Latin America Cyber Security Market Size, Share, Trends and Forecast by Security Type, Component, Deployment, End User, and Country, 2026-2034

Latin America Cyber Security Market Summary:

The Latin America cyber security market size was valued at USD 23.06 Billion in 2025 and is projected to reach USD 41.03 Billion by 2034, growing at a compound annual growth rate of 6.61% from 2026-2034.

The Latin America cyber security market is witnessing significant expansion driven by accelerating digital transformation initiatives, proliferating cloud computing adoption, and escalating cybercrime sophistication targeting enterprises and government institutions. Regulatory frameworks mandating robust data protection practices, including Brazil's LGPD and Chile's Law 21.459, are compelling organizations to implement comprehensive security protocols. The region's expanding internet connectivity and remote work culture further amplify demand for identity and access management solutions and endpoint protection technologies, bolstering Latin America cyber security market share.

Key Takeaways and Insights:

-

By Security Type: Network security dominates the market with a share of 28.07% in 2025, owing to the escalating frequency of network-based cyber threats including distributed denial-of-service attacks, malware propagation, and unauthorized access attempts. Widespread adoption of firewalls and intrusion detection systems across enterprises and government institutions is fueling the market expansion.

-

By Component: Solution leads the market with a share of 62.09% in 2025, driven by increasing deployment of software-driven security tools designed to detect, prevent, and respond to cyber threats. Rising adoption of advanced threat detection solutions including endpoint detection and response, identity and access management, and security information and event management systems is propelling growth.

-

By Deployment: Cloud-based exhibits a clear dominance with a 65.10% share in 2025, reflecting enterprises' migration toward distributed hybrid cloud environments and growing demand for scalable, cost-effective security platforms. Cloud-native security solutions gaining traction among organizations seeking policy-as-code, multi-cloud visibility, and automated remediation capabilities.

-

By End User: Banking, financial services, and insurance represent the largest segment with a market share of 26.12% in 2025, reflecting heightened exposure to cyber threats including ransomware, phishing, and payment fraud. Rapid expansion of digital banking platforms and mobile payment systems necessitates continuous investment in protective measures and compliance-oriented cybersecurity solutions.

