Latin America Cryptocurrency Market Size, Share, Trends and Forecast by Type, Component, Process, Application, and Country, 2025-2033

Latin America Cryptocurrency Market Overview:

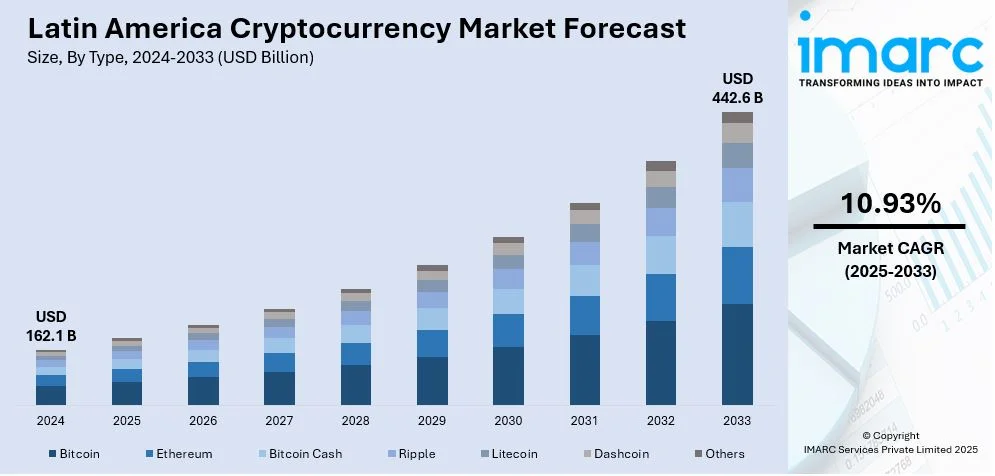

The Latin America cryptocurrency market size reached USD 162.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 442.6 Billion by 2033, exhibiting a growth rate (CAGR) of 10.93% during 2025-2033. The high inflation, and strong demand for financial inclusion are significantly impacting the Latin America cryptocurrency market share. The widespread adoption of DeFi, crypto mining growth, enhanced blockchain infrastructure, supportive regulations, and a young, tech-savvy population further propel the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 162.1 Billion |

| Market Forecast in 2033 | USD 442.6 Billion |

| Market Growth Rate 2025-2033 | 10.93% |

Latin America Cryptocurrency Market Trends:

Rise of Decentralized Finance (DeFi)

Decentralized Finance (DeFi) is rapidly gaining momentum in Latin America, by providing decentralized lending, borrowing, and trading services, established financial systems are being revolutionized. This surge is driven by the region’s economic instability and the population’s demand for alternative financial solutions. In line with this, in May 2023, Num Finance, a decentralized finance (DeFi) protocol, raised USD 1.5 Million to expand its stablecoin offerings in Latin America and the Middle East. It further aims to launch stablecoins linked to the Colombian peso, Brazilian real, Bahrain dinar, and Mexican peso. The initiative aims to cater to underserved markets and enhance the availability of local currency stablecoins. DeFi platforms empower users with greater financial autonomy, allowing them to access investment opportunities and financial services without relying on traditional intermediaries like banks. This democratization of finance is particularly beneficial in areas with limited banking infrastructure, enhancing financial inclusion. Additionally, the transparent and secure nature of blockchain technology instills trust among users wary of conventional financial institutions, which is positively influencing the Latin America cryptocurrency market outlook. Innovative startups and increasing cryptocurrency adoption are further fueling DeFi’s growth, positioning Latin America as a burgeoning hub for decentralized financial innovation. However, challenges such as regulatory uncertainty and the need for greater education remain.

Growth in Crypto Mining and Blockchain Infrastructure

The growth of crypto mining and blockchain infrastructure in Latin America is driven by favorable energy costs and suitable climatic conditions drive the growth of crypto mining and blockchain infrastructure in Latin America. Countries like Paraguay, Chile, and Argentina access abundant renewable energy sources, such as hydroelectricity, thereby significantly reducing operational costs associated with mining works. For instance, on March 2024, Texan company Giga Energy announced its partnership with Exa Tech and Phoenix Global Resources to launch a bitcoin mining operation in Argentina’s Mendoza province, utilizing wasted methane from the Vaca Muerta shale gas reserve. The initiative will cut down emissions and turn a profit on excess energy as bitcoin prices surge. Additionally, the region’s temperate climates aid in the efficient cooling of mining equipment, lowering energy consumption and enhancing profitability. Investments in blockchain infrastructures, particularly modern data centers and fast internet connectivity, enhance the efficiency and scalability of the ecosystem. Governments and private-sector players enhance innovation with incentives and partnerships, thereby attracting global mining corporations and blockchain startups from all over the world. This expansion not only stimulates local economies but also positions Latin America as a competitive hub in the global cryptocurrency landscape. However, challenges like regulatory uncertainty and ensuring energy sustainability must be addressed to maintain long-term Latin America cryptocurrency market growth.

Latin America Cryptocurrency Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, component, process, and application.

Type Insights:

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dashcoin

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes bitcoin, Ethereum, bitcoin cash, ripple, litecoin, dashcoin, and others.

Component Insights:

- Hardware

- Software

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware and software.

Process Insights:

- Mining

- Transaction

The report has provided a detailed breakup and analysis of the market based on the process. This includes mining and transactions.

Application Insights:

.webp)

- Trading

- Remittance

- Payment

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes trading, remittance, payment, and others.

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Cryptocurrency Market News:

- On October 2024, Ripple announced its partnership with Mercado Bitcoin, Latin America's largest cryptocurrency exchange, to enhance cross-border payments. The partnership allows Mercado Bitcoin to improve its offerings while venturing internationally. Ripple also launched its end-to-end payment solutions in Brazil, cutting costs and enabling faster transactions for businesses while giving Brazil significance in the crypto industry.

- On September 2024, Bitget announced its partnership with LALIGA as its official crypto partner, marking the exchange's entry into Eastern, Southeast Asia, and Latin America. The collaboration highlights a shared commitment to excellence and digital innovation.

- On February 2024, Crypto.com announced its collaboration with BTG Pactual, the biggest investment bank in Latin America, to enhance crypto services in the region. The collaboration will revolve around the listing on Crypto.com's platform of BTG Pactual's stablecoin, BTG DOL. BTG DOL is the first dollar-backed stablecoin developed by a bank, aiming to bridge traditional and digital finance while paving accessibility to the emerging digital economy.

Latin America Cryptocurrency Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Dashcoin, Others |

| Components Covered | Hardware, Software |

| Processs Covered | Mining, Transactions |

| Applications Covered | Trading, Remittance, Payment, Others |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America cryptocurrency market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America cryptocurrency market on the basis of type?

- What is the breakup of the Latin America cryptocurrency market on the basis of component?

- What is the breakup of the Latin America cryptocurrency market on the basis of process?

- What is the breakup of the Latin America cryptocurrency market on the basis of application?

- What is the breakup of the Latin America cryptocurrency market on the basis of country?

- What are the various stages in the value chain of the Latin America cryptocurrency market?

- What are the key driving factors and challenges in the Latin America cryptocurrency market?

- What is the structure of the Latin America cryptocurrency market and who are the key players?

- What is the degree of competition in the Latin America cryptocurrency market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America cryptocurrency market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America cryptocurrency market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America cryptocurrency industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)