Latin America Crowdfunding Market Size, Share, Trends and Forecast by Type, End Use, and Country, 2025-2033

Latin America Crowdfunding Market Overview:

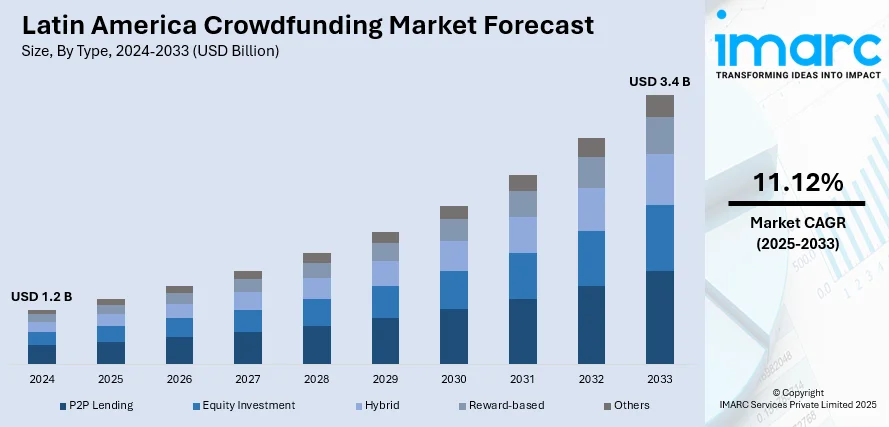

The Latin America crowdfunding market size reached USD 1.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.4 Billion by 2033, exhibiting a growth rate (CAGR) of 11.12% during 2025-2033. The market is experiencing significant growth, driven by increased internet and smartphone access, a vibrant startup culture, and supportive regulations. Fintech innovations and growing entrepreneurial activity enhance accessibility and trust, positioning crowdfunding as a vital alternative financing method and fostering economic and social development across the region. Latin America’s share of the global crowdfunding market reached 10.3% in 2024.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 3.4 Billion |

| Market Growth Rate 2025-2033 | 11.12% |

Latin America Crowdfunding Market Trends:

Expanding User Base

The expanding user base in Latin America crowdfunding market outlook is significantly driven by increased internet penetration and widespread smartphone usage. As internet access becomes more ubiquitous, particularly in urban and even some rural areas, more individuals and businesses gain the ability to connect with crowdfunding platforms. According to industry reports, in 2023, mobile technologies contributed 8% of GDP in Latin America, totaling USD 520 Billion. Mobile internet users reached 418 million (65% of the population), up by 75 million. By April, 29 operators launched 5G in 10 countries, expected to rise from 5% to 55% of connections by 2030. In line with this, smartphones play a crucial role by enabling on-the-go access, making it easier for users to create, manage, and support campaigns anytime, anywhere. This digital accessibility lowers barriers to entry, allowing a diverse range of participants, including young entrepreneurs and small businesses, to engage in online fundraising. At the same time, many individuals are drawn to alternative finance options that bypass traditional banking systems, making crowdfunding especially attractive in regions with limited access to credit. The trend is not limited to small projects; larger-scale initiatives are also gaining momentum through real estate crowdfunding, allowing investors to collectively fund housing developments and infrastructure projects. Rising trust in crowdfunding investment opportunities, combined with stronger regulatory support, is encouraging higher participation across demographics. These factors are collectively strengthening Latin America’s adoption of crowd investing, positioning the region as a growing hub for diverse funding models.