-

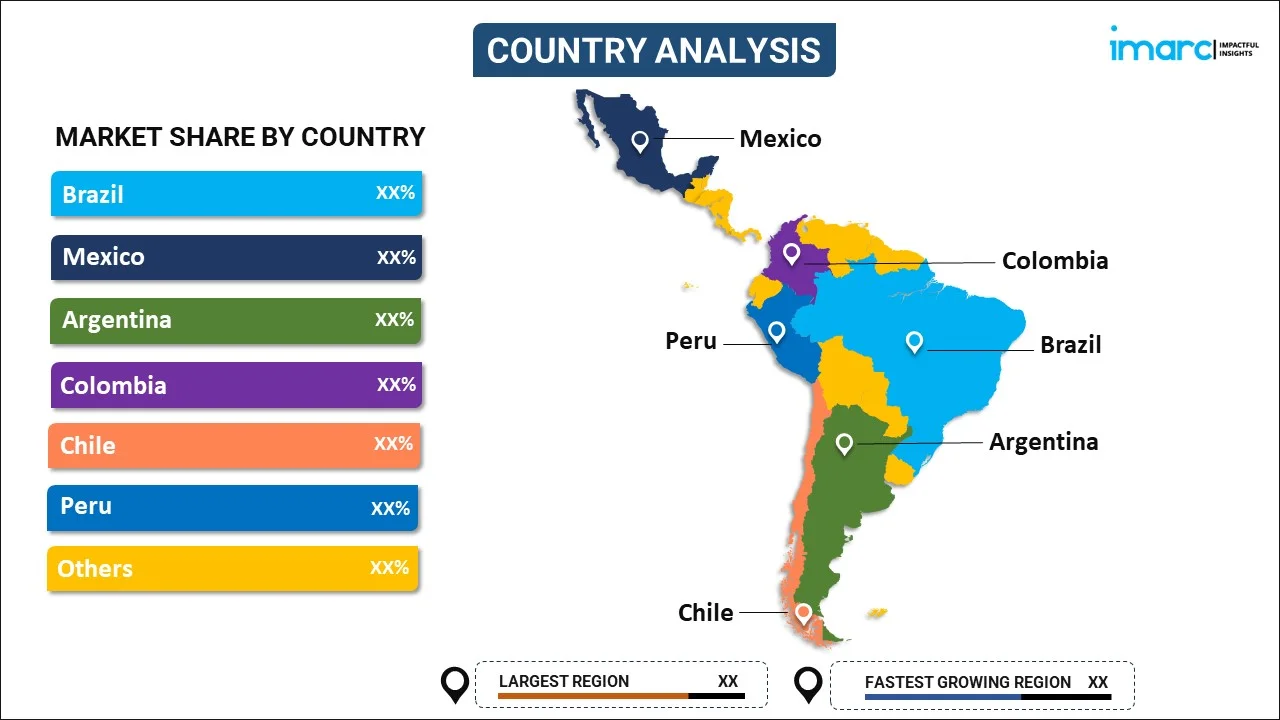

By Country: Brazil is the biggest region with 49.08% share in 2025, driven by government initiatives including the National Cybersecurity Strategy, advanced regulatory environment through LGPD enforcement, and substantial investments in secure digital infrastructure. Enterprises across São Paulo and major metropolitan areas are prioritizing cybersecurity expenditure to mitigate reputational and financial risks.

-

Key Players: Leading players drive the Latin America cyber security market by expanding product portfolios, leveraging artificial intelligence for predictive threat detection, and strengthening regional distribution networks. Strategic investments in managed security services, security operations center expansion, and public-private partnerships accelerate market penetration and enhance cyber resilience capabilities.

The Latin America cyber security market is experiencing robust growth as enterprises prioritize digital resilience against increasingly sophisticated cyber threats. Organizations across banking, healthcare, government, and telecommunications sectors are channeling substantial investments toward comprehensive protection frameworks incorporating network security, cloud security, and endpoint protection solutions. The region's digital transformation initiatives, coupled with expanding internet penetration and mobile device proliferation, have significantly broadened attack surfaces requiring robust defensive measures. The rapid expansion of digital banking platforms and mobile payment systems has created substantial demand for secure infrastructure across financial institutions. Fintech proliferation has intensified requirements for advanced encryption, multi-factor authentication, and behavioral analytics to protect sensitive customer data. Public-private partnerships are establishing Security Operations Centers and fostering international cooperation to enhance regional cyber maturity and address persistent talent shortages affecting the market's development trajectory.

Latin America Cyber Security Market Trends:

Artificial Intelligence Integration in Threat Detection

Organizations across Latin America are increasingly embedding artificial intelligence and machine learning algorithms into cybersecurity platforms to enable predictive analytics and automated incident response capabilities. These technologies facilitate real-time traffic monitoring to effectively identify and block sophisticated zero-day threats before they compromise critical systems. Advanced neural networks are enhancing threat detection accuracy while reducing false positive rates that burden security operations teams. In order to meet the increasing demand for adaptable and scalable cybersecurity models, solution providers are utilizing behavioral analytics in conjunction with automated threat intelligence.

Zero Trust Architecture Adoption

The adoption of zero trust security frameworks is gaining significant momentum across Latin American enterprises as organizations transition from traditional perimeter-based defenses. This approach assumes no implicit trust inside networks and demands rigorous verification for every access request, continuously validating users and devices. Financial institutions and government agencies are prioritizing zero trust rollouts to address cloud security gaps, poor API security vulnerabilities, and hybrid-cloud complexity that leave organizations exposed to data breaches and account hijacking threats.

Managed Security Services Expansion

The demand for managed security services is accelerating as organizations confront persistent cybersecurity talent shortages limiting internal capabilities. Cloud-based pay-as-you-go platforms and managed security service providers are making enterprise-grade protection accessible and affordable for small and medium-sized enterprises. Nearshoring dynamics are driving global managed security service providers to establish Security Operations Centers in São Paulo and Bogotá, injecting fresh competition while fostering talent pools through on-the-job upskilling programs and twenty-four-hour monitoring capabilities.

