospace, Technology, Others |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America contract logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America contract logistics market on the basis of type?

- What is the breakup of the Latin America contract logistics market on the basis of end user?

- What is the breakup of the Latin America contract logistics market on the basis of country?

- What are the various stages in the value chain of the Latin America contract logistics market?

- What are the key driving factors and challenges in the Latin America contract logistics market?

- What is the structure of the Latin America contract logistics market and who are the key players?

- What is the degree of competition in the Latin America contract logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America contract logistics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America contract logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America contract logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)