To get more information on this market, Request Sample

Rapid Growth in Startup Culture

The growing startup culture in Latin America is characterized by a significant increase in entrepreneurial activity, with more individuals launching innovative startups and diverse projects across various sectors. According to industry reports, Latin America became an emerging startup ecosystem, with over 9,000 funded startups raising USD 3.9 Billion in VC investment in 2023. The region has seen rapid digital adoption in fintech and e-commerce. This growth has led to over 60 unicorns being established in the past decade. This vibrant ecosystem is driven by a combination of youthful talent, access to technology, and supportive educational initiatives. Crowdfunding has become a pivotal tool for these entrepreneurs, enabling them to secure essential initial funding without relying solely on traditional financial institutions. In particular, crowdfunding for startups is helping early ventures gain visibility and financial backing while also validating their concepts with potential customers. Small enterprises are increasingly turning to crowdfunding for business as a flexible way to finance expansions, product launches, and operational growth. Additionally, many platforms now highlight equity crowdfunding, giving investors a stake in the company’s success rather than just serving as donors. These models are reshaping how entrepreneurs approach fundraising, creating deeper engagement between businesses and their supporters. This validation process helps startups refine their concepts and build a loyal customer base even before their official launch, further fueling the Latin America crowdfunding market growth.

Latin America Crowdfunding Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type and end use.

Type Insights:

- P2P Lending

- Equity Investment

- Hybrid

- Reward-based

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes P2P lending, equity investment, hybrid, reward-based, and others.

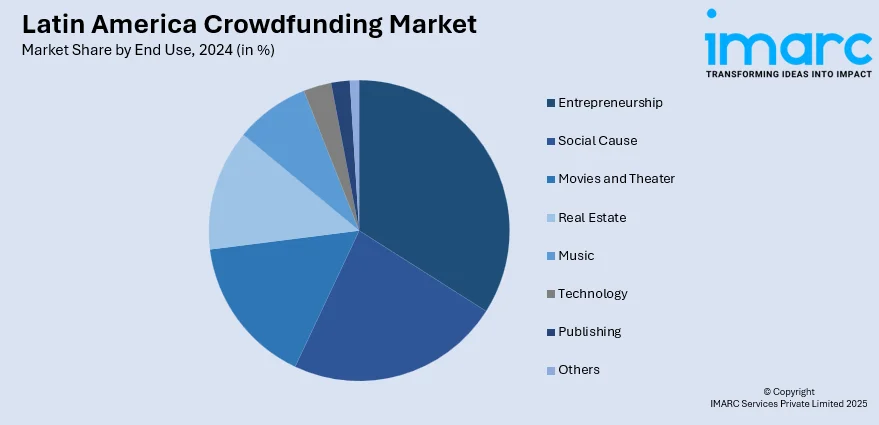

End Use Insights:

- Entrepreneurship

- Social Cause

- Movies and Theater

- Real Estate

- Music

- Technology

- Publishing

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes entrepreneurship, social cause, movies and theater, real estate, music, technology, publishing, and others.

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Crowdfunding Market News:

- In April 2024, GoFundMe expanded its crowdfunding services to Mexico, allowing local fundraisers to solicit donations. This growth marks the platform's entry into its 20th country, targeting untapped Latin American markets. The expansion aims to enhance financial support and philanthropy in Mexico, leveraging established ties with U.S. users.

- In September 2023, Infocheck, a Chilean fintech startup, raised USD 350,000 through crowdfunding on the Broota platform. The company streamlines risk assessment for B2C and B2B clients, providing real-time market reports. This funding supports product development and enhances their sales team.

Latin America Crowdfunding Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | P2P Lending, Equity Investment, Hybrid, Reward-based, Others |

| End Uses Covered | Entrepreneurship, Social Cause, Movies and Theater, Real Estate, Music, Technology, Publishing, Others |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America crowdfunding market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America crowdfunding market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America crowdfunding industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The crowdfunding market in Latin America reached USD 1.2 Billion in 2024.

The Latin America crowdfunding market is projected to exhibit a CAGR of 11.12% during 2025-2033, reaching USD 3.4 Billion by 2033.

The Latin America crowdfunding market is driven by growing internet and smartphone adoption, increased social media engagement, expanding fintech infrastructure, and demand for alternative financing among startups and SMEs. Supportive regulations, rising financial inclusion, and investor interest in high-return opportunities further accelerate crowdfunding growth across the region.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)