Market Outlook 2026-2034:

The Latin America cyber security market outlook remains strongly positive as digital transformation initiatives accelerate and regulatory frameworks mature across the region. Enterprises are expected to prioritize investments in cloud security solutions and identity and access management platforms to address evolving threat landscapes. Growing adoption of artificial intelligence and machine learning technologies for predictive threat detection will drive innovation across security platforms. The market generated a revenue of USD 23.06 Billion in 2025 and is projected to reach a revenue of USD 41.03 Billion by 2034, growing at a compound annual growth rate of 6.61% from 2026-2034. Public-private partnerships and international cooperation frameworks will continue strengthening regional cyber resilience. Managed security service providers are expected to expand their presence, establishing new Security Operations Centers to address persistent talent shortages while delivering enterprise-grade protection capabilities.

Latin America Cyber Security Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Security Type |

Network Security |

28.07% |

|

Component |

Solution |

62.09% |

|

Deployment |

Cloud-based |

65.10% |

|

End User |

Banking, Financial Services, and Insurance |

26.12% |

|

Country |

Brazil |

49.08% |

Security Type Insights:

- Network Security

- Cloud Security

- Application Security

- End-Point Security

- Wireless Network Security

- Others

Network security dominates with a market share of 28.07% of the total Latin America cyber security market in 2025.

The prevalence of network-based cyberthreats including distributed denial-of-service attacks, virus propagation, and unauthorized access attempts targeting enterprise infrastructure is largely responsible for network security's supremacy. Widespread adoption of firewalls, intrusion detection systems, and secure gateways across enterprises and government institutions, particularly in Brazil and Mexico, is driving substantial demand for comprehensive network protection solutions. Organizations are implementing next-generation firewall technologies featuring deep packet inspection, encrypted traffic analysis, and application-aware filtering capabilities to defend against sophisticated attack vectors exploiting network vulnerabilities.

The digitization of public infrastructure and financial services has intensified regulatory requirements mandating compliance with minimum security standards across critical sectors. In order to defend against widespread cyberattacks that target subscriber data and digital communications infrastructure, telecom companies and internet service providers are improving their network security procedures. To address convergent IT-OT risks in the mining, manufacturing, and energy sectors, industrial operators are modernizing legacy systems with industrial firewalls, network segmentation, and protocol-aware intrusion monitoring. This ensures operational continuity and safeguards sensitive industrial control systems.

Component Insights:

- Hardware

- Solution

- Threat Intelligence and Response

- Identity and Access Management

- Data Loss Prevention

- Security and Vulnerability Management

- Intrusion Prevention System

- Others

- Services

- Professional Services

- Managed Services

Solution leads with a share of 62.09% of the total Latin America cyber security market in 2025.

The growing use of software-driven security tools intended to identify, stop, and address cyberthreats in a variety of industrial verticals is what propels the solution segment's supremacy. Rising adoption of advanced threat detection and response solutions, including endpoint detection and response, identity and access management, and security information and event management systems, reflects enterprises' commitment to comprehensive protection frameworks. Organizations are prioritizing solutions offering real-time threat visibility, behavioral analytics, and automated remediation workflows to minimize incident dwell times and reduce operational burden on security teams.

The integration of artificial intelligence and machine learning into cybersecurity platforms is enabling predictive analytics and automated incident response capabilities that proactively identify emerging threats before exploitation occurs. Cloud-native security platforms are gaining significant traction among small and medium enterprises seeking cost-effective and scalable protection solutions without extensive hardware investments. Platform unification is favoring vendors delivering prevention, detection, response, and governance capabilities under integrated consoles, answering customer demands for reduced complexity, improved operational efficiency, and streamlined security management across hybrid environments.

Deployment Insights:

- Cloud-based

- On-premise

Cloud-based exhibits a clear dominance with a 65.10% share of the total Latin America cyber security market in 2025.

As agencies and businesses shift workloads into distributed hybrid environments, cloud-native frameworks are reshaping procurement priorities. Because serverless or containerized assets cannot be sufficiently secured by traditional perimeter tools, there is a growing need for unified cloud security posture management solutions. Laws requiring data protection, like Chile's Law 21.459 and Brazil's LGPD, support the move away from isolated point solutions and toward comprehensive cloud-native defenses. Organizations are adopting secure access service edge architectures combining network security functions with wide-area networking capabilities to support geographically dispersed workforces accessing cloud resources.

