Latin America Cross Border Road Freight Market Size, Share, Trends and Forecast by Function, End User, and Country, 2026-2034

Latin America Cross Border Road Freight Market Overview:

The Latin America cross border road freight market size reached USD 37.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 67.6 Billion by 2034, exhibiting a growth rate (CAGR) of 6.73% during 2026-2034. The market is fueled by growing regional trade, enhanced connectivity from infrastructure investments, and evolving supply chain demands. Additionally, advancements in logistics technology and sustainability practices are optimizing operations, supporting market expansion across diverse industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 37.6 Billion |

| Market Forecast in 2034 | USD 67.6 Billion |

| Market Growth Rate (2026-2034) | 6.73% |

Access the full market insights report Request Sample

Latin America Cross Border Road Freight Market Trends:

Increased E-commerce and Cross-border Trade

With the rise of the e-commerce sector and subsequently, increasing cross-border trade activities, the Latin America cross-border road freight market has been on the up for quite some time now. As countries like Brazil, Mexico, and Argentina rank high on e-commerce growth, road freight demand has grown significantly. For instance, according to the International Trade Administration (ITA) 2024 report, Mexico is witnessing significant growth in internet usage, representing 81% of the population. Hence, this growth has propelled the expansion of the e-commerce market, which is projected to reach USD 63 billion by 2025. Moreover, this trend is supported by the rising need for faster delivery times, especially in the last-mile segment, driving the adoption of road freight over traditional air and sea options. Additionally, the liberalization of trade agreements has facilitated smoother and more frequent cross-border shipments, increasing the volume of goods transported via road networks in the region.

Sustainability and Green Logistics

Environmental concerns and government regulations are driving the adoption of more sustainable practices within the Latin American cross-border road freight sector. For instance, as per the industry reports, in 2024, Brazilian government introduced the National Green Mobility and Innovation Program (Mover), offering tax incentives worth BRL 3.5–4.1 billion annually through 2028 to reduce automotive emissions and promote sustainability. Moreover, carriers are rapidly making investments in cleaner technologies, mainly encompassing electric trucks and substitute fuel vehicles, driven by the rising demand for green logistics solutions. The implementation of stricter environmental standards and incentives for eco-friendly transportation solutions is accelerating the shift toward more sustainable freight practices. As a result, logistics companies are investing in green infrastructure and eco-friendly freight solutions to meet both regulatory requirements and consumer expectations for sustainability in cross-border trade. For instance, in November 2024, 11 leading companies announced the launch of the Zero Emission Vehicles Emerging Markets Initiative to accelerate the electrification of Mexico’s transportation sector. The initiative aims for 9,000 electric vehicles by 2027 and 17,000 by 2030, supporting Mexico’s goal of reducing GHG emissions by 35% by 2030, while advancing sustainable mobility and decarbonization efforts.

Latin America cross border road freight Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on function and end user

Function Insights:

.webp)

To get detailed segment analysis of this market Request Sample

- Full Truck Load (FTL)

- Less than Truck Load (LTL)

- Courier, Express, and Parcel (CEP)

The report has provided a detailed breakup and analysis of the market based on the function. This includes full truck load (FTL), less than truck Load (LTL), and courier, express, and parcel (CEP).

End User Insights:

- Chemicals

- Agriculture, Fishing, and Forestry

- Construction

- Distributive Trade

- Pharmaceutical and Healthcare

- Manufacturing and Automotive

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes chemicals, agriculture, fishing, and forestry, construction, distributive trade, pharmaceutical and healthcare, and manufacturing and automotive.