Cloud deployment is expanding rapidly as organizations benefit from scalability, cost-effectiveness, and ease of implementation compared to on-premise alternatives. Cloud-based pay-as-you-go platforms and managed services are making enterprise-grade protection affordable for small and medium-sized enterprises previously unable to invest in comprehensive security infrastructure. Vendors embedding policy-as-code, container runtime defense, and cloud security posture management into unified consoles are gaining substantial traction within enterprise accounts requiring multi-cloud visibility, automated compliance monitoring, and auto-remediation capabilities to address configuration vulnerabilities before exploitation occurs.

End User Insights:

- Banking, Financial Services, and Insurance

- Healthcare

- Manufacturing

- Retail

- Government

- IT and Telecommunication

- Others

Banking, financial services, and insurance represents the leading segment with a 26.12% share of the total Latin America cyber security market in 2025.

The sector's heightened exposure to cyber threats including ransomware, phishing, and payment fraud necessitates continuous investment in protective measures and regulatory compliance solutions. The segment's domination is mostly due to the quick growth of digital banking and mobile payment services, which are now popular targets for cybercriminals. Compared to other businesses, financial institutions in Latin America are three hundred times more likely to be the target of cyberattacks, resulting in average yearly cybersecurity investments reaching eighteen million dollars. Quantitative risk engines are being used by insurance companies more frequently to directly link control maturity to underwriting capital and premium pricing.

With startups and neobanks implementing multi-factor authentication, advanced encryption, and behavioral analytics to protect user data and transaction integrity, the growth of fintech has increased demand for cybersecurity solutions. Central bank regulations across Brazil and Mexico mandate stringent cybersecurity risk management, internal information security policies, and periodic audits for payment institutions operating within national financial ecosystems. Real-time fraud detection tools and secure digital payment systems are becoming essential infrastructure as digital banking transactions continue expanding across metropolitan financial centers and increasingly penetrating underserved regional markets.

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

Brazil dominates the market with a share of 49.08% of the total Latin America cyber security market in 2025.

With significant public investments and a sophisticated legislative framework, Brazil continues to serve as the market leader in Latin America for cybersecurity. The country established the National Cybersecurity Policy in December 2023, setting forth specific principles and objectives to guide cybersecurity activities across public and private sectors. Brazil's National Data Protection Authority issued multiple significant regulations in 2024, including the Security Incident Reporting Regulation and the Data Protection Officer Regulation, creating fresh compliance demand for enterprises.

Brazil's digital transformation has accelerated its pivotal role in the regional cybersecurity market, with the country ranking twelfth globally in information technology markets and representing over thirty-six percent of the Latin American technology sector. The Brazilian cybersecurity market benefits from managed security service provider nearshoring and zero-trust rollouts creating new demand layers. Enterprise awareness about reputational and financial risks associated with cyber incidents is catalyzing substantial investments in comprehensive security frameworks across São Paulo and major metropolitan business centers.

Market Dynamics:

Growth Drivers:

Why is the Latin America Cyber Security Market Growing?

Escalating Cyber Threat Landscape and Attack Sophistication

In February 2025, SonicWall recorded a two hundred fifty-nine percent rise in ransomware attacks across Latin American and a one hundred twenty-four percent increase in IoT assaults in its 2025 Annual Cyber Threat Report, underscoring growing attack surfaces in the region and intensifying demand for comprehensive endpoint protection solutions. The Latin America cyber security market is experiencing substantial growth due to the escalating frequency and sophistication of cyber threats targeting enterprises and government institutions across the region. Organizations are facing unprecedented volumes of attack attempts significantly exceeding global averages, compelling substantial investments in protective measures and incident response capabilities.

The commoditization of ransomware toolkits has dramatically lowered barriers to entry for malicious actors, enabling even low-skill attackers to mount sophisticated campaigns targeting critical infrastructure and sensitive data repositories. Cybercriminal organizations are increasingly leveraging advanced persistent threat techniques, social engineering tactics, and zero-day exploits to penetrate enterprise defenses. Government institutions and financial organizations remain primary targets due to the valuable information they store and critical processes they operate. The proliferation of ransomware incidents affecting government, manufacturing, and healthcare sectors has heightened executive awareness regarding cybersecurity investments. Enterprises are responding by implementing layered defense strategies incorporating endpoint detection, immutable backup solutions, and incident response retainer contracts to minimize operational disruptions.

Stringent Data Protection Regulations and Compliance Requirements

As governments and regulatory agencies enact extensive privacy laws to safeguard sensitive data, strict data protection laws in Latin American nations are greatly boosting the regional cybersecurity business. Brazil's LGPD enforcement and Chile's Law 21.459 mandate round-the-clock monitoring, privacy-by-design engineering, and rapid breach notification protocols. Businesses are encouraged to spend extensively in compliance-oriented cybersecurity solutions since noncompliance with these standards carries a significant risk of financial penalties and serious brand harm. In September 2024, Brazil passed Lei 14,967, which increased the enterprise sector's need for compliance and placed more stringent cybersecurity requirements on private security companies.

Accelerating Cloud Adoption and Digital Transformation

The shifting preferences of businesses toward cloud infrastructures are substantially expanding the cybersecurity market as companies migrate data and applications to distributed hybrid environments. The rise of digital transformation and remote work models has raised critical concerns over security vulnerabilities and potential data breaches. Organizations are implementing identity and access management solutions to ensure secure access to systems and data. Cloud security solutions and managed security services are expected to post the fastest growth, both exceeding thirteen percent compound annual growth rate, as enterprises seek scalable and cost-effective protection frameworks.

Market Restraints:

What Challenges the Latin America Cyber Security Market is Facing?

Persistent Cybersecurity Talent Shortages

The Latin America cyber security market faces significant challenges from persistent cybersecurity talent shortages limiting organizations' ability to deploy and maintain advanced security measures. Thirty-one percent of the smallest organizations report vacant security roles, creating gaps that increase average breach costs when incidents occur. Because of the sharp spike in wages caused by scarcity, businesses are forced to outsource security operations or use platforms that rely heavily on automation.

Inadequate Infrastructure and Budget Constraints

Inadequate infrastructure across many Latin American countries hinders market expansion, particularly among small and medium-sized enterprises with limited budgets for comprehensive cybersecurity implementations. High implementation costs for advanced security solutions and ongoing subscription expenses for security updates create financial barriers. Legacy system upgrades and integration complexity further challenge organizations seeking to modernize their cybersecurity frameworks.

Foreign Exchange Volatility and Economic Uncertainty

Foreign exchange volatility and economic uncertainty remain structural challenges affecting cybersecurity investments across the Latin America region. Budget constraints and unclear return on investment calculations stall security spending decisions. Organizations struggle with fragmentation across overlapping security tools, inflating licensing, integration, and security operations center staffing costs while suppressing net new investment in comprehensive protection frameworks.

Competitive Landscape:

The Latin America cyber security market exhibits a fragmented competitive landscape characterized by the presence of global technology leaders and regional specialists competing across enterprise and government sectors. International vendors are localizing threat intelligence, translating interfaces, and aligning feature sets with regional regulatory requirements to entrench market positions. Strategic channel deepening through distribution network expansion and pre-sales localization initiatives are enabling market penetration across diverse customer segments. By utilizing industry knowledge in the energy and aerospace corridors and providing regulatory workflow automation that is compliant with local laws, regional specialists offer cost advantages and domain depth. Nearshoring dynamics are driving managed security service providers to open Security Operations Centers in major metropolitan areas, injecting fresh competition while fostering talent development.

Latin America Cyber Security Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Security Types Covered | Network Security, Cloud Security, Application Security, End-Point Security, Wireless Network Security, Others |

| Components Covered |

|

| Deployments Covered | Cloud-based, On-premise |

| End Users Covered | Banking, Financial Services, and Insurance, Healthcare, Manufacturing, Retail, Government, IT and Telecommunication, Others |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Latin America cyber security market size was valued at USD 23.06 Billion in 2025.

The Latin America cyber security market is expected to grow at a compound annual growth rate of 6.61% from 2026-2034 to reach USD 41.03 Billion by 2034.

Network security dominated the market with a share of 28.07%, driven by increasing frequency of network-based cyber threats and widespread adoption of firewalls and intrusion detection systems across enterprises and government institutions.

Key factors driving the Latin America cyber security market include escalating cyber threat sophistication, stringent data protection regulations including Brazil's LGPD, accelerating cloud adoption, remote work proliferation, and increasing investments in identity and access management solutions.

Major challenges include persistent cybersecurity talent shortages, inadequate infrastructure in certain regions, budget constraints among small and medium enterprises, foreign exchange volatility, and the complexity of integrating advanced security solutions with legacy systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)