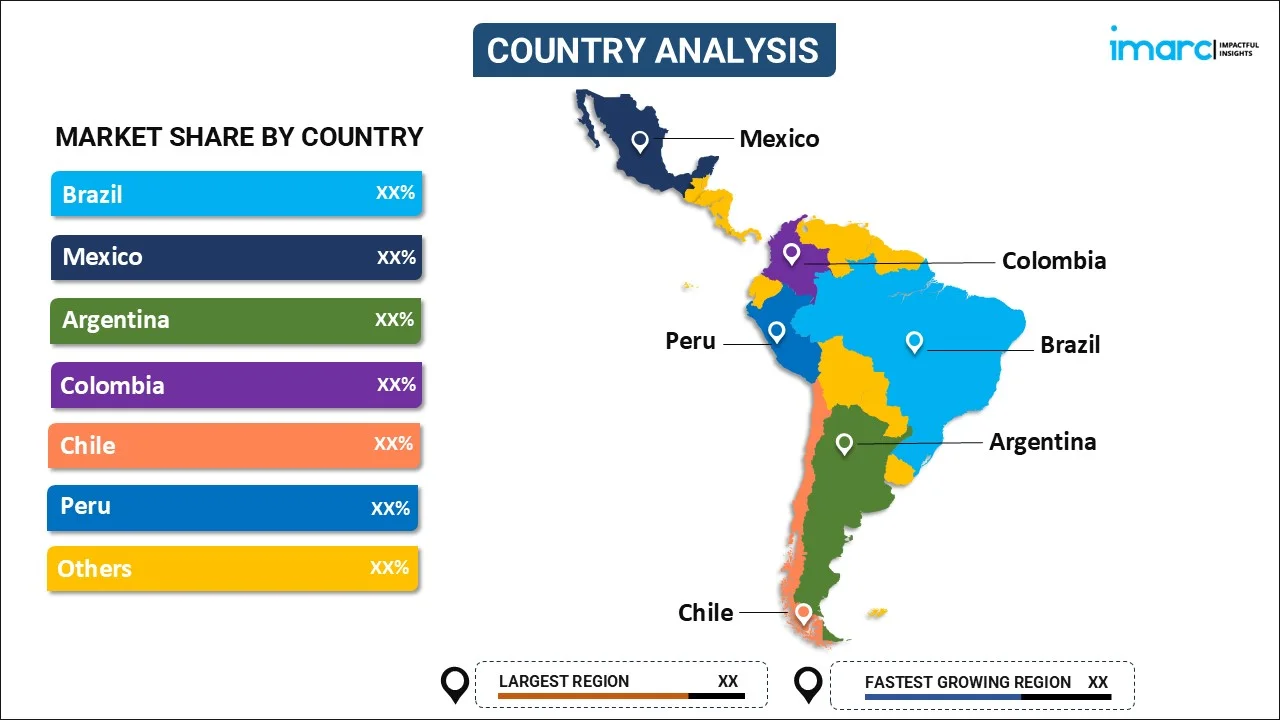

Country Insights:

To get detailed regional analysis of this market Request Sample

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Cross Border Road Freight Market News:

- In February 2025, Rhenus Logistics, a global logistics company, announced the launch of Rhenus Beyond Borders to significantly improve cross-border trade. With CTPAT validation across the United States, the service upgrades both exports and imports between Mexico, the USA, and Canada, enhancing efficacy and minimizing costs.

- In September 2024, DHL Supply Chain announced plans to expand its electric vehicle (EV) fleet in Latin America, targeting 1,000 EVs by 2025, up from its current 550–600. The company’s zero emissions strategy includes electrifying new facilities, exploring alternative fuels like natural gas, and optimizing logistics through "Control Towers" for efficient route planning.

Latin America Cross Border Road Freight Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Functions Covered | Full Truck Load (FTL), Less than Truck Load (LTL), Courier, Express, and Parcel (CEP) |

| End Users Covered | Chemicals, Agriculture, Fishing, and Forestry, Construction, Distributive Trade, Pharmaceutical and Healthcare, Manufacturing and Automotive |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America cross border road freight market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America cross border road freight market on the basis of function?

- What is the breakup of the Latin America cross border road freight market on the basis of end user?

- What is the breakup of the Latin America cross border road freight market on the basis of country?

- What are the various stages in the value chain of the Latin America cross border road freight market?

- What are the key driving factors and challenges in the Latin America cross border road freight market?

- What is the structure of the Latin America cross border road freight market and who are the key players?

- What is the degree of competition in the Latin America cross border road freight market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America cross border road freight market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America cross border road freight market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America cross border road freight